EBK PRINCIPLES OF MANAGERIAL FINANCE

14th Edition

ISBN: 9780100666757

Author: ZUTTER

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 8.6P

Learning Goal 2

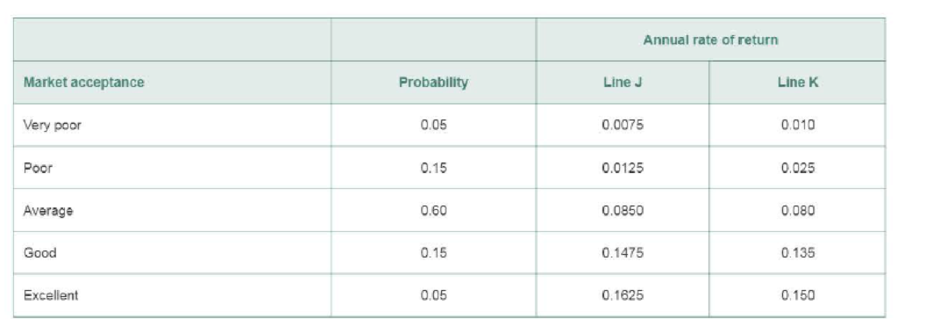

P8-6 Bar charts and risk Swan’s Sportswear is thinking about bringing out a line of designer jeans. Currently, it is negotiating with two well-known designers. Because of the highly competitive nature of the industry, the two lines of jeans have been given code names. After

Use the table to:

- a. Construct a bar chart for each line’s annual rate of return.

- b. Calculate the average return for each line.

- c. Evaluate the relative riskiness for each jeans line’s rate of return using the bar charts.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Ethical Situation: What Would You Do? Discussion Question As one of the newer district sales managers for a fast-growing technology company, you've asked your salespeople to give you three sales forecasts in their territories for the coming year: (a) optimistic, (b) pessimistic, and (c) most likely. After totaling their three different sales forecasts, you realize that the optimistic forecast will increase sales by nearly 20% in your district, the pessimistic forecast by 10%, and the most likely by about 15%. Your national sales manager has asked each district sales manager to give her their most likely sales forecast for the coming year, so she can assign sales quotas. Your thoughts are that it's probably best to give her the most pessimistic sales forecast because this should help ensure that she assigns your district a quota that you should easily achieve. If you can exceed your assigned district sales quota by a substantial amount, you'll probably get a large bonus, and you may…

PLEASE SOLVE IN EXCEL :B&B has a new baby powder ready to market. If the firm goes directly to the market with the product, there is only a 60 percent chance of success. However, the firm can conduct customer segment research, which will take a year and cost $1.21 million. By going through research, the company will be able to better target potential customers and will increase the probability of success to 75 percent. If successful, the baby powder will bring a present value profit (at time of initial selling) of $19.1 million. If unsuccessful, the present value payoff is only $6.1 million. The appropriate discount rate is 14 percent. Calculate the NPV for the firm if it goes to market immediately and if it conducts customer segment research. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) Should the firm conduct customer segment research or go to the market immediately? multiple…

6. A business has decided to develop and market a new laptop. Management has calculated the average cost for each laptop would be $1000 and has added a 70% margin to set the final price. Which type of pricing method is this business using?

(a) Cost pricing

(b) Market pricing

(c) Penetration pricing

(d) Competition pricing

7. Which of the following strategies uses a sales approach to marketing?

(a) A business that focuses on producing products

(b) A business that decides to increase its advertising budget

(c) A business that decides to implement loyalty cards for their customers

(d) A business that focuses on customer satisfaction in order to increase their sales

Chapter 8 Solutions

EBK PRINCIPLES OF MANAGERIAL FINANCE

Ch. 8.1 - Prob. 1FOECh. 8.1 - What is risk in the context of financial decision...Ch. 8.1 - Prob. 8.2RQCh. 8.1 - Prob. 8.3RQCh. 8.2 - Explain how the range is used in scenario...Ch. 8.2 - Prob. 8.5RQCh. 8.2 - Prob. 8.6RQCh. 8.2 - What does the coefficient of variation reveal...Ch. 8.3 - What is an efficient portfolio? How can the return...Ch. 8.3 - Prob. 8.9RQ

Ch. 8.3 - How does international diversification enhance...Ch. 8.4 - Prob. 8.11RQCh. 8.4 - Prob. 8.12RQCh. 8.4 - Prob. 8.13RQCh. 8.4 - What impact would the following changes have on...Ch. 8 - Prob. 1ORCh. 8 - Prob. 8.1STPCh. 8 - Prob. 8.2STPCh. 8 - Prob. 8.1WUECh. 8 - Prob. 8.2WUECh. 8 - Prob. 8.3WUECh. 8 - Prob. 8.4WUECh. 8 - Prob. 8.5WUECh. 8 - Prob. 8.6WUECh. 8 - Prob. 8.1PCh. 8 - Prob. 8.2PCh. 8 - Prob. 8.3PCh. 8 - Prob. 8.4PCh. 8 - Prob. 8.5PCh. 8 - Learning Goal 2 P8-6 Bar charts and risk Swans...Ch. 8 - Prob. 8.7PCh. 8 - Prob. 8.8PCh. 8 - Prob. 8.9PCh. 8 - Prob. 8.10PCh. 8 - Prob. 8.11PCh. 8 - Prob. 8.12PCh. 8 - Prob. 8.13PCh. 8 - Prob. 8.14PCh. 8 - Learning Goal 4 P8- 15 Correlation, risk, and...Ch. 8 - Prob. 8.16PCh. 8 - Learning Goal 5 P8- 17 Total, nondiversifiable,...Ch. 8 - Prob. 8.18PCh. 8 - Prob. 8.19PCh. 8 - Prob. 8.20PCh. 8 - Prob. 8.21PCh. 8 - Prob. 8.22PCh. 8 - Prob. 8.23PCh. 8 - Prob. 8.24PCh. 8 - Prob. 8.25PCh. 8 - Prob. 8.26PCh. 8 - Prob. 8.27PCh. 8 - Learning Goal 6 P8- 28 Security market line (SML)...Ch. 8 - Prob. 8.29PCh. 8 - Prob. 8.30PCh. 8 - Prob. 8.31PCh. 8 - Prob. 1SE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ethical Behavior Consider the following scenario between Dave, a printer, and Steve, an assistant in the local universitys athletic department. Steve: Dave, our department needs to have 10,000 posters printed for the basketball team for next year. Heres the mock-up, and well need them in a month. How much will you charge? Dave: Well, given the costs I have for ink and paper, 1 can come in at around 5,000. Steve: Great, heres what I want you to do. Print me up an invoice for 7,500. Huts our budget. Then, when they pay you, you give me a check for 2,500. Ill make sure that you get the job. Required: CONCEPTUAL CONNECTION Is Steves proposal ethical? What should Dave do?arrow_forwardPlease do not give solution in image formate thanku With the growing popularity of casual surf print clothing, two recent MBA graduates decided to broaden this casual surf concept to encompass a “surf lifestyle for the home.” With limited capital, they decided to focus on surf print table and floor lamps to accent people’s homes. They projected unit sales of these lamps to be 7,300 in the first year, with growth of 5 percent each year for the next five years. Production of these lamps will require $38,000 in net working capital to start. The net working capital will be recovered at the end of the project. Total fixed costs are $98,000 per year, variable production costs are $12 per unit, and the units are priced at $40 each. The equipment needed to begin production will cost $178,000. The equipment will be depreciated using the straight-line method over a five-year life and is not expected to have a salvage value. The effective tax rate is 23 percent and the required rate of return is…arrow_forwardQuestion ENGINEERING ECONOMICS You want to launch a printing services business on campus. The initial cost to get the business running with a September 1st launch date would be $2,000. You estimate that the revenues would approximately offset your costs (e.g. paper, toner, etc.) in the first month of operation so that the monthly profit would be $0. Afterwards, you estimate that profits would increase by $80 each month until the end of the academic year (i.e. $80 profit in October, $160 profit in November, etc. until the end of April). Your annual MARR is 10%, compounded monthly. (a) Calculate the internal rate of return for your investment based on an 8 months study period. Select the appropriate IRR between options 1 to 4 below. (b) Suppose that you now consider another investment opportunity for your printing business services, also with monthly profits, and the internal rate of return of 3%. Is this alternative economically feasible based on IRR?arrow_forward

- MANAGEMENT ACCOUNTING Gxsport is a small business manufactures sportswear focusing on tracksuits. Gxsportperform very well in 2021 with yearly sales amounting to RM630,000, equivalent to 12,600pieces sold. For the 1st quarter of 2022, the sales are predicted to increase by 7% ascompared to 2021’s sales due to the raised of awareness for a healthy lifestyle.The price of the tracksuit is RM50 per piece. The labour rate is RM7 per hour and eachpiece of tracksuit requires 0.4 hours to make. Manufacturing overheads are charges atRM1.50 per piece. The inventory is expected to have a balance of 500 pieces of tracksuitsas at 1st January 2022 and increase by 10% as at 31st March 2022.Calculate the production budget (in unit) for the 1st quarter 2022 (1st January to 31st March2022).arrow_forwardANSWER THE FOLLOWING Problem 2 You are currently started expansion of your existing store which currently render 15% of the current market for infant clothing, your newly acquired store will have a projection of 13% market percentage addition as your customers. After series of advertisements and positive feedbacks from customers, 74% of those who were your customers remain and those other buyers (20% of them) which weren’t your customers became your customers. Project how many percent will be buying on your apparel at the end of the third month. a. 41.03% b. 61.03% c. 38.96% d. none of these (2) Project how many percent will not be buying on your apparel at the end of the 1st a. 64.88% b. 35.12% c. 72% d. none of these (3) Project how many percent will not be buying on your apparel at the end of the 7st a. none of these b. 72% c. 64.88% d. 39.46%arrow_forwardPlease step by step process. Professor von Nordenflycht presents Dean Kayande with two new proposals for offering a graduate certificate program. Both programs will cost $60,000, for classroom and instructor time. Both programs are projected to have two possible revenue outcomes. Program 1, which focuses on accounting, is projected to have a 50% chance of generating $150,000 in revenue and a 50% chance of generating $100,000 in revenue. Project 2, which focuses on cryptocurrencies, is predicted to have a 62.5% chance of generating $200,000 in revenue or, otherwise, generating no revenue! a. What is the expected value of each program? b. What is the variance of each program?arrow_forward

- Baby Benefits Baby Benefits (BB) has a new baby powder ready to take to market. If the firm goes straight to the market, there is only a 55% chance of success. A successful product would mean a profit of £30 million while an unsuccessful one would mean only £3 million. The firm could commission a market research company at a cost of £1 million to establish the best segments to target and how to market to these potential customers. This will increase the chance of success to 60% with the same monetary amounts for successful and unsuccessful launches. Required: Calculate the expected value of the profits if no research is undertaken. Calculate the expected value of profit if the market research is undertaken, and hence conclude whether the market research is worthwhile or not. Calculate the maximum amount the company should consider paying for such research, assuming all the estimates are reliable.arrow_forwardA furniture's store is considering tow marketing strategies: a loyalty program that would cost $3,000 and increase revenue by $15,000, or a seasonal sale that would cost $5,000 and increase revenue by $25,000. The store's contribution margin is 30%. Which strategy should they pursue if the goal is to maximize ROMI? What about if the goal is to maximize revenue growth?arrow_forwardSuppose startup QuickFood proposes a new business model for delivering food in suburban areas. The business model includes fast revenue growth through entry into new cities. The company hopes to be worth $500 million in 5 years. A reasonable discount rate for the food delivery sector based on public comparables is 12%. How much is this company worth today (please round to closest unit)? -60 -284 -446 -313 -300arrow_forward

- 1. Gxsport is a small business manufactures sportswear focusing on tracksuits. Gxsportperform very well in 2021 with yearly sales amounting to RM630,000, equivalent to 12,600pieces sold. For the 1st quarter of 2022, the sales are predicted to increase by 7% ascompared to 2021’s sales due to the raised of awareness for a healthy lifestyle.The price of the tracksuit is RM50 per piece. The labour rate is RM7 per hour and eachpiece of tracksuit requires 0.4 hours to make. Manufacturing overheads are charges atRM1.50 per piece. The inventory is expected to have a balance of 500 pieces of tracksuitsas at 1st January 2022 and increase by 10% as at 31st March 2022. 1. Calculate the production budget (in unit) for the 1st quarter 2022 (1st January to 31st March2022).arrow_forward1. What is the value of a loyal customer (VLC) if the customer retention rate is 50 percent? Round your answer to the nearest cent. $ fill in the blank 2 2. What is the value of a loyal customer (VLC) if the customer retention rate increases to 75 percent? Round your answer to the nearest cent. $ fill in the blank 3 3. What is a 1 percent change in market share worth to the manufacturer if it represents 100,000 customers? Round your answers to the nearest dollar. 50 percent customer retention rate case: $ fill in the blank 4 75 percent customer retention rate case: $ fill in the blank 5 4. What do you conclude? If customer retention can be increased from 50 to 75 percent through better value chain performance, the economic payoff isarrow_forwardIm looking for assistance with question 4 (bold below), including parts a and b Practice 1: & F., Inc. has developed a new product, the Number Cruncher 2000 to add to its ever-expanding offerings. After doing market research, it has determined that customers would be willing to pay $140 for the NC2000. D&F seeks to earn 25% profit on the product. At present, D&F makes a similar, old style model (The NC1000) for $101.25, which sells for $130. What must the target cost be in order to earn the 25% profit that the company demands? If D&F can adjust its costs to the target cost, the company estimates that it can sell 50,000 NC2000s. What would D&F’s profit be at this point? How many of the old style NC1000s would have to be sold to reach the same profit? D&F’s head of manufacturing operations is sensitive to the attainability of the cost projections in number 1 above. He has been analyzing the production process to determine how long it takes for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License