Concept explainers

a.

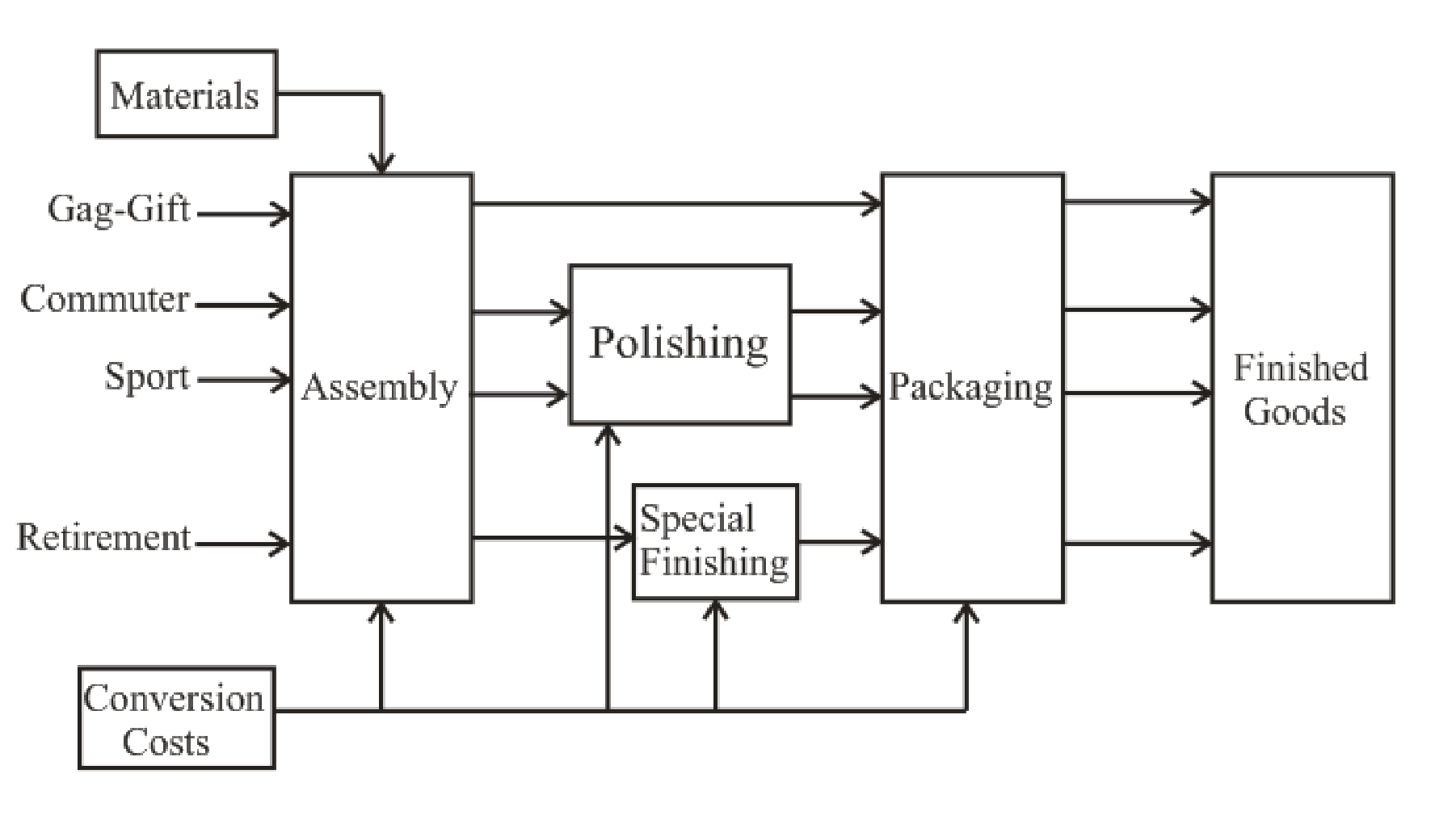

Draw the flow of the different models through the production process.

a.

Explanation of Solution

Production cost:

Production cost refers to the cost associated with the production process. Direct costs associated with the process and stages of completion are taken into consideration while computing the cost of the production of any product.

Description of the diagram:

The four products go through the process as drawn above. All the four products go through assembly line. Only the products commuter and sport go for polishing before going through packaging. Product retirement goes through special finishing process and not polishing. The only product that has been packaged straight away from assembly line is Gag-Gift. All the products are then converted into finished goods.

The cost will be different for every product as well. Gag-Gift will include assembly and packaging. Commuter and sport will include assembly, polishing and packaging. Retirement includes cost of assembly, special finishing and packaging.

b.

Determine the cost per unit transferred to finished goods inventory for each of the four watches.

b.

Explanation of Solution

Cost per unit:

Total amount accounted for and total units accounted are considered computation of cost per equivalent unit.

Compute the cost per unit transferred to finished goods inventory for each of the four watches:

| Particulars | Total | Gag-Gift | Commuter | Sport | Retirement |

| Materials | $ 321,000 | $ 15,000 | $ 90,000 | $ 156,000 | $ 60,000 |

| Conversion costs: | |||||

| Assembly | $ 120,000 | $ 20,000(1) | $ 40,000(2) | $ 52,000(3) | $ 8,000(4) |

| Polishing | $ 69,000 | $ 0 | $ 30,000(5) | $ 39,000(6) | $ 0 |

| Special finishing | $ 20,000 | $ 0 | $ 0 | $ 0 | $ 20,000(7) |

| Packaging | $ 90,000 | $ 15,000(8) | $ 30,000(9) | $ 39,000(10) | $ 6,000(11) |

| Total conversion costs | $ 299,000 | $ 35,000 | $ 100,000 | $ 130,000 | $ 34,000 |

| Total product cost | $ 620,000 | $ 50,000 | $ 190,000 | $ 286,000 | $ 94,000 |

| Number of units | 5,000 | 10,000 | 13,000 | 2,000 | |

| Cost per unit | $ 10.00(12) | $ 19.00(13) | $ 22.00(14) | $ 47.00(15) |

Working note 1:

Compute the conversion costs of assembly for Gag-gift:

Working note 2:

Compute the conversion costs of assembly for Commuter:

Working note 3:

Compute the conversion costs of assembly for Sport:

Working note 4:

Compute the conversion costs of assembly for Retirement:

Working note 5:

Compute the conversion costs of polishing for Commuter:

Working note 6:

Compute the conversion costs of polishing for Sport:

Working note 7:

Compute the conversion costs of special packaging for Retirement:

Working note 8:

Compute the conversion costs of packaging for Gag-gift:

Working note 9:

Compute the conversion costs of packaging for Commuter:

Working note 10:

Compute the conversion costs of packaging for Sport:

Working note 11:

Compute the conversion costs of packaging for Retirement:

Working note 12:

Compute the cost per unit transferred to finished goods for Gag-gift:

Working note 13:

Compute the cost per unit transferred to finished goods for Commuter:

Working note 14:

Compute the cost per unit transferred to finished goods for Gag-gift:

Working note 15:

Compute the cost per unit transferred to finished goods for Gag-gift:

Want to see more full solutions like this?

Chapter 8 Solutions

FUNDAMENTALS OF...(LL)-W/ACCESS>IP<

- Activity-based product costing Sweet Sugar Company manufactures three products (white sugar, brown sugar, and powdered sugar) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows: The activity bases identified for each activity are as follows: The activity-base usage quantities and units produced for the three products were determined from corporate records and are as follows: Each product requires 0.5 machine hour per unit. Instructions Determine the activity rate for each activity. Determine the total and per-unit activity cost for all three products. Round to nearest cent. Why arent the activity unit costs equal across all three products since they require the same machine time per unit?arrow_forwardEntries for materials cost flows in a process cost system The Hershey Company manufactures chocolate confectionery products. The three largest raw materials are cocoa, sugar, and dehydrated milk. These raw materials first go into the Blending Department. The blended product is then sent to the Molding Department, where the bars of candy are formed. The candy is then sent to the Packing Department, where the bars are wrapped and boxed. The boxed candy is then sent to the distribution center, where it is eventually sold to food brokers and retailers. Show the accounts debited and credited for each of the following business events: A. Materials used by the Blending Department B. Transfer of blended product to the Molding Department C. Transfer of chocolate to the Packing Department D. Transfer of boxed chocolate to the distribution center E. Sale of boxed chocolatearrow_forwardTyeDye Lights makes two products: Party and Holiday. It takes 80,900 direct labor hours to manufacture the Party Line and 93,500 direct labor hours to manufacture the Holiday Line. Overhead consists of $225,000 in the machine setup cost pool and $149,960 in the packaging cost pool. The machine setup pool has 52,000 setups for the Party product and 98,000 setups for the Holiday product. The packaging cost pool has 26,000 parts in the Party product and 39,200 parts for the Holiday product. Using the traditional cost method of direct labor hours, what is the predetermined overhead rate? A. $1.50 per direct labor hour B. $2.15 per direct labor hour C. $2.30 per direct labor hour D. $3.80 per direct labor hourarrow_forward

- Activity-based product costing Mello Manufacturing Company is a diversified manufacturer that manufactures three products (Alpha, Beta, and Omega) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows: The activity bases identified for each activity are as follows: The activity-base usage quantities and units produced for the three products were determined from corporate records and are as follows: Each product requires 40 minutes per unit of machine time. Instructions Determine the activity rate for each activity. Determine the total and per-unit activity cost for all three products. Round to nearest cent. Why arent the activity unit costs equal across all three products since they require the same machine time per unit?arrow_forwardBenson Pharmaceuticals uses a process-costing system to compute the unit costs of the over-the-counter cold remedies that it produces. It has three departments: mixing, encapsulating, and bottling. In mixing, the ingredients for the cold capsules are measured, sifted, and blended (with materials assumed to be uniformly added throughout the process). The mix is transferred out in gallon containers. The encapsulating department takes the powdered mix and places it in capsules (which are necessarily added at the beginning of the process). One gallon of powdered mix converts into 1,500 capsules. After the capsules are filled and polished, they are transferred to bottling, where they are placed in bottles that are then affixed with a safety seal, lid, and label. Each bottle receives 50 capsules. During March, the following results are available for the first two departments: Overhead in both departments is applied as a percentage of direct labor costs. In the mixing department, overhead is 200% of direct labor. In the encapsulating department, the overhead rate is 150% of direct labor. Required: 1. Prepare a production report for the mixing department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to two decimal places for the unit cost.) 2. Prepare a production report for the encapsulating department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to four decimal places for the unit cost.) 3. CONCEPTUAL CONNECTION Explain why the weighted average method is easier to use than FIFO. Explain when weighted average will give about the same results as FIFO.arrow_forwardHandy Leather, Inc., produces three sizes of sports gloves: small, medium, and large. A glove pattern is first stencilled onto leather in the Pattern Department. The stenciled patterns are then sent to the Cut and Sew Department, where the glove is cut and sewed together. Handy Leather uses the multiple production department factory overhead rate method of allocating factory overhead costs. Its factory overhead costs were budgeted as follows: The direct labor estimated for each production department was as follows: Direct labor hours are used to allocate the production department overhead to the products. The direct labor hours per unit for each product for each production department were obtained from the engineering records as follows: a. Determine the two production department factory overhead rates. b. Use the two production department factory overhead rates to determine the factory overhead per unit for each product.arrow_forward

- Golding Manufacturing, a division of Farnsworth Sporting, Inc., produces two different models of bows and eight models of knives. The bow-manufacturing process involves the production of two major subassemblies: the limbs and the handle. The limbs pass through four sequential processes before reaching final assembly: lay-up, molding, fabricating, and finishing. In the Lay-Up Department, limbs are created by laminating layers of wood. In Molding, the limbs are heat treated, under pressure, to form a strong resilient limb. In the Fabricating Department, any protruding glue or other processing residue is removed. Finally, in Finishing, the limbs are cleaned with acetone, dried, and sprayed with the final finishes. The handles pass through two processes before reaching final assembly: pattern and finishing. In the Pattern Department, blocks of wood are fed into a machine that is set to shape the handles. Different patterns are possible, depending on the machines setting. After coming out of the machine, the handles are cleaned and smoothed. They then pass to the Finishing Department where they are sprayed with the final finishes. In Final Assembly, the limbs and handles are assembled into different models using purchased parts such as pulley assemblies, weight adjustment bolts, side plates, and string. Golding, since its inception, has been using process costing to assign product costs. A predetermined overhead rate is used based on direct labor dollars (80 percent of direct labor dollars). Recently, Golding has hired a new controller, Karen Jenkins. After reviewing the product costing procedures, Karen requested a meeting with the divisional manager, Aaron Suhr. The following is a transcript of their conversation: KAREN: Aaron, I have some concerns about our cost accounting system. We make two different models of bows and are treating them as if they were the same product. Now I know that the only real difference between the models is the handle. The processing of the handles is the same, but the handles differ significantly in the amount and quality of wood used. Our current costing does not reflect this difference in direct material input. AARON: Your predecessor is responsible. He believed that tracking the difference in direct material cost wasnt worth the effort. He simply didnt believe that it would make much difference in the unit cost of either model. KAREN: Well, he may have been right, but I have my doubts. If there is a significant difference, it could affect our views of which model is more important to the company. The additional bookkeeping isnt very stringent. All we have to worry about is the Pattern Department. The other departments fit what I view as a process-costing pattern. AARON: Why dont you look into it? If there is a significant difference, go ahead and adjust the costing system. After the meeting, Karen decided to collect cost data on the two models: the Deluxe model and the Econo model. She decided to track the costs for one week. At the end of the week, she had collected the following data from the Pattern Department: a. There were a total of 2,500 bows completed: 1,000 Deluxe models and 1,500 Econo models. b. There was no beginning work in process; however, there were 300 units in ending work in process: 200 Deluxe and 100 Econo models. Both models were 80 percent complete with respect to conversion costs and 100 percent complete with respect to direct materials. c. The Pattern Department experienced the following costs: d. On an experimental basis, the requisition forms for direct materials were modified to identify the dollar value of the direct materials used by the Econo and Deluxe models: Required: 1. Compute the unit cost for the handles produced by the Pattern Department, assuming that process costing is totally appropriate. 2. Compute the unit cost of each handle, using the separate cost information provided on materials. 3. Compare the unit costs computed in Requirements 1 and 2. Is Karen justified in her belief that a pure process-costing relationship is not appropriate? Describe the costing system that you would recommend. 4. In the past, the marketing manager has requested more money for advertising the Econo line. Aaron has repeatedly refused to grant any increase in this products advertising budget because its per-unit profit (selling price less manufacturing cost) is so low. Given the results in Requirements 1 through 3, was Aaron justified in his position?arrow_forwardGolding Manufacturing, a division of Farnsworth Sporting Inc., produces two different models of bows and eight models of knives. The bow-manufacturing process involves the production of two major subassemblies: the limbs and the handles. The limbs pass through four sequential processes before reaching final assembly: layup, molding, fabricating, and finishing. In the layup department, limbs are created by laminating layers of wood. In the molding department, the limbs are heat-treated, under pressure, to form strong resilient limbs. In the fabricating department, any protruding glue or other processing residue is removed. Finally, in the finishing department, the limbs are cleaned with acetone, dried, and sprayed with the final finishes. The handles pass through two processes before reaching final assembly: pattern and finishing. In the pattern department, blocks of wood are fed into a machine that is set to shape the handles. Different patterns are possible, depending on the machines setting. After coming out of the machine, the handles are cleaned and smoothed. They then pass to the finishing department, where they are sprayed with the final finishes. In final assembly, the limbs and handles are assembled into different models using purchased parts such as pulley assemblies, weight-adjustment bolts, side plates, and string. Golding, since its inception, has been using process costing to assign product costs. A predetermined overhead rate is used based on direct labor dollars (80% of direct labor dollars). Recently, Golding has hired a new controller, Karen Jenkins. After reviewing the product-costing procedures, Karen requested a meeting with the divisional manager, Aaron Suhr. The following is a transcript of their conversation: Karen: Aaron, I have some concerns about our cost accounting system. We make two different models of bows and are treating them as if they were the same product. Now I know that the only real difference between the models is the handle. The processing of the handles is the same, but the handles differ significantly in the amount and quality of wood used. Our current costing does not reflect this difference in material input. Aaron: Your predecessor is responsible. He believed that tracking the difference in material cost wasnt worth the effort. He simply didnt believe that it would make much difference in the unit cost of either model. Karen: Well, he may have been right, but I have my doubts. If there is a significant difference, it could affect our views of which model is more important to the company. The additional bookkeeping isnt very stringent. All we have to worry about is the pattern department. The other departments fit what I view as a process-costing pattern. Aaron: Why dont you look into it? If there is a significant difference, go ahead and adjust the costing system. After the meeting, Karen decided to collect cost data on the two models: the Deluxe model and the Econo model. She decided to track the costs for one week. At the end of the week, she had collected the following data from the pattern department: a. There were a total of 2,500 bows completed: 1,000 Deluxe models and 1,500 Econo models. b. There was no BWIP; however, there were 300 units in EWIP: 200 Deluxe and 100 Econo models. Both models were 80% complete with respect to conversion costs and 100% complete with respect to materials. c. The pattern department experienced the following costs: d. On an experimental basis, the requisition forms for materials were modified to identify the dollar value of the materials used by the Econo and Deluxe models: Required: 1. Compute the unit cost for the handles produced by the pattern department, assuming that process costing is totally appropriate. Round unit cost to two decimal places. 2. Compute the unit cost of each handle, using the separate cost information provided on materials. Round unit cost to two decimal places. 3. Compare the unit costs computed in Requirements 1 and 2. Is Karen justified in her belief that a pure process-costing relationship is not appropriate? Describe the costing system that you would recommend. 4. In the past, the marketing manager has requested more money for advertising the Econo line. Aaron has repeatedly refused to grant any increase in this products advertising budget because its per-unit profit (selling price minus manufacturing cost) is so low. Given the results in Requirements 1 through 3, was Aaron justified in his position?arrow_forwardFrenchys makes two types of scarves: polyester (poly) and silk. There are two cost pools: setup, with an estimated $120,000 in overhead, and inspection, with $30,000 in overhead. Poly is estimated to have 800,000 setups and 450,000 inspections, while silk has 400,000 setups and 150,000 inspections. How much overhead is applied to each product?arrow_forward

- Dama Company produces womens blouses and uses the FIFO method to account for its manufacturing costs. The product Dama makes passes through two processes: Cutting and Sewing. During April, Damas controller prepared the following equivalent units schedule for the Cutting Department: Costs in beginning work in process were direct materials, 20,000; conversion costs, 80,000. Manufacturing costs incurred during April were direct materials, 240,000; conversion costs, 320,000. Required: 1. Prepare a physical flow schedule for April. 2. Compute the cost per equivalent unit for April. 3. Determine the cost of ending work in process and the cost of goods transferred out. 4. Prepare the journal entry that transfers the costs from Cutting to Sewing.arrow_forwardCycle Time, Velocity, Product Costing Mulhall, Inc., has a JIT system in place. Each manufacturing cell is dedicated to the production of a single product or major subassembly. One cell, dedicated to the production of mopeds, has four operations: machining, finishing, assembly, and qualifying (testing). The machining process is automated, using computers. In this process, the model’s frame and engine are constructed. In finishing, the frame is sandblasted, buffed, and painted. In assembly, the frame and engine are assembled. Finally, each model is tested to ensure operational capability. For the coming year, the moped cell has the following budgeted costs and cell time (both at theoretical capacity): Budgeted conversion costs $5,541,120 Budgeted materials $18,668,000 Cell time 35,520 Theoretical output 17,760 models During the year, the following actual results were obtained: Actual conversion costs $5,541,120 Actual materials $4,009,000 Actual cell time…arrow_forwardDiamond Inc. manufactures jewelry. The company has two departments, Assembly and Polishing. For the Polishing Department, material is added when the process is 80% complete. Work happens evenly throughout the process, so Conversion Costs are added evenly to the product. Once assembly is complete, the jewelry pieces are immediately transferred to the Polishing Department. Once the polishing is complete, the final product is transferred to Finished Goods Inventory. Data for the Polishing Department is as follows: Equiv Units Ending Equiv Units Open WIP New Costs Transferred-In 200 60 $250 $15,050 Direct Materials 140 - $500 $1,500 Conversion Costs 182 42 $1,250 $4,000 Actual units Ending Inventory 60 Units Transferred out 140 Provide calculations in good form for the costs per equivalent units and the total cost reconciliation for the department. If Diamond…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,