Concept explainers

David R. and Ella M. Cole (ages 39 and 38, respectively) are husband and wife who live at 1820 Elk Avenue, Denver, CO 80202. David is a self-employed consultant specializing in retail management, and Ella is a dental hygienist for a chain of dental clinics.

- David earned consulting fees of $145,000 in 2018. He maintains his own office and pays for all business expenses. The Coles are adequately covered by the medical plan provided by Ella’s employer but have chosen not to participate in its § 401(k) retirement plan.

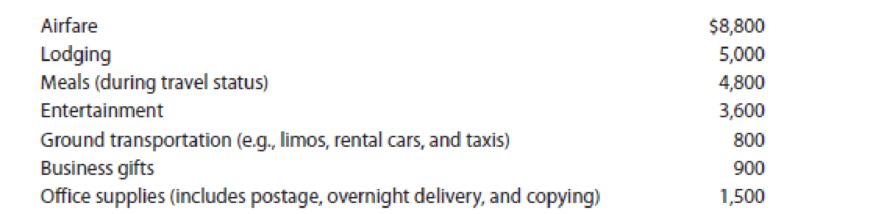

David’s employment-related expenses for 2018 are summarized below.

The entertainment involved taking clients to sporting and musical events. The business gifts consisted of $50 gift certificates to a national restaurant. These were sent by David during the Christmas holidays to 18 of his major clients.

In addition, David drove his 2016 Ford Expedition 11,000 miles for business and 3,000 for personal use during 2018. He purchased the Expedition on August 15, 2015, and has always used the automatic (standard) mileage method for tax purposes. Parking and tolls relating to business use total $340 in 2018.

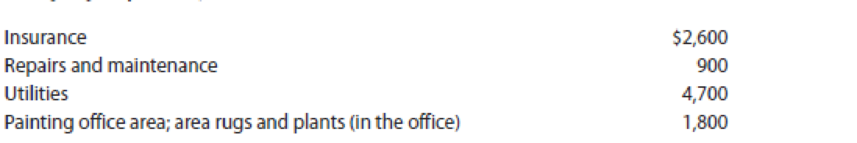

When the Coles purchased their present residence in April 2015, they devoted 450 of the 3,000 square feet of living space to an office for David. The property cost $440,000 ($40,000 of which is attributable to the land) and has since appreciated in value. Expenses relating to the residence in 2018 (except for mortgage interest and property taxes; see below) are as follows:

In terms of depreciation, the Coles use the MACRS percentage tables applicable to 39-year nonresidential real property. As to depreciable property (e.g., office furniture), David tries to avoid capitalization and uses whatever method provides the fastest write-off for tax purposes.

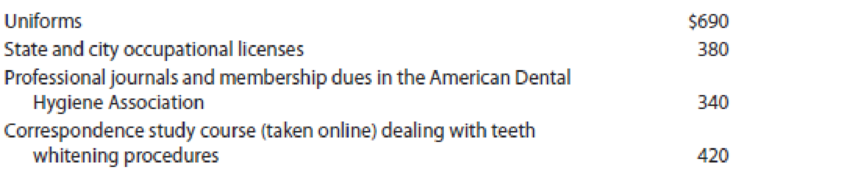

Ella works at a variety of offices as a substitute when a hygienist is ill or on vacation or when one of the clinics is particularly busy (e.g., prior to the beginning of the school year). Besides her transportation, she must provide and maintain her own uniforms. Her expenses for 2018 appear below.

Ella’s salary for the year is $42,000, and her Form W-2 for the year shows income tax withholdings of $5,000 (Federal) and $1,000 (state) and the proper amount of Social Security and Medicare taxes.

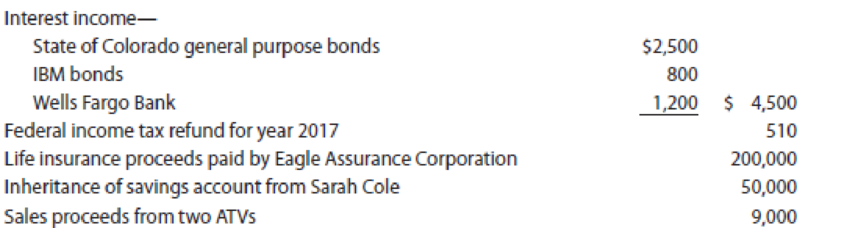

Besides die items already mentioned, die Coles had the following receipts during 2018.

For several years, the Coles’ household has included David’s divorced mother, Sarah, who has been claimed as their dependent. In late December 2017, Sarah unexpectedly died of coronary arrest in her sleep. Unknown to Ella and David, Sarah had a life insurance policy and a savings account (with David as the designated beneficiary of each). In 2017, the Coles purchased two ATVs for $14,000. After several near mishaps, they decided that the sport was too dangerous. In 2018, they sold the ATVs to their neighbor.

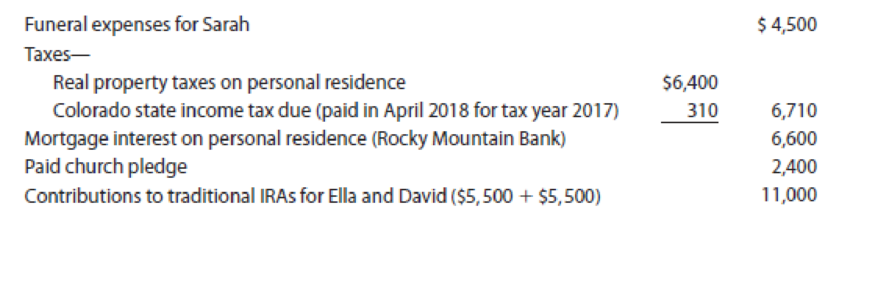

- Additional expenditures for 2018 include:

In 2018, the Coles made quarterly estimated tax payments of $6,000 (Federal) and $500 (state) for a total of $24,000 (Federal) and $2,000 (state).

Part 1—Tax Computation

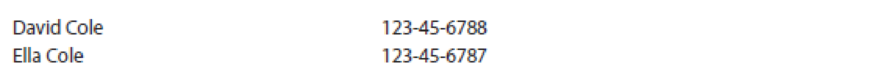

Using the appropriate forms and schedules, compute the Coles’ Federal income tax for 2018. Disregard the alternative minimum tax (AMT) and various education credits since these items are not discussed until later in the text (Chapters 12 and 13). Relevant Social Security numbers are:

The Coles do not want to contribute to the Presidential Election Campaign Fund. Also, they want any overpayment of tax refunded to them and not applied toward next year’s tax liability*. David will have a self-employment tax liability; refer to Exhibit 13 9 in Chapter 13 to compute this liability. Suggested software: ProConnect Tax Online.

Part 2—Follow-Up Advice

Ella has always wanted to pursue a career in nursing. To this end, she has earned a substantial number of college credits on a part-time basis. With Sarah no longer requiring home care, Ella believes that she can now complete her degree by attending college on a full-time basis.

David would like to know how Ella’s plans will affect their income tax position. Specifically, he wants to know:

- How much Federal income tax they will save if Ella quits her job.

- Any tax benefits that might be available from the cost of the education.

Write a letter to David addressing these concerns. Note: In making your projections, use the information generated in Part 1 and assume that the year remains 2018. Also disregard any consideration of the educational tax credits (i.e., American Opportunity and lifetime learning) since they are not discussed until Chapter 13.

1.

Calculate the Mrs. C’s federal income tax.

Explanation of Solution

Federal Income Tax: Federal income tax is the tax imposed by the federal government on the income of an individual and business organization. Federal income tax has a standard base for certain level of income.

Calculate the Mrs. C’s federal income tax.

| Particulars | Amount ($) | Amount ($) |

| Consulting practice (Mr. D) | ||

| Consulting fees | 145,000 | |

| Less: Business expenses | (31,803) | 113,197 |

| Earnings (Mrs. E) | 42,000 | |

| Interest income (Note 1) | ||

| Colorado bonds | 0 | |

| IBM bonds | 800 | |

| Wells F bank | 1,200 | 2,000 |

| Federal income tax refund (Note 2) | 0 | |

| Life insurance proceeds (Note 3) | 0 | |

| Inherited saving account (Note 4) | 0 | |

| One-half of self-employment taxes (Note 12) | (7,997) | |

| Sale of ATVs (Note 5) | 0 | |

| IRA contributions | (11,000) | |

| AGI | 138,200 | |

| Itemized deductions: | ||

| Medical (Note 7) | 0 | |

| Taxes: (Note 8) | ||

| Property | 5,440 | |

|

Income | 3,310 | |

| Interest (Note 9) | 5,610 | |

| Contributions | 2,400 | |

| Miscellaneous (Note 10) | 0 | |

| Total itemized deductions | 16,760 | |

| The Mr. & Mrs. C and will use the married, filing joint standard deduction since it is greater than their total itemized deductions | (24,000) | |

| Deduction for qualified business income (Note 11) | (21,040) | |

| Taxable income | $93,160 | |

| Tax on $93,160 using the 2018 tax tables | 12,378 | |

| 15,994 | ||

| Self-employment (Note 12) | 28,372 | |

| Less: Federal tax withheld and estimated tax payments | (29,000) | |

| Net tax due | (628) |

Table (1)

Notes:

- (1) On state and local bonds is an exclusion under § 103, interest.

- (2) Federal tax refunds are nontaxable.

- (3) Life insurance proceeds are exclusions under § 101.

- (4) Exclusions under § 102 are Inheritances.

- (5) Since, Sale of the ATV is zero because Mr. C paid $14,000 as a result its $5,000 loss. Therefore, it is not deductible in case of personal losses.

- (6) Compute Mr. D’s job expenses.

| Particulars | Amount ($) | Amount ($) |

| Airfare | 8,800 | |

| Lodging | 5,000 | |

| Meals | 2,400 | |

| Entertainment | 0 | |

| Transportation | 800 | |

| Business gifts | 450 | |

| Office supplies | 1,500 | |

| Business mileage | 5,995 | |

| Business parking and tolls | 340 | |

| Office in the home: 15%(business use) | ||

| Insurance | 390 | |

| Repairs and maintenance | 135 | |

| Utilities | 705 | |

| Interest | 990 | |

| Taxes | 960 | |

| Painting, area rugs, and plants | 1,800 | |

| Depreciation | 1,538 | 6,518 |

| Total | 31,803 |

Table (2)

Mr. D’s office in the home deduction under the simplified method would have been only $1,500.

(7) Mrs. S funeral expenses are not deductible because Mr. C did not provide any information.

(8) As part of the office in the home deduction property taxes of $960 have already been claimed. It includes 2017’s final amount of state income taxes, 2018’s state income taxes paid plus withholdings from salary of Mrs. E and 2018’s estimated state tax payments.

(9) As part of the office in home deduction interest of $990 is claimed.

(10) Miscellaneous expense is zero because Mrs. E is an employee, so job related expenses are miscellaneous itemized deductions.

(11) Mr. D is consulting is a “specified services” business, the Mr. C’s taxable income before the QBI deduction is less than where the phase out limitations apply. Mr. D’s QBI is $105,200 and less Mr. D’s self-employment tax deduction ($7,997). The modified taxable income is taxable income before the QBI deduction lee any net capital gain. Modified taxable income is $114,200 since they used the standard deduction.

20% of qualified business income $21,040

(Or)

20% of modified taxable income $22,840

Whichever is less is the deduction for qualified business income is $21,040.

(12) Compute self-employment tax.

| Particulars | Amount ($) |

| Schedule C net income | 113,197 |

| x 0.9235 | |

| Self-employment tax base (a) | $104,537 |

| Self-employment tax rate (b) | 15.3% |

| Self-employment tax (a x b) | 15,994 |

Table (3)

One-half of Mr. D’s self-employment taxes ($7,997) are allowed for AGI deduction.

2.

Write a report to Mr. D.

Explanation of Solution

Young, Nellen, Hoffman, Raabe, & Maloney, CPAs 5

5191 Natorp Boulevard

Mason, OH 45040

February 6, 2019

Mr. D

1820 Elk Avenue

Denver, CO 80202

Dear Mr.D:

From the enquiry regarding the job status of Ms. E, I can make certain projections with respect to the tax saving involved. Your joint tax liability would be reduced by $5,826 without her salary. This amount is based on the gross income falling by an amount of $42,000 along with your deductions for qualified business income reducing to $14,440. Your revised taxable income would be concluded to $57,760 and your tax liability that is based on 2018 Tax Tables amounts to $6,552.

You will be substituting her out-of-pocket job-related expenses of $1,830 that do not generate any tax benefit in terms of deductions. It will be substituted up to $4,000 in tuition expenses that would generate a tax benefit. Since you belong in the 12% tax bracket, a deduction of $4,000 will save you up to $480 in taxes.

My projections can be more accurate if you are aware about the college expense of Ms. E.

Sincerely,

Mr. J, Manager

Want to see more full solutions like this?

Chapter 9 Solutions

Individual Income Taxes

- John Benson, age 40, is single. His Social Security number is 111-11-1111, and he resides at 150 Highway 51, Tangipahoa, LA 70465. John has a 5-year-old child, Kendra, who lives with her mother, Katy. As a result of his divorce in 2016, John pays alimony of 6,000 per year to Katy and child support of 12,000. The 12,000 of child support covers 65% of Katys costs of rearing Kendra. Kendras Social Security number is 123-45-6789, and Katys is 123-45-6788. Johns mother, Sally, lived with him until her death in early September 2019. He incurred and paid medical expenses for her of 15,588 and other support payments of 11,000. Sallys only sources of income were 5,500 of interest income on certificates of deposit and 5,600 of Social Security benefits, which she spent on her medical expenses and on maintenance of Johns household. Sallys Social Security number was 123-45-6787. John is employed by the Highway Department of the State of Louisiana in an executive position. His salary is 95,000. The appropriate amounts of Social Security tax and Medicare tax were withheld. In addition, 9,500 was withheld for Federal income taxes and 4,000 was withheld for state income taxes. In addition to his salary, Johns employer provides him with the following fringe benefits. Group term life insurance with a maturity value of 95,000; the cost of the premiums for the employer was 295. Group health insurance plan; Johns employer paid premiums of 5,800 for his coverage. The plan paid 2,600 for Johns medical expenses during the year. Upon the death of his aunt Josie in December 2018, John, her only recognized heir, inherited the following assets. Three months prior to her death, Josie gave John a mountain cabin. Her adjusted basis for the mountain cabin was 120,000, and the fair market value was 195,000. No gift taxes were paid. During the year, John reported the following transactions. On February 1, 2019, he sold for 45,000 Microsoft stock that he inherited from his father four years ago. His fathers adjusted basis was 49,000, and the fair market value at the date of the fathers death was 41,000. The car John inherited from Josie was destroyed in a wreck on October 1, 2019. He had loaned the car to Katy to use for a two-week period while the engine in her car was being replaced. Fortunately, neither Katy nor Kendra was injured. John received insurance proceeds of 16,000, the fair market value of the car on October 1, 2019. On December 28, 2019, John sold the 300 acres of land to his brother, James, for its fair market value of 160,000. James planned on using the land for his dairy farm. Other sources of income for John are: Potential itemized deductions for John, in addition to items already mentioned, are: Part 1Tax Computation Compute Johns net tax payable or refund due for 2019. Part 2Tax Planning Assume that rather than selling the land to James, John is considering leasing it to him for 12,000 annually with the lease beginning on October 1, 2019. James would prepay the lease payments through December 31, 2019. Thereafter, he would make monthly lease payments at the beginning of each month. What effect would this have on Johns 2019 tax liability? What potential problem might John encounter? Write a letter to John in which you advise him of the tax consequences of leasing versus selling. Also prepare a memo addressing these issues for the tax files.arrow_forwardLance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501. Lance works for the convention bureau of the local Chamber of Commerce, and Wanda is employed part-time as a paralegal for a law firm. During 2018, the Deans had the following receipts: Wanda was previously married to John Allen. When they divorced several years ago, Wanda was awarded custody of their two children, Penny and Kyle. (Note: Wanda has never issued a Form 8332 waiver.) Under the divorce decree, John was obligated to pay alimony and child supportthe alimony payments were to terminate if Wanda remarried. In July, while going to lunch in downtown Santa Fe, Wanda was injured by a tour bus. Because the driver was clearly at fault, the owner of the bus, Roadrunner Touring Company, paid her medical expenses (including a one-week stay in a hospital). To avoid a lawsuit, Roadrunner also transferred 90,000 to her in settlement of the personal injuries she sustained. The Deans had the following expenditures for 2018: The life insurance policy was taken out by Lance several years ago and designates Wanda as the beneficiary. As a part-time employee, Wanda is excluded from coverage under her employers pension plan. Consequently, she provides for her own retirement with a traditional IRA obtained at a local trust company. Because the mayor is a member of the local Chamber of Commerce, Lance felt compelled to make the political contribution. The Deans household includes the following, for whom they provide more than half of the support: Penny graduated from high school on May 9, 2018, and is undecided about college. During 2018, she earned 8,500 (placed in a savings account) playing a harp in the lobby of a local hotel. Wayne is Wandas widower father who died on December 20, 2017. For the past few years, Wayne qualified as a dependent of the Deans. Federal income tax withheld is 4,200 (Lance) and 2,100 (Wanda). The proper amount of Social Security and Medicare tax was withheld. Determine the Federal income tax for 2018 for the Deans on a joint return by completing the appropriate forms. They do not want to contribute to the Presidential Election Campaign Fund. All members of the family had health care coverage for all of 2018. If an overpayment results, it is to be refunded to them. Suggested software: ProConnect Tax Online.arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning