Concept explainers

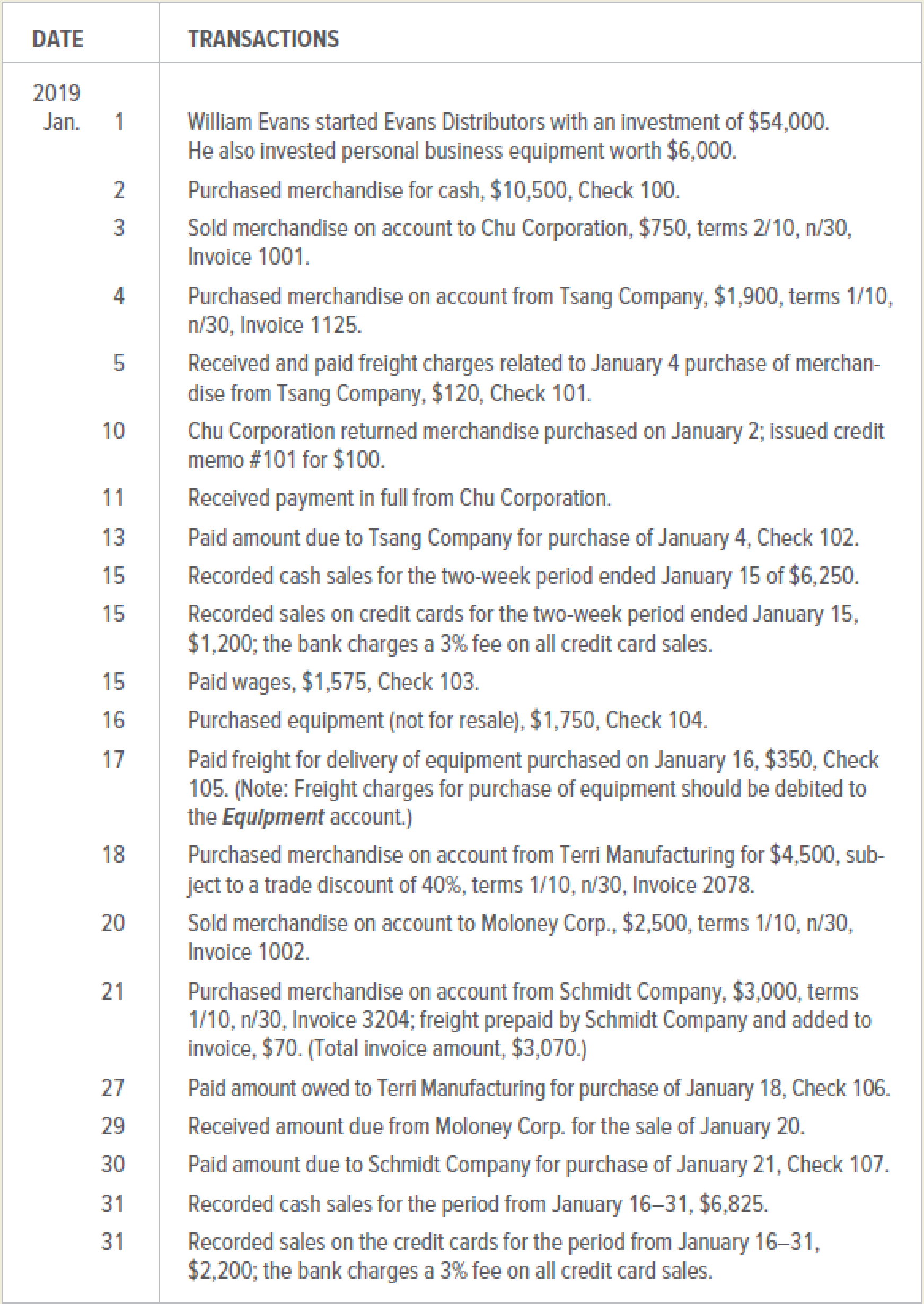

William Evans began Evans Distributors, a sporting goods distribution company, in January 2019 and engaged in the transactions below. Assume Evans Distributors and its customers take advantage of all cash discounts.

INSTRUCTIONS

Record the transactions in a general journal. Number the first journal as page 1. Provide brief explanations after each

Prepare general journal for the transactions of company ED.

Explanation of Solution

General Journal:

All the transactions of a business are prima facie recorded in general journal in chronological order. The general ledger is also known as the primary books of account.

Record the transactions in the general journal as follows:

Recording the capital invested:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 1, 2019 | Cash | 54,000 | ||

| Equipment | 6,000 | |||

| Capital | 60,000 | |||

| (to record the capital invested and equipment provided) | ||||

Table (1)

- • The cash account is an asset account and the account balance is increasing. Therefore, it is debited.

- • The equipment account is asset account and the balance of account is increasing. Therefore, it is debited.

- • The capital account is owners’ equity account. The balance is increased by introducing capital. Hence, it is credited.

Recording the merchandise purchased on cash:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 2, 2019 | Purchases | 10,500 | ||

| Cash | 10,500 | |||

| (to record the merchandise purchased for cash) | ||||

Table (2)

- • The purchases account is expense account and has a normal debit balance which is increasing. Hence, it is debited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the merchandise sold on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 3, 2019 | Accounts receivables/Company C | 750 | ||

| Sales | 750 | |||

| (to record the merchandise sold on account with terms 2/10, n/30) | ||||

Table (3)

- • The accounts receivable is an asset and the account balance is increasing. Hence, it is debited.

- • The sales account is a revenue account. The revenue is generated on selling the merchandise. Hence, it is credited.

Recording the merchandise purchased on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 4, 2019 | Purchases | 1,900 | ||

| Accounts payable/Company TS | 1,900 | |||

| (to record the merchandise purchased on account with terms 1/10, n/30) | ||||

Table (4)

- • The purchases account is expense account and has a normal debit balance which is increasing. Hence, it is debited.

- • Accounts payable is a liability and the account balance is increasing. Therefore, it is credited.

Recording the freight charges paid:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 5, 2019 | Freight In | 120 | ||

| Cash | 120 | |||

| (to record the freight charges paid) | ||||

Table (5)

- • Freight-in charges are the expenses and the expenses are increasing. Hence, the account is debited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the sold goods returned:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 10, 2019 | Sales returns and allowances | 100 | ||

| Accounts receivables/Company C | 100 | |||

| (to record goods returned and credit memo issued) | ||||

Table (6)

- • The sales returns and allowances account is identified as contra revenue account with normal debit balance and increasing. Therefore, it is debited.

- • The account receivable account is an asset account and the account balance is decreasing. Therefore, the accounts payable account is credited.

Recording the payment received from the buyer:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 11, 2019 | Sales Discount | 13 | ||

| Cash | 637 | |||

| Accounts receivable/Company C | 650 | |||

| (to record the payment received and discount provided) | ||||

Table (7)

- • The sales discount account is identified as contra revenue account and it has normal debit balance which is increasing. Therefore, it is debited.

- • The cash account is an asset account and the account balance is increasing. Therefore, it is debited.

- • The accounts receivable account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the payment made:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 13, 2019 | Accounts payable/Company TS | 1,900 | ||

| Purchases discounts | 19 | |||

| Cash | 1,881 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (8)

- • The accounts payable account is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on cash:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 15, 2019 | Purchases | 6,250 | ||

| Cash | 6,250 | |||

| (to record the inventory purchased on cash) | ||||

Table (9)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • The cash account is an asset account and account balance is decreasing. Therefore, it is credited.

Recording of the merchandise sold using credit card:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 15, 2019 | Credit card expense | 36 | ||

| Cash | 1,164 | |||

| Sales | 1,200 | |||

| (to record the merchandise sold on) | ||||

Table (10)

- • The credit card expense is the expense account which has normal debit balance. The balance is increasing. Therefore, it is debited.

- • The cash account is an asset account and the account balance is increasing. Therefore, the cash account is debited.

- • The sales account is identified as the revenue account and the revenue is generated from selling merchandise. Therefore, sales account is credited.

Recording the wages paid:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 15, 2019 | Wages | 1,575 | ||

| Cash | 1,575 | |||

| (to record the wages paid) | ||||

Table (11)

- • Wages are the expenses and the expenses are increasing. Hence, it is debited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchase of equipment:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 16, 2019 | Equipment | 1,750 | ||

| Cash | 1,750 | |||

| (to record the equipment purchased) | ||||

Table (12)

- • Equipment is an asset and the account balance of asset is increasing. Hence, the account is debited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the charges paid for transporting equipment:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 17, 2019 | Equipment | 350 | ||

| Cash | 350 | |||

| (to record the freight charges paid on equipment) | ||||

Table (13)

- • Freight-in charges are the expenses and the expenses are increasing. Hence, the account is debited. The freight-in charges related to transport of equipment are debited to the equipment account only.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 18 , 2019 | Purchases | 1,700 | ||

| Accounts payable/Company TE | 1,700 | |||

| (to record the inventory purchased on account with terms1/10, n/30) | ||||

Table (14)

- • The purchases account is debited. This is because the purchase account is an expense account and has normal debit balance which is increasing.

- • Accounts payable is liability and account balance is increasing. Therefore, it is credited.

Recording the merchandise sold on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 20, 2019 | Accounts receivables/Company M | 2,500 | ||

| Sales | 2,500 | |||

| (to record the merchandise sold on account with terms 1/10, n/30) | ||||

Table (15)

- • The accounts receivable is an asset and the account balance is increasing. Hence, it is debited.

- • The sales account is a revenue account. The revenue is generated on selling the merchandise. Hence, it is credited.

Record the purchases on the credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 21, 2019 | Purchases | 3,000 | ||

| Freight In | 70 | |||

| Accounts payable/Company S | 3,070 | |||

| (to record the inventory purchased on account with terms 1/30, n/30) | ||||

Table (16)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • Freight-in charges are the expenses and the expenses are increasing. Hence, the account is debited.

- • The accounts payable is a liability and the account balance is increasing. Therefore, it is credited.

Recording the payment made:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 27, 2019 | Accounts payable/Company TE | 2,700 | ||

| Purchases discounts | 27 | |||

| Cash | 2,673 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (17)

- • The accounts payable account is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the payment received from the buyer:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 29, 2019 | Sales Discount | 25 | ||

| Cash | 2,475 | |||

| Accounts receivable/Company M | 2,500 | |||

| (to record the payment received and discount provided) | ||||

Table (18)

- • The sales discount account is identified as contra revenue account and it has normal debit balance which is increasing. Therefore, it is debited.

- • The cash account is asset account and the account balance is increasing. Hence, cash account is debited. The amount in cash account would be calculated by subtracting the merchandise returned by the buyer and the sales discount provided.

- • The accounts receivable account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the payment made:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 30, 2019 | Accounts payable/Company S | 3,070 | ||

| Purchases discounts | 30 | |||

| Cash | 3,040 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (19)

- • The accounts payable account is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on cash:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 30, 2019 | Purchases | 6,825 | ||

| Cash | 6,825 | |||

| (to record the inventory purchased on cash) | ||||

Table (20)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • The cash account is an asset account and account balance is decreasing. Therefore, it is credited.

Recording of the merchandise sold using credit card:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 30, 2019 | Credit card expense | 66 | ||

| Cash | 2,134 | |||

| Sales | 2,200 | |||

| (to record the merchandise sold on) | ||||

Table (21)

- • The credit card expense is the expense account which has normal debit balance. The balance is increasing. Therefore, it is debited.

- • The cash account is an asset account and the account balance is increasing. Therefore, the cash account is debited.

- • The sales account is identified as the revenue account and the revenue is generated from selling merchandise. Therefore, sales account is credited.

Working Note:

Calculation for sales discount:

The sales discount is provided to the customer by the seller fulfilling the terms of making the timely payments as per 2/10, n/30 terms. The customer is entitled to receive the two percent of sales discount on the merchandise sold if the payment is made with ten days of invoice provided.

The amount calculated as per given information would be $13.

Calculation of purchases discount:

The purchases discounts are received by the buyer for fulfilling the terms of timely payment to seller for purchases. The terms related to paying on timely basis with the company TS was agreed as 1/10, n/30. The terms 1/10, n/30 means the buyer is entitled to receive one percent of purchase discount on the purchases amount. The buyer will be entitled to the discount only if the payment is paid within ten days after provided invoice.

The amount calculated as purchase discount would be $19.

Calculations for the credit card expense:

The fee is charged for availing the services of credit card. The bank fee to be charged as credit card is given as three percent for all credit card sales.

The expense would amount to be $36.

Calculations for the purchases amount:

The seller provides the trade discount of forty percent on the list price to the buyer. The purchases amount to be recorded by the buyer would be at the invoice price.

The purchases amount that would be calculated is $2,700.

Calculation of purchases discount:

The purchases discounts are received by the buyer for fulfilling the terms of timely payment to seller for purchases. The terms related to paying on timely basis with the company TE was agreed as 1/10, n/30. The terms 1/10, n/30 means the buyer is entitled to receive one percent of purchase discount on the purchases amount. The buyer will be entitled to the discount only if the payment is paid within ten days after provided invoice.

The amount calculated as purchase discount would be $27.

Calculation for sales discount:

The sales discount is provided to the customer by the seller fulfilling the terms of making the timely payments as per 1/10, n/30 terms. The customer is entitled to receive the one percent of sales discount on the merchandise sold if the payment is made with ten days of invoice provided.

The amount calculated as per given information would be $25.

Calculation of purchases discount:

The purchases discounts are received by the buyer for fulfilling the terms of timely payment to seller for purchases. The terms related to paying on timely basis with the company S was agreed as 1/10, n/30. The terms 1/10, n/30 means the buyer is entitled to receive one percent of purchase discount on the purchases amount. The buyer will be entitled to the discount only if the payment is paid within ten days after provided invoice.

The amount calculated as purchase discount would be $30.

Calculations for the credit card expense:

The fee is charged for availing the services of credit card. The bank fee to be charged as credit card is given as three percent for all credit card sales.

The expense would amount to be $66.

Want to see more full solutions like this?

Chapter 8 Solutions

COLLEGE ACCOUNTING

- Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.arrow_forwardDomingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.arrow_forwardInner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $8,500 from their personal account to the business account. B. Paid rent $650 with check #101. C. Initiated a petty cash fund $550 check #102. D. Received $750 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement office supplies $200, Maintenance Expense $140, Miscellaneous Expense $65. Cash on Hand $93. Check #106. J. Increased Petty Cash by $100, check #107.arrow_forward

- Hajun Company started its business on May 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $5,000 from their personal account to the business account. B. Paid rent $400 with check #101. C. Initiated a petty cash fund $200 check #102. D. Received $400 cash for services rendered E. Purchased office supplies for $90 with check #103. F. Purchased computer equipment $1,000, paid $350 with check #104 and will pay the remainder in 30 days. G. Received $500 cash for services rendered. H. Paid wages $250, check #105. I. Petty cash reimbursement office supplies $25, Maintenance Expense $125, Miscellaneous Expense $35. Cash on hand $18. Check #106. J. Increased Petty Cash by $50, check #107.arrow_forwardLavender Company started its business on April 1, 2019. The following are the transactions that happened during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $7,500 from their personal account to the business account. B. Paid rent $600 with check #101. C. Initiated a petty cash fund $250 check #102. D. Received $350 cash for services rendered. E. Purchased office supplies for $125 with check #103. F. Purchased computer equipment $1,500, paid $500 with check #104, and will pay the remainder in 30 days. G. Received $750 cash for services rendered. H. Paid wages $375, check #105. I. Petty cash reimbursement Office Supplies $50, Maintenance Expense $80, Miscellaneous Expense $60. Cash on hand $8. Check #106. J. Increased Petty Cash by $70, check #107.arrow_forwardDixon Menswear Shop purchased shirts from Colt Company on May 28, 2019, and received an invoice with a list price amount of 5,000 and payment terms of 2/10, n/30. Dixon uses the net method to record purchases. Dixon should record purchases of: a. 4,000 b. 4,900 c. 5,000 d. 5,100arrow_forward

- On January 1, Incredible Infants sold goods to Babies Inc. for $1,540, terms 30 days, and received payment on January 18. Which journal would the company use to record this transaction on the 18th? A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journalarrow_forwardDomingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries and then use the journal entries to prepare the trial balance. The owners invested $10,000 from their personal account to the business account. Paid rent $500 with check #101. Initiated a petty cash fund $500 with check #102. Received $1,000 cash for services rendered. Purchased office supplies for $158 with check #103. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. Received $800 cash for services rendered. Paid wages $600, check #105. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. Increased petty cash by $30, check #107.arrow_forwardDomingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. A. The owners invested $12,000 from their personal account to the business account.B. Paid rent $700 with check #101.C. Initiated a petty cash fund $500 with check #102.D. Received $1,000 cash for services rendered.E. Purchased office supplies for $158 with check #103.F. Purchased computer equipment $2,100, paid $1,350 with check #104, and will pay the remainder in 30 days.G. Received $800 cash for services rendered.H. Paid wages $800, check #105.I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $75, miscellaneous expense $55. Cash on hand $18. Check #106.J. Increased petty cash by $30, check #107. Prepare the journal entries. If an amount box does not require an entry, leave it blank. A. fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 B. fill in the blank 8 fill in the blank 9…arrow_forward

- Domingo Company started its business on May 1, 2019. The following transactions occurred during the month of May and the following entries were recorded. A. The owners invested $9,500 from their personal account to the business account.B. Paid rent $600 with check #101.C. Initiated a petty cash fund $600 with check #102.D. Received $1,100 cash for services rendered.E. Purchased office supplies for $158 with check #103.F. Purchased computer equipment $2,300, paid $1,350 with check #104, and will pay the remainder in 30 days.G. Received $800 cash for services rendered.H. Paid wages $800, check #105.I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $115. Check #106.J. Increased petty cash by $30, check #107. A. Cash 9,500 Domingo, Capital 9,500 B. Rent Expense 600 Cash 600 C. Petty Cash 600 Cash 600 D. Cash 1,100 Services Income 1,100 E. Office…arrow_forwardDomingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. A. The owners invested $12,000 from their personal account to the business account.B. Paid rent $600 with check #101.C. Initiated a petty cash fund $600 with check #102.D. Received $1,100 cash for services rendered.E. Purchased office supplies for $158 with check #103.F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days.G. Received $800 cash for services rendered.H. Paid wages $600, check #105.I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $73, miscellaneous expense $55. Cash on hand $116. Check #106.J. Increased petty cash by $30, check #107. Prepare the journal entries. If an amount box does not require an entry, leave it blank. A. Domingo, Capital Domingo, Capital Cash Cash B. Rent Expense Rent Expense Cash Cash C. Petty Cash…arrow_forwardDaryl Swan operates four video rental stores. She has just received the monthly bank statement at October31, 2019 from Bank of Montreal, and the statement shows an ending balance of $4,180. Listed on thestatement are an EFT rent collection by the bank for Swan of $150, a service charge of $15, four NSFcheques totalling $100, and a $20 charge for printed cheques. In reviewing her cash records, Swanidentifies outstanding cheques totalling $306 and an October 31 deposit in transit of $1,002. DuringOctober she recorded a $315 cheque for the salary of a part-time employee as $31. Swan’s Cash accountshows an October 31 cash balance of $5,145.Required:1. Prepare a bank reconciliation for Daryl Swan to determine how much cash Swan actually has atOctober 31, 2019?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,