Financing business expansion

You hold a 30% common stock interest in the family-owned business, a vending machine company. Your sister, who is the manager, has proposed an expansion of plant facilities al an expected cost of $6,000,000. Two alternative plans have been suggested as methods of financing the expansion. Each plan is briefly described as follows:

Plan 1, Issue $6,000,000 of 15-year. 8% notes at face amount.

Plan 2. Issue an additional 100.000 shares of $20 par common stock at $25 per share, and $3,500,000 of 15-year. 8% notes at face amount.

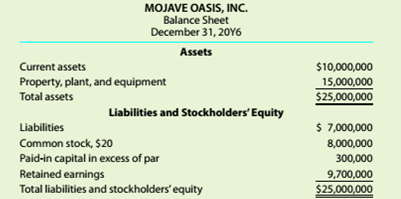

The balance sheet as of the end of the previous fiscal year is as follows:

Net income has remained relatively constant over the past several years. The expansion program is expected to increase yearly income before bond interest and income tax from $900,000 in the previous year to $1,200,000 for this year. Your sister has asked you. as the company treasurer, to prepare an analysis of each financing plan.

a. Discuss the factors that should be considered in evaluating the two plans.

b. Which plan offers the greater benefit to the present stockholders? Give reasons for your opinion.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Survey of Accounting (Accounting I)

- Cost of Capital, Net Present Value Leakam Companys product engineering department has developed a new product that has a 3-year life cycle. Production of the product requires development of a new process that requires a current 100,000 capital outlay. The 100,000 will be raised by issuing 60,000 of bonds and by selling new stock for 40,000. The 60,000 in bonds will have net (after-tax) interest payments of 3,000 at the end of each of the 3 years, with the principal being repaid at the end of Year 3. The stock issue carries with it an expectation of a 17.5% return, expressed in the form of dividends at the end of each year (with 7,000 in dividends expected for each of the next 3 years). The sources of capital for this investment represent the same proportion and costs that the company typically has. Finally, the project will produce after-tax cash inflows of 50,000 per year for the next 3 years. Required: 1. Compute the cost of capital for the project. (Hint: The cost of capital is a weighted average of the two sources of capital, where the weights are the proportion of capital from each source.) 2. CONCEPTUAL CONNECTION Compute the NPV for the project. Explain why it is not necessary to subtract the interest payments and the dividend payments and appreciation from the inflow of 50,000 in carrying out this computation.arrow_forwardFirm Valuation Through Excess Returns ApproachThe incorporation of XYZ Inc. was completed through the raising of funds. These funds include net proceeds from debt and from equity at P5,000,000 and P20,000,000 respectively. The after-tax costs of debt and of equity are 9% and 15% in order. If the actual return of XYZ is forecasted to be 17% annually over the firm’s 10-year life, compute the firm value.arrow_forwardAERO Corporation was founded by Mr.Chen. At the beginning of the establishment of AERO Corporation, Mr.Chen had initial shares 10,000 pieces. Mr.Chen wants to expand his business venture with take investors to invest for 5 years. Mr.Chen estimates that if you want reached the terminal value at the end of the fifth year of $ 300,000,000, then investment funds given by investors is $ 15,000,000. Financing from investors will be done as many as two stages, where the second stage is carried out in the third year (in the third years ,second stage investors will invest their funds in AERO Corporation). First stage investors demand a rate of return of 70% while the second stage investors demand rate of return of 50%. Public information shows that competitors of AERO is "SX Corppration" has a market capitalization value of $45,000,000 and obtain net profit of $30,000,000 last year. e. Describe in the form of a pie chart the configuration of Mr.Chen's shareholding and investors as a result of…arrow_forward

- A company is planning the financing of a major expansion. It will use common stock to fund this expansion. The company currently has 300,000 shares outstanding selling at an average of $130 per share. It would sell an additional 50,000 shares to bring in an estimated $5 million. The new project is expected to raise EBIT by 18% when implemented. The company’s capital structure contains long-term debt of $10 million which pays interest of 11%. Current Income Statement Net Sales 66,000,000 COGS 42,000,000 Gross Profits 24,000,000 S and A Expenses 9,300,000 Operating Profits 14,700,000 Interest on Debt 1,100,000 EBT 13,600,000 Taxes at 34% 4,600,000 EAT 9,000,000 Develop an analysis of EPS and show the effect of any dilution of earnings. Develop the same analysis for an alternative issue of $5 million of 10% preferred stock, and an alternative issue of $5 million of 9% debt. Develop specific comparative costs of all…arrow_forwardAbdullah has OMR 5000 to invest in a small business venture. His partner has promised to pay him back OMR 8200 in five years. What is the return earned on this investment? Select one: a. None of these b. 10.39 % c. 12.40 % d. 10.75 % e. 14.50 % Gross working capital refer to the Select one: a. Firms liabilities in total current assets of the enterprise b. Firms investment in total fixed assets of the enterprise c. Firms investment in total Equity of the enterprise d. Firms investment in total current assets of the enterprise e. None of the optionsarrow_forwardRequired information [The following information applies to the questions displayed below.] Penny Arcades, Inc., is trying to decide between the following two alternatives to finance its new $17 million gaming center: a. Issue $17 million of 6% bonds at face amount.b. Issue 1 million shares of common stock for $17 per share. Required:1. Assuming bonds or shares of stock are issued at the beginning of the year, complete the income statement for each alternative. (Enter your answer in dollars, not millions. (i.e., $5.5 million should be entered as 5,500,000). Round your "Earnings per Share" to 2 decimal places. Round your "Earnings per Share" to 2 decimal places.)arrow_forward

- Landman Corporation (LC) manufactures time series photographic equipment. It is currently at its target debt-equity ratio of .75. It’s considering building a new $60 million manufacturing facility. This new plant is expected to generate aftertax cash flows of $7.3 million in perpetuity. The company raises all equity from outside financing. There are three financing options: 1. A new issue of common stock: The flotation costs of the new common stock would be 9 percent of the amount raised. The required return on the company’s new equity is 15 percent. 2. A new issue of 20-year bonds: The flotation costs of the new bonds would be 3.6 percent of the proceeds. If the company issues these new bonds at an annual coupon rate of 5.3 percent, they will sell at par. 3. Increased use of accounts payable financing: Because this financing is part of the company’s ongoing daily business, it has no flotation costs and the company assigns it a cost that is the same as the overall firm WACC. Management…arrow_forwardThe Great Flying Pterosaur Company (GFP) currently produces drones forcommercial use. This product is expected to be in use for the foreseeablefuture, GFP’s annual net profit after tax are expected to be $400,000 perannum. Capital allowances (straight-line) are $20,000 per annum for thecompany’s existing non-current assets.GFP issued preference shares (perpetual) with face value $1 million and adividend rate is 5 percent. GFP is expected to pay its investors. There are2,000,000 ordinary shares outstanding. GFP’s cost of capital is 10 percent.GFP is considering to put aside $270,000 to purchase a machine to producean additional line of drones. This machine will operate for three years. At theend of its useful life, it be disposed for zero value. The risk level of the companywill remain unchanged. The expected demand is 10,000 new drones per year.Each new drone will be priced at $40 and thereafter rise at 8 percent per year.Total variable costs are expected to be $20 per drone in the…arrow_forwardMuffins masonry incs balance sheet list next fixed assets as $ 14 million. The fixed assets could currently be sold for 19 million dollars. muffins current balance sheet shows current liabilities of 5.5 million dollars and networking capital of 4.5 million dollars. if all the current accounts were liquidated today the company would receive 7.25 million dollars cash after paying the 5.5 million incurrent liabilities. what is the book value of muffins missionaries assets today and market value of these assets? Enter answers in millions of dollars rounded to 2 decimal places Book value. Market value. Current assets: Fixed assets: Total:arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning