Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 9, Problem 3P

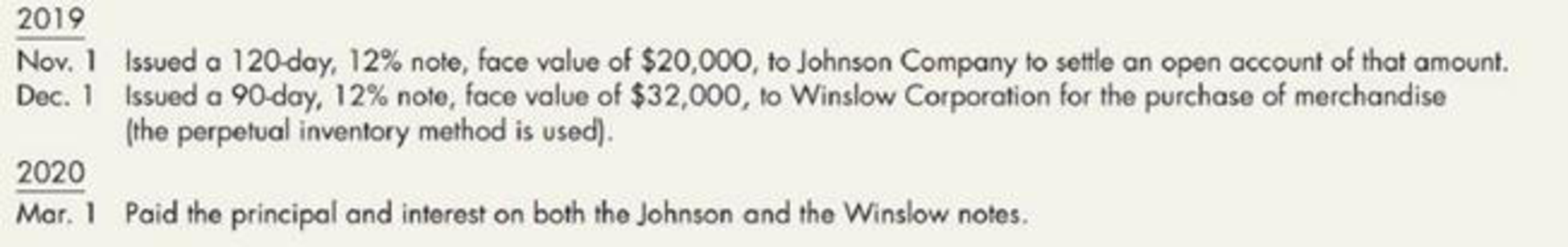

Trade Note Transactions Adjusto Corporation (which is on a December 31 fiscal year-end) engaged in the following transactions during 2019 and 2020:

Required:

Prepare

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 9 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 9 - Prob. 1GICh. 9 - Prob. 2GICh. 9 - List the three characteristics of a liability....Ch. 9 - Prob. 4GICh. 9 - Prob. 5GICh. 9 - Prob. 6GICh. 9 - Prob. 7GICh. 9 - Prob. 8GICh. 9 - How does materiality affect the accounting for...Ch. 9 - Distinguish between an interest-bearing note and a...

Ch. 9 - Prob. 11GICh. 9 - How should long-term debt that is callable by a...Ch. 9 - Prob. 13GICh. 9 - Prob. 14GICh. 9 - Prob. 15GICh. 9 - Prob. 16GICh. 9 - Prob. 17GICh. 9 - Prob. 18GICh. 9 - Prob. 19GICh. 9 - Prob. 20GICh. 9 - Prob. 21GICh. 9 - Prob. 22GICh. 9 - Prob. 23GICh. 9 - Prob. 24GICh. 9 - Prob. 25GICh. 9 - Prob. 26GICh. 9 - Prob. 27GICh. 9 - Prob. 28GICh. 9 - The balance in Ashwood Companys accounts payable...Ch. 9 - On September 1, 2019, a company borrowed cash and...Ch. 9 - When a company receives a deposit from a customer...Ch. 9 - Bronson Apparel Inc. operates a retail store and...Ch. 9 - Prob. 5MCCh. 9 - Prob. 6MCCh. 9 - Prob. 7MCCh. 9 - Prob. 8MCCh. 9 - Prob. 9MCCh. 9 - Prob. 10MCCh. 9 - Rescue Sequences LLC purchased inventory by...Ch. 9 - Use the same information in RE9-1 except that the...Ch. 9 - Cee Co.s fiscal year begins April 1. At the...Ch. 9 - Prob. 4RECh. 9 - Prob. 5RECh. 9 - Smith Company is required to charge customers an...Ch. 9 - Wallace Corporation summarizes the following...Ch. 9 - Borat Company gives annual bonuses after the end...Ch. 9 - Prob. 9RECh. 9 - Prob. 10RECh. 9 - After years of experience, Dilcort Company...Ch. 9 - Prob. 1ECh. 9 - Notes Payable On December 1, 2019, Insto Photo...Ch. 9 - Non-Interest-Bearing Notes Payable On November 16,...Ch. 9 - Discounting of Notes Payable On October 30, 2019,...Ch. 9 - Disclosure of Debt On May 1, 2019, Ramden Company...Ch. 9 - Short-Term Debt Expected to Be Refinanced On...Ch. 9 - Short-Term Debt Expected to Be Refinanced On...Ch. 9 - Refundable Deposits Party Warehouse Inc. rents a...Ch. 9 - Prob. 9ECh. 9 - Property Taxes Family Practice Associates has an...Ch. 9 - Prob. 11ECh. 9 - Prob. 12ECh. 9 - Prob. 13ECh. 9 - Prob. 14ECh. 9 - Prob. 15ECh. 9 - Prob. 16ECh. 9 - Prob. 17ECh. 9 - Prob. 18ECh. 9 - Prob. 19ECh. 9 - Prob. 20ECh. 9 - Cash Rebates On January 1, 2020, Fro-Yo Inc. began...Ch. 9 - Prob. 22ECh. 9 - Prob. 1PCh. 9 - Notes Payable and Effective Interest On November...Ch. 9 - Trade Note Transactions Adjusto Corporation (which...Ch. 9 - Prob. 4PCh. 9 - Short-Term Debt Expected to Be Refinanced On...Ch. 9 - Non-Interest-Bearing Note Payable: Present Value...Ch. 9 - Prob. 7PCh. 9 - Prob. 8PCh. 9 - Payroll and Payroll Taxes Bailey Dry Cleaners has...Ch. 9 - Bonus Obligation and Income Tax Expense James...Ch. 9 - Prob. 11PCh. 9 - Contingencies Fallon Company, a toy manufacturer...Ch. 9 - Prob. 13PCh. 9 - Assurance-Type Warranty Clean-All Inc. sells...Ch. 9 - Prob. 15PCh. 9 - Premium Obligation Yummy Cereal Company is...Ch. 9 - Comprehensive Selected transactions of Lizard Lick...Ch. 9 - Comprehensive Selected transactions of Shadrach...Ch. 9 - Prob. 1CCh. 9 - Prob. 2CCh. 9 - Prob. 3CCh. 9 - Pending Damage Suit Disclosure On December 15,...Ch. 9 - Various Contingency Issues Skinner Company has the...Ch. 9 - Prob. 6CCh. 9 - Prob. 7CCh. 9 - Prob. 8CCh. 9 - Prob. 10C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comprehensive Selected transactions of Shadrach Computer Corporation during November and December of 2019 are as follows: Required: Prepare journal entries to record the preceding transactions of Shadrach Computer Corporation for 2019. Include year-end accruals. Round all calculations to the nearest dollar.arrow_forwardComprehensive Selected transactions of Lizard Lick Corporation during 2019 are as follows: Required: Prepare journal entries to record the preceding transactions for 2019. Include year-end interest accruals.arrow_forwardAnderson Air is a customer of Handler Cleaning Operations. For Anderson Airs latest purchase on January 1, 2018, Handler Cleaning Operations issues a note with a principal amount of $1,255,000, 6% annual interest rate, and a 24-month maturity date on December 31, 2019. Record the journal entries for Handler Cleaning Operations for the following transactions. A. Entry for note issuance B. Subsequent interest entry on December 31, 2018 C. Honored note entry at maturity on December 31, 2019arrow_forward

- Non-Interest-Bearing Notes Payable On November 16, 2019, Clear Glass Company borrowed 20,000 from First American Bank by issuing a 90-day, non-interest-bearing note. The bank discounted this note at 12% and remitted the difference to Clear Glass. Required: 1. Prepare the journal entries of Clear Glass to record the preceding information, the related calendar year-end adjusting entry, and payment of the note at maturity. 2. Show how the preceding items Would be reported on the December 31, 2019, balance sheet. 3. Next Level What is Clear Glass Companys effective interest rate?arrow_forwardBalance Sheet from Adjusted Trial Balance The following is the alphabetical adjusted trial balance of Meadows Company on December 31, 2019; Required: 1. Prepare Meadowss December 31, 2019, balance sheet. 2. Next Level Compute the debt-to-assets ratio. What does it indicate about Meadows at the end of 2019?arrow_forwardReversing Entries On December 31, 2019, Kellams Company made the following adjusting entries for its annual accounting period: Required: Prepare whatever reversing entries are appropriate.arrow_forward

- ACCRUED INTEREST PAYABLE The following is a list of outstanding notes payable as of December 31, 20--: REQUIRED 1. Compute the accrued interest at the end of the year. 2. Prepare the adjusting entry in the general journal.arrow_forwardInterest-Bearing and Non-Interest-Bearing Notes On December 11, 2019, Hooper Inc. made a credit sale to Marshall Company and required Marshall to sign a 12,000,60-day note. Required: Prepare the journal entries necessary to record the receipt of the note by Hooper, the accrual of interest on December 31, 2019, and the customers repayment on February 9, 2020, assuming: 1. Interest of 12% was in addition to the face value of the note. 2. The note was issued as a 12,000 non-interest-bearing note with a present value of 11,765. The implicit interest rate on the note receivable was 12%. Assume a 360-day year. (Round to the nearest dollar.)arrow_forwardDallas Company loaned to Ewing Company on December 1, 2019. Ewing will pay Dallas $720 of interest ($60 per month) on November 30, 2020. Dallass adjusting entry at December 31, 2019, is: a. Interest Expense ........... 60 c. Interest Receivable ....... 60 Cash ......................... 60 Interest Income ........ 60 b. Cash ............................ 60 d. No adjusting entry is required. Interest Income ........ 60arrow_forward

- Restructuring (Debtor) Oakwood Corporation is delinquent on a 2,400,000, 10% note to Second National Bank that was due January 1, 2019. At that time, Oakwood owed the principal amount plus 34,031.82 of accrued interest. Oakwood enters into a debt restructuring agreement with the bank on January 2, 2019. Required: Prepare the journal entries for Oakwood to record the debt restructuring agreement and all subsequent interest payments assuming the following independent alternatives: 1. The bank extends the repayment date to December 31, 2022, forgives the accrued interest owed, reduces the principal by 200,000, and reduces the interest rate to 8%. 2. The bank extends the repayment date to December 31, 2022, forgives the accrued interest owed, reduces the principal by 200,000, and reduces the interest rate to 1%. 3. The bank accepts 160,000 shares of Oakwoods 55 par value common stock, which is currently selling for 14.50 per share, in full settlement of the debt. 4. The bank accepts land with a fair value of 2,300,000 in full settlement of the debt. The land is being carried on Oakwoods books at a cost of 2,200,000.arrow_forwardProperty Taxes Family Practice Associates has an estimated property tax liability of 7,200 assessed as of January 1,2019, for the year May 1, 2019, to April 30, 2020. The property tax is paid on September 1, 2019. The property tax becomes a lien against the property on May 1. Required: 1. Prepare the necessary monthly journal entries to record the preceding information for the period from May 1 to September 30, 2019 (assuming actual taxes are the same as estimated). 2. What would be the amount of the liability on December 31, 2019?arrow_forwardDisclosure of Debt On May 1, 2019, Ramden Company issues 13% bonds with a face value of 2 million. The bond contract calls for retirement of the bonds in periodic installments of 200,000, starting on May 1, 2020, and continuing on each May 1 thereafter until all bonds are retired. Required: How would the preceding information appear in Ramdens balance sheets on December 31, 2019, and 2020?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

7.2 Ch 7: Notes Payable and Interest, Revenue recognition explained; Author: Accounting Prof - making it easy, The finance storyteller;https://www.youtube.com/watch?v=wMC3wCdPnRg;License: Standard YouTube License, CC-BY