Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

14th Edition

ISBN: 9780133507690

Author: Lawrence J. Gitman, Chad J. Zutter

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 9.11P

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

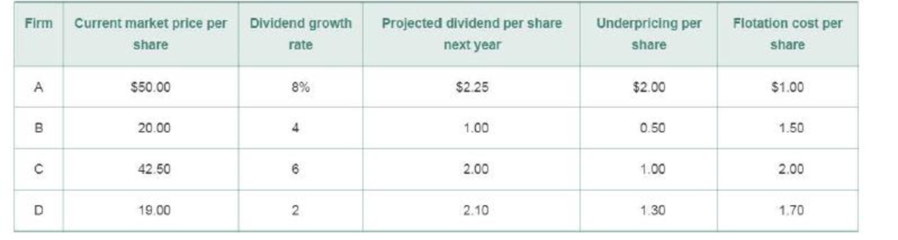

Using the data for a firm shown in the following table attached below, calculate the cost of retained earnings and the cost of new common stock using the constant-growth valuation model.

The required rate of return on a stock consists of two components, dividend growth rate on the stock measures which of the one component

Capital gains yield

Dividend yield

Market growth rate

Discount rate

Compute the following ratios for both companies for the current year, and decide which company’s stock better fits your investment strategy.

Debt Ratio

Earning per share of common stocks

Price/earning ration

Dividend payout

Chapter 9 Solutions

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Ch. 9.1 - Prob. 1FOECh. 9.1 - What is the cost of capital?Ch. 9.1 - Prob. 9.2RQCh. 9.1 - Prob. 9.3RQCh. 9.1 - What are the typical sources of long-term capital...Ch. 9.2 - Prob. 9.5RQCh. 9.2 - Prob. 9.6RQCh. 9.2 - Prob. 9.7RQCh. 9.3 - How would you calculate the cost of preferred...Ch. 9.4 - What premise about share value underlies the...

Ch. 9.4 - How do the constant-growth valuation model and...Ch. 9.4 - Why is the cost of financing a project with...Ch. 9.5 - Prob. 1FOPCh. 9.5 - Prob. 9.13RQCh. 9.5 - Prob. 9.14RQCh. 9.5 - Prob. 9.15RQCh. 9 - Prob. 1ORCh. 9 - Learning Goals 3, 4, 5, 6 ST9-1 Individual...Ch. 9 - Prob. 9.1WUECh. 9 - Prob. 9.2WUECh. 9 - Prob. 9.3WUECh. 9 - Weekend Warriors Inc. has 35% debt and 65% equity...Ch. 9 - Oxy Corporation uses debt, preferred stock, and...Ch. 9 - Prob. 9.1PCh. 9 - Prob. 9.2PCh. 9 - Prob. 9.3PCh. 9 - Prob. 9.4PCh. 9 - The cost of debt Gronseth Drywall Systems Inc. is...Ch. 9 - After-tax cost of debt Bella Wans is interested in...Ch. 9 - Prob. 9.7PCh. 9 - Cost of preferred stock Determine the cost for...Ch. 9 - Prob. 9.9PCh. 9 - Prob. 9.10PCh. 9 - Retained earnings versus new common stock Using...Ch. 9 - The effect of tax rate on WACC K. Bell Jewelers...Ch. 9 - WACC: Market value weights The market values and...Ch. 9 - WACC: Book weights and market weights Webster...Ch. 9 - Prob. 9.15PCh. 9 - Cost of capital Edna Recording Studios Inc....Ch. 9 - Prob. 9.17PCh. 9 - Prob. 9.18PCh. 9 - Calculation of individual costs and WACC Lang...Ch. 9 - Weighted average cost of capital (WACC) American...Ch. 9 - Prob. 9.21PCh. 9 - Eco Plastics Company Since its inception, Eco...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Financial leverage Costco Wholesale Corporation (COST) and Wel-Mart Stroes Inc. (WMT)reported the following data (in milllions) for a recent year: Compute the return on stockholders equity. Round to one decimal place.arrow_forwardUse the extended DuPont equation to provide a breakdown of Computrons projected return on equity. How does the projection compare with the previous years and with the industrys DuPont equation?arrow_forwardRatio Analysis Consider the following information taken from the stockholders equity section: How do you interpret the companys payout and profitability performance? Required: 1. Calculate the following for 2020. (Note. Round answers to two decimal places.) 2. CONCEPTUAL CONNECTION Assume 2019 ratios were: and the current year industry averages are: How do you interpret the companys payout and profitability performance?arrow_forward

- Stockholder Payout Ratios The following information pertains to Milo Mindbender Corporation: Required: Calculate the dividend yield, dividend payout, and total payout. (Note: Round answers to two decimal places.)arrow_forwardRatio Analysis Consider the following information. Required: Calculate the stockholder payout ratios. (Note: Round answers to two decimal places.) Calculate the stockholder profitability ratios. (Note: Round answers to two decimal places.)arrow_forwardRatio Analysis MJO Inc. has the following stockholders equity section of the balance sheet: On the balance sheet date, MJOs stock was selling for S25 per share. Required: Assuming MJOs dividend yield is 1%, what are the dividends per common share? Assuming MJOs dividend yield is 1% and its dividend payout is 20%, what is MJOs net income?arrow_forward

- Which statement is true? The cost of preferred stock remains constant from year to year. Preferred stock is valued using the perpetuity present value formula. Preferred stock is generally the cheapest source of capital for a firm. An increase in the market value of preferred stock will increase a firm's weighted average cost of capital.arrow_forwardEvaluate the firm’s profitability for 2008 by computing: a. Return on Common Stockholders’ Equity. b. Earnings Per Share (EPS) c. Price-earnings Ratio d. Pay-out Ratio to Common Shares e. Dividend Yield Per Share on Common Stockarrow_forwardWhich of the following statements best describes how a change in a firm’s stock price would affect a stock’s capital gains yield? The capital gains yield on a stock that the investor already owns has an inverse relationship with the firm’s expected future stock price. The capital gains yield on a stock that the investor already owns has a direct relationship with the firm’s expected future stock price. Walter Utilities is a dividend-paying company and is expected to pay an annual dividend of $2.25 at the end of the year. Its dividend is expected to grow at a constant rate of 9.00% per year. If Walter’s stock currently trades for $26.00 per share, what is the expected rate of return? Which of the following statements will always hold true? The constant growth valuation formula is not appropriate to use for zero growth stocks. It will never be appropriate for a rapidly growing startup company that pays no dividends at present—but is expected to…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License