Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 4SCQ

Suppose that the market

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

News reports from the western United States occasionally report incidents of cattle ranchers slaughtering many newborn calves and burying them in mass graves rather than transporting them to markets. Assuming that this is rational behavior by profit-maximizing "firms," explain what economic factors may influence such behavior. Justify your answer.

Will a profit-maximizing firm in a competitive market ever produce a positive level of output in the range where the marginal cost is falling? Give an explanation.

Assume that marginal revenue equals rising marginal cost at 100 units of output. At this output level, a firm's average total cost is $11 and its total variable cost is $600. If the price of the product is $3 per unit and the firm follows its optimal strategy, the firm will earn an economic profit equal to

Chapter 8 Solutions

Principles of Economics 2e

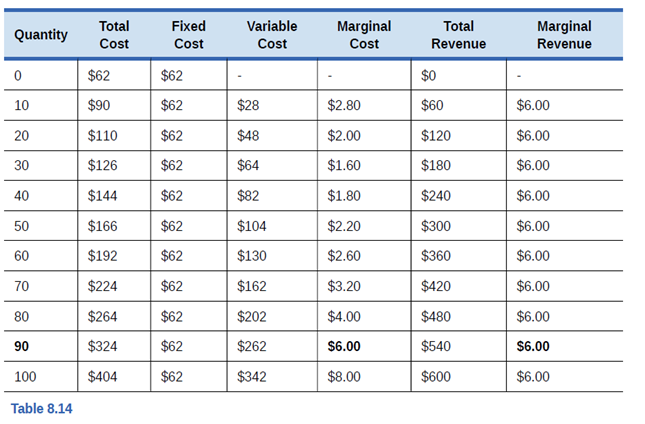

Ch. 8 - Firms ill a perfectly competitive market are said...Ch. 8 - Would independent trucking fit the characteristics...Ch. 8 - Look at Table 8.13. What would happen to the films...Ch. 8 - Suppose that the market price increases to 6, as...Ch. 8 - Explain in words why a profit-maximizing film will...Ch. 8 - A firms marginal cost curve above the average...Ch. 8 - If new technology in a perfectly competitive...Ch. 8 - A market in perfect competition is in long-run...Ch. 8 - Productive efficiency and allocative efficiency...Ch. 8 - Explain how the profit-maximizing rule of setting...

Ch. 8 - A single firm in a perfectly competitive market is...Ch. 8 - What are the four basic assumptions of perfect...Ch. 8 - What is a price taker firm?Ch. 8 - How does a perfectly competitive firm decide what...Ch. 8 - What prevents a perfectly competitive firm from...Ch. 8 - How does a perfectly competitive film calculate...Ch. 8 - Briefly explain the reason for the shape of a...Ch. 8 - What two rules does a perfectly competitive firm...Ch. 8 - How does the average cost curve help to show...Ch. 8 - What two lines on a cost curve diagram intersect...Ch. 8 - Should a firm shut down immediately if it is...Ch. 8 - How does the average variable cost curve help a...Ch. 8 - What two lines on a cost curve diagram intersect...Ch. 8 - Why does entry occur?Ch. 8 - Why does exit occur?Ch. 8 - Do entry and exit occur in the short run, the long...Ch. 8 - What price will a perfectly competitive firm end...Ch. 8 - Will a perfectly competitive market display...Ch. 8 - Will a perfectly competitive market display...Ch. 8 - Finding a life partner is a complicated process...Ch. 8 - Can you name five examples of perfectly...Ch. 8 - Your company operates in a perfectly competitive...Ch. 8 - Since a perfectly competitive firm can sell as...Ch. 8 - Many films in the United States file for...Ch. 8 - Why will profits for films in a perfectly...Ch. 8 - Why will losses for firms in a perfectly...Ch. 8 - Assuming that the market for cigarettes is in...Ch. 8 - In the argument for why perfect competition is...Ch. 8 - The AAA Aquarium Co. sells aquariums for 20 each....Ch. 8 - Perfectly competitive firm Doggies Paradise Inc....Ch. 8 - A computer company produces affordable,...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Ravenna Candles recently purchased candleholders for resale in its shops. Which of the following costs would be...

Financial Accounting (12th Edition) (What's New in Accounting)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (5th Edition)

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (4th Edition)

Determine the annual budget for office utilities using the data from the past 12 months shown in Figure 9-7. Ut...

Construction Accounting And Financial Management (4th Edition)

Artic Camping Gears currently sells 35,000 units at $73 per unit. Its expenses are as follows: Management belie...

Principles of Accounting Volume 2

Knowledge Booster

Similar questions

- Consider a firm that has two types of employees in their marketing department with the following compensation structures. i. Sales staff that make "cold calls" to businesses to try and generate work for the firm. They are paid flat hourly wages and spend most of their time driving around to businesses to develop and curate those relationships. ii. A marketing manager that earns an annual salary, whose responsibilities are to manage the sales staff and develop a strategic marketing plan, while at the same time they make commission on the work that they bring in for the firm themselves. Based upon this description, for each type of employee identify a problem with the incenctives provided by the compensation schemes and the nature of their responsibilities. Then provide a potential solution for each, based upon our discussions of incentive design and moral hazard.arrow_forwardA firm has revenue given by R(q) = 160q - 3q2 and its cost function is C(q) = 500 + 40 Q What is the profit-maximizing level of output? What profit does the firm earn at this output level? The firm maximizes profit by producing q = _______. (Enter your response as a whole number.) Corresponding profit is pi = $_________. Enter your response as a whole number).arrow_forwardif a competitive firm's marginal costs always increase with output then at the profit maximising output level, producer surplus isarrow_forward

- When the competitive firm maximizes profit, its marginal cost of an additional unit of output is always equal to the: Minimum of average total cost. Minimum total cost. Price. Maximum total revenue.arrow_forwardThe marginal cost of a competitive firm is MC(Q)=4Q+7. The market price is 80. Suppose the current output level is Q=15. At this point, would the firm like to increase or decrease its output level? Enter 1 for increase, 2 for decrease.arrow_forwardCreate a firm model (two graphs, one for total units and one for marginal units) that shows how economists explain the firm level of production that maximizes its profit. Do not use numbers. Just graphs and detailed explanations. Show why the equilibrium point shows the maximum possible profit & and that any other point will not reflect a quantity that maximizes the firm profit. Derive the supply function from the firm theory. Do not use numbers. Just graphs and detailed explanations.arrow_forward

- Evaluate the following statements. If a statement is true, explain why. If it is false, identify the mistake and correct the error. Assume the market is perfectly competitive. A profit-maximizing firm should select the output level at which the difference between the market price and marginal cost is greatest. An increase in fixed cost lowers the profit-maximizing quantity of output produced in the short run.arrow_forwardWhich of the following offers the best explanation of why “marginal revenue equals marginal cost” is the rule that indicates the profit-maximizing output level? a. If output were reduced from the profit-maximizing level, then the firm would be gaining marginal revenue that exceeds marginal cost, and thus increasing the level of profit. b. The marginal revenue is equal to the marginal cost at all levels of output for a perfectly competitive firm. c. If output were increased from the profit-maximizing level, then the firm would be gaining marginal revenue that is less than the marginal cost incurred in producing this additional unit, and thus reducing the level of profit. d. Because the firm colludes with other similar firms to set price equal to marginal cost.arrow_forwardRefer to the diagram above. Which of the following explains the slope of the total revenue curve illustrated in this graph? Question 1 options: total revenue is shown as a straight line sloping up indicaates a perfectly competitive firm. the slope of the total revenue curve is determined by the price of the goods produced. at higher levels of output, diminishing returns will cause the total cost to slope downward steeply. the slope of the total revenue curve is explained by both of the first two statements above.arrow_forward

- The cost function for a firm is given by CQ) = 5 + Q If the firm sells output in a perfectly competitive market and other firms in the industry sell output at a price of $20, what price should the manager of this firm put on the product? What level of output should be produced to maximize profits? How much profit will be earned? As per your solution provided The profit is maximized: MC=MR=P C(Q) = 5+Q2 MC= dC/dQ = 2Q ...what is dC and dQ here??? and why dC/dQ = 2Q?? please assistarrow_forwardYou are the manager of a firm that sells its product in a competitive market with market (inverse) demand given by P = 50 − 0.5Q. The market equilibrium price is $50. Your firm's cost function is C = 40 + 5Q2. Your firm's marginal revenue is Multiple Choice MR(Q) = 50 − Q. indeterminable based on the information in the question. MR(Q) = 10Q. $50.arrow_forwardAssume the market for tortillas is perfectly competitive. The market supply and demand curves for tortillas are given as follows: Supply curve: P = 5Q Demand curve: P = 120 - 10Q The short run marginal cost curve for a typical tortilla factory is: MC = 20q Assuming all tortilla factories are identical, calculate the following: Equilibrium price for tortillas: __1__ Profit maximizing short run equilibrium level of output for a tortilla factory: __2__ Given profit maximizing output as above, a tortilla factory is: __3__ Total number of tortilla factories: __4__ Producer surplus of a tortilla factory: __5__arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning