Concept explainers

Using an Aging Schedule to Estimate

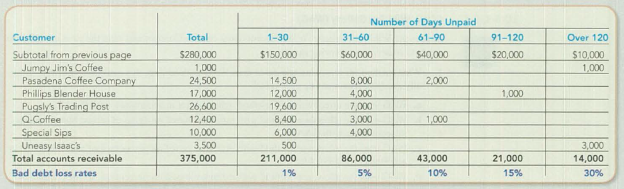

Assume you were recently hired by Caffe D’Amore, the company that formulated the world’s first flavored instant cappuccino and now manufactures several lines of flavored cappuccino mixes. Given the company’s tremendous sales growth, Caffe D’Amore’s receivables also have grown. Your job is to evaluate and improve collections of the company’s receivables.

By analyzing collections of

Required:

- 1. Enter the above totals in a spreadsheet and then insert formulas to calculate the total estimated uncollectible balance.

- 2. Prepare the year-end

adjusting journal entry to adjust the Allowance for Doubtful Accounts to the balance you calculated above. Assume the allowance account has an unadjusted credit balance of $8,000. - 3. Of the customer account balances shown above on the last page of the aged listing, which should be your highest priority for contacting and pursuing collection?

- 4. Assume Jumpy Jim’s Coffee account is determined to be uncollectible. Prepare the journal entry to write off the entire account balance.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

FUND.OF FINANCIAL ACCT.-CONNECT ACCESS

- Aerotech Corp is a multinational company that offers various products to its customers. The company provides discounts to its clients as part of its sales strategy. However, accounting for these discounts can be complex due to different types of discounts and the timing of recognition. Aerotech Corp recently offered a volume-based discount to one of its major customers, which resulted in a significant reduction in revenue for the current financial year. The finance team is struggling to account for this discount correctly. Can you provide a comprehensive step-by-step explanation of how Aerotech Corp should account for this volume-based discount in its financial statements in accordance with the Generally Accepted Accounting Principles (GAAP)?arrow_forwardHussein Al Lawati SAOG has recognized that the organization is facing a liquidity crisis. Accordingly, the accountant of the organization has studied the payment records from the customer and has noticed that the company at present offers its customers 25 days credit. Half the customers by value, pay on time. The other half takes an average of 50 days to pay. In this background you are planning to offer a cash discount of 2.5 per cent to your customers for the payment made within 25 days. The credit controller anticipates that half of the customers who now take an average of 50 days to pay will pay in 25 days. The other half will still take an average of 50 days to pay. It is anticipated that the proposed scheme will reduce bad debts amount by RO. 450,000 a year. Annual sales revenue of RO 45,000,000 is made evenly throughout the year. At present the business has a large overdraft RO. 5,000,000 with its bank at an interest of 7 percent a year. Required: a. Calculate receivables…arrow_forwardHussein Al Lawati SAOG has recognized that the organization is facing a liquidity crisis. Accordingly, the accountant of the organization has studied the payment records from the customer and has noticed that the company at present offers its customers 25 days credit. Half the customers by value, pay on time. The other half takes an average of 50 days to pay. In this background you are planning to offer a cash discount of 2.5 per cent to your customers for the payment made within 25 days. The credit controller anticipates that half of the customers who now take an average of 50 days to pay will pay in 25 days. The other half will still take an average of 50 days to pay. It is anticipated that the proposed scheme will reduce bad debts amount by RO. 450,000 a year. Annual sales revenue of RO 45,000,000 is made evenly throughout the year. At present the business has a large overdraft RO. 5,000,000 with its bank at an interest of 7 percent a year. Required: How much is the Net cost of…arrow_forward

- Ethics and Revenue Recognition Alan Spalding is CEO of a large appliance wholesaler. Alan is under pressure from Wall Street Analysts to meet his aggressive sales revenue growth projections. Unfortunately, near the end of the year he realizes that sales must dramatically improve if his projections are going to be met. To accomplish this objective, he orders his sales force to contact their largest customers and offer them price discounts if they buy by the end of the year. Alan also offered to deliver the merchandise to a third-party warehouse with whom the customers could arrange delivery when the merchandise was needed. Required: Do you believe that revenue from these sales should be recognized in the current year? Why or why not?arrow_forwardThe new owners of Sheraton Natural Foods Inc. have hired you to help them diagnose and cure problems that the company has had in maintaining adequate liquidity. As a first step, you perform a liquidity analysis. You then do an analysis of the company’s short-term activity ratios. Your calculations and appropriate industry norms are listed. Ratio Sheraton Industry Norm Current ratio 4.5 4.0 Quick ratio 2.0 3.1 Inventory turnover 6.0 10.4 Average collection period 73 days 52 days Average payment period 31 days 40 days Requirements: What recommendations relative to the amount and the handling of inventory could you make…arrow_forwardBud Lighting Co. is a retailer of commercial and residential lighting products. Gowen Geter, the company’s chief accountant, is in the process of making year-end adjusting entries for uncollectible accounts receivable. In recent years, the company has experienced an increase in accounts that have become uncollectible. As a result, Gowen believes that the company should increase the percentage used for estimating doubtful accounts from 2% to 4% of credit sales. This change will significantly increase bad debt expense, resulting in a drop in earnings for the first time in company history. The company president, Tim Burr, is under considerable pressure to meet earnings goals. He suggests that this is “not the right time” to change the estimate. He instructs Gowen to keep the estimate at 2%. Gowen is confident that 2% is too low, but he follows Tim’s instructions. Evaluate the decision to use the lower percentage to improve earnings. How would raising the percentage change the financial…arrow_forward

- Historically, your company has calculated bad debts using an aging of accounts receivable. Near the end of the fiscal year, the company is in a cash crunch and needs to borrow money from the bank, using accounts receivable as collateral. The owner of the company knows that many of the accounts receivable are more than 90 days past due, resulting in net receivables equal to only 80% of total receivables. You are asked by the owner asks you to change the method of estimating bad debts to a flat 3% of receivables. What should you do?arrow_forwardWhich of the following would best explain an increase in receivables turnover? The company adopted new credit policies last year and began offering credit to customers with weak credit histories. Due to problems with an error in its old credit scoring system, the company had accumulated a substantial amount of uncollectible accounts and wrote off a large amount of its receivables. To match the terms offered by its closest competitor, the company adopted new payment terms now requiring net payment within 30 days rather than 15 days, which had been its previous requirement.arrow_forwardYour client, Corp. B, is a trading or distributor of home living product. Corp B import goods and sells them to its customers who are retail stores. In the current year, Corp. B's financial statements reported an increase in net income. The increase was driven by increased sales. Corp B's accounts receivable also increased rapidly. Corp B reportedly has many new customers.You are informed that there may be a fictitious revenue generated using fictitious customers. Corp B makes fictitious credit sales using bogus customers, and when receivables are due, management make kiting in order to look like the fictitious accounts receivable paid by their customer. What kind of audit procedure will you use to examine for possible kiting?arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT