Concept explainers

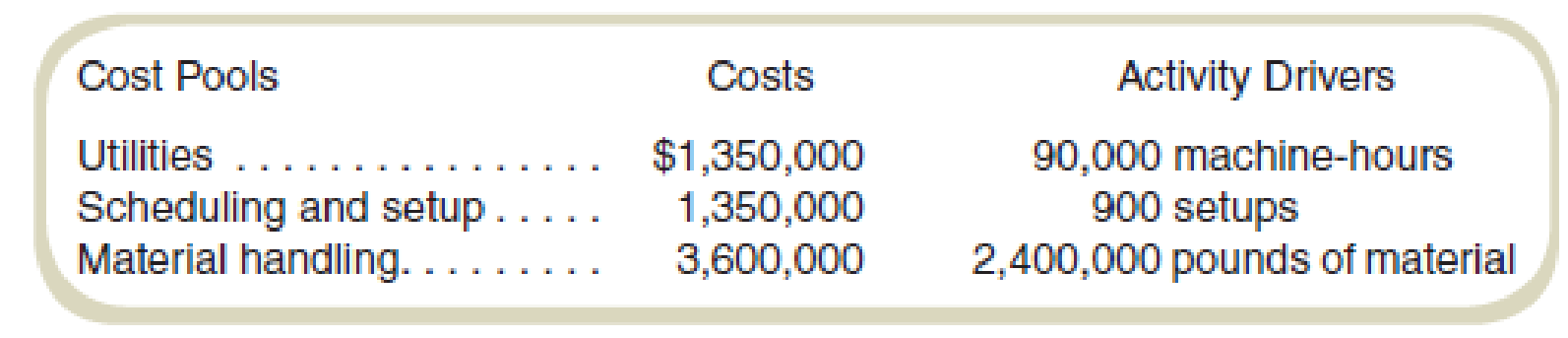

Churchill Products is considering updating its cost system to an activity-based costing system and is interested in understanding the effects. The company’s cost accountant has identified three

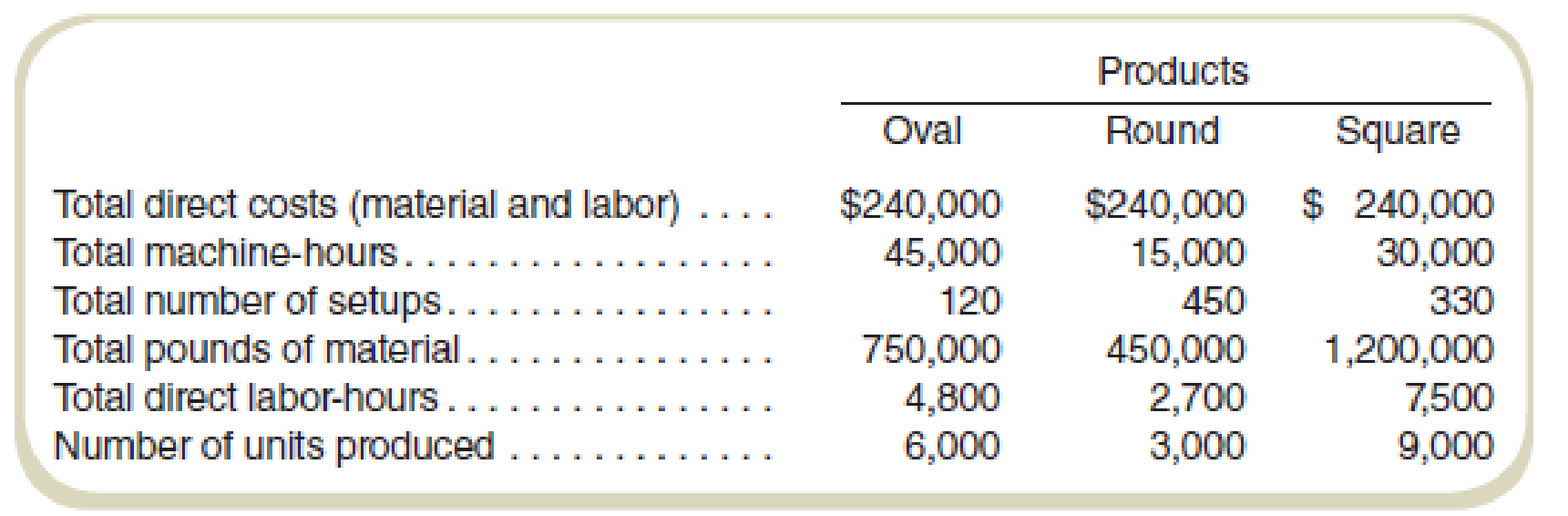

The company manufactures three models of water basins (Oval, Round, and Square). The plans for production for the next year and the budgeted direct costs and activity by product line are as follows:

Required

- a. The current cost accounting system charges overhead to products based on direct labor-hours. What unit product costs will be reported for the three products if the current cost system continues to be used?

- b. A consulting firm has recommended using an activity-based costing system, with the activities based on the cost pools identified by the cost accountant. Prepare a cost flow diagram of the proposed ABC system.

- c. What are the cost driver rates for the three cost pools identified by the cost accountant?

- d. What unit product costs will be reported for the three products if the ABC system suggested by the cost accountant’s classification of cost pools is used?

- e. If management should decide to implement an activity-based costing system, what benefits should it expect?

a.

Determine the unit product costs according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Compute the unit cost:

| Particulars | Oval | Round | Square |

| Direct costs | $240,000 | $240,000 | $240,000 |

|

Add: Overhead | $2,016,000 | $1,134,000 | $3,150,000 |

| Total costs | $2,256,000 | $1,374,000 | $3,390,000 |

| Number of units | 6,000 | 3,000 | 9,000 |

| Unit cost | $376 | $458 | $377 |

Table: (1)

Compute the burden rate:

b.

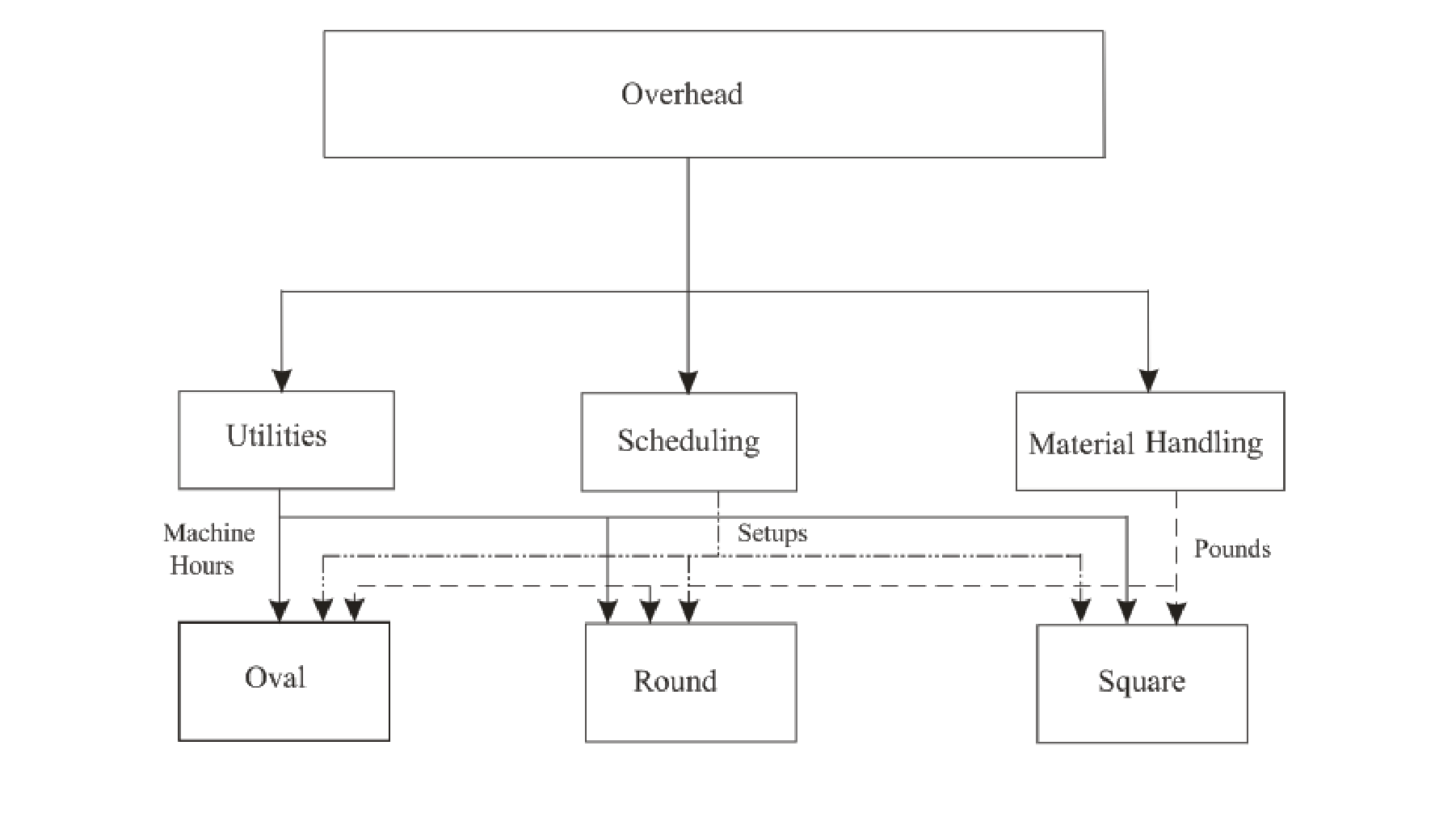

Prepare a cost flow diagram according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Cost flow diagram:

Cost flow diagram determines the flow of the cost of the operations through working dynamics of the cost flow system.

Figure (1)

c.

Determine the cost driver rate according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Determine the cost drivers and cost drivers rate:

| Particulars | Cost | Cost driver |

Cost per cost driver |

| Utilities | $1,350,000 | 90,000 machine hours | $15 |

| Scheduling and setup | $1,350,000 | 900 setups | $1,500 |

| Material handling | $3,600,000 | 2,400,000 lbs. | $1.50 |

Table: (2)

d.

Determine the unit product costs according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Compute the unit cost:

| Particulars | Oval | Round | Square |

| Direct costs | $240,000 | $240,000 | $240,000 |

| Add:Overhead: | |||

|

Utilities | $675,000 | $225,000 | $450,000 |

|

Scheduling and setup | $180,000 | $675,000 | $495,000 |

|

Material handling | $1,125,000 | $675,000 | $1,800,000 |

| Total costs | $2,220,000 | $1,815,000 | $2,985,000 |

| Number of units | $6,000 | $3,000 | $9,000 |

|

Unit cost | $370 | $605 | $332 |

Table: (3)

e.

Determine the effect of implementing activity-based costing system.

Explanation of Solution

Activity-based costing (ABC):

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

The relevance of the ABC system according to the information given in the question:

The implementation of the ABC system would make the understanding of product costs. The cost drivers would be determined by breaking down the costs with respect to the cost drivers. The determination and analysis of the product complexity, product cost, and product volume would provide the correlation between the three. This vital information would be critical for pricing decisions and profitability strategies.

Want to see more full solutions like this?

Chapter 9 Solutions

FUNDAMENTALS OF COST....-W/CODE>CUSTOM<

- Firenza Company manufactures specialty tools to customer order. Budgeted overhead for the coming year is: Previously, Sanjay Bhatt, Firenza Companys controller, had applied overhead on the basis of machine hours. Expected machine hours for the coming year are 50,000. Sanjay has been reading about activity-based costing, and he wonders whether or not it might offer some advantages to his company. He decided that appropriate drivers for overhead activities are purchase orders for purchasing, number of setups for setup cost, engineering hours for engineering cost, and machine hours for other. Budgeted amounts for these drivers are 5,000 purchase orders, 500 setups, and 2,500 engineering hours. Sanjay has been asked to prepare bids for two jobs with the following information: The typical bid price includes a 40 percent markup over full manufacturing cost. Required: 1. Calculate a plantwide rate for Firenza Company based on machine hours. What is the bid price of each job using this rate? 2. Calculate activity rates for the four overhead activities. What is the bid price of each job using these rates? 3. Which bids are more accurate? Why?arrow_forwardLonsdale Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and activity bases are as follows: Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activity-base usage quantities and units produced follow: a. Determine the activity rate for each activity. b. Use the activity rates in (a) to determine the total and per-unit activity costs associated with each product. Round to the nearest cent.arrow_forwardEclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering using the multiple production department factory overhead rate method. The following factory overhead was budgeted for Eclipse: Direct machine hours were estimated as follows: In addition, the direct machine hours (dmh) used to produce a unit of each product in each department were determined from engineering records, as follows: a. Determine the per-unit factory overhead allocated to the commercial and residential motors under the single plantwide factory overhead rate method, using direct machine hours as the allocation base. b. Determine the per-unit factory overhead allocated to the commercial and residential motors under the multiple production department factory overhead rate method, using direct machine hours as the allocation base for each department. c. Recommend to management a product costing approach, based on your analyses in (a) and (b). Support your recommendation.arrow_forward

- The controller for Muir Companys Salem plant is analyzing overhead in order to determine appropriate drivers for use in flexible budgeting. She decided to concentrate on the past 12 months since that time period was one in which there was little important change in technology, product lines, and so on. Data on overhead costs, number of machine hours, number of setups, and number of purchase orders are in the following table. Required: 1. Calculate an overhead rate based on machine hours using the total overhead cost and total machine hours. (Round the overhead rate to the nearest cent and predicted overhead to the nearest dollar.) Use this rate to predict overhead for each of the 12 months. 2. Run a regression equation using only machine hours as the independent variable. Prepare a flexible budget for overhead for the 12 months using the results of this regression equation. (Round the intercept and x-coefficient to the nearest cent and predicted overhead to the nearest dollar.) Is this flexible budget better than the budget in Requirement 1? Why or why not?arrow_forwardThe controller of the South Charleston plant of Ravinia, Inc., monitored activities associated with materials handling costs. The high and low levels of resource usage occurred in September and March for three different resources associated with materials handling. The number of moves is the driver. The total costs of the three resources and the activity output, as measured by moves for the two different levels, are presented as follows: Required: 1. Determine the cost behavior formula of each resource. Use the high-low method to assess the fixed and variable components. 2. Using your knowledge of cost behavior, predict the cost of each item for an activity output level of 9,000 moves. 3. Construct a cost formula that can be used to predict the total cost of the three resources combined. Using this formula, predict the total materials handling cost if activity output is 9,000 moves. In general, when can cost formulas be combined to form a single cost formula?arrow_forwardThe management of Wheeler Company has decided to develop cost formulas for its major overhead activities. Wheeler uses a highly automated manufacturing process, and power costs are a significant manufacturing cost. Cost analysts have decided that power costs are mixed; thus, they must be broken into their fixed and variable elements so that the cost behavior of the power usage activity can be properly described. Machine hours have been selected as the activity driver for power costs. The following data for the past eight quarters have been collected: Required: 1. Prepare a scattergraph by plotting power costs against machine hours. Does the scatter-graph show a linear relationship between machine hours and power cost? 2. Using the high and low points, compute a power cost formula. 3. Use the method of least squares to compute a power cost formula. Evaluate the coefficient of determination. 4. Rerun the regression and drop the point (20,000; 26,000) as an outlier. Compare the results from this regression to those for the regression in Requirement 3. Which is better?arrow_forward

- Pelder Products Company manufactures two types of engineering diagnostic equipment used in construction. The two products are based upon different technologies, X-ray and ultrasound, but are manufactured in the same factory. Pelder has computed the manufacturing cost of the X-ray and ultrasound products by adding together direct materials, direct labor, and overhead cost applied based on the number of direct labor hours. The factory has three overhead departments that support the single production line that makes both products. Budgeted overhead spending for the departments is as follows: Pelders budgeted manufacturing activities and costs for the period are as follows: The budgeted cost to manufacture one ultrasound machine using the activity-based costing method is: a. 225. b. 264. c. 293. d. 305.arrow_forwardA local picnic table manufacturer has budgeted these overhead costs: They are considering adapting ABC costing and have estimated the cost drivers for each pool as shown: Recent success has yielded an order for 1,000 tables. Assume direct labor costs per hour of $20. Determine how much the job would cost given the following activities:arrow_forwardEvans, Inc., has a unit-based costing system. Evanss Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The plant has used direct labor hours for years to assign overhead to products. To help design engineers understand the assumed cost relationships, the Cost Accounting Department developed the following cost equation. (The equation describes the relationship between total manufacturing costs and direct labor hours; the equation is supported by a coefficient of determination of 60 percent.) Y=5,000,000+30X,whereX=directlaborhours The variable rate of 30 is broken down as follows: Because of competitive pressures, product engineering was given the charge to redesign products to reduce the total cost of manufacturing. Using the above cost relationships, product engineering adopted the strategy of redesigning to reduce direct labor content. As each design was completed, an engineering change order was cut, triggering a series of events such as design approval, vendor selection, bill of materials update, redrawing of schematic, test runs, changes in setup procedures, development of new inspection procedures, and so on. After one year of design changes, the normal volume of direct labor was reduced from 250,000 hours to 200,000 hours, with the same number of products being produced. Although each product differs in its labor content, the redesign efforts reduced the labor content for all products. On average, the labor content per unit of product dropped from 1.25 hours per unit to one hour per unit. Fixed overhead, however, increased from 5,000,000 to 6,600,000 per year. Suppose that a consultant was hired to explain the increase in fixed overhead costs. The consultants study revealed that the 30 per hour rate captured the unit-level variable costs; however, the cost behavior of other activities was quite different. For example, setting up equipment is a step-fixed cost, where each step is 2,000 setup hours, costing 90,000. The study also revealed that the cost of receiving goods is a function of the number of different components. This activity has a variable cost of 2,000 per component type and a fixed cost that follows a step-cost pattern. The step is defined by 20 components with a cost of 50,000 per step. Assume also that the consultant indicated that the design adopted by the engineers increased the demand for setups from 20,000 setup hours to 40,000 setup hours and the number of different components from 100 to 250. The demand for other non-unit-level activities remained unchanged. The consultant also recommended that management take a look at a rejected design for its products. This rejected design increased direct labor content from 250,000 hours to 260,000 hours, decreased the demand for setups from 20,000 hours to 10,000 hours, and decreased the demand for purchasing from 100 component types to 75 component types, while the demand for all other activities remained unchanged. Required: 1. Using normal volume, compute the manufacturing cost per labor hour before the year of design changes. What is the cost per unit of an average product? 2. Using normal volume after the one year of design changes, compute the manufacturing cost per hour. What is the cost per unit of an average product? 3. Before considering the consultants study, what do you think is the most likely explanation for the failure of the design changes to reduce manufacturing costs? Now use the information from the consultants study to explain the increase in the average cost per unit of product. What changes would you suggest to improve Evanss efforts to reduce costs? 4. Explain why the consultant recommended a second look at a rejected design. Provide computational support. What does this tell you about the strategic importance of cost management?arrow_forward

- Silven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Silven produces two models of cell phones with the following expected activity demands: 1. Determine the total overhead assigned to each product using the four activity drivers. 2. Determine the total overhead assigned to each model using the two most expensive activities. The costs of the two relatively inexpensive activities are allocated to the two expensive activities in proportion to their costs. 3. Using ABC as the benchmark, calculate the percentage error and comment on the accuracy of the reduced system. Explain why this approach may be desirable.arrow_forwardAdam Corporation manufactures computer tables and has the following budgeted indirect manufacturing cost information for the next year: If Adam uses the step-down (sequential) method, beginning with the Maintenance Department, to allocate support department costs to production departments, the total overhead (rounded to the nearest dollar) for the Machining Department to allocate to its products would be: a. 407,500. b. 422,750. c. 442,053. d. 445,000.arrow_forwardDouglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred: Marston applies overhead using rates based on direct labor hours, machine hours, number of moves, and number of batches. The second level of activity (the right column in the preceding table) is the practical level of activity (the available activity for resources acquired in advance of usage) and is used to compute predetermined overhead pool rates. Required: 1. Prepare a performance report for Marstons manufacturing costs in the current year. 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost. 3. One of Marstons managers said the following: Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at 10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of 30,000 per year. Also, I know that fuel costs about 0.25 per move. Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College