The City of Lynnwood was recently incorporated and had the following transactions for the fiscal year ended December 31.

- 1. The city council adopted a General Fund budget for the fiscal year. Revenues were estimated at $2,000,000 and appropriations were $1,990,000.

- 2. Property taxes in the amount of $1,940,000 were levied. It is estimated that $9,000 of the taxes levied will be uncollectible.

- 3. A General Fund transfer of $25,000 in cash and $300,000 in equipment (with accumulated

depreciation of $65,000) was made to establish a central duplicating internal service fund. - 4. A citizen of Lynnwood donated marketable securities with a fair value of $800,000. The donated resources are to be maintained in perpetuity with the city using the revenue generated by the donation to finance an afterschool program for children, which is sponsored by the culture and recreation function. Revenue earned and received as of December 31 was $40,000.

- 5. The city’s utility fund billed the city’s General Fund $125,000 for water and sewage services. As of December 31, the General Fund had paid $124,000 of the amount billed.

- 6. The central duplicating fund purchased $4,500 in supplies.

- 7. Cash collections recorded by the general government function during the year were as follows:

- 8. During the year, the internal service fund billed the city’s general government function $15,700 for duplicating services and it billed the city’s utility fund $8,100 for services.

- 9. The city council decided to build a city hall at an estimated cost of $5,000,000. To finance the construction, 6 percent bonds were sold at the face value of $5,000,000. A contract for $4,500,000 has been signed for the project; however, no expenditures have been incurred as of December 31.

- 10. The general government function issued a purchase order for $32,000 for computer equipment. When the equipment was received, a voucher for $31,900 was approved for payment and payment was made.

Required

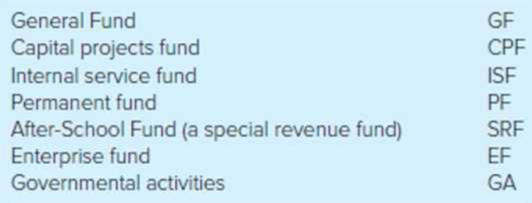

Prepare all journal entries to properly record each transaction for the fiscal year ended December 31. Use the following funds and government-wide activities, as necessary:

Each

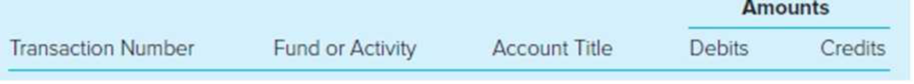

Your answer sheet should be organized as follows:

Prepare necessary journal entries to properly record each transaction for the fiscal year ended December 31.

Explanation of Solution

Government-wide financial statement: This statement provides a combined summary of the net position and the changes in the net position of the government.

Fund financial statement: The fund financial statement provides detail financial information on the governmental, proprietary and fiduciary activities of the primary government.

Prepare necessary journal entries to properly record each transaction for the fiscal year ended December 31.

| Transaction Number | Fund or Activity | Account Title | Debit ($) | Credit ($) |

| 1. | GF | Estimated Revenues | 2,000,000 | |

| Appropriations | 1,990,000 | |||

| Budgetary fund balance | 10,000 | |||

| (To record the general fund receipt) | ||||

| 2. | GF | Taxes receivable-current | 1,940,000 | |

| Allowance for uncollectible current taxes | 9,000 | |||

| Revenues | 1,931,000 | |||

| (To record the property tax levy and uncollectible portion) | ||||

| GA | Taxes receivable- Current | 1,940,000 | ||

| Allowance for uncollectible current taxes | 9,000 | |||

| General revenues-property taxes | 1,931,000 | |||

| (To record the amount of property tax and amount of general revenue) | ||||

| 3. | GF | Interfund transfers out | 25,000 | |

| Cash | 25,000 | |||

| (To record the general fund transfer) | ||||

| ISF | Cash | 25,000 | ||

| Equipment | 300,000 | |||

| Accumulated Depreciation | 65,000 | |||

| Interfund Transfer In | 260,000 | |||

| (To record the inter-fund Transfer In) | ||||

| 4. | PF | Investment –marketable securities | 800,000 | |

| Revenues-contributions for endowment | 800,000 | |||

| (To record the donated marketable security) | ||||

| Cash | 40,000 | |||

| Revenues –Investment earnings | 40,000 | |||

| (To record the revenue at the end) | ||||

| PF | Interfund Transfer Out | 40,000 | ||

| Cash | 40,000 | |||

| (To record the Inter-fund Transfer Out) | ||||

| SRF | Cash | 40,000 | ||

| Interfund Transfers In | 40,000 | |||

| (To record the Inter-fund Transfer In) | ||||

| GA | Investment –marketable securities | 800,000 | ||

| General revenues-contributions for endowment | 800,000 | |||

| (To record marketable securities and general revenues) | ||||

| Cash | 40,000 | |||

| Programs revenues-culture and recreation- operating grants and contributions | 40,000 | |||

| (To record the donation made on culture and creation) | ||||

| 5. | EF | Due from other funds | 125,000 | |

| Charges for services | 125,000 | |||

| (To record the general fund for sewage and water services) | ||||

| Cash | 124,000 | |||

| Due from other funds | 124,000 | |||

| (To record the amount paid) | ||||

| GF | Expenditures | 125,000 | ||

| Due from other funds | 125,000 | |||

| (To record the actual due amount) | ||||

| Due from other funds | 124,000 | |||

| Cash | 124,000 | |||

| (To record the funds due to other funds) | ||||

| GA | Expense-general government | 125,000 | ||

| Internal balances | 125,000 | |||

| (To record the internal balance) | ||||

| Internal balances | 124,000 | |||

| Cash | 124,000 | |||

| (To record the cash settlement) | ||||

| 6. | ISF & GA | Inventory of supplies | 4,500 | |

| Cash | 4,500 | |||

| (To record the purchase of central duplicating fund) | ||||

| 7. | GF | Cash | 1,988,000 | |

| Taxes receivable-current | 1,925,000 | |||

| Revenues | 63,000 | |||

| (To record the cash collection) | ||||

| GA | Cash | 1,988,000 | ||

| Taxes receivable-current | 1,925,000 | |||

| Program revenue-general government-charges for services | 63,000 | |||

| (To record the cash collection) | ||||

| 8. | ISF | Due from other funds | 23,800 | |

| Billings to departments | 23,800 | |||

| (To record the total funds due from department) | ||||

| EF | Expense-administrative | 8,100 | ||

| Due to other funds | 8,100 | |||

| (To record the City’s utility fund) | ||||

| GF | Expenditures-General government | 15,700 | ||

| Due to other funds | 15,700 | |||

| (To record the internal service fund) | ||||

| GA | Internal balances | 8,100 | ||

| Program revenues-general government-charges for services | 8,100 | |||

| (To record the government charges for service) | ||||

| 9. | CPF | Cash | 5,000,000 | |

| Proceeds of bonds | 5,000,000 | |||

| (To record the sale of bond) | ||||

| Encumbrance | 4,500,000 | |||

| Encumbrances outstanding | 4,500,000 | |||

| (To record the amount of contract) | ||||

| GA | Cash | 5,000,000 | ||

| Bond payable | 5,000,000 | |||

| (To record the cash receipt on bond) | ||||

| 10. | GF | Encumbrance | 32,000 | |

| Encumbrances outstanding | 32,000 | |||

| (To record the issue of purchase order) | ||||

| Encumbrance Outstanding | 32,000 | |||

| Expenditures | 31,900 | |||

| Encumbrances | 32,000 | |||

| Cash | 31,900 | |||

| (To record the cash payment of purchase) | ||||

| GA | Equipment | 31,900 | ||

| Cash | 31,900 | |||

| (To record the purchase of equipment on cash) |

(Table 1)

Want to see more full solutions like this?

Chapter 9 Solutions

ACCOUNTING FOR GOVERNMENTAL & NONPROFIT

- The county legislature approved the budget for the current year. Revenues from property taxes are budgeted at $800,000. According to the county assessor, the assessed valuation of all of the property in the county is $50,000,000. Of this amount, property worth $10,000,000 belongs to the federal government or to religious organizations and, therefore, is not subject to property taxes. In addition, certificates for the following exemptions have been filed: Homestead $2,500,000 Veterans 1,000,000 Old age, blindness, etc. 500,000 In the past, uncollectible property taxes averaged about 3 percent of the levy. This rate is not expected to change in the foreseeable future. Requirement: Calculate the levy on a piece of property that was assessed for $100,000 (after exemptions).arrow_forwardThe City of Greystone maintains its books so as to prepare fund accounting statements and prepares worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: The City levied property taxes for the current fiscal year in the amount of $8,000,000. At year-end, $720,000 of the taxes had not been collected. It was estimated that $330,000 of that amount would be collected during the 60 days after the end of the fiscal year and that $360,000 would be collected after that time and the balance would be uncollectible. The City had recognized the maximum of property taxes allowable under modified accrual accounting. $255,000 of property taxes had been deferred at the end of the previous year and was recognized under modified accrual as revenue in the current year. In addition to the expenditures reported under modified accrual accounting, the city computed that an additional $104,000…arrow_forwardChesterfield County had the following transactions. A budget is passed for all ongoing activities. Revenue is anticipated to be $939,750, with approved spending of $594,000 and operating transfers out of $275,000. A contract is signed with a construction company to build a new central office building for the government at a cost of $6,000,000. The county previously recorded the budget for this project. Bonds are issued for $6,000,000 (face value) to finance construction of the new office building. The new building is completed. An invoice for $6,000,000 is received by the county and paid. Previously unrestricted cash of $1,350,000 is set aside by county officials to begin paying the bonds issued in (c). A portion of the bonds comes due, and $1,350,000 is paid. Of this total, $235,000 represents interest. The interest had not been previously accrued. Property tax levies are assessed. Total billing for this tax is $885,000. On this date, the assessment is a legally enforceable claim…arrow_forward

- The following information pertains to the City of Williamson for 2020, its first year of legal existence. For convenience, assume that all transactions are for the general fund, which has three separate functions: general government, public safety, and health and sanitation. Receipts: Property taxes $320,000 Franchise taxes 42,000 Charges for general government services 5,000 Charges for public safety services 3,000 Charges for health and sanitation services 42,000 Issued long-term note payable 200,000 Receivables at end of year: Property taxes (90% estimated to be collectible) 90,000 Payments: Salary: General government 66,000 Public safety 39,000 Health and sanitation 22,000 Rent: General government 11,000 Public safety 18,000 Health and sanitation 3,000 Maintenance: General government 21,000 Public safety 5,000 Health and sanitation 9,000 Insurance: General government 8,000 Public safety ($2,000 still prepaid…arrow_forwardThe City of Fenton levied $3,000,000 of General Fund property taxes for the fiscal year ending December 31, 2011, with an estimated uncollectible amount of $200,000. During 2011 and January and February of 2012, $2,500,000 of the levy is expected to be collected; however, $300,000 of the levy is not expected to be collected until after February 2012. The amount of property tax revenues to be recognized in FY 2011 is:?arrow_forwardThe City of Havisham has a fiscal year ending December 31, Year 5. If the city were to produce financial statements right now, the following figures would be included:– Governmental activities: Assets = $800,000, Liabilities = $300,000, and Change in Net Position for the period = increase of $100,000– Business-type activities: Assets = $500,000, Liabilities = $200,000, and Change in Net Position for the period = increase of $60,000– Governmental funds: Assets = $300,000, Liabilities = $100,000, and Change in Fund Balances = increase of $40,000– Proprietary funds: Assets = $700,000, Liabilities = $300,000, and Change in Net Assets for the period = increase of $70,000Other information: The city council is considered the highest level of decision-making authority for the government. Where applicable, current financial resources are viewed by the government as available if collected within 75 days of the end of a fiscal year.For each of the following, indicate whether the overall statement…arrow_forward

- The City of Bagranoff holds $90,000 in cash that will be used to make a bond payment when the debt comes due early next year. The assistant treasurer had made that decision. However, just before the end of the current year, the city council formally approved using this money in this way. The city council has been designated as the highest level of decision-making authority for this government. What impact does the council’s action have on the reporting of fund financial statements? Fund balance—unassigned goes down and fund balance—restricted goes up. Fund balance—assigned goes down and fund balance—committed goes up. Fund balance—unassigned goes down and fund balance—assigned goes up. Fund balance—assigned goes down and fund balance—restricted goes up.arrow_forwardThe following transactions relate to the General Fund of the City of Buffalo Falls for the year ended December 31, 2020: Beginning balances were: Cash, $94,000; Taxes Receivable, $191,000; Accounts Payable, $53,000; and Fund Balance, $232,000. The budget was passed. Estimated revenues amounted to $1,240,000 and appropriations totaled $1,237,200. All expenditures are classified as General Government. Property taxes were levied in the amount of $920,000. All of the taxes are expected to be collected before February 2021. Cash receipts totaled $890,000 for property taxes and $300,000 from other revenue. Contracts were issued for contracted services in the amount of $97,000. Contracted services were performed relating to $87,000 of the contracts with invoices amounting to $85,200. Other expenditures amounted to $968,000. Accounts payable were paid in the amount of $1,100,000. The books were closed. Required:a. Prepare journal entries for the above transactions.b. Prepare a Statement of…arrow_forwardChesterfield County had the following transactions. Prepare the entries first for fund financial statements and then for government-wide financial statements.a. A budget is passed for all ongoing activities. Revenue is anticipated to be $834,000 with approved spending of $540,000 and operating transfers out of $242,000.b. A contract is signed with a construction company to build a new central office building for the government at a cost of $8 million. A budget for this project has previously been recorded.c. Bonds are sold for $8 million (face value) to finance construction of the new office building.d. The new building is completed. An invoice for $8 million is received and paid.e. Previously unrestricted cash of $1 million is set aside to begin paying the bonds issued in (c).f. A portion of the bonds comes due and $1 million is paid. Of this total, $100,000 represents interest. The interest had not been previously accrued.g. Citizens’ property tax levies are assessed. Total billing…arrow_forward

- The following information is provided about some of the Town of Truesdale’s General Fund operating statement and budgetary accounts for the fiscal year ended June 30. Estimated revenues $ 3,150,000 Revenues 3,190,000 Appropriations 3,185,000 Expenditures 3,175,000 Estimated other financing sources 400,000 Encumbrances 20,000 Encumbrances outstanding 20,000 Budgetary fund balance (calculate) The Town of Truesdale will honor all of its outstanding encumbrances in the next fiscal period. Prepare the journal entry(ies) to close budgetary accounts required to be closed at the fiscal year end using the information provided.arrow_forwardThe following transactions occurred during the 2020 fiscal year for the City of Evergreen. For budgetary purposes, the city reports encumbrances in the Expenditures section of its budgetary comparison schedule for the General Fund but excludes expenditures chargeable to a prior year’s appropriation. The budget prepared for the fiscal year 2020 was as follows: Estimated Revenues: Taxes $ 1,957,000 Licenses and permits 374,000 Intergovernmental revenue 399,000 Miscellaneous revenues 64,000 Total estimated revenues 2,794,000 Appropriations: General government 475,200 Public safety 890,200 Public works 654,200 Health and welfare 604,200 Miscellaneous 88,000 Total appropriations 2,711,800 Budgeted increase in fund balance $ 82,200 Encumbrances issued against the appropriations during the year were as follows: General government $ 60,000 Public safety 252,000 Public works 394,000 Health and…arrow_forwardThe City of Bagranoff holds $90,000 in cash that will be used to make a bond payment when the debt comes due early next year. The assistant treasurer had made that decision. However, just before the end of the current year, the city council formally approved using this money in this way. The city council has been designated as the highest level of decision-making authority for this government. What impact does the council’s action have on the reporting of fund financial statements? Choose the correct.a. Fund balance—unassigned goes down and fund balance—restricted goes up.b. Fund balance—assigned goes down and fund balance—committed goes up.c. Fund balance—unassigned goes down and fund balance—assigned goes up.d. Fund balance—assigned goes down and fund balance—restricted goes up.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education