To calculate: The MIRR (Modified

Introduction:

MIRR is the Modified Internal Rate of Return; it is a financial measure of attracting investments. It is utilized in capital budgeting to rank the alternative investments of the same size.

Answer to Problem 22QP

The MIRR for the project using the discounted approach is 19.21%, reinvestment approach is 14.49%, and combination approach is 14.14%.

Explanation of Solution

Given information:

Company M is assessing a project where the cash flows are $10,430, $13,850, $11,270, $9,830, and -$4,050 for year 1, 2, 3, 4, and 5 respectively. The initial cost is $27,500.

Discounted approach:

In this approach, compute the negative cash outflows value at year 0. On the other hand, the positive cash flows remain at its time of occurrence. Hence, discount the cash outflows to year 0.

Hence, the discounted cash flow at time 0 is -$30,014.73.

Equation of MIRR in a discounted approach:

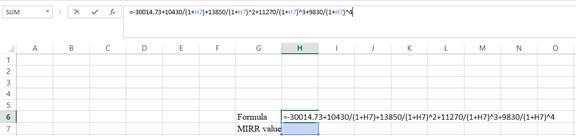

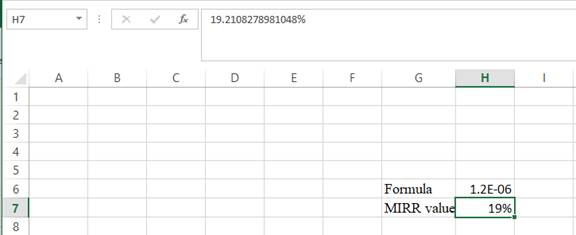

Compute MIRR using a spreadsheet:

Step 1:

- Type the equation of

NPV in H6 in the spreadsheet and consider the MIRR value as H7.

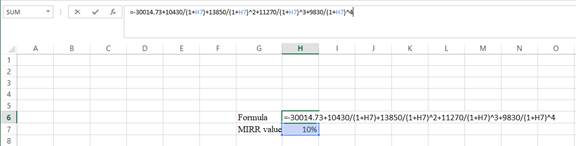

Step 2:

- Assume the MIRR value as 0.10%.

Step 3:

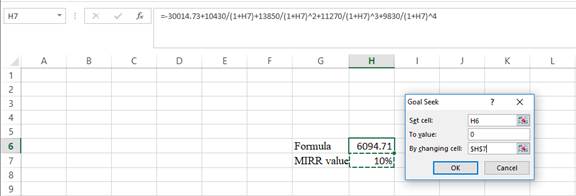

- In the spreadsheet, go to data and select the what-if analysis.

- In the what-if analysis, select goal seek.

- In set cell, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the by changing cell.

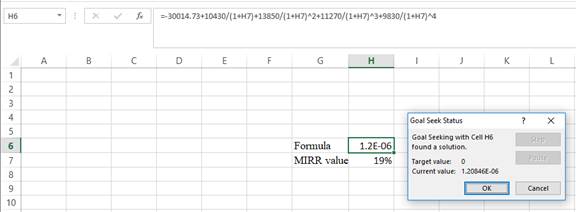

Step 4:

- Following the previous step click OK in the goal seek. The goal seek status appears with the MIRR value.

Step 5:

- Thevalue appears to be 19.2108278981048%.

Hence, the MIRR value is 19.21%.

Reinvestment approach:

In this approach, compute the

Hence, the reinvesting cash flow at time 5 is $54,104.61.

Equation of MIRR in reinvestment approach:

Compute the MIRR:

Hence, the MIRR is 14.49%.

Combination approach:

In this approach, compute all the cash outflows at year 0 and all the

Hence, the total cash outflow at year 0 is -$30,014.73.

Hence, the value of total cash inflows is $58,154.61.

Equation of MIRR in combination approach:

Compute the MIRR:

Hence, the MIRR is $14.14%.

Want to see more full solutions like this?

Chapter 8 Solutions

Loose Leaf for Essentials of Corporate Finance

- Redbird Company is considering a project with an initial investment of $265,000 in new equipment that will yield annual net cash flows of $45,800 each year over its seven-year life. The companys minimum required rate of return is 8%. What is the internal rate of return? Should Redbird accept the project based on IRR?arrow_forwardStaten Corporation is considering two mutually exclusive projects. Both require an initial outlay of 150,000 and will operate for five years. The cash flows associated with these projects are as follows: Statens required rate of return is 10%. Using the net present value method and the present value table provided in Appendix A, which of the following actions would you recommend to Staten? a. Accept Project X and reject Project Y. b. Accept Project Y and reject Project X. c. Accept Projects X and Y. d. Reject Projects X and Y.arrow_forwardBuena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a net cash inflow one year from now of 810,000. Assume the cost of capital is 10 percent. Required: 1. Break the 810,000 future cash inflow into three components: a. The return of the original investment b. The cost of capital c. The profit earned on the investment 2. Now, compute the present value of the profit earned on the investment. 3. Compute the NPV of the investment. Compare this with the present value of the profit computed in Requirement 2. What does this tell you about the meaning of NPV?arrow_forward

- Jasmine Manufacturing is considering a project that will require an initial investment of $52,000 and is expected to generate future cash flows of $10,000 for years 1 through 3, $8,000 for years 4 and 5, and $2,000 for years 6 through 10. What is the payback period for this project?arrow_forwardProject S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs, and PIs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected?arrow_forwardThe Ulmer Uranium Company is deciding whether or not to open a strip mine whose net cost is $4.4 million. Net cash inflows are expected to be $27.7 million, all coming at the end of Year 1. The land must be returned to its natural state at a cost of $25 million, payable at the end of Year 2. Plot the project’s NPV profile. Should the project be accepted if r = 8%? If r = 14%? Explain your reasoning. Can you think of some other capital budgeting situations in which negative cash flows during or at the end of the project’s life might lead to multiple IRRs? What is the project’s MIRR at r = 8%? At r = 14%? Does the MIRR method lead to the same accept-reject decision as the NPV method?arrow_forward

- Net present value method, internal rate of return method, and analysis for a service company The management of Advanced Alternative Power Inc. is considering two capital investment projects. The estimated net cash flows from each project are as follows: The wind turbines require an investment of 887,600, while the biofuel equipment requires an investment of 911,100. No residual value is expected from either project. Instructions 1. Compute the following for each project: A. The net present value. Use a rate of 6% and the present value of an annuity table appearing in Exhibit 5 of this chapter. B. A present value index. (Round to two decimal places.) 2. Determine the internal rate of return for each project by (A) computing a present value factor for an annuity of 1 and (B) using the present value of an annuity of 1 table appearing in Exhibit 5 of this chapter. 3. What advantage does the internal rate of return method have over the net present value method in comparing projects?arrow_forwardFenton, Inc., has established a new strategic plan that calls for new capital investment. The company has a 9.8% required rate of return and an 8.3% cost of capital. Fenton currently has a return of 10% on its other investments. The proposed new investments have equal annual cash inflows expected. Management used a screening procedure of calculating a payback period for potential investments and annual cash flows, and the IRR for the 7 possible investments are displayed in image. Each investment has a 6-year expected useful life and no salvage value. A. Identify which project(s) is/are unacceptable and briefly state the conceptual justification as to why each of your choices is unacceptable. B. Assume Fenton has $330,000 available to spend. Which remaining projects should Fenton invest in and in what order? C. If Fenton was not limited to a spending amount, should they invest in all of the projects given the company is evaluated using return on investment?arrow_forwardProject Y cost $8,000 and will generate net cash inflows of $1,500 in year one, $2,000 in year two, $2,500 in year three, $3,000 in year four and $2,000 in year five. What is the NPV using 8% as the discount rate?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT