PRINCIPLES OF CORPORATE FINANCE

13th Edition

ISBN: 9781264052059

Author: BREALEY

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 6PS

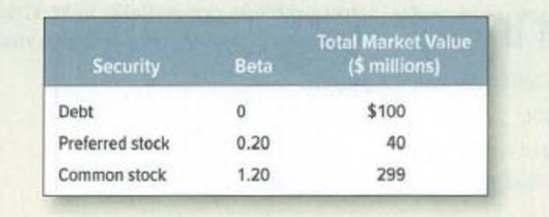

Company cost of capital Nero Violins has the following capital structure:

- a. What is the firm’s asset beta? (Hint: What is the beta of a portfolio of all the firm’s securities?)

- b. Assume that the

CAPM is correct. What discount rate should Nero set for investments that expand the scale of its operations without changing its asset beta? Assume a risk-free interest rate of 5% and a market risk premium of 6%. Ignore taxes.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

If a firm cannot invest retained earnings to earn a rate of returngreater than or equal to the required rate of return on retained earnings, it should return those funds to its stockholders.

The cost of equity using the CAPM approach

The current risk-free rate of return (rRFrRF) is 4.67% while the market risk premium is 5.75%. The Burris Company has a beta of 0.78. Using the capital asset pricing model (CAPM) approach, Burris’s cost of equity is .

The cost of equity using the bond yield plus risk premium approach

The Taylor Company is closely held and, therefore, cannot generate reliable inputs with which to use the CAPM method for estimating a company’s cost of internal equity. Taylor’s bonds yield 11.52%, and the firm’s analysts estimate that the firm’s risk premium on its stock over its bonds is 3.55%. Based on the bond-yield-plus-risk-premium approach, Taylor’s cost of internal equity is:

18.84%

15.07%

14.32%

18.08%

The…

Show your work for the following

A firm's equity beta is 1.2 and its debt is risk free. Given a 0.7 debt to equity ratio, what is the firm's asset beta? (Assume no taxes.)

Multiple Choice

A) 0.7

B) 0

C) 1.0

D) 1.2

True or False: It is free for a company to raise money through retained earnings, because retained earnings represent money that is left over after dividends are paid out to shareholders.

False

True

The cost of equity using the CAPM approach

The current risk-free rate of return (rRFrRF) is 4.23% while the market risk premium is 6.63%. The Allen Company has a beta of 0.78. Using the capital asset pricing model (CAPM) approach, Allen’s cost of equity is (9.40%, 8.46, 11.28, 9.87) .

The cost of equity using the bond yield plus risk premium approach

The Hoover Company is closely held and, therefore, cannot generate reliable inputs with which to use the CAPM method for estimating a company’s cost of internal equity. Hoover’s bonds yield 10.28%, and the firm’s analysts estimate that the firm’s risk premium on its stock over its bonds is 3.55%. Based on the bond-yield-plus-risk-premium approach, Hoover’s cost of internal equity is:

13.83%…

Chapter 9 Solutions

PRINCIPLES OF CORPORATE FINANCE

Ch. 9 - (VAR.P and STDEV.P) Choose two well-known stocks...Ch. 9 - (AVERAGE, VAR.P and STDEV.P) Now calculate the...Ch. 9 - (SLOPE) Download the Standard Poors index for the...Ch. 9 - Definitions Define the following terms: a. Cost of...Ch. 9 - True/false True or false? a. The company cost of...Ch. 9 - Company cost of capital Quark Productions (Give...Ch. 9 - Company cost of capital The total market value of...Ch. 9 - Company cost of capital You are given the...Ch. 9 - Company cost of capital Nero Violins has the...Ch. 9 - WACC A company is 40% financed by risk-free debt....

Ch. 9 - WACC Binomial Tree Farms financing includes 5...Ch. 9 - Prob. 10PSCh. 9 - Measuring risk The following table shows estimates...Ch. 9 - Prob. 12PSCh. 9 - Asset betas Which of these projects is likely to...Ch. 9 - Asset betas EZCUBE Corp. is 50% financed with...Ch. 9 - Prob. 15PSCh. 9 - Prob. 16PSCh. 9 - Prob. 17PSCh. 9 - Fudge factors John Barleycorn estimates his firms...Ch. 9 - Prob. 19PSCh. 9 - Prob. 20PSCh. 9 - Certainty equivalents A project has a forecasted...Ch. 9 - Certainty equivalents A project has the following...Ch. 9 - Prob. 23PSCh. 9 - Beta of costs Suppose that you are valuing a...Ch. 9 - Fudge factors An oil company executive is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- True or False: It is free for a company to raise money through retained earnings, because retained earnings represent money that is left over after dividends are paid out to shareholders. False True The cost of equity using the CAPM approach The current risk-free rate of return (TRF) is 3.86% while the market risk premium is 6.63%. The Monroe Company has a beta of 0.92. Using the capital asset pricing model (CAPM) approach, Monroe's cost of equity is The cost of equity using the bond yield plus risk premium approach The Lincoln Company is closely held and, therefore, cannot generate reliable inputs with which to use the CAPM method for estimating a company's cost of internal equity. Lincoln's bonds yield 11.52%, and the firm's analysts estimate that the firm's risk premium on its stock over its bonds is 4.95%. Based on the bond-yield-plus-risk-premium approach, Lincoln's cost of internal equity is: 19.76% 16.47% 15.65% O 18.12%arrow_forwardWhat is the principal message of the Capital Asset Pricing Model (CAPM)? What are its assumptions? What is Beta? Is high beta good or bad for a company? Which type of company will have a higher Beta: a fast food chain or a luxury cruise-ship company? Why? Brimbank company shares has an expected return of 15%. The share’s Beta is 1.2, the risk-free rate is 3% and the market risk premium is 6%. Based on this information do you think the share is overvalued or undervalued? Why? A [particular share sells for $30. The shares’ Beta is 1.25, the risk-free rate is 4%, and the expected return on the market portfolio is 10%. If you predict that the share’s market price next year will be $33 (and no dividend), should you buy the share or not? Why?arrow_forwardAnswer the following a) When will the different DCF methods use the same discount rate? b) The cost of debt (ka) will change as the capital structure of a firm changes. Why or why not? c) Why does the cost of equity (k.) increase as the amount of debt in the capital structure of a firm increases? Why? d) Freebie Inc.'s common stock has a beta of 1.3. If the risk-free rate is 4.5% and the expected return on the market is 12%, what is its cost of equity capital? e) Why do branded food companies command the highest EBIT multiple (about 8) and transportation companies the lowest (about 3)? f) Should a firm use its cost of capital as a hurdle/discount rate to value all internal divisions? Why or why not? g) An option can have more than one source of value. Consider a mining company. The company can mine for ores today or wait another year (or more) to mine. What real options can you identify here? h) Do you consider dividend payments by the firm in calculating cash flows? Why or why not? i)…arrow_forward

- The relationship between WACC and investors' required rates of return The required rate of return of an investor is the rate of return that an investor demands to purchase a firm’s stocks or bonds and thus provide funds for capital investment. Therefore, required returns from the investors’ point of view correspond to the required returns or the weighted average cost of capital (WACC) from the firm’s point of view. Indicate in the following table whether each of the statements about WACC and the required rates of return of investors is true or false. Statement True False Flotation costs increase the cost of newly issued stock compared to the cost of the firm’s existing, or already outstanding, common stock or retained earnings. The firm’s cost of debt is what an investor is willing to pay for the firm’s stock before considering flotation costs. The amount that an investor is willing to pay for a firm’s bonds is inversely related to the…arrow_forwardYou have the following information about Burgundy Basins, a sink manufacturer. Equity shares outstanding Stock price per share Yield to maturity on debt Book value of interest-bearing debt Coupon interest rate on debt Market value of debt Book value of equity Cost of equity capital Tax rate a. What is the internal rate of return on the investment? Note: Round your answer to 2 decimal places. Internal rate of return I Weighted-average cost Burgundy is contemplating what for the company is an average-risk investment costing $38 million and promising an annual ATCF of $4.9 million in perpetuity. % b. What is Burgundy's weighted-average cost of capital? Note: Round your answer to 2 decimal places. 20 million % $39 7.5% $350 million 4.4% $ 245 million $ 410 million 11.8% 35%arrow_forwardUnder normal circumstances, the weighted average cost of capital is used as the firm's required rate of return because a. as long as the firm's investments earn returns greater than the cost of capital, the value of the firm will increase b. it is comparable to the average of all the interest rates on debt that currently prevail in the financial markets c. returns below the cost of capital will cover all the fixed costs associated with capital and provide excess returns to the firm's stockholdersarrow_forward

- The cost of retained earnings True or False: It is free for a company to raise money through retained earnings, because retained earnings represent money that is left over after dividends are paid out to shareholders. True False The cost of equity using the CAPM approach The current risk-free rate of return (rRF ) is 4.23% while the market risk premium is 6.17%. The D’Amico Company has a beta of 1.56. Using the capital asset pricing model (CAPM) approach, D’Amico’s cost of equity is . The cost of equity using the bond yield plus risk premium approach The Kennedy Company is closely held and, therefore, cannot generate reliable inputs with which to use the CAPM method for estimating a company’s cost of internal equity. Kennedy’s bonds yield 10.28%, and the firm’s analysts estimate that the firm’s risk premium on its stock over its bonds is 5.89. Based on the bond-yield-plus-risk-premium approach, Kennedy’s cost of internal equity is:…arrow_forwardFor a typical firm, which of the following sequences is CORRECT? All rates are after taxes, and assume that the firm operates at its target capital structure rs: Cost of equities new stock issuance re: Cost of equities retained earnings rd: Cost of debts WACC: Weigthed average costs of capital rs > re rd WACC re rs > WACC rd. WACC > re> rs >rd. rd >rers > WACCarrow_forwardWhich of the below statements does the MM Proposition I predict? A. In a perfect market, the value of a firm is independent of its capital structure B.In a perfect market, the discount rate depends on the capital structure C.In a perfect market, the value of a firm decreases in leverage D.In a perfect market, the NPY of investments depends on the existing debt/equity mixarrow_forward

- WHICH OF THE FOLLOWING STATEMENTS IS MOST CORRECT? A. IF A FIRM'S EXPECTED BASIC EARNING POWER (BEP) IS CONSTANT FOR ALL ITS ASSETS AND EXCEES INTEREST RATE ON ITS DEBT, THEN ADDING ASSETS FINANCING THEM WITH DEBT WILL RAISE THE FIRM'S EXPECTED RATE OF RETURN ON COMMON EQUITY (ROE)? B. THE HIGHER ITS TAX RATE, THE LOWER A FIRM'S BEP RATIO WILL BE, OTHER THINGS HELD CONSTANT. C. THE HIGHER THE INTEREST RATE ON ITS DEBT, THE LOWER THE FIRM'S BEP RATIO WILL BE, OTHER THINGS HELD CONSTANT. D. THE HIGHER ITS DEBT RATIO, THE LOWER THE FIRM'S BEP RATIO WILL BE, OTHER THINGS HELD CONSTANT. E. STATEMENT A IS FALSE, BUT B, C AND D ARE ALL TRUE.arrow_forwardMatch the following A premium over and above the risk-free rate. ✓ The computed cost of capital determined by multiplying the cost of each item in the optimal capital structure by its weighted representation in the overall capital structure and summing the results A measure of the amount of debt used in the capital structure of the firm Superior growth of a firm may achieve during its early years, before leveling off to a more normal growth ✓ The earnings available to common stockholders divided by the number of common stock shares outstanding ✓ A line or equation that depicts the risk-related return of a security based on risk-free rate plus a market premium related to the beta coefficient of the security A measure of the spread or dispersion of a series of numbers around the expected value A model for determining the value of a share of stock by taking the present value of an expected stream of future dividends. A. Supernormal Growth B. Market Risk Premium C. Financial Leverage D.…arrow_forwardThe cost of raising capital through retained eamings is the cost of raising capital through issuing new common stock. The cost of equity using the CAPM approach The current risk-free rate of return (rRF) is 4.23 % , while the market risk premium is 6.63 %. the D'Amico Company has a beta of 0.78. Using the Capital Asset Pricing Model (CAPM) approach, D'Amico's cost of equity is The cost of equity using the bond yield plus risk premium approach The Hoover Company is closely held and, therefore, cannot generate reliable inputs with which to use the CAPM method for estimating a company's cost of internal equity. Hoover's bonds yield 11.52%, and the fim's analysts estimate that the firm's risk premium on its stock over its bonds is 3.55 %. Based on the bond-yield-plus-risk-premium approach, Hoover's cost of internal equity is: 18.08% 14.32% 15.07% 18.84% The cost of equity using the discounted cashflow (or dividend growth) approach Kirby Enterprises's stock is currently selling for $32.45…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

What is WACC-Weighted average cost of capital; Author: Learn to invest;https://www.youtube.com/watch?v=0inqw9cCJnM;License: Standard YouTube License, CC-BY