Segmented Income Statement, Management Decision Making

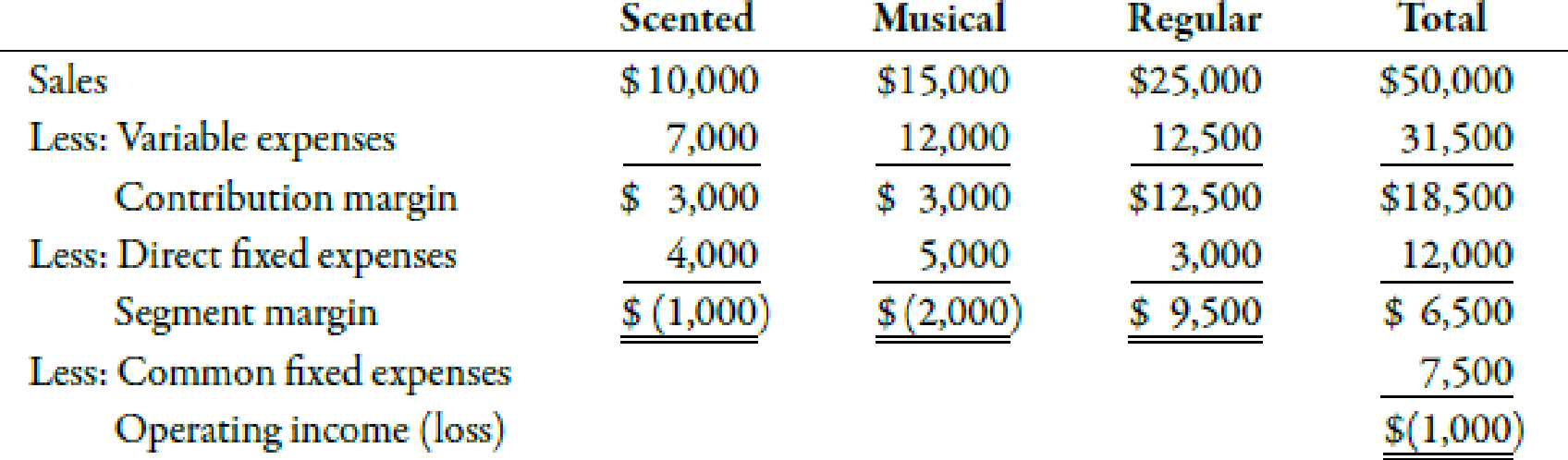

FunTime Company produces three lines of greeting cards: scented, musical, and regular. Segmented income statements for the past year are as follows:

Kathy Bunker, president of FunTime, is concerned about the financial performance of her firm and is seriously considering dropping both the scented and musical product lines. However, before making a final decision, she consults Jim Dorn, FunTime’s vice president of marketing.

Required:

- 1. CONCEPTUAL CONNECTION Jim believes that by increasing advertising by $1,000 ($250 for the scented line and $750 for the musical line), sales of those two lines would increase by 30%. If you were Kathy, how would you react to this information?

- 2. CONCEPTUAL CONNECTION Jim warns Kathy that eliminating the scented and musical lines would lower the sales of the regular line by 20%. Given this information, would it be profitable to eliminate the scented and musical lines?

- 3. CONCEPTUAL CONNECTION Suppose that eliminating either line reduces sales of the regular cards by 10%. Would a combination of increased advertising (the option described in Requirement 1) and eliminating one of the lines be beneficial? Identify the best combination for the firm.

1.

Describe the reaction of Person K on the increase in advertisement expense and sales.

Explanation of Solution

Segmented Income Statement:

Variable costing is used in the preparation of a segmented income statement. In this income statement, the variable expenses are recorded separately from the fixed expenses which are further divided into direct fixed expenses and common expenses.

The following table represents the segmented income statement of Company F:

| Company F | ||||

| Segmented Income Statement | ||||

| For the Previous Year | ||||

| Scented ($) | Musical ($) | Regular ($) | Total ($) | |

| Sales1 | 13,000 | 19,500 | 25,000 | 57,500 |

| Less variable expenses2 | 9,100 | 15,600 | 12,500 | 37,200 |

| Contribution margin | 3,900 | 3,900 | 12,500 | 20,300 |

| Less direct fixed expenses3: | 4,250 | 5,750 | 3,000 | 13,000 |

| Segment margin | (350) | (1,850) | 9,500 | 7,300 |

| Less common fixed expenses: | 7,500 | |||

| Operating income (loss) | (200) | |||

Table (1)

The amount of operating loss is $200. Person K should accept the increase in the direct fixed expense and sales. The overall operating loss before the increase is $1,000 whereas the overall operating loss after the increase is $200. This represents that there is a decrease in the operating loss after an increase in the direct fixed expense and sales.

Working Notes:

1. Calculation of revised sales for scented cards:

Hence, the amount of revised sales for scented cards is $13,000.

Calculation of revised sales for musical cards:

Hence, the amount of revised sales for musical cards is $19,500.

2. Calculation of revised variable expense for scented cards:

Hence, the amount of revised variable expense for scented cards is $9,100.

Calculation of revised variable expense for musical cards:

Hence, the amount of revised variable expense for musical cards is $15,600.

3. Calculation of revised fixed direct expense for scented cards:

Hence, the revised fixed direct expense for scented cards is $4,250.

Calculation of revised fixed direct expense for musical cards:

Hence, the revised fixed direct expense for musical cards is $5,750.

2.

Describe whether it would be beneficial for the company to eliminate the scented and musical lines.

Explanation of Solution

The following table represents the operating income or loss after eliminating scented and musical lines:

| Company F | |

| Segmented Income Statement | |

| For the Previous Year | |

| Regular ($) | |

| Sales1 | 20,000 |

| Less variable expenses2 | 10,000 |

| Contribution margin | 10,000 |

| Less direct fixed expenses: | 3,000 |

| Segment margin | 7,000 |

| Less common fixed expenses: | 7,500 |

| Operating income (loss) | (500) |

Table (2)

The amount of operating loss is $500. If the company eliminates the scented and musical lines, then the sales and variable expenses will get reduced by 20%. The overall operating loss was $1,000 but the revised operating loss after eliminating scented and musical line is $500.

Although the operating loss decreases, still it is not profitable because when the direct fixed expenses of scented and musical lines increase, the operating loss reduces to $200.

Working Notes:

1. Calculation of revised sales:

Hence, the amount of revised sales is $20,000.

2. Calculation of revised variable expense:

Hence, the amount of revised variable expense is $10,000.

3.

Describe whether the combination of an increase in advertising and eliminating either of the lines would be beneficial. Also, identify the best combination.

Explanation of Solution

Since the musical line has the highest segment loss, the line should be eliminated. The following table represents the income statement after eliminating musical lines:

| Company F | |||

| Segmented Income Statement | |||

| For the Previous Year | |||

| Scented ($) | Regular ($) | Total ($) | |

| Sales1 | 13,000 | 22,500 | 35,500 |

| Less variable expenses2 | 9,100 | 11,250 | 20,350 |

| Contribution margin | 3,900 | 11,250 | 15,150 |

| Less direct fixed expenses3: | 4,250 | 3,000 | 7,250 |

| Segment margin | (350) | 8,250 | 7,900 |

| Less common fixed expenses: | 7,500 | ||

| Operating income (loss) | 400 | ||

Table (3)

Therefore, the amount of operating income is $400. The company should consider this type of combination as it is more profitable than any other combination.

Working Notes:

1. Calculation of revised sales for scented cards:

Hence, the amount of revised sales for scented cards is $13,000.

Calculation of revised sales for the regular line:

Hence, the amount of revised sales for the regular line is $22,500.

2. Calculation of revised variable expense for scented cards:

Hence, the amount of revised variable expense for scented cards is $9,100.

Calculation of revised variable expense for the regular line:

Hence, the amount of revised variable expense for the regular line is $11,250.

3. Calculation of revised fixed direct expense for scented cards:

Hence, the revised fixed direct expense for scented cards is $4,250.

Want to see more full solutions like this?

Chapter 8 Solutions

CENGAGENOWV2 FOR HANSEN/MOWEN S CORNERS

- Special-Order Decision, Qualitative Aspects Randy Stone, manager of Specialty Paper Products Company, was agonizing over an offer for an order requesting 5,000 boxes of calendars. Specialty Paper Products was operating at 70% of its capacity and could use the extra business. Unfortunately, the orders offering price of 4.20 per box was below the cost to produce the calendars. The controller, Louis Barns, was opposed to taking a loss on the deal. However, the personnel manager, Yatika Blaine, argued in favor of accepting the order even though a loss would be incurred. It would avoid the problem of layoffs and would help to maintain the companys community image. The full cost to produce a box of calendars follows: Later that day, Louis and Yatika met over coffee. Louis sympathized with Yatiks concerns and suggested that the two of them rethink the special-order decision. He offered to determine relevant costs if Yatika would list the activities that would be affected by a layoff. Yatika eagerly agreed and came up with the following activities: an increase in the state unemployment insurance rate from 1% to 2% of total payroll, notification costs to lay off approximately 20 employees, and increased costs of rehiring and retraining workers when the downturn was over. Louis determined that these activities would cost the following amounts: Total payroll is 1,460,000 per year. Layoff paperwork is 25 per laid-off employee. Rehiring and retraining is 150 per new employee. Required: 1. CONCEPTUAL CONNECTION Assume that the company will accept the order only if it increases total profits (without taking the potential layoffs into consideration). Should the company accept or reject the order? Provide supporting computations. 2. CONCEPTUAL CONNECTION Consider the new information on activity costs associated with the layoff. Should the company accept or reject the order? Provide supporting computations.arrow_forwardEvaluating selling and administrative cost allocations Gordon Gecco Furniture Company has two major product lines with the following characteristics: Commercial office furniture: Few large orders, little advertising support, shipments in full truckloads, and low handling complexity Home office furniture: Many small orders, large advertising support, shipments in partial truckloads, and high handling complexity The company produced the following profitability report for management: The selling and administrative expenses are allocated to the products on the basis of relative sales dollars. Evaluate the accuracy of this report and recommend an alternative approach.arrow_forward) Sales Mix Analysis Delving further into the operations, another branch which is in the restaurant business is brought into focus. Management desires a net income of $ 135,000 from this division which has fixed costs of $ 300,000 per year. The following information about the operations of the division for the past two years has been supplied. (please refer to image) You are required to prepare a report to show : 1. The total sales required to achieve the desired net income 2. The total sales of each product required to meet the objective.arrow_forward

- Explaining why companies use performance evaluation systems Financial performance is measured in many ways. Requirements 1. Explain the difference between lag and lead indicators. 2. The following is a list of financial measures. Indicate whether each is a lag or a lead indicator: a. Income statement shows net income of $100,000 b. Listing of next week’s orders of $50,000 c. Trend showing that average hits on the redesigned Web site are increasing at 5% per week d. Price sheet from vendor reflecting that cost per pound of sugar for the next month is $2 e. Contract signed last month with large retail store that guarantees a minimum shelf space for Grandpa’s Overloaded Chocolate Cookies for the next yeararrow_forwardScorecard Measures, Strategy Translation At the end of 20x1, Mejorar Company implemented a low-cost strategy to improve its competitive position. Its objective was to become the low-cost producer in its industry. A Balanced Scorecard was developed to guide the company toward this objective. To lower costs, Mejorar undertook a number of improvement activities such as JIT production, total quality management, and activity-based management. Now, after two years of operation, the president of Mejorar wants some assessment of the achievements. To help provide this assessment, the following information on one product has been gathered: 20x1 20x3 Theoretical annual capacity* 249,600 249,600 Actual production** 208,000 234,000 Market size (in units sold) 1,300,000 1,300,000 Production hours available (40 workers) 104,000 104,000 Very satisfied customers 62,400 117,000 Actual cost per unit $340 $272 Days of inventory 14 7 Number of defective…arrow_forwardScorecard Measures, Strategy Translation At the end of 20x1, Mejorar Company implemented a low-cost strategy to improve its competitive position. Its objective was to become the low-cost producer in its industry. A Balanced Scorecard was developed to guide the company toward this objective. To lower costs, Mejorar undertook a number of improvement activities such as JIT production, total quality management, and activity-based management. Now, after two years of operation, the president of Mejorar wants some assessment of the achievements. To help provide this assessment, the following information on one product has been gathered: 20x1 20x3 Theoretical annual capacity* 249,600 249,600 Actual production** 208,000 234,000 Market size (in units sold) 1,300,000 1,300,000 Production hours available (40 workers) 104,000 104,000 Very satisfied customers 62,400 117,000 Actual cost per unit $340 $272 Days of inventory 14 7 Number of defective…arrow_forward

- Refer to the information for Petoskey Company from Exercise 8-44. Assume that 20% of theAlanson customers choose to buy from Petoskey because it offers a full range of products, including Conway. If Conway were no longer available from Petoskey, these customers would goelsewhere to purchase Alanson.Required:CONCEPTUAL CONNECTION Estimate the impact on profit that would result from droppingConway. Explain why Petoskey should keep or drop Conwayarrow_forwardDifferential Analysis Report for Sales Promotion Proposal (SEE ATTACHMENT FOR QUESTION OVERVIEW) Rocket Shoe Company is planning a one-month campaign for August to promote sales of one of its two shoe products. A total of $98,000 has been budgeted for advertising, contests, redeemable coupons, and other promotional activities. The following data have been assembled for their possible usefulness in deciding which of the products to select for the campaign. Cross-TrainerShoe RunningShoe Unit selling price $70 $77 Unit production costs: Direct materials $ (13) $(17) Direct labor (4) (6) Variable factory overhead (3) (4) Fixed factory overhead (7) (8) Total unit production costs $(27) $(35) Unit variable selling expenses (23) (21) Unit fixed selling expenses (13) (8) Total unit costs $(63) $(64) Operating income per unit $ 7 $ 13 No increase in facilities would be necessary to produce and sell the increased…arrow_forwardROI, RI, EVA, and performance evaluation. Cora Manufacturing makes fashion products and competes on the basis of quality and leading-edge designs. The company has two divisions, clothing and cosmetics. Cora has $5,000,000 invested in assets in its clothing division. After-tax operating income from sales of clothing this year is $1,000,000. The cosmetics division has $12,500,000 invested in assets and an after-tax operating income this year of $2,000,000. The weightedaverage cost of capital for Cora is 6%. The CEO of Cora has told the manager of each division that the division that “performs best” this year will get a bonus.arrow_forward

- Restructuring a Segmented Income Statement Millard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them in the West, Central, and East regions. Each of these regions is about the same size and each has its own manager and sales staff. The company has been experiencing losses for many months. In an effort to improve performance, management has requested that the monthly income statement be segmented by sales region. The company’s first effort at preparing a segmented income statement for May is given below. The cost of goods sold and shipping expense are both variable. All other costs are fixed. Required: 1. List any weaknesses that you see in the company’s segmented income statement given above. 2. Explain the basis that is apparently being used to allocate the corporate expenses to the regions. Do you agree with these allocations? Explain. 3. Prepare a new contribution format segmented income statement for May.…arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Davis Stores sells clothing in 15 stores located around the southwestern United States. The managers at Davis are considering expanding by opening new stores and are interested in estimating costs in potential new locations. They believe that costs are driven in large part by store volume measured by revenue. The following data were collected from last year’s operations (revenues and costs in thousands of dollars). Store Revenues Costs 101 $4,100 $4,214 102 2,227 2,894 103 5,738 5,181 104 3,982 3,998 105 2,914 3,676 106 4,023 3,319 107 6,894 5,029 108 1,779 2,374 109 5,416 4,688 110 3,228 2,959 111 3,886 4,179 112 4,690 3,200 113 3,552 2,556 114 4,817 4,655 115 2,124 2,986 Required: a. Use the high-low method to estimate the fixed and variable portions of store costs based on revenues.arrow_forwardSegmented Income Statements: Analysis of Proposals to Improve Profits Shannon, Inc., has two divisions. One produces and sells paper party supplies (napkins, paper plates, invitations); the other produces and sells cookware. A segmented income statement for the most recent quarter is given below: Party Supplies Division Cookware Division Total Sales $500,000 $750,000 $1,250,000 Less: Variable expenses 425,000 460,000 885,000 Contribution margin $ 75,000 $290,000 $ 365,000 Less: Direct fixed expenses 85,000 110,000 195,000 Segment margin $ (10,000) $180,000 $ 170,000 Less: Common fixed expenses 130,000 Operating income $ 40,000 On seeing the quarterly statement, Madge Shannon, president of Shannon, Inc., was distressed and discussed her disappointment with Bob Ferguson, the company's vice president of finance. MADGE: "The Party Supplies Division is…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,