Concept explainers

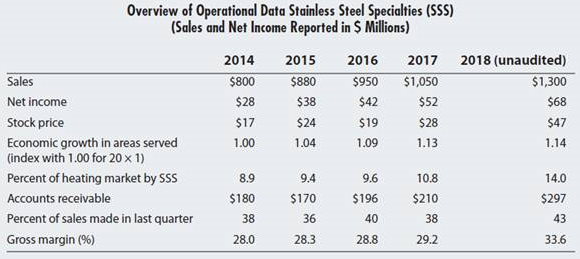

Stainless Steel Specialties (SSS) is a manufacturer of hot water—based heating systems for homes and commercial businesses. The company has grown about 10% in each of the past five years. The company has not made any acquisitions. Following are some statistics for the company:

Additional information available to the auditor includes:

- The company has touted its new and improved technology for the increase both in sales and in gross margin.

- The company claims to have decreased administrative expenses, thus increasing net profits.

- The company has reorganized its sales process to a more centralized approach and has empowered individual sales managers to negotiate better prices to drive sales as long as the amounts are within corporate guidelines.

- The company has changed its salesperson compensation by increasing the commission on sales to new customers.

- Sales commissions are no longer affected by returned goods if the goods are returned more than 90 days after sale and/or by not collecting the receivables. SSS has justified the changes in sales commissions on the following grounds:

- The salesperson is not responsible for quality issues—the main reason that customers return products.

- The salesperson is not responsible for approving credit; rather credit approval is under the direction of the global sales manager.

a. What is the importance of the information about salesperson compensation to the audit of receivables and revenue? Explain how the auditor would use this information in planning analytical procedures.

b. Perform planning analytical procedures using the data included in the table and the information about the change in performance. For each year, you will most likely want to focus on the % change of the various statistics over the prior year. Focus on Steps 3, 4, and 5 of the planning analytical procedures process. What are the important insights that the auditor should gain from performing such procedures?

c. Why should the auditor be interested in a company’s stock price when performing an audit, as stock price is dependent, at least in part, on audited financial reports?

d. What information about SSS might the auditor consider as fraudrisk factors?

e. Identify specific substantive

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Auditing: A Risk Based-Approach (MindTap Course List)

- Bannister Company, an electronics firm, buys circuit boards and manually inserts various electronic devices into the printed circuit board. Bannister sells its products to original equipment manufacturers. Profits for the last two years have been less than expected. Mandy Confer, owner of Bannister, was convinced that her firm needed to adopt a revenue growth and cost reduction strategy to increase overall profits. After a careful review of her firms condition, Mandy realized that the main obstacle for increasing revenues and reducing costs was the high defect rate of her products (a 6 percent reject rate). She was certain that revenues would grow if the defect rate was reduced dramatically. Costs would also decline as there would be fewer rejects and less rework. By decreasing the defect rate, customer satisfaction would increase, causing, in turn, an increase in market share. Mandy also felt that the following actions were needed to help ensure the success of the revenue growth and cost reduction strategy: a. Improve the soldering capabilities by sending employees to an outside course. b. Redesign the insertion process to eliminate some of the common mistakes. c. Improve the procurement process by selecting suppliers that provide higher-quality circuit boards. Required: 1. State the revenue growth and cost reduction strategy using a series of cause-and-effect relationships expressed as if-then statements. 2. Illustrate the strategy using a strategy map. 3. Explain how the revenue growth strategy can be tested. In your explanation, discuss the role of lead and lag measures, targets, and double-loop feedback.arrow_forwardEdward L. Vincent is CFO of Energy Resources, Inc. The company specializes in the exploration and development of natural gas. It’s near year-end, and Edward is feeling terrific. Natural gas prices have risen throughout the year, and Energy Resources is set to report recordbreaking performance that will greatly exceed analysts’ expectations. However, during an executive meeting this morning, management agreed to “tone down” profits due to concerns that reporting excess profits could encourage additional government regulations in the industry, hindering future profitability. At the beginning of the current year, the company purchased equipment for $4,200,000. The company’s standard practice for equipment like this is to use straight-line depreciation over 12 years using an estimated residual value of $600,000. To address the issue discussed in the meeting, Edward is considering three options. Option 1: Adjust the estimated service life of the equipment from 12 years to 6 years. Option 2:…arrow_forwardDiamond Computers, which is owned and operated by Dale Diamond, manufactures and sells different types of computers. The company has reported profits every year since its inception in 2002 and has applied for a bank loan near the end of 2021 to upgrade manufacturing facilities. These upgrades should significantly boost future productivity and profitability. In preparing the financial statements for the year, the chief accountant, Sandy Walters, mentions to Dale that approximately $80,000 of computer inventory has become obsolete and a write-down of inventory should be recorded in 2021. Dale understands that the write-down would result in a net loss being reported for company operations in 2021. This could jeopardize the company’s application for the bank loan, which would lead to employee layoffs. Dale is a very kind, older gentleman who cares little for his personal wealth but who is deeply devoted to his employees’ well-being. He truly believes the loan is necessary for the company’s…arrow_forward

- Kiley Corporation had the following data for the most recent year (in millions). The new CFO believes (1) that an improved inventory management system could lower the average inventory by $4,000, (2) that improvements in the credit department could reduce receivables by $2,000, and (3) that the purchasing department could negotiate better credit terms and thereby increase accounts payable by $2,000. Furthermore, she thinks that these changes would not affect either sales or the costs of goods sold. If these changes were made, by how many days would the cash conversion cycle be lowered? (Hint: Calculate the CCC for original and then for revised and take the difference. SHOW ALL WORK)arrow_forwardKiley Corporation had the following data for the most recent year (in millions). The new CFO believes (1) that an improved inventory management system could lower the average inventory by $4,000, (2) that improvements in the credit department could reduce receivables by $2,000, and (3) that the purchasing department could negotiate better credit terms and thereby increase accounts payable by $2,000. Furthermore, she thinks that these changes would not affect either sales or the costs of goods sold. If these changes were made, by how many days would the cash conversion cycle be lowered? Original Revised Annual sales: unchanged $110,000 $110,000 Cost of goods sold: unchanged $80,000 $80,000 Average inventory: lowered by $4,000 $20,000 $16,000 Average receivables: lowered by $2,000 $16,000 $14,000 Average payables: increased by $2,000 $10,000 $12,000 Days in year 365 365arrow_forwardWells Company is a pesticide manufacturer. Its sales declined greatly this year due to the passage of legislation outlawing the sale of several of Wells' chemical pesticides. During the coming year, Wells will have environmentally safe and competitive replacement chemicals to replace these discontinued products. Sales in the next year are expected to greatly exceed those of any prior year. Therefore, the decline in this year's sales and profits appears to be a one-year aberration. Even so, the company president believes that a large dip in the current year's profits could cause a significant drop in the market price of Wells's stock and make it a takeover target. To avoid this possibility, he urges Tim Allen, controller, to accrue every possible revenue and to defer as many expenses as possible in making this period's year-end adjustments. The president says to Tim, “We need the revenues this year, and next year we can easily absorb expenses deferred from this year. We can't let our…arrow_forward

- Edward L. Vincent is CFO of Energy Resources, Inc. The company specializes in the exploration and development of natural gas. It's near year-end, and Edward is feeling terrific. Natural gas prices have risen throughout the year, and Energy Resources is set to report record-breaking performance that will greatly exceed analysts' expectations. However, during an executive meeting this morning, management agreed to "tone down" profits due to concerns that reporting excess profits could encourage additional government regulations in the industry, hindering future profitability. Edward decides to adjust the estimated service life of development equipment from 10 years to 6 years. He also plans to adjust estimated residual values on development equipment to zero as it is nearly impossible to accurately estimate residual values on equipment like this anyway. Required: 1.Explain how the adjustment of estimated service life from 10 years to 6 years will affect depreciation…arrow_forwardRichmond, Inc., operates a chain of 44 department stores. Two years ago, the board of directors of Richmond approved a large-scale remodeling of its stores to attract a more upscale clientele. Before finalizing these plans, two stores were remodeled as a test. Linda Perlman, assistant controller, was asked to oversee the financial reporting for these test stores, and she and other management personnel were offered bonuses based on the sales growth and profitability of these stores. While completing the financial reports, Perlman discovered a sizable inventory of outdated goods that should have been discounted for sale or returned to the manufacturer. She discussed the Situation with her management colleagues; the consensus was to ignore reporting this inventory as obsolete because reporting it would diminish the financial results and their bonuses. Required: According to the IMA’s Statement of Ethical Professional Practice, would it be ethical for Perlman not to report the inventory…arrow_forwardENVIRO-WEAR had reached $25,000,000 in sales in its sixth year, when a disastrous set of events put the firm and its prospects in a tailspin. One of the key sales managers was overheard by a news reporter telling jokes about the poor quality of the firm’s clothing, and the news of it spread quickly. Also, rumors (largely unfounded) spread at the same time that the firm was not really as environmentally conscious in its manufacturing and packaging as it claimed. The result was an immediate falloff in sales, and some retailers were returning the goods. Mike intends to fire the manager and deny publicly any association with the manager’s comments, as well as to defend the firm’s environmental record. Required What are the ethical issues involved in the case, and how would you resolve them?arrow_forward

- Malone Industries has been in business for five years and has been very successful. In the past year, it expanded operations by buying Hot Metal Manufacturing for a price greater than the value of the net assets purchased. In the past year, the customer base has expanded much more than expected, and the companys owners want to increase the goodwill account. Your CPA firm has been hired to help Malone prepare year-end financial statements, and your boss has asked you to talk to Malones managers about goodwill and whether an adjustment can be made to the goodwill account. How do you respond to the owners and managers?arrow_forwardCheckpoint Systems is a leading provider of source tagging, handheld labeling systems, retail merchandising systems, and bar-code labeling systems. In a press release, Checkpoint stated the following: GAAP reported net loss for the fourth quarter of 2004 was 29.3 million, or 0.78 per diluted share, compared to net earnings of 4.5 million, or 0.13 per diluted share, for the fourth quarter 2003. Excluding impairment and restructuring charges, net of tax, the Companys net income for the fourth quarter 2004 was 0.30 per diluted share, compared to 0.27 per diluted share in the fourth quarter 2003. Calculate the amount of the impairment and restructuring charges Checkpoint reported in 2004 and 2003. Discuss why the firm reported earnings both including and excluding impairment and restructuring charges.arrow_forwardIn 20x5, Major Company initiated a full-scale, quality improvement program. At the end of the year, Jack Aldredge, the president, noted with some satisfaction that the defects per unit of product had dropped significantly compared to the prior year. He was also pleased that relationships with suppliers had improved and defective materials had declined. The new quality training program was also well accepted by employees. Of most interest to the president, however, was the impact of the quality improvements on profitability. To help assess the dollar impact of the quality improvements, the actual sales and the actual quality costs for 20x4 and 20x5 are as follows by quality category: All prevention costs are fixed (by discretion). Assume all other quality costs are unit-level variable. Required: 1. Compute the relative distribution of quality costs for each year and prepare a pie chart. Do you believe that the company is moving in the right direction in terms of the balance among the quality cost categories? Explain. 2. Prepare a one-year trend performance report for 20x5 (compare the actual costs of 20x5 with those of 20x4, adjusted for differences in sales volume). How much have profits increased because of the quality improvements made by Major Company? 3. Estimate the additional improvement in profits if Major Company ultimately reduces its quality costs to 2.5 percent of sales revenues (assume sales of 10 million).arrow_forward

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning