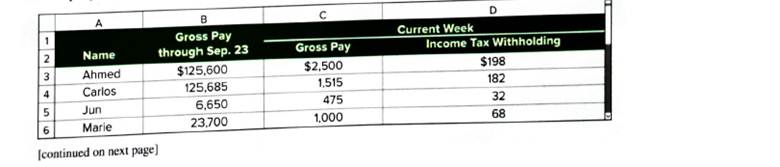

Fishing Guides Co. has four employees. FICA Social Security taxes are 6.2% of the first $127,200 paid to each Problem employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the Company’s FUTA taxes are 0.6% and SUTA taxes are 1.75%. The company is preparing its payroll calculations for the week ended September 30. Payroll records show the following information for the company's four employees.

In addition to gross pay, the company must pay two-thirds of the 60% of the $50 per employee weekly health insurance; each employee pays the remaining 40%. The company also contributes an extra 5% of each employee’s gross pay (at no cost to employees) to a pension fund.

Required

Compute the following for the week ended September30 (Round amounts to the nearest cent):

- Each employee’s FICA withholdings for Social Security.

- Each employee’s FICA withholdings for Medicare.

- Employer’s FICA taxes for Social Security.

- Employer’s FICA taxes for Medicare.

- Employer’s FUTA taxes.

- Employer’s SUTA taxes.

- Each employee’s net (take-home) pay.

- Employer’s total payroll-related expenses for each employee.

1.

Introduction: FICA withholdings for social security is a payroll deduction done by the employers and paid to the government. It is the withholding done to secure retirement and disabilities.

To compute: Each employee’s FICA withholdings for Social Security.

Explanation of Solution

Computation of each employee’s FICA withholdings for social security.

| Particular | Amount |

| Person A | |

| Maximum limit for FICA Social security tax | $127,200 |

| Gross pay till September 23 | $125,600 |

| Remaining limit(A) | $1,600 |

| Gross pay for current week(B) | $2,500 |

| Gross pay on which tax has to be deducted(Lower of A & B) | $1,600 |

| FICA social security tax rate | 6.20% |

| FICA social security tax | $99.20 |

| Person C | |

| The maximum limit for FICA Social security tax | $127,200 |

| Gross pay till September 23 | $125,685 |

| Remaining limit(A) | $1,515 |

| Gross pay for current week(B) | $1,515 |

| Gross pay on which tax has to be deducted(Lower of A & B) | $1,515 |

| FICA social security tax rate | 6.20% |

| FICA social security tax | $93.93 |

| Person J | |

| The maximum limit for FICA Social security tax | $127,200 |

| Gross pay till September 23 | $6,650 |

| Remaining limit(A) | $120,550 |

| Gross pay for the current week(B) | $475 |

| Gross pay on which tax has to be deducted(Lower of A & B) | $475 |

| FICA social security tax rate | 6.20% |

| FICA social security tax | $29.45 |

| Person M | |

| The maximum limit for FICA Social security tax | $127,200 |

| Gross pay till September 23 | $23,700 |

| Remaining limit(A) | $103,500 |

| Gross pay for current week(B) | $1,000 |

| Gross pay on which tax has to be deducted(Lower of A & B) | $1,000 |

| FICA social security tax rate | 6.20% |

| FICA social security tax | $62 |

2.

Introduction: FICA withholdings for Medicare is a payroll deduction done by the employers and paid to the Internal Revenue Service. It is the withholding done to secure an employee from the financial distress of an unexpected medical emergency.

To compute: Each employee’s FICA withholdings for Medicare.

Explanation of Solution

Computation of each employee’s FICA withholdings for Medicare.

| Particular | Amount |

| Person A | |

| Gross pay of current week | $2,500 |

| FICA Medicare tax rate | 1.45% |

| FICA Medicare tax | $36.25 |

| Person C | |

| Gross pay of current week | $1,515 |

| FICA Medicare tax rate | 1.45% |

| FICA Medicare tax | $21.97 |

| Person J | |

| Gross pay of current week | $475 |

| FICA Medicare tax rate | 1.45% |

| FICA Medicare tax | $6.89 |

| Person M | |

| Gross pay of current week | $1,000 |

| FICA Medicare tax rate | 1.45% |

| FICA Medicare tax | $14.50 |

3.

Introduction: Employer’s FICA taxes for social security is the contribution made by the employer for the employee’s retirement benefits and future survivorship.

To compute: Employer’s FICA taxes for Social Security.

Explanation of Solution

Computation of Employer’s FICA taxes for social security.

| Particular | Amount |

| FICA social security tax of person A | $99.20 |

| FICA social security tax of person C | $93.93 |

| FICA social security tax of person J | $29.45 |

| FICA social security tax of person M | $62 |

| Total employer’s FICA taxes for social security | $284.58 |

4.

Introduction: Employer’s FICA taxes for Medicare is the contribution made by the employer for the employee’s medical expenses. It is like a medical insurance premium of an employee.

To compute: Employer’s FICA taxes for Medicare.

Explanation of Solution

Computation of Employer’s FICA taxes for Medicare.

| Particular | Amount |

| FICA taxes for Medicare of person A | $36.25 |

| FICA taxes for Medicare of person C | $21.97 |

| FICA taxes for Medicare of person J | $6.89 |

| FICA taxes for Medicare of person M | $14.50 |

| Total employer’s FICA taxes for Medicare | $79.61 |

5.

Introduction: Federal unemployment tax act (FUTA) is a law applicable on employers. Under this act, tax is imposed on employer’s payroll expense to collect funds for the scheme made for removing unemployment.

To compute: Employer’s FUTA taxes.

Explanation of Solution

Computation of Employer’s FUTA taxes.

| Particular | Amount |

| Person A | |

| Maximum limit of gross pay for FUTA taxes | $7,000 |

| Gross pay till September 23 | $125,600 |

| Remaining limit(A) | $0 |

| Gross pay for current week(B) | $2,500 |

| Gross pay on which tax has to be deducted(Lower of A & B) | $0 |

| FUTA tax rate | 0.60% |

| FUTA tax | $0 |

| Person C | |

| Maximum limit of gross pay for FUTA taxes | $7,000 |

| Gross pay till September 23 | $125,685 |

| Remaining limit(A) | $0 |

| Gross pay for current week(B) | $1,515 |

| Gross pay on which tax has to be deducted(Lower of A & B) | $0 |

| FUTA tax rate | 0.60% |

| FUTA tax | $0 |

| Person J | |

| Maximum limit of gross pay for FUTA taxes | $7,000 |

| Gross pay till September 23 | $6,650 |

| Remaining limit(A) | $350 |

| Gross pay for current week(B) | $475 |

| Gross pay on which tax has to be deducted(Lower of A & B) | $350 |

| FUTA tax rate | 0.6% |

| FUTA tax | $2.10 |

| Person M | |

| Maximum limit of Gross pay for FUTA taxes | $7,000 |

| Gross pay till September 23 | $23,700 |

| Remaining limit(A) | $0 |

| Gross pay for current week(B) | $1,000 |

| Gross pay on which tax has to be deducted(Lower of A & B) | $0 |

| FUTA tax rate | 0.6% |

| FUTA tax | $0 |

| Total FUTA tax of Employer | $2.10 |

6.

Introduction: State unemployment tax act (SUTA) is a law made to impose a tax on employers. The employers pay this amount to the state unemployment fund, established by the state government to remove unemployment.

To compute: Employer’s SUTA taxes.

Explanation of Solution

Computation of Employer’s SUTA taxes.

| Particular | Amount |

| Person A | |

| Maximum limit of gross pay for SUTA taxes | $7,000 |

| Gross pay till September 23 | $125,600 |

| Remaining limit(A) | $0 |

| Gross pay for current week(B) | $2,500 |

| Gross pay on which tax has to be deducted(Lower of A & B) | $0 |

| SUTA tax rate | 1.75% |

| SUTA tax | $0 |

| Person C | |

| Maximum limit of gross pay for SUTA taxes | $7,000 |

| Gross pay till September 23 | $125,685 |

| Remaining limit(A) | $0 |

| Gross pay for current week(B) | $1,515 |

| Gross pay on which tax has to be deducted(Lower of A & B) | $0 |

| SUTA tax rate | 1.75% |

| SUTA tax | $0 |

| Person J | |

| Maximum limit of gross pay for SUTA taxes | $7,000 |

| Gross pay till September 23 | $6,650 |

| Remaining limit(A) | $350 |

| Gross pay for current week(B) | $475 |

| Gross pay on which tax has to be deducted(Lower of A & B) | $350 |

| SUTA tax rate | 1.75% |

| SUTA tax | $6.13 |

| Person M | |

| Maximum limit of Gross pay for SUTA taxes | $7,000 |

| Gross pay till September 23 | $23,700 |

| Remaining limit(A) | $0 |

| Gross pay for current week(B) | $1,000 |

| Gross pay on which tax has to be deducted(Lower of A & B) | $0 |

| SUTA tax rate | 1.75% |

| SUTA tax | $0 |

| Total SUTA tax of Employer | $6.13 |

7.

Introduction: Take-home pay to an employee means the amount paid to an employee against their salary after deducting all the voluntary contributions and withholdings for which the employee is liable.

To compute: Each employee’s net (take-home) pay.

Explanation of Solution

Computation of each employee’s net (take home) pay.

| Particular | Person A | Person C | Person J | Person M |

| Gross Pay | $2,500 | $1,515 | $475 | $1,000 |

| Less: Income Tax Withholding | ($198) | ($182) | ($32) | ($68) |

| Less: FICA social security tax | ($99.20) | ($93.93) | ($29.45) | ($62) |

| Less: FICA taxes for Medicare | ($36.25) | ($21.97) | ($6.89) | ($14.50) |

| Less: Weekly health insurance | ($20) | ($20) | ($20) | ($20) |

| Net (take home) pay | $2,146.55 | $1197.1 | $386.66 | $835.5 |

8.

Introduction: Payroll related expense are the expense related to the employees of the company which is incurred due to providing employment. All the payment made to employees, government and any other fund is included in it.

To compute:Employer’s total payroll-related expense for each employee.

Explanation of Solution

Computation of employer’s total payroll-related expense for each employee.

| Particular | Person A | Person C | Person J | Person M |

| Gross pay | $2,500 | $1,515 | $475 | $1,000 |

| Employer’s FICA taxes for social security | $99.2 | $93.93 | $29.45 | $62 |

| Employer’s FICA taxes for Medicare | $36.25 | $21.97 | $6.89 | $14.50 |

| Employer’s FUTA taxes | $0 | $0 | $2.10 | $0 |

| Employer’s SUTA taxes | $0 | $0 | $6.13 | $0 |

| Employee weekly health insurance | $30 | $30 | $30 | $30 |

| Total payroll-related expense | $2,665.45 | $1,660.90 | $549.57 | $1,106.50 |

Want to see more full solutions like this?

Chapter 9 Solutions

Financial Accounting: Information for Decisions

- Payrex Co. has six employees. All are paid on a weekly basis. For the payroll period ending January 7, total employee earnings were 12,500, all of which were subject to SUTA, FUTA, Social Security, and Medicare taxes. The SUTA tax rate in Payrexs state is 5.4%, but Payrex qualifies for a rate of 2.0% because of its good record of providing regular employment to its employees. Other employer payroll taxes are at the rates described in the chapter. REQUIRED 1. Calculate Payrexs FUTA, SUTA, Social Security, and Medicare taxes for the week ended January 7. 2. Prepare the journal entry for Payrexs payroll taxes for the week ended January 7. 3. What amount of payroll taxes did Payrex save because of its good employment record?arrow_forwardOn January 21, the column totals of the payroll register for Great Products Company showed that its sales employees had earned 14,960, its truck driver employees had earned 10,692, and its office employees had earned 8,670. Social Security taxes were withheld at an assumed rate of 6.2 percent, and Medicare taxes were withheld at an assumed rate of 1.45 percent. Other deductions consisted of federal income tax, 3,975, and union dues, 560. Determine the amount of Social Security and Medicare taxes withheld and record the general journal entry for the payroll, crediting Salaries Payable for the net pay. All earnings were taxable. Round amounts to the nearest penny.arrow_forwardOn January 21, the column totals of the payroll register for Great Products Company showed that its sales employees had earned 14,960, its truck driver employees had earned 10,692, and its office employees had earned 8,670. Social Security taxes were withheld at an assumed rate of 6.2 percent, and Medicare taxes were withheld at an assumed rate of 1.45 percent. Other deductions consisted of federal income tax, 3,975, and union dues, 560. Determine the amount of Social Security and Medicare taxes withheld and record the general journal entry for the payroll, crediting Salaries Payable for the net pay. All earnings were taxable. Round amounts to the nearest penny.arrow_forward

- During the third calendar quarter of 20--, the Beechtree Inn, owned by Dawn Smedley, employed the persons listed below. Also given are the employees salaries or wages and the amount of tips reported to the owner. The tips were reported by the 10th of each month. The federal income tax and FICA tax to be withheld from the tips were estimated by the owner and withheld equally over the 13 weekly pay periods. The employers portion of FICA tax on the tips was estimated as the same amount. Employees are paid weekly on Friday. The following paydays occurred during this quarter: Taxes withheld for the 13 paydays in the third quarter follow: Based on the information given, complete Form 941 on the following pages for Dawn Smedley. Phone number: (901) 555-7959 Date filed: October 31, 20--arrow_forwardMarc Associates employs Janet Evanovich at its law firm. Her gross income for June is $7,500. Payroll for the month of June follows: federal income tax of $650, state income tax of $60, local income tax of $30, FICA Social Security tax rate at 6.2%, FICA Medicare tax rate at 1.45%, health-care insurance premium of $300, donations to a charity of $50, and pension plan contribution of $200. The employee is responsible for covering 40% of his or her health insurance premium. A. Record the journal entry to recognize employee payroll for the month of June; dated June 30, 2017. B. Record remittance of the employees salary with cash on July 1.arrow_forwardDuring the third calendar quarter of 20--, Bayview Inn, owned by Diane R. Peters, employed the persons listed below. Also given are the employees salaries or wages and the amount of tips reported to the owner. The tips were reported by the 10th of each month. The federal income tax and FICA tax to be withheld from the tips were estimated by the owner and withheld equally over the 13 weekly pay periods. The employers portion of FICA tax on the tips was estimated as the same amount. Employees are paid weekly on Friday. The following paydays occurred during this quarter: Taxes withheld for the 13 paydays in the third quarter follow: Based on the information given, complete Form 941 on the following pages for Diane R. Peters. Phone number: (901) 555-7959 Date filed: October 31, 20--arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College