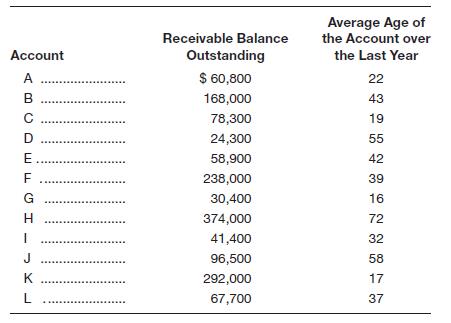

Charming Paper Company sells to the 12 accounts listed here:

Capital Financial Corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. Customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. The current prime rate is 15.5 percent, and Capital charges 4.5 percent over prime to Charming as its annual loan rate.

a. Determine the maximum loan for which Charming Paper Company could qualify.

b. Determine how much one month’s interest expense would be on the loan balance determined in part a.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- Lowe and Price Co has annual credit sales of $12,000,000, and three months are allowed for payment. The company decides to offer a 2% discount for payments made within ten days of the invoice being sent, and to reduce the maximum time allowed for payment to two months. It is estimated that 50% of customers will take the discount. The company requires a 20% return on investments. Assume that the volume of sales will be unaffected by the discount. What is the reduction in accounts receivable? What is the opportunity income from the reduction in accounts receivable? What is the discount allowed each year? What is the net benefit of new discount policy each year?arrow_forwardCook Security Systems has a $37,500 line of credit, which charges an annual percentage rate of prime rate plus 4%. The starting balance on October 1 was $9,100. On October 4 they made a payment of $1,400. On October 13 the business borrowed $2,100, and on October 19 they borrowed $4,600. If the current prime rate is 8%, what is the new balance (in $)? (Round your answer to the nearest cent.) $arrow_forwardCook Security Systems has a $37,500 line of credit, which charges an annual percentage rate of prime rate plus 4%. The starting balance on October 1 was $9,300. On October 4 they made a payment of $1,800. On October 13 the business borrowed $2,100, and on October 19 they borrowed $4,800. If the current prime rate is 8%, what is the new balance (in $)?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning