Fundamentals Of Financial Accounting

6th Edition

ISBN: 9781259864230

Author: PHILLIPS, Fred, Libby, Robert, Patricia A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 6SDC

Critical Thinking: Analyzing the Impact of Credit Policies

Problem Solved Company has been operating for five years as a software consulting firm. During this period, it has experienced rapid growth in Sales Revenue and in

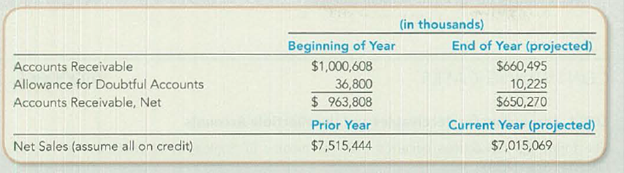

put into place more stringent credit-granting and collection procedures that you expect will reduce receivables by approximately one-third by year-end. You have gathered the following data related to the changes (in thousands):

Required:

- 1. Compute, to one decimal place, the accounts receivable turnover ratio based on three different assumptions:

- a. The stringent credit policies reduce Accounts Receivable, Net and decrease Net Sales as projected in the table.

- b. The stringent credit policies reduce Accounts Receivable, Net as projected in the table but do not decrease Net Sales from the prior year.

- c. The stringent credit policies are not implemented, resulting in no change from the beginning of the year Accounts Receivable balance and no change in Net Sales from the prior year.

- 2. On the basis of your findings in requirement 1, write a brief memo to the chief financial officer explaining the potential benefits and drawbacks of more stringent credit policies and how they are likely to affect the accounts receivable turnover ratio.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Your first major assignment after your recent promotion at Ice Nine involves overseeing the management of accounts receiv- be able and inventory. The first item that you must attend to in- volves a proposed change in credit policy that would involve relaxing credit terms from the existing terms of 1/50, net 70 to 2/60, net 90 in hopes of securing new sales. The management at Ice Nine does not expect bad debt losses on its current customers to change under the new credit policy. The following information should aid you in the analysis of this problem.

New sales level (all credit)

$8,000,000

Original sales level (all credit)

$7,000,000

Contribution margin

25%

Percent bad debt losses on new sales

8%

New average collection period

75 days

Original average collection period

60 days

Additional investment in inventory

$50,000

Pre-tax required rate of return

15%

New percent cash discount

2%

Percent of customers taking the new cash discount

50%

Original percent cash…

Your first major assignment after your recent promotion at Ice Nine involves overseeing the management of accounts receiv- be able and inventory. The first item that you must attend to in- volves a proposed change in credit policy that would involve relaxing credit terms from the existing terms of 1/50, net 70 to 2/60, net 90 in hopes of securing new sales. The management at Ice Nine does not expect bad debt losses on its current customers to change under the new credit policy. The following information should aid you in the analysis of this problem.

New sales level (all credit)

$8,000,000

Original sales level (all credit)

$7,000,000

Contribution margin

25%

Percent bad debt losses on new sales

8%

New average collection period

75 days

Original average collection period

60 days

Additional investment in inventory

$50,000

Pre-tax required rate of return

15%

New percent cash discount

2%

Percent of customers taking the new cash discount

50%

Original percent cash…

Your first major assignment after your recent promotion at Ice Nine involves overseeing the management of accounts receiv- be able and inventory. The first item that you must attend to in- volves a proposed change in credit policy that would involve relaxing credit terms from the existing terms of 1/50, net 70 to 2/60, net 90 in hopes of securing new sales. The management at Ice Nine does not expect bad debt losses on its current customers to change under the new credit policy. The following information should aid you in the analysis of this problem.

New sales level (all credit)

$8,000,000

Original sales level (all credit)

$7,000,000

Contribution margin

25%

Percent bad debt losses on new sales

8%

New average collection period

75 days

Original average collection period

60 days

Additional investment in inventory

$50,000

Pre-tax required rate of return

15%

New percent cash discount

2%

Percent of customers taking the new cash discount

50%

Original percent cash…

Chapter 8 Solutions

Fundamentals Of Financial Accounting

Ch. 8 - What are the advantages and disadvantages of...Ch. 8 - Prob. 2QCh. 8 - Which basic accounting principles does the...Ch. 8 - Using the allowance method, is Bad Debt Expense...Ch. 8 - What is the effect of the write-off of...Ch. 8 - How does the use of calculated estimates differ...Ch. 8 - A local phone company had a customer who rang up...Ch. 8 - What is the primary difference between accounts...Ch. 8 - What are the three components of the interest...Ch. 8 - As of May 1, 2016, Krispy Kreme Doughnuts had...

Ch. 8 - Does an increase in the receivables turnover ratio...Ch. 8 - What two approaches can managers take to speed up...Ch. 8 - When customers experience economic difficulties,...Ch. 8 - (Supplement 8A) Describe how (and when) the direct...Ch. 8 - (Supplement 8A) Refer to question 7. What amounts...Ch. 8 - 1. When a company using the allowance method...Ch. 8 - 2. When using the allowance method, as Bad Debt...Ch. 8 - 3. For many years, Carefree Company has estimated...Ch. 8 - 4. Which of the following best describes the...Ch. 8 - 5. If the Allowance for Doubtful Accounts opened...Ch. 8 - 6. When an account receivable is recovered a....Ch. 8 - Prob. 7MCCh. 8 - 8. If the receivables turnover ratio decreased...Ch. 8 - Prob. 9MCCh. 8 - Prob. 10MCCh. 8 - Prob. 1MECh. 8 - Evaluating the Decision to Extend Credit Last...Ch. 8 - Reporting Accounts Receivable and Recording...Ch. 8 - Recording Recoveries Using the Allowance Method...Ch. 8 - Recording Write-Offs and Bad Debt Expense Using...Ch. 8 - Determining Financial Statement Effects of...Ch. 8 - Estimating Bad Debts Using the Percentage of...Ch. 8 - Estimating Bad Debts Using the Aging Method Assume...Ch. 8 - Recording Bad Debt Estimates Using the Two...Ch. 8 - Prob. 10MECh. 8 - Prob. 11MECh. 8 - Recording Note Receivable Transactions RecRoom...Ch. 8 - Prob. 13MECh. 8 - Determining the Effects of Credit Policy Changes...Ch. 8 - Prob. 15MECh. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Bad Debt Expense Estimates and...Ch. 8 - Determining Financial Statement Effects of Bad...Ch. 8 - Prob. 3ECh. 8 - Recording Write-Offs and Recoveries Prior to...Ch. 8 - Prob. 5ECh. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Recording and Reporting Allowance for Doubtful...Ch. 8 - Recording and Determining the Effects of Write-Off...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Using Financial Statement Disclosures to Infer...Ch. 8 - Using Financial Statement Disclosures to Infer Bad...Ch. 8 - Prob. 15ECh. 8 - Analyzing and Interpreting Receivables Turnover...Ch. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions Jung ...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions CS...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Prob. 2PBCh. 8 - Prob. 3PBCh. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording and Reporting Credit Sales and Bad Debts...Ch. 8 - Prob. 2COPCh. 8 - Recording Daily and Adjusting Entries Using FIFO...Ch. 8 - Prob. 1SDCCh. 8 - Prob. 2SDCCh. 8 - Ethical Decision Making: A Real-Life Example You...Ch. 8 - Critical Thinking: Analyzing the Impact of Credit...Ch. 8 - Using an Aging Schedule to Estimate Bad Debts and...Ch. 8 - Accounting for Receivables and Uncollectible...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ethics and Revenue Recognition Alan Spalding is CEO of a large appliance wholesaler. Alan is under pressure from Wall Street Analysts to meet his aggressive sales revenue growth projections. Unfortunately, near the end of the year he realizes that sales must dramatically improve if his projections are going to be met. To accomplish this objective, he orders his sales force to contact their largest customers and offer them price discounts if they buy by the end of the year. Alan also offered to deliver the merchandise to a third-party warehouse with whom the customers could arrange delivery when the merchandise was needed. Required: Do you believe that revenue from these sales should be recognized in the current year? Why or why not?arrow_forwardGlencoe First National Bank operated for years under the assumption that profitability can be increased by increasing dollar volumes. Historically, First Nationals efforts were directed toward increasing total dollars of sales and total dollars of account balances. In recent years, however, First Nationals profits have been eroding. Increased competition, particularly from savings and loan institutions, was the cause of the difficulties. As key managers discussed the banks problems, it became apparent that they had no idea what their products were costing. Upon reflection, they realized that they had often made decisions to offer a new product which promised to increase dollar balances without any consideration of what it cost to provide the service. After some discussion, the bank decided to hire a consultant to compute the costs of three products: checking accounts, personal loans, and the gold VISA. The consultant identified the following activities, costs, and activity drivers (annual data): The following annual information on the three products was also made available: In light of the new cost information, Larry Roberts, the bank president, wanted to know whether a decision made two years ago to modify the banks checking account product was sound. At that time, the service charge was eliminated on accounts with an average annual balance greater than 1,000. Based on increases in the total dollars in checking, Larry was pleased with the new product. The checking account product is described as follows: (1) checking account balances greater than 500 earn interest of 2 percent per year, and (2) a service charge of 5 per month is charged for balances less than 1,000. The bank earns 4 percent on checking account deposits. Fifty percent of the accounts are less than 500 and have an average balance of 400 per account. Ten percent of the accounts are between 500 and 1,000 and average 750 per account. Twenty-five percent of the accounts are between 1,000 and 2,767; the average balance is 2,000. The remaining accounts carry a balance greater than 2,767. The average balance for these accounts is 5,000. Research indicates that the 2,000 category was by far the greatest contributor to the increase in dollar volume when the checking account product was modified two years ago. Required: 1. Calculate rates for each activity. 2. Using the rates computed in Requirement 1, calculate the cost of each product. 3. Evaluate the checking account product. Are all accounts profitable? Compute the average annual profitability per account for the four categories of accounts described in the problem. What recommendations would you make to increase the profitability of the checking account product? (Break-even analysis for the unprofitable categories may be helpful.)arrow_forwardThe following are excerpts from the financial statements of 2018 and 2019 of Mandela Corporation. 2019 2018 Sales $187,600 $195,000 Accounts Receivable (net): Beginning of Year 68,100 66,500 End of Year 60,200 68,100 A newly hired manager has started implementing new credit policies. Required: a. As a consultant, you are contracted to analyze Accounts Receivable Turnover and Number of Days’ Sales in Receivable and provide opinion as to whether Mandela’s credit policy changes are working b. What conclusions does your analysis suggest. Are the new credit policies working?arrow_forward

- Best Exports has noticed their current year net income is only $60,000. In order to get a loan from their bank to assist the business they will need to provide a statement of cash flows. In reviewing the statement of cash flows, you notice a large increase ($80,000) in accounts receivable due to two of your largest customers being behind in payments. Since the bank looks at the operating activities, this increase will create concern. You make a suggestion to reclassify the accounts receivables to long-term, thus removing them from current assets will increase the net cash from operations. Under what circumstances would this reclassification be considered ethical or unethical? Support your selection by finding an article which explains your choice.arrow_forwardYou are a Corporate Credit Analyst for your bank. A new corporate customer in the manufacturing sector approached your bank for a large credit facility in the sum of $20 million for production equipment and warehousing. The customer submitted the following financials to you. List two strengths and two weaknesses of the borrower in relation to credit.arrow_forwardOutsourcing Call Centers; Strategy; Ethics; Present-Value Analysis (Chapter 12) Merchants’Bank (MB) is a large regional bank operating in 634 locations in the southeastern United States.Until 2014, the bank operated a call center for customer inquiries out of a single location in Atlanta,Georgia. MB understood the importance of the call center for overall customer satisfaction andmade sure that the center was managed effectively. However, in early 2013, it became clear that thecost of running the center was increasing very rapidly, along with the firm’s growth, and that someissues were arising about the quality of the service. To improve the quality and dramatically reducethe cost of the service, MB moved its call center to Bangalore, India, to be run by an experiencedoutsourcing firm, Naftel, which offers similar services to other banks like MB.The Naftel contract was for 5 years, and in late 2017 it was time to consider whether to renewthe contract, change to another call center…arrow_forward

- Problem - Accounts Receivable Activity Michael’s Bookshelf specializes in used, rare, and out-of-print books. The store has alarge base of repeat customers who purchase books on 30-day accounts. At 15 daysoverdue, each customer gets a phone call from Michael requesting payment. Michael hasexperienced a high success rate with this collection effort. Michael’s CPA is preparingyear-end financial statements and has asked him for his estimate of uncollectibleaccounts. Michael has a balance of $65,000 in the Accounts Receivable account at theend of the year. He has analyzed his uncollectible accounts using an aging of theaccounts receivable. He estimates that only 2.5 percent of his accounts receivablebalance will not be collected. The Allowance for Doubtful Accounts has a credit balanceof $210 in the trial balance. 1. Prepare the journal entry to record the bad debts expense at year end. 2. Show the balance sheet presentation of the accounts receivable account. 3. What is the amount of bad…arrow_forwardLetni Corporation engages in the manufacture and sale of semiconductor chips for the computing and communications industries. During the past year, operating revenues remained relatively flat compared to the prior year but management notices a big increase in accounts receivable. The increase in receivables is largely due to the recent economic slowdown in the computing and telecommunications industries. Many of the company’s customers are having financial difficulty, lengthening the period of time it takes to collect on accounts. Below are year-end amounts. Age Group OperatingRevenue AccountsReceivable AverageAge AccountsWritten Off Two years ago $ 1,160,000 $ 136,000 5 days $ 0 Last year 1,460,000 146,000 7 days 1,000 Current year 1,560,000 316,000 40 days 0 Paul, the CEO of Letni, notices that accounts written off over the past three years have been minimal and, therefore, suggests that no allowance for uncollectible accounts be…arrow_forwardLetni Corporation engages in the manufacture and sale of semiconductor chips for the computing and communications industries. During the past year, operating revenues remained relatively flat compared to the prior year but management notices a big increase in accounts receivable. The increase in receivables is largely due to the recent economic slowdown in the computing and telecommunications industries. Many of the company’s customers are having financial difficulty, lengthening the period of time it takes to collect on accounts. Below are year-end amounts. Age Group OperatingRevenue AccountsReceivable AverageAge AccountsWritten Off Two years ago $1,160,000 $136,000 5 days $0 Last year 1,460,000 146,000 7 days 1,000 Current year 1,560,000 316,000 40 days 0 Paul, the CEO of Letni, notices that accounts written off over the past three years have been minimal and, therefore, suggests that no allowance for…arrow_forward

- Letni Corporation engages in the manufacture and sale of semiconductor chips for the computing and communications industries. During the past year, operating revenues remained relatively flat compared to the prior year but management notices a big increase in accounts receivable. The increase in receivables is largely due to the recent economic slowdown in the computing and telecommunications industries. Many of the company’s customers are having financial difficulty, lengthening the period of time it takes to collect on accounts. Below are year-end amounts. Age Group OperatingRevenue AccountsReceivable AverageAge AccountsWritten Off Two years ago $1,160,000 $ 136,000 5 days $0 Last year 1,460,000 146,000 7 days 1,000 Current year 1,560,000 316,000 40 days 0 Paul, the CEO of Letni, notices that accounts written off over the past three years have been minimal and, therefore, suggests that no allowance for uncollectible accounts be…arrow_forwardCodification Situation You are conducting an accounting research project for your boss. Your boss has asked you to determine the appropriate U.S. GAAP that specifies how your company should recognize revenues from the sales of products in a retail store. Your boss is confused because most customers pay cash, but some customers purchase on credit terms, and pay in cash 30 days later. Your manager also wants you to determine the GAAP guidance for how revenue should be recognized in income. Your manager has a lot of knowledge and experience in accounting and has heard about, but has never used, the FASB Accounting Standards Codification system. Directions Use the FASB Accounting Standards Codification system to conduct the research your manager has assigned to you. Use the Codification to determine how to recognize revenue from retail sales, including the right to return. Be prepared to show your manager the specific FASB ASC references that provide the appropriate guidance. Also prepare a brief memo explaining to your manager the different levels of the Codification and how to use the Codification system.arrow_forwardINTRODUCTION Bryce Commings was assistant controller for Waterton Company, and his responsibilities included bank relations, accounts receivable collection, and cash management. From his business readings he was aware that many wall street economists were forecasting a recession for late 2019 into middle 2020. He remembered that in the last recession Waterton was criticized for weakened liquidity as shown on its balance sheet. He ran a simulation with improved accounts receivable and inventory turnovers, Bryce was disappointed with the overall liquidity picture. He was concerned that he was missing something. Maybe he did not understand the relationships among the liquidity measures or maybe he had an error in his worksheet or maybe financial relationships had changed in the past ten years. He assumed if cash came in faster with better collections and more efficient inventory control, liquidity metrics would improve. The eight conventional liquidity measures were current ratio,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY