Concept explainers

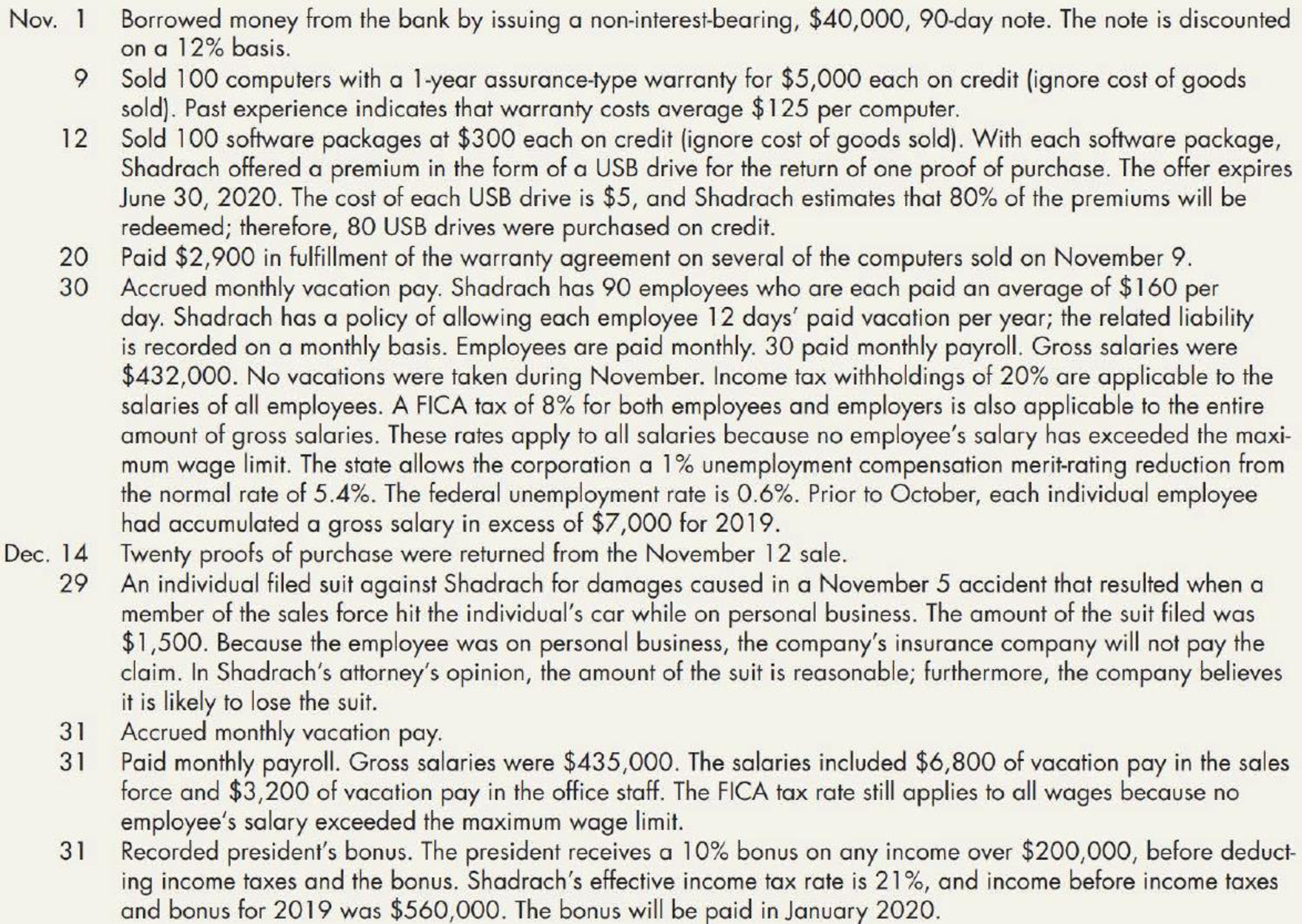

Comprehensive Selected transactions of Shadrach Computer Corporation during November and December of 2019 are as follows:

Required:

Prepare

Prepare the journal entries in the books of Corporation SC for the year 2019.

Explanation of Solution

Note payable: Note payable denotes a long-term liability that describes the amount borrowed, signed and issued note. The note carries all the details of payable amounts, interest amounts, and maturity dates.

Discount on notes payable: This is the value that arises when the note is issued at less than par value. The discount which is the interest value is included in the face value of note, and is recording as contra-liability to Notes Payable account with a normal debit balance.

Warranty:

Warranty is a written guarantee that is given by the seller to the buyer for the product against product’s defect.

Income tax:

Income tax is the compulsory contribution made by the individuals and companies for the benefits that are received from the government. This income tax will be paid on the amount that is earned by the individual or company.

Bonus:

Bonus is an extra payment given by the employer to the employees with the regular salary to increase the company earnings.

Payroll tax:

Payroll tax refers to the tax that are equally contributed by employees and employer based on the salary and wages of an employee. Payroll tax includes taxes like federal tax, local income tax, state tax, social security tax and federal and state unemployment tax.

Prepare the journal entries in the books of Corporation SC for the month November.

| Date | Account titles and explanation | Debit ($) | Credit($) |

| November 1, 2019 | Cash | $38,800 | |

| Discount on notes payable | $1,200 | ||

| Notes Payable | $40,000 | ||

| (To record the amount borrowed by issuing 90-days, non-interest bearing note) | |||

| November 9, 2019 | Accounts receivable | $500,000 | |

| Sales | $500,000 | ||

| (To record the sale of 100 computers on credit) | |||

| November 9, 2019 | Warranty expense | $12,500 | |

| Estimated warranty liability | $12,500 | ||

| (To record the estimated warranty liability) | |||

| November 12, 2019 | Accounts receivable | $30,000 | |

| Sales | $30,000 | ||

| (To record the sale of 100 software packages on credit) | |||

| November 12, 2019 | Inventory of premiums | $400 | |

| Accounts payable | $400 | ||

| (To record the purchase of 80 USB drives on credit) | |||

| November 12, 2019 | Premium expense | $400 | |

| Estimated premium liability | $400 | ||

| (To record estimated premium liability) | |||

| November 20, 2019 | Estimated warranty liability | $2,900 | |

| Cash | $2,900 | ||

| (To record payment of estimated premium liability) | |||

| November 30, 2019 | Salaries expenses | 14,400 | |

| Liabilities for compensated absences (1) | 14,400 | ||

| (To record the liability of compensated absences for the month of November) | |||

| November 30, 2019 | Salaries expenses | 432,000 | |

| Federal income taxes withholding payable | 86,400 | ||

| F.I.C.A taxes payable | 34,560 | ||

| Cash (Balancing figure) | 311,040 | ||

| (To record salaries expenses and employees withholding items) | |||

| November 30, 2019 | Payroll tax expenses | 34,560 | |

| F.I.C.A taxes payable | 34,560 | ||

| (To record the employer payroll taxes) |

Table (1)

Working note (1):

Determine the liability for compensated absences for the month of November.

Prepare the journal entries in the books of Corporation SC for the month December.

| Date | Account titles and explanation | Debit ($) | Credit($) |

| December 14, 2019 | Estimated premium liability | 100 | |

| Inventory of premiums | 100 | ||

| (To record the 20 proof of purchase were returned from the November 12 sale) | |||

| December 29, 2019 | Loss from accident | 1,500 | |

| Estimated liability from lawsuit | 1,500 | ||

| To record the estimated liability and accrue of loss) | |||

| December 31, 2019 | Salaries expenses | 14,400 | |

| Liabilities for compensated absences | 14,400 | ||

| (To record the liability of compensated absences for the month of December) | |||

| December 31, 2019 | Salaries expenses | 425,000 | |

| Liability for compensated absences | 10,000 | ||

| Federal income taxes withholding payable | 87,000 | ||

| F.I.C.A taxes payable | 34,800 | ||

| Cash | 313,200 | ||

| (To record salaries expenses and employees withholding items) | |||

| December 31, 2019 | Payroll tax expenses | 34,800 | |

| F.I.C.A taxes payable | 34,800 | ||

| (To record the employer payroll taxes) | |||

| December 31, 2019 | Salaries expenses(Officer’s bonus) | 36,000 | |

| Bonus payable (2) | 36,000 | ||

| (To record the bonus payable to the president for the year 2019) | |||

| December 31, 2019 | Income tax expenses (3) | 157,200 | |

| Income taxes payable | 157,200 | ||

| (To recognize the income tax expenses of the year 2019) | |||

| December 31, 2019 | Interest expenses | 800 | |

| Discount on notes payable | 800 | ||

| (To recognize the interest expenses for 2 months) |

Table (2)

Working note (2):

Calculate the amount of president bonus for 2019.

Working note (3):

Calculate the income tax expense Corporation SC for the year 2019.

Want to see more full solutions like this?

Chapter 9 Solutions

Interm.acct.:reporting.(ll)-w/access

- Comprehensive Selected transactions of Lizard Lick Corporation during 2019 are as follows: Required: Prepare journal entries to record the preceding transactions for 2019. Include year-end interest accruals.arrow_forwardTrade Note Transactions Adjusto Corporation (which is on a December 31 fiscal year-end) engaged in the following transactions during 2019 and 2020: Required: Prepare journal entries to record the preceding transactions on Adjustos books, including the adjusting entries at the end of 2019. Assume a 360-day year.arrow_forwardThe following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2019: Instructions 1. Prepare a multiple-step income statement. 2. Prepare a statement of owners equity. 3. Prepare a balance sheet, assuming that the current portion of the note payable is 50,000. 4. Briefly explain how multiple-step and single-step income statements differ.arrow_forward

- Selected accounts from the ledger of Restoration Arts for the fiscal year ended April 30, 2019, are as follows: Prepare a statement of owners equity for the year.arrow_forwardKoolman Construction Company began work on a contract in 2019. The contract price is 3,000,000, and the company determined that its performance obligation was satisfied over time. Other information relating to the contract is as follows: Required: 1. Compute the gross profit or loss recognized in 2019 and 2020. 2. Prepare the appropriate sections of the income statement and ending balance sheet for each year.arrow_forwardPrepare an income statement using the following information for CK Company for the month of February 2019.arrow_forward

- Analyzing Accounts Receivable Upham Companys June 30, 2019, balance sheet included the following information: Required: 1. Prepare the journal entries necessary for Upham to record the preceding transactions. 2. Prepare an analysis and schedule that shows the amounts of the accounts receivable, allowance for doubtful accounts, notes receivable, and notes receivable dishonored accounts that will be disclosed on Uphams June 30, 2020, balance sheet.arrow_forwardReversing Entries On December 31, 2019, Kellams Company made the following adjusting entries for its annual accounting period: Required: Prepare whatever reversing entries are appropriate.arrow_forwardByrd Company had the following transactions during 2019 and 2020: 1. Prepare the journal entries for Byrd for both 2019 and 2020. Assume that the net price method is used to account for the credit terms. 2. Show how the preceding items would be reported in the current liabilities section of Byrd’s December 31, 2019, balance sheet. 3. Next Level Assuming Byrd’s current assets were $1,200,000 and its current ratio was 2.4 at the end of 2018, compute the current ratio at the end of 2019 (based solely on the effects of the preceding transactions).arrow_forward

- Greenlaw Inc., a publishing company, is preparing its December 31, 2019, financial statements and must determine the proper accounting treatment for each of the following situations: 1. Greenlaw sells subscriptions to several magazines for a 1, 2, or 3-year period. Cash receipts from subscribers are credited to Unearned Revenue: Magazine Subscriptions, and this account had a balance of $2,500,000 at December 31, 2019. Outstanding subscriptions at December 31, 2019, expire as follows: During 2020—$600,000 During 2021—$900,000 During 2022—$400,000 2. On January 4, 2019, Greenlaw discontinued collision, fire, and theft coverage on its delivery vehicles and became self-insured for these risks. Actual losses of $45,000 during 2019 were charged to delivery expense. The 2018 premium for the discontinued coverage amounted to $100,000, and the controller wants to set up a reserve for self-insurance by a debit to Delivery Expense of $55,000 and a credit to Reserve for Self-Insurance of $55,000.…arrow_forwardThe balance in Ashwood Company’s accounts payable account at December 31, 2019, was $1,200,000 before any necessary year-end adjustment relating to the following:arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College