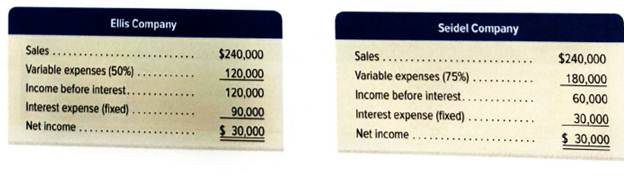

Shown here are condensed income statements for two different companies (both are organized as LLCs and pay no income taxes).

Required

- Compute times interest earned for Ellis Company.

- Compute times interest earned for Seidel Company.

- What happens to each company’s net income if sales increase by 10%?

- What happens to each company’s net income if sales increase by 40%?

- What happens to each company’s net income if sales increase by 90%?

- What happens to each company’s net income if sales decrease by 20%?

- What happens to each company’s net income if sales decrease by 50%?

- What happens to each company’s net income if sales decrease by 80%? Analysis Component

- Comment on the results from parts 3 through 8 in relation to the fixed-cost strategies of the two companies and the ratio values you computed in parts 1 and 2.

1.

Introduction: The times interest earned refer to the ratio of income before interest and taxes to interest earned.

To calculate: Times interest earned for company E.

Explanation of Solution

Computation of times interest earned for company E:

2.

Introduction: The times interest earned refer to the ratio of income before interest and taxes to interest earned.

To calculate: Times interest earned for company S.

Explanation of Solution

Computation of times interest earned for company S:

3.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales increased by 10%.

Explanation of Solution

If sales increased by 10% for each company,

For company E;

For company S:

Computing net income for company E:

| Particular | Amount |

| Sales | $264,000 |

| Less: variable expense (50%) | (132,000) |

| Income before interest | 132,000 |

| Less: Interest expense(fixed) | (90,000) |

| Net income | $42,000 |

Computing net income for company S:

| Particular | Amount |

| Sales | $264,000 |

| Less: variable expense (75%) | (180,000) |

| Income before interest | 84,000 |

| Less: Interest expense(fixed) | (30,000) |

| Net income | $54,000 |

4.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales increased by 40%.

Explanation of Solution

If sales increased by 40% for each company,

For company E;

For company S:

Computing net income for company E:

| Particular | Amount |

| Sales | $336,000 |

| Less: variable expense (50%) | (168,000) |

| Income before interest | 168,000 |

| Less: Interest expense(fixed) | (90,000) |

| Net income | $78,000 |

Computing net income for company S:

| Particular | Amount |

| Sales | $336,000 |

| Less: variable expense (75%) | (252,000) |

| Income before interest | 84,000 |

| Less: Interest expense(fixed) | (30,000) |

| Net income | $54,000 |

5.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales increased by 90%.

Explanation of Solution

If sales increased by 90% for each company,

For company E;

For company S:

Computing net income for company E:

| Particular | Amount |

| Sales | $456,000 |

| Less: variable expense (50%) | (228,000) |

| Income before interest | 228,000 |

| Less: Interest expense(fixed) | (90,000) |

| Net income | $138,000 |

Computing net income for company S:

| Particular | Amount |

| Sales | $456,000 |

| Less: variable expense (75%) | (342,000) |

| Income before interest | 114,000 |

| Less: Interest expense(fixed) | (30,000) |

| Net income | $84,000 |

6.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales decreased by 20%.

Explanation of Solution

If sales decreased by 20% for each company,

For company E;

For company S:

Computing net income for company E:

| Particular | Amount |

| Sales | $192,000 |

| Less: variable expense (50%) | (96,000) |

| Income before interest | 96,000 |

| Less: Interest expense(fixed) | (90,000) |

| Net income | $6,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $192,000 |

| Less: variable expense (75%) | (144,000) |

| Income before interest | 48,000 |

| Less: Interest expense(fixed) | (30,000) |

| Net income | $18,000 |

7.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales decreased by 50%.

Explanation of Solution

If sales decreased by 50% for each company,

For company E;

For company S:

Computing net income for company E:

| Particular | Amount |

| Sales | $120,000 |

| Less: variable expense (50%) | (60,000) |

| Income before interest | 60,000 |

| Less: Interest expense(fixed) | (90,000) |

| Net income | ($30,000) |

Computing net income for company S:

| Particular | Amount |

| Sales | $120,000 |

| Less: variable expense (75%) | (90,000) |

| Income before interest | 30,000 |

| Less: Interest expense(fixed) | (30,000) |

| Net income | $0 |

8.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales decreased by 80%.

Explanation of Solution

If sales decreased by 80% for each company,

For company E;

For company S:

Computing net income for company M:

| Particular | Amount |

| Sales | $48,000 |

| Less: variable expense (50%) | (24,000) |

| Income before interest | 24,000 |

| Less: Interest expense(fixed) | (90,000) |

| Net income | ($74,000) |

Computing net income for company W:

| Particular | Amount |

| Sales | $48,000 |

| Less: variable expense (75%) | (36,000) |

| Income before interest | 12,000 |

| Less: Interest expense(fixed) | (30,000) |

| Net loss | ($18,000) |

9.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

The time's interest earned refers to the ratio of income before interest and taxes to interest earned.

To comment: On the result for interest earned by both the companies and for part 3 to 8.

Explanation of Solution

Comments on times interest earned by both the companies are:

For company E:

The time's interest earned by company E is 1.3 times which is lesser than 2.5 times this indicates that it is difficult for the company to meet its debt and to invest in the company is riskier from the investor's point of view.

For company S:

The time's interest earned by company E is 2times which lesser than 2.5 times but the situation is better than company S, this indicates the riskier to invest in the company from an investor point of view.

Comments on the fixed cost strategies for the company The company fixed cost does not affect the net income as the sales increase but when sales start decreasing the net income is falling down and lead to losses for the company. Thus the company should increase sales or maintain sales to generate profit for the firm.

Want to see more full solutions like this?

Chapter 9 Solutions

Financial Accounting: Information for Decisions

- The income statement, statement of retained earnings, and balance sheet for Somerville Company are as follows: Includes both state and federal taxes. Refer to the information for Somerville Company on the previous pages. Also, assume that the price per common share for Somerville is 8.10. Required: Compute the price-earnings ratio. (Note: Round the answer to two decimal places.)arrow_forwardAlbion Inc. provided the following information for its most recent year of operations. The tax rate is 40%. Required: 1. Compute the following: (a) return on sales, (b) return on assets, (c) return on stockholders equity, (d) earnings per share, (e) price-earnings ratio, (f) dividend yield, and (g) dividend payout ratio. 2. CONCEPTUAL CONNECTION If you were considering purchasing stock in Albion, which of the above ratios would be of most interest to you? Explain.arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forward

- Income statements for two different companies in the same industry are as follows: Required: 1. Compute the degree of operating leverage for each company. 2. Compute the break-even point for each company. Explain why the break-even point for Quintex, Inc., is higher. 3. Suppose that both companies experience a 50 percent increase in revenues. Compute the percentage change in profits for each company. Explain why the percentage increase in Quintexs profits is so much greater than that of Trimax.arrow_forwardou have been given the following information for Moore’s HoneyBee Corp.: Net sales = $44,000,000. Gross profit = $19,400,000. Other operating expenses = $3,400,000. Addition to retained earnings = $8,328,000. Dividends paid to preferred and common stockholders = $2,100,000. Depreciation expense = $2,000,000. The firm’s tax rate is 21 percent. The firm's interest expense is all tax deductible.Calculate the cost of goods sold and the interest expense for Moore’s HoneyBee Corp. (Round your answers to the nearest dollar amount.) Cost of goods sold Interest expensearrow_forwardWhat is the difference between operating income, net income and other comprehensive income? If a company has a revenue of 2.2million and operating income of $120,000. Does the company has a high operating income margin?arrow_forward

- Please do both of the questions below:- 1. Use the following information to work out the net profit before tax:Cost of sales. $60,000 Interest payable. $4000 expenses. $20,000. sales turnover. $100,000 2. Vindhya Limited earns $200,000 in sales, has expenses of $80,000 and cost of goods sold amount to $90,000. What is the firm's gross profit?arrow_forwardKwok Enterprises has the following income statement. How much after-tax operating income does the firm have? Sales $2,900 Costs 1,400 Depreciation 250 EBIT $1,250 Interest expense 70 EBT $1,180 Taxes (25%) 295 Net income $885 arrow_forwardPrepare common size income statement for price company, a sole proprietorship, for the two years shown as above by converting the dollar amounts into percentage. For each year, sales will appear as 100 percent and other items will be expressed as a percentage of sale. ( income race are not involved as the business is not incorporated).arrow_forward

- XYZ Co has disclosed the following financial information for the period ending 12/31/19: sales of $1,522,982, cost of goods sold of $825,220, depreciation expenses of $101,083, and interest expenses of $80,341. Assume that the firm has an average tax rate of 35 percent. What is the company's net income?( Please round your answer for the Tax and Net income line to the whole number, for example 5. ) Sales COGS ( ? ) Deprecation ( ? ) Interest exp ( ? ) Pre-Tax Income ? Tax ( ? ) Net Income ?arrow_forwardConsider the following income statement for the Heir Jordan Corporation: HEIR JORDAN CORPORATIONIncome Statement Sales $ 47,600 Costs 35,600 Taxable income $ 12,000 Taxes (25%) 3,000 Net income $ 9,000 Dividends $ 3,000 Addition to retained earnings 6,000 The balance sheet for the Heir Jordan Corporation follows. Based on this information and the income statement, supply the missing information using the percentage of sales approach. Assume that accounts payable vary with sales, whereas notes payable do not. (Leave no cells blank - be certain to enter "0" whenever the item is not a constant percentage of sales. Enter each answer as a percent rounded 2 decimal places, e.g., 32.16.) HEIR JORDAN CORPORATION Balance Sheet Percentage of Sales Percentage of Sales Assets…arrow_forwardEcare Berhad has the following income statement items for 2021: Revenue/Sales RM4,801,139 Finance costs/Interest expense RM293,938 Other items of income RM38,552 Cost of sales (COGS) RM3,917,144 Income tax expenses 35% of taxable income Dividend payment 40% of net profit What is the amount of the firm's earning before tax? Select one: a. RM628,609 b. RM590,057 c. RM408,596 d. RM883,995arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning