Complete the accounting cycle using current liability transcations (LO 8–1, 8–2, 8–4, 8–6)

On January 1, 2018. the general ledger of ACME Fireworks includes the following account balance:

| Accounts | Debit | Credit |

| Cash | $ 25,100 | |

| 46,200 | ||

| Allowance for Uncollectible Accounts | $ 4,200 | |

| Inventory | 20,000 | |

| Land | 46,000 | |

| Equipment | 15,000 | |

| Accumulated |

1,500 | |

| Accounts Payable | 28,500 | |

| Notes Payable (6%. due April 1, 2019) | 50,000 | |

| Common Stock | 35,000 | |

| 33,100 | ||

| Totals | $152,300 | $152,300 |

During January 2018, the following transactions occur:

January 2 Sold gift cards totaling $8,000. The cards are redeemable for merchandise within one year of the purchase date.

January 6 Purchase additional inventory on account, $147,000.

January 15 Firework sales for the first half of the month total $135,000. All of these sales are on account. The cost of the units sold is $73,800.

January 23 Receive $125,400 from customers on accounts receivable.

January 25 Pay $90,000 to inventory suppliers on accounts payable.

January 28 Write off accounts receivable as uncollectible, $4,800.

January 30 Firework sales for the second half of the month total $143,000. Sales include $11,000 for cash and $132,000 on account. The cost of the units sold is $79,500.

January 31 Pay cash for monthly salaries, $52,000.

Required:

1. Record each of the transactions listed above.

2. Record

a. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipment was purchased, the company estimated a residual value of $3,000 and a two-year service life.

b. At the end of January. $11,000 of accounts receivable are past due, and the company estimates that 30% of these accounts will not be collected. Of the remaining accounts receivable, the company estimates that 5% will not be collected.

c. Accrued interest expense on notes payable for January.

d. Accrued income taxes at the end of January are $13,000.

e. By the end of January, $3,000 of the gift cards sold on January 2 have been redeemed.

3. Prepare an adjusted

4. Prepare a multiple-step income statement for the period ended January 31, 2018.

5. Prepare a classified balance sheet as of January 31, 2018.

6. Record closing entries.

7. Analyze the following for ACME Fireworks:

a. Calculate the

b. Calculate the acid-test ratio at the end of January. If the average acid-test ratio for the industry is 1.5, is ACME Fireworks more or less likely to haw difficulty paving its currently maturing debts (compared to the industry average)?

c. Assume the notes payable were due on April 1, 2018, rather than April 1, 2019. Calculate the revised current ratio at the end of January, and indicate whether the revised ratio would increase, decrease. or remain unchanged compared to your answer in (a).

1.

To record: The journal entries for given transactions.

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

The journal entries for given transactions of Company ACME are as follows:

| Date | Account Titles and Explanation | Debit($) | Credit($) | |||

| 2018 | Cash | 8,000 | ||||

| January 2 | Deferred Revenue | 8,000 | ||||

| (To record the sale of gift cards for cash) | ||||||

| 2018 | Inventory | 147,000 | ||||

| January, 6 | Accounts payable | 147,000 | ||||

| (To record purchase of inventory on account) | ||||||

| 2018 | Accounts Receivable | 135,000 | ||||

| January 15 | Sales Revenue | 135,000 | ||||

| (To record sales of inventory on account) | ||||||

| Cost of goods sold | 73,800 | |||||

| Inventory | 73,800 | |||||

| (To record the cost of inventory sold) | ||||||

| 2018 | ||||||

|

January 23 | Cash | 125,400 | ||||

| Accounts Receivable | 125,400 | |||||

| (To record cash on account) | ||||||

| 2018 | Accounts Payable | 90,000 | ||||

| January 25 | Cash | 90,000 | ||||

| (To record pay of cash ) | ||||||

| 2018 | Allowance for uncollectible accounts | 4,800 | ||||

| January 28 | Accounts Receivable | 4,800 | ||||

| (To record the written off of uncollectible accounts) | ||||||

| 2018 | Cash | 11,000 | ||||

| January 30 | Accounts Receivable | 132,000 | ||||

| Sales Revenue | 143,000 | |||||

| ( To record sale of inventory for cash) | ||||||

| Cost of goods sold | 79,500 | |||||

| Inventory | 79,500 | |||||

| (To record of cost of inventory sold) | ||||||

| 2018 | Salaries Expense | 52,000 | ||||

| January 31 | Cash | 52,000 | ||||

| (To record payment of salaries) | ||||||

Table (1)

2.

To record: The given adjusting entries of Company ACME.

Explanation of Solution

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. The purpose of adjusting entries is to adjust the revenue, and the expenses during the period in which they actually occurs.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Adjusting entries of Company ACME are as follows:

| Date | Account Titles and Explanation | Debit($) | Credit($) | |||

| 2018 | Depreciation Expense (1) | 500 | ||||

| January 31 | Accumulated Depreciation | 500 | ||||

| (To record the depreciation for January) | ||||||

| 2018 | Bad Debt Expense (3) | 12,500 | ||||

| January 31 | Allowance for Uncollectible Accounts | 12,500 | ||||

| (To adjust uncollectible accounts) | ||||||

| 2018 | Interest Expense (4) | 250 | ||||

| January 31 | Interest Payable | 250 | ||||

| (To adjust interest expense) | ||||||

| 2018 | Income Tax Expense | 13,000 | ||||

| January 31 | Income Tax Payable | 13,000 | ||||

| (To adjust income taxes) | ||||||

| 2018 | Deferred Revenue | 3,000 | ||||

| January 31 | Sales Revenue | 3,000 | ||||

| (To adjust the revenue for the gift cards redeemed) | ||||||

Table (2)

Working Notes:

a .

Calculate the depreciation on the equipment.

b.

Calculate the bad debt expense.

c .

Calculate the Interest expense.

3.

To Prepare: Adjusted trial balance for the month January 31, 2018.

Explanation of Solution

| ACME Fireworks | ||

| Adjusted Trial Balance | ||

| 31-Jan-18 | ||

| Accounts (Refer table 4) | Debit (Amount in $) | Credit (Amount in $) |

| Cash | $27,500 | |

| Accounts Receivable | 183,000 | |

| Inventory | 13,700 | |

| Land | 46,000 | |

| Equipment | 15,000 | |

| Allowance for Uncollectible Accounts | $11,900 | |

| Accumulated Depreciation | 2,000 | |

| Accounts Payable | 85,500 | |

| Deferred Revenue | 5,000 | |

| Interest Payable | 250 | |

| Income Tax Payable | 13,000 | |

| Notes Payable | 50,000 | |

| Common Stock | 35,000 | |

| Retained Earnings | 33,100 | |

| Sales Revenue | 281,000 | |

| Cost of Goods Sold | 153,300 | |

| Salaries Expense | 52,000 | |

| Bad Debt Expense | 12,500 | |

| Depreciation Expense | 500 | |

| Interest Expense | 250 | |

| Income Tax Expense | 13,000 | |

| Totals | $516,750 | $516,750 |

Table (3)

Calculation of adjusted trial balance of Company ACME for the month January:

| Accounts | Ending Balance |

| |

| Cash | $27,500 | = |

|

| Accounts Receivable | 183,000 | = |

|

| Inventory | 13,700 | = |

|

| Land | 46,000 | = | 46,000 |

| Equipment | 15,000 | = | 15,000 |

| Allow for Uncollectible Accounts | 11,900 | = |

|

| Accumulated Depreciation | 2,000 | = |

|

| Accounts Payable | 85,500 | = |

|

| Deferred Revenue | 5,000 | = |

|

| Interest Payable | 250 | = | 250 |

| Income Tax Payable | 13,000 | = | 13,000 |

| Notes Payable | 50,000 | = | 50,000 |

| Common Stock | 35,000 | = | 35,000 |

| Retained Earnings | 33,100 | = | 33,100 |

| Sales Revenue | 281,000 | = |

|

| Cost of Goods Sold | 153,300 | = |

|

| Salaries Expense | 52,000 | = | 52,000 |

| Bad Debt Expense | 12,500 | = | 12,500 |

| Depreciation Expense | 500 | = | 500 |

| Interest Expense | 250 | = | 250 |

| Income Tax Expense | 13,000 | = | 13,000 |

(Table 4)

4.

To Prepare: the multiple income statement for the period ended January 31, 2018.

Explanation of Solution

| ACME Fireworks | ||

| Multiple-Step Income Statement | ||

| For the year ended January 31, 2018 | ||

| Particulars | Amount in $ | Amount in $ |

| Sales revenue | $281,000 | |

| Cost of goods sold | 153,300 | |

| Gross profit | $127,700 | |

| Salaries expense | 52,000 | |

| Bad debt expense | 12,500 | |

| Depreciation expense | 500 | |

| Total operating expenses | 65,000 | |

| Operating income | 62,700 | |

| Interest expense | 250 | |

| Income before taxes | 62,450 | |

| Income tax expense | 13,000 | |

| Net income | $49,450 | |

Table (5)

5.

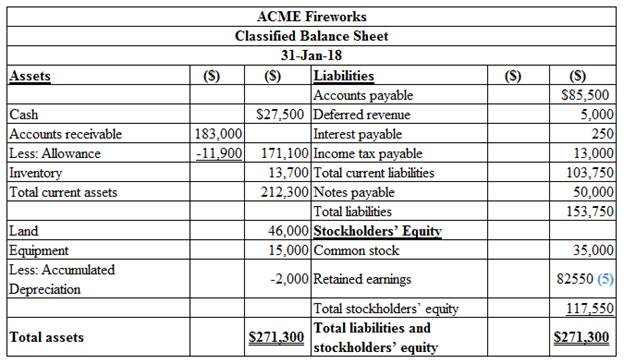

To Prepare: classified balance sheet as on January 31, 2018.

Explanation of Solution

Figure (1)

Working Notes:

6.

To Record: the closing entries.

Explanation of Solution

| Date | Account Titles and Explanation | Debit($) | Credit($) | |

| 2018 | Sales Revenue | 281,000 | ||

| January 31 | Retained Earnings | 281,000 | ||

| (To record the closing revenue accounts) | ||||

| Retained Earnings | 231,550 | |||

| Cost of goods sold | 153,300 | |||

| Salaries Expense | 52,000 | |||

| Bad debt Expense | 12,500 | |||

| Depreciation Expense | 500 | |||

| Interest Expense | 250 | |||

| Income Tax Expense | 13,000 | |||

| (To close the expense accounts) | ||||

Table (6)

7. a

To Calculate: the current ratio at the end of January.

Explanation of Solution

Calculate the current ratio at the end of January.

Company ACME has liquidity more than the average level required by industry. They have high portion of current assets to meet out their current liabilities which is comparatively higher than the industry average of 1.8.

7. b.

To Calculate: the acid-test ratio at the end of January.

Explanation of Solution

Calculate the acid –test ratio at the end of January.

Company ACME has less difficulty in its paying its currently maturing debts. They have high portion of quick assets to meet out their current liabilities which is comparatively higher than the industry average of 1.5.

7. c.

To Indicate: whether the revised ratio would increase, decrease or remain unchanged compared to the requirement a.

Explanation of Solution

Calculate current ratio assuming notes payable as current liabilities.

Notes payable would be included in the current liabilities as the notes payable are to be due on April. This would decrease the value of the current assets and increase the value of current liabilities because ratio gets reduced when they are divided by larger number.

Want to see more full solutions like this?

Chapter 8 Solutions

FINANCIAL ACCOUNTING (LL W/CONNECT) >IP<

- Current Liabilities The following items are accounts on Smiths balance sheet of December 31, 2016: Required Identify which of the accounts should be classified as a current liability on Smiths balance sheet. For each item that is not a current liability, indicate the category of the balance sheet in which it would be classified. Assume the company has the following balance sheet categories: current asset; property, plant, and equipment; long-term investment; intangible asset; current liability; long-term liability; and stockholders equity.arrow_forwardConsider the following situations and determine (1) which type of liability should be recognized (specific account), and (2) how much should be recognized in the current period (year). A. A business depreciates a building with a book value of $12,000, using straight-line depreciation, no salvage value, and a remaining useful life of six years. B. An organization has a line of credit with a supplier. The company purchases $35,500 worth of inventory on credit. Terms of purchase are 3/20, n/60. C. An employee earns $1,000 in pay and the employer withholds $46 for federal income tax. D. A customer pays $4,000 in advance for legal services. The lawyer has previously recognized 30% of the services as revenue. The remainder is outstanding.arrow_forwardClassification of Assets and Liabilities Indicate the appropriate classification of each of the following as a current asset (CA), noncurrent asset (NCA), current liability (CL), or long-term liability (LTL). ______ 1. Inventory ______ 2. Accounts payable ______ 3. Cash ______ 4. Patents ______ 5. Notes payable, due in six months ______ 6. Taxes payable ______ 7. Prepaid rent (for the next nine months) ______ 8. Bonds payable, due in ten years ______ 9. Machineryarrow_forward

- Do not copy from bartleby and cheggg The Creative Electronics Company shows the following selected adjusted account balances as at December 31, 2020: Accounts Payable 112,000 Salaries Payable 153,000 Accumulated Depreciation, Equipment 40,000 Estimated Warranty Liability 35,000 Mortgage Payable 292,000 Notes Payable, 6 months 38,000 Required: Prepare the current liability section of Creative's balance sheet. $52,000 in principal is due during 2021 regarding the mortgage payable.arrow_forwardDo not copy from bartleby The Creative Electronics Company shows the following selected adjusted account balances as at December 31, 2020: Accounts Payable 112,000 Salaries Payable 153,000 Accumulated Depreciation, Equipment 40,000 Estimated Warranty Liability 35,000 Mortgage Payable 292,000 Notes Payable, 6 months 38,000 Required: Prepare the current liability section of Creative's balance sheet. $52,000 in principal is due during 2021 regarding the mortgage payable.arrow_forwardCraig Ferguson Company has the following balances in selected accounts on December 31, 2019: Accounts Receivable $ -0-Accumulated Depreciation—Equipment 10,000Interest Payable -0-Notes Payable 20,000Prepaid Insurance 2,700Salaries and Wages Payable -0-Supplies 3,500Unearned Service Revenue 50,000All the accounts have normal balances. The information below has been gathered at December 31, 2019.1. Craig Ferguson Company borrowed $20,000 by signing a 12%, one-year note on August 1, 2019.2. A count of supplies on December 31, 2019, indicates that supplies of $900 are on hand.3. Depreciation on the equipment for 2019 is $2,000.4. Craig Ferguson Company paid $2,700 for 12 months of insurance coverage on May 1, 2019.5. On November 1, 2019, Craig Ferguson collected $50,000 for consulting services to be performed fromNovember 1, 2019, through March 31, 2020.6. Craig Ferguson performed consulting services for a client in December 2019. The client will be billed$6,300.7. Craig Ferguson Company…arrow_forward

- 1. The company uses asset method to record payment for annual insurance amounting to P12,000.00. On February 1, 2021, the bookkeeper entered it in the books as (DR) Insurance Expense, P21,000 and (CR) Cash, P21,000.00. a. Transposition b. Transplacement c. No error d. Error of Omission e. Error of account titles2. The company uses asset method to record payment for annual insurance amounting to P12,000.00. On February 1, 2021, the bookkeeper entered it in the books as (DR) Prepaid Insurance, P21,000 and (CR) Cash, P21,000.00. a. Transposition b. Transplacement c. No error d. Error of Omission e. Error of account titles3. The company uses asset method to record payment for annual insurance amounting to P12,000.00. On February 1, 2021, the bookkeeper entered it in the books as (DR) Prepaid Insurance, P120,000.00 and (CR) Cash, P120,000.00 a. Transposition b.…arrow_forwardThe following is a portion of the current assets section of the balance sheets of Avanti's, Inc., at December 31, 2020 and 2019: 12/31/20 12/31/19 Accounts receivable, less allowance for baddebts of $9,750 and $15,336, respectively $179,866 $225,851 Required:a. If $11,849 of accounts receivable were written off during 2020, what was the amount of bad debts expense recognized for the year? (Hint: Use a T-account model of the Allowance account, plug in the three amounts that you know, and solve for the unknown.) b. The December 31, 2020, Allowance account balance includes $3,034 for a past due account that is not likely to be collected. This account has not been written off.(1) If it had been written off, will there be any effect of the write-off on the working capital at December 31, 2020? Yes No (2) If it had been written off, will there be any effect of the write-off on net income and ROI for the year ended December 31, 2020? Yes No c. The…arrow_forwardCastro Company has the following balances in selected accounts on December 31, 2020. Accounts Receivable $ –0– Accumulated Depreciation—Equipment –0–Equipment 7,000 Interest Payable –0– Notes Payable 10,000 Prepaid Insurance 2,100 Salaries and Wages Payable –0– Supplies 2,450 Unearned Service Revenue 32,000 All the accounts have normal balances. The information below has been gathered at December 31, 2020. 1. Castro Company borrowed $10,000 by signing a 9%, one-year note on September 1, 2020. 2. A count of supplies on December 31, 2020, indicates that supplies of $900 are on hand. 3. Depreciation…arrow_forward

- Volta Electronics Inc. reported the following items on its December 31, 2014, trial balance: Accounts Payable ....................................................$108,900Advances to Employees ...................................... ..........4,500Unearned Rent Revenue ............................................. 28,800Estimated Liability Under Warranties ........................ 25,800Cash Surrender Value of Officers' Life Insurance ........7,500Bonds Payable ............................................................. 555,000Discount on Bonds Payable ......................................... 22,500Trademarks ....................................................................... 3,900 The amount that should be recorded on Volta’s balance sheet as total liabilities is Group of answer choices $741,000 $696,000 $703,500 $700,500arrow_forward(Current Liability Entries and Adjustments) Described below are certain transactions of Edwardson Corporation. The company uses the periodic inventory system.1. On February 2, the corporation purchased goods from Martin Company for $70,000 subject to cash discount terms of 2/10, n/30. Purchases and accounts payable are recorded by the corporation at net amounts after cash discounts. The invoice was paid on February 26.2. On April 1, the corporation bought a truck for $50,000 from General Motors Company, paying $4,000 in cash and signing a 1-year, 12% note for the balance of the purchase price.3. On May 1, the corporation borrowed $83,000 from Chicago National Bank by signing a $92,000 zero-interest-bearing note due 1 year from May 1.4. On August 1, the board of directors declared a $300,000 cash dividend that was payable on September 10 to stockholders of record on August 31.Instructions(a) Make all the journal entries necessary to record the transactions above using appropriate…arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College