Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 25E

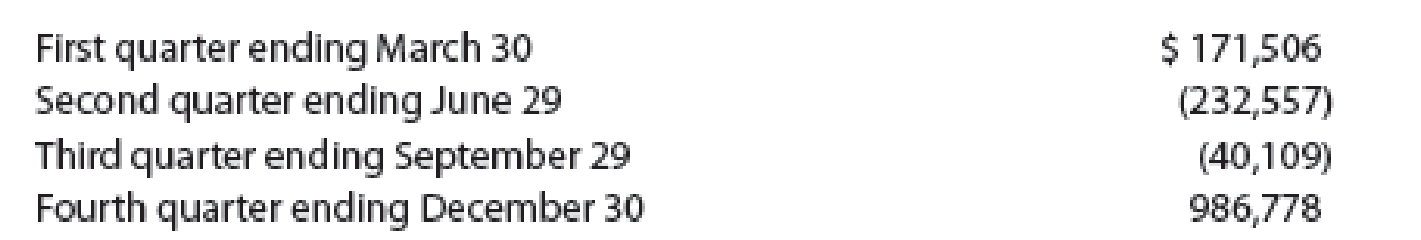

Mattel, Inc., designs, manufactures, and markets toy products worldwide. Mattel’s toys include Barbie™ fashion dolls and accessories, Hot Wheels™, and Fisher-Price brands. For a recent year, Mattel reported the following net

Explain why Mattel reported negative net cash flows from operating activities during the second and third quarters and a large positive cash flow for the fourth quarter, with overall net positive cash flow for the year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

At one time, the Coca-Cola Company reported a number called” economic profit” that is very similar to residual operating income. It also reported free cash flow in its annual summary of selected financial data. The respective numbers for 1992-1999 are given below (in millions of dollars), along with what Coke calls total capital (similar to net operating assets) and return on total capital (similar to return on net operating assets):

1992

1993

1994

1995

1996

1997

1998

1999

Economic Profit

1300

1549

1896

2291

2718

3325

2480

1128

Free Cash Flow

873

1623

2146

2102

2413

3533

1876

2332

Total Capital

7095

7684

8744

9456

10669

11186

13552

15740

Return on Capital

29.40%

31.20%

32.70%

34.90%

36.70%

39.40%

30.20%

18.20%

a. Economic profit and free cash flow are similar, in most years, and their growth patterns are similar. Why?

b. Based on this past history, would you be indifferent in valuing Coke using discounted cash flow methods or residual operating income methods?

The management of ABC Company felt proud of their accomplishments concerning cash flow for the end of the year because overall cash increased by $1,500,000. In the operating section, the company showed an increase in cash of $250,000 because of net income. However, because of increases in accounts receivable and inventory, the overall cash outflow from operating activities was $100,000.

In the investing section, purchases of long-term assets outweighed the sale of long-term assets which resulted in a cash outflow from investing activities of $500,000.

The company has a line-of-credit with the bank. During the year, the company drew on the line which resulted in cash inflow from financing activities of $2,100,000. The cash inflow from financing activities of $2,100,000 less the cash outflow from operating activities of $100,000 and less the cash out flow from investing activities resulted in the overall cash increase of $1,500,000.

Analyze the cash flows of ABC Company. What conclusions…

TSW Inc. had the following data for last year: Net income = $850; Net operating profit after taxes (NOPAT) = $700; Total assets = $2,800; and Total operating capital = $2,100. Information for the just-completed year is as follows: Net income = $1,200; Net operating profit after taxes (NOPAT) = $950; Total assets = $2,450; and Total operating capital = $2,350. How much free cash flow did the firm generate during the just-completed year?

Group of answer choices

$595

$770

$700

$630

$735

Chapter 8 Solutions

Financial Accounting

Ch. 8 - Prob. 1DQCh. 8 - Why should the employee who handles cash receipts...Ch. 8 - Prob. 3DQCh. 8 - Why should the responsibility for maintaining the...Ch. 8 - Assume that Brooke Miles, accounts payable clerk...Ch. 8 - Prob. 6DQCh. 8 - Prob. 7DQCh. 8 - Prob. 8DQCh. 8 - Prob. 9DQCh. 8 - Prob. 10DQ

Ch. 8 - Prob. 1PEACh. 8 - Prob. 1PEBCh. 8 - Prob. 2PEACh. 8 - Prob. 2PEBCh. 8 - Prob. 3PEACh. 8 - Prob. 3PEBCh. 8 - Prob. 4PEACh. 8 - Prob. 4PEBCh. 8 - Financial data for Otto Company follow: a....Ch. 8 - Prob. 5PEBCh. 8 - Prob. 1ECh. 8 - Prob. 2ECh. 8 - Prob. 3ECh. 8 - Pacific Bank provides loans to businesses in the...Ch. 8 - Prob. 5ECh. 8 - An employee of JHT Holdings, Inc., a trucking...Ch. 8 - Prob. 7ECh. 8 - Prob. 8ECh. 8 - Prob. 9ECh. 8 - Prob. 10ECh. 8 - Prob. 11ECh. 8 - Prob. 12ECh. 8 - Prob. 13ECh. 8 - Abbe Co. is a small merchandising company with a...Ch. 8 - Prob. 15ECh. 8 - Prob. 16ECh. 8 - Prob. 17ECh. 8 - Prob. 18ECh. 8 - Prob. 19ECh. 8 - Prob. 20ECh. 8 - Prob. 21ECh. 8 - Prob. 22ECh. 8 - Prob. 23ECh. 8 - Prob. 24ECh. 8 - Mattel, Inc., designs, manufactures, and markets...Ch. 8 - El Dorado Inc. has monthly cash expenses of...Ch. 8 - Prob. 27ECh. 8 - Amicus Therapeutics, Inc., is a biopharmaceutical...Ch. 8 - Prob. 1PACh. 8 - Cactus Restoration Company completed the following...Ch. 8 - Prob. 3PACh. 8 - Prob. 4PACh. 8 - Prob. 5PACh. 8 - Prob. 1PBCh. 8 - Cedar Springs Company completed the following...Ch. 8 - Prob. 3PBCh. 8 - Prob. 4PBCh. 8 - Prob. 5PBCh. 8 - During the preparation of the bank reconciliation...Ch. 8 - Prob. 2CPCh. 8 - Prob. 3CPCh. 8 - Prob. 4CPCh. 8 - Prob. 5CPCh. 8 - TearLab Corp. is a health care company that...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mattel, Inc., designs, manufactures, and markets toy products worldwide. Mattels toys include Barbie fashion dolls and accessories, Hot Wheels, and Fisher-Price brands. For a recent year, Mattel reported the following net cash flows from operating activities (in thousands): Explain why Mattel reported negative net cash flows from operating activities during the first and second quarters and a large positive cash flow for the fourth quarter, with overall net positive cash flow for the year.arrow_forwardABC Inc. had the following data for last year: Net income = $1000; Net operating profit after taxes (NOPAT) = $900; Total assets = $3,200; and Total operating capital = $2,200. Information for the just-completed year is as follows: Net income = $1,300; Net operating profit after taxes (NOPAT) = $1225; Total assets = $2,900; and Total operating capital = $2,800. How much free cash flow did the firm generate during the just-completed year?arrow_forwardSummit Manufacturing’s most recent statements of cash flows indicate that the firm has paid large dividends to its stockholders in each of the past three years. Upon noting this information, A : potential investors would be more likely to invest in Summit, but potential lenders may be less likely to grant the company a loan. B : potential investors would be less likely to invest in Summit, but potential lenders may be more likely to grant the company a loan. C : potential investors would be less likely to invest in Summit, and potential lenders may be less likely to grant the company a loan. D : potential investors would be more likely to invest in Summit, and potential lenders may be more likely to grant the company a loan.arrow_forward

- During the year, Broozer’s increased its accounts receivable by $240, increased its inventory by $195, decreased its accounts payable by $80, increased its short-term notes payable by $100 and increased its LTD by $600.. How did these accounts affect the firm’s cash flows from operating activities for the year?arrow_forwardThe Emerald Corporation had $55,000 in cash at year-end 2010 and $25,000 in cash at year end 2011. The firm invested $250,000 in property, plant and equipment. Cash flow from financing activities totaled $170,000. What was the cash flow from operating activities? If accruals increased by $25,000, receivables and inventories increased by $100,000, and depreciation and amortization totaled $10,000, what was the firm’s net income?arrow_forwardTSW Inc. had the following data for last year: Net income = $800; Net operating profit after taxes (NOPAT) = $700; Total assets = $3,000; and Total operating capital = $2,000. Information for the just-completed year is as follows: Net income = $1,000; Net operating profit after taxes (NOPAT) = $750; Total assets = $2,600; and Total operating capital = $2,500. How much free cash flow did the firm generate during the just-completed year? Select the correct answer. a. $240 b. $260 c. $255 d. $245 e. $250arrow_forward

- At the beginning of the year, National Corporation had P100,000 in cash. The company undertook a major expansion during this same year. Looking at its statement of cash flows, you see that the net cash provided by its operations was P350,000 and the company’s investing activities required cash expenditures of P800,000. The company’s cash position at the end of the year was P70,000. What was the net cash provided by the company’s financing activities?arrow_forwardEMC Corporation manufactures large-scale, high-performance computer systems. In a recent annual report, the balance sheet included the following information ($ in millions): 2015 2014 Current assets: Receivables, less allowances of $90 in 2015 and $72 in 2014 $ 3,977 $ 4,413 In addition, the income statement reported sales revenue of $24,704 ($ in millions) for the current year. All sales are made on a credit basis. The statement of cash flows indicates that cash collected from customers during the current year was $25,737 ($ in millions). Note that there could have been significant recoveries of accounts receivable previously written off. Required:1. Compute the following ($ in millions): The net amount of bad debts written off or reinstated by EMC during 2015. The amount of bad debt expense or reduction of bad debt expense that EMC included in its income statement for 2015. 2. Suppose that EMC had used the direct write-off method to account for bad…arrow_forwardMC Corporation manufactures large-scale, high-performance computer systems. In a recent annual report, the balance sheet included the following information ($ in millions): 2015 2014 Current assets: Receivables, less allowances of $90 in 2015 and $72 in 2014 $ 3,977 $ 4,413 In addition, the income statement reported sales revenue of $24,704 ($ in millions) for the current year. All sales are made on a credit basis. The statement of cash flows indicates that cash collected from customers during the current year was $25,737 ($ in millions). Note that there could have been significant recoveries of accounts receivable previously written off. Required:1. Compute the following ($ in millions): The net amount of bad debts written off or reinstated by EMC during 2015. The amount of bad debt expense or reduction of bad debt expense that EMC included in its income statement for 2015. 2. Suppose that EMC had used the direct write-off method to account for bad…arrow_forward

- Capstone Turbine Corporation produces and sells turbine generators for such applications as charging electric, hybrid vehicles. Capstone Turbine reported the following financial data for a recent year (in thousands): Net cash flows from operating activities $(23,018) Cash and cash equivalents 32,221 a. Determine the monthly cash expenses. Round to one decimal place.b. Determine the ratio of cash to monthly cash expenses. Round to one decimal place.c. Based on your analysis, do you believe that Capstone Turbine will remainin business?arrow_forwardObserve the following statement: STATEMENT OF CASH FLOW FOR “COUCH POTATO TECHNOLOGIES P/L” For the year ending June 30 2011 2010 $000 2011 $000 Receipts from customers (sales) 350 180 Payments for purchases 50 60 Payments to employees 80 80 Purchase of assets 10 20 Payments for operating expenses 10 15 Additional Information: • Industry Average Efficiency : 20% • Net profit in 2010 : $21 000 a) Define the term working capital. b) Comment on the cash flow of Couch Potato Technologies P/L in 2010. c) Calculate and comment on the efficiency of Couch Potato Technologies P/L d) Calculate and comment on the net profit of Couch Potato Technologies P/L. e) Recommend TWO strategies that can be used to manage the working capital of Couch Potato Technologies P/L.arrow_forwardOlympic, Inc. had the following positive and negative cash flows during the current year: Positive cash flows: Received from customers $240,000 Interest and dividends 50,000 Sale of plant assets 330,000 Negative cash flows: Paid to suppliers and employees $127,000 Purchase of investments 45,000 Purchase of treasury stock 36,000 Determine the amount of cash provided by or used for operating activities by the direct method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License