Concept explainers

MIRR. Suppose the company in the previous problem uses a discount rate of 11 percent and a reinvestment rate of 8 percent on all of its projects. Calculate the MIRR of the project using all three methods with these rates.

To calculate: The MIRR (Modified Internal Rate of Return) for the project utilizing all three methods at a rate of discount and rate of reinvestment of 11% and 8% respectively.

Introduction:

MIRR is the Modified Internal Rate of Return which is a financial measure of attracting the investments. It is utilized in capital budgeting to rank the alternative investments of the same size.

Answer to Problem 23QP

The MIRR for the project using the discounted approach is 19.41%, reinvestment approach is 13.30%, and combination approach is 13.12%.

Explanation of Solution

Given information:

Company M is assessing a project where the cash flows are $10,430, $13,850, $11,270, $9,830, and -$4,050 for year 1, 2, 3, 4, and 5 respectively. The initial cost is $27,500. The rate of discount and the rate of reinvestment are 11% and 8% respectively.

Discounted approach:

In this approach, compute the negative cash outflows value at year 0. On the other hand, the positive cash flows remain at its time of occurrence. Hence, discount the cash outflows to year 0.

Hence, the discounted cash flow at time 0 is -$29,903.48.

Equation of MIRR in discounted approach:

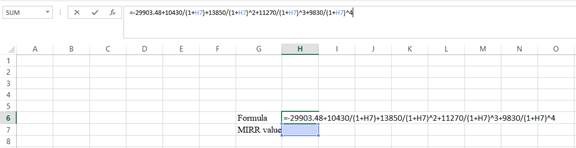

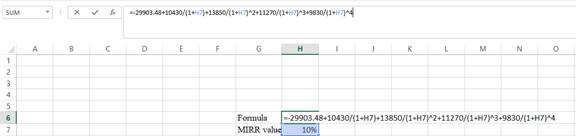

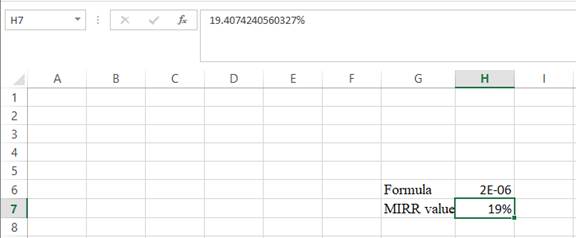

Compute MIRR using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the MIRR value as H7.

Step 2:

- Assume the MIRR value as 10%.

Step 3:

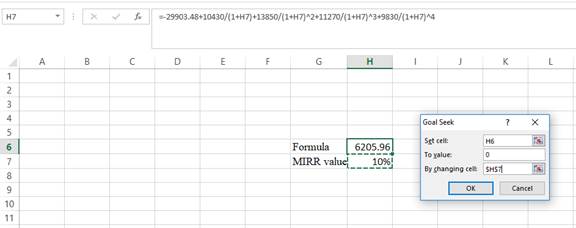

- In the spreadsheet, go to data and select the what-if analysis.

- In the what-if analysis, select goal seek.

- In set cell, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the by changing cell.

Step 4:

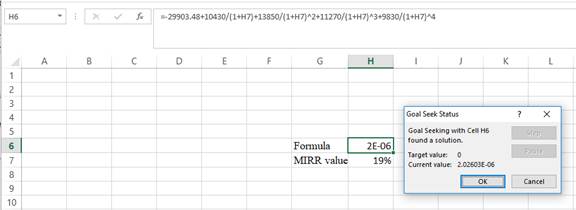

- Following the previous step click OK in the goal seek. The goal seek status appears with the MIRR value.

Step 5:

- Thevalue appears to be 19.4074240560327%.

Hence, the MIRR value is 19.41%.

Reinvestment approach:

In this approach, compute the future value of all the cash flows excluding the initial cost at the closure of the project. Hence, compute the reinvesting cash flows to year 5 is:

Hence, the reinvesting cash flow at time 5 is $51,348.64.

Equation of MIRR in reinvestment approach:

Compute the MIRR:

Hence, the MIRR is 13.30%.

Combination approach:

In this approach, compute all the cash outflows at year 0 and all the cash inflows at the closure of the project. Hence, the value of the cash flows is as follows:

Hence, the total cash outflow at year 0 is -$29,903.48.

Hence, the value of total cash inflows is $55,398.64.

Equation of MIRR in combination approach:

Compute the MIRR:

Hence, the MIRR is 13.12%.

Want to see more full solutions like this?

Chapter 8 Solutions

Loose Leaf for Essentials of Corporate Finance

- Nashville's Kitchen Corp. is considering a proposed project with the following cash flows. If both the discount rate and the reinvestment rate are 16 percent, what is the project’s modified internal rate of return (MIRR) using the combination approach? Solve using a Financial Calculator showing all calculator inputs. Year Cash Flow 0 –$375,000 1 133,500 2 -35,600 3 244,700 4 271,000arrow_forwardDuo Corporation is evaluating a project with the following cash flows. The company uses a discount rate of 12% and a reinvestment rate of 9% on all is projects. Calculate the MIRR of the project using all three methods with these interest rates.arrow_forwardHome & More is considering a project with cash flows of −$368,000, $133,500, −$35,600, $244,700, and $258,000 for Years 0 to 4, respectively. Should this project be accepted based on the combination approach to the modified internal rate of return (MIRR) if both the discount rate and the reinvestment rate are 14.6 percent? Why or why not?arrow_forward

- Cooney Co. is evaluating the following mutually exclusive projects. The manager has determined that the appropriate discount rate is 6.2% for all the recommended projects. Rank order the projects based on the profitability index. Year Project A Project B Project C 0 (35,000) (65,000) (86,000) 1 - 40,000 44,000 2 - 22,000 44,000 3 55,000 22,000 35,000arrow_forwardMonroe, Inc., is evaluating a project. The company uses a 13.8 percent discount rate for this project. Cost and cash flows are shown in the table. What is the NPV of the project? Year Project 0 ($11,368,000) 1 $ 2,127,589 2 $ 3,787,552 3 $ 3,125,650 4 $ 4,115,899 5 $ 4,556,424 Round to two decimal places.arrow_forwardA project has the following cash flows set out below. What is the profitability index of this project if the relevant discount rate is 2 percent? Enter your final answer to two decimal places. Year Cash flow 0 -1,745 1 537 2 2,066 3 3,912arrow_forward

- Required: Calculate the NPV of each project at 10% discount rate. Giventhe above four projects’ cash flows and using a 10% discount rate,which projects that would have been accepted under PaybackPeriod will now be rejected under Net Present Value?arrow_forwardMcCann Company has identified an investment project with the following cash flows. a. If the discount rate is 11 percent, what is the present value of these cash flows? b. What is the present value at 18 percent? c. What is the present value at 29 percent?arrow_forwardPerform a financial analysis for a project. Assume that the projected costs and benefits for this project are spread over four years as follows: Estimated costs are $300,000 in Year 1 and $ 75,000 each year in Years 2, 3, and 4. Estimated benefits are $0 in Year 1 and $110,000 each year in Years 2, 3, and 4. Use a 6 percent discount rate, and round the discount factors to two decimal places. What is the Return on Investment (ROI)? (Keep your answer in two decimal places. e.g. 46.59. Do not enter % symbol.)arrow_forward

- Suppose the following two independent investment opportunities are available to Fitz, Inc. The appropriate discount rate is 8 percent. Year Project Alpha Project Beta 0 −$5,500 −$7,100 1 2,800 1,600 2 2,700 5,500 3 1,700 4,500 a. Compute the profitability index for each of the two projects. (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) b. Which project(s), if either, should the company accept based on the profitability index rule? multiple choice Neither project Project Beta Both projects Project Alphaarrow_forwardWhat is the NPV of the following project if the discount rate is 11%? Round to the nearest cent.Investment today: $-121,000; Cash flow in year 1: $66,000; Cash flow in year 2: $72,000; Cash flow in year 3: $66,000arrow_forwardWhat is the net present value of a project with the following cash flows if the discount rate is 15 percent? Year 0: Cash Flow 5-48,000, Year 1: Cash flow = $15,600, Year 2: Cash flow = $28,900, Year 3: Cash flow = 515, 200 Seleccione una: A. -$1,618.48 B. $1,035.24 C. S9.593.19 D $2,687.98 E. $1,044.16arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College