Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

14th Edition

ISBN: 9780133507690

Author: Lawrence J. Gitman, Chad J. Zutter

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.14P

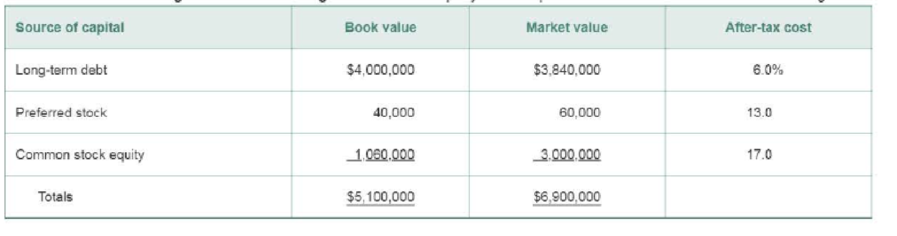

WACC: Book weights and market weights Webster Company has compiled the information shown in the following table

- a. Calculate the WACC using book value weights.

- b. Calculate the WACC using market value weights.

- c. Compare the answers obtained in parts a and b. Explain the differences.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Many financial analysts substitute one amount for another in making ratioanalysis comparisons in order to better achieve intercompany or companyto-industry data comparability. Which of the substitutions described herewould not achieve better data comparability (for the ratio indicated) underany situation?a. Cost of goods sold for sales—in the numerator of the inventory turnoverratio.b. Cost of plant and equipment for net book value—in the numerator of theplant and equipment turnover ratio.c. Expected future earnings per share for current earnings per share—in thedenominator of the price/earnings ratio.d. Average net assets for average total assets—in the denominator of the returnon investment ratio.

In computing the WACC, what is the difference between using the current market value weights rather than book value proportions?

When calculating a company’s WACC, should book value, market value, or targetweights be used? Explain.

Chapter 9 Solutions

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Ch. 9.1 - Prob. 1FOECh. 9.1 - What is the cost of capital?Ch. 9.1 - Prob. 9.2RQCh. 9.1 - Prob. 9.3RQCh. 9.1 - What are the typical sources of long-term capital...Ch. 9.2 - Prob. 9.5RQCh. 9.2 - Prob. 9.6RQCh. 9.2 - Prob. 9.7RQCh. 9.3 - How would you calculate the cost of preferred...Ch. 9.4 - What premise about share value underlies the...

Ch. 9.4 - How do the constant-growth valuation model and...Ch. 9.4 - Why is the cost of financing a project with...Ch. 9.5 - Prob. 1FOPCh. 9.5 - Prob. 9.13RQCh. 9.5 - Prob. 9.14RQCh. 9.5 - Prob. 9.15RQCh. 9 - Prob. 1ORCh. 9 - Learning Goals 3, 4, 5, 6 ST9-1 Individual...Ch. 9 - Prob. 9.1WUECh. 9 - Prob. 9.2WUECh. 9 - Prob. 9.3WUECh. 9 - Weekend Warriors Inc. has 35% debt and 65% equity...Ch. 9 - Oxy Corporation uses debt, preferred stock, and...Ch. 9 - Prob. 9.1PCh. 9 - Prob. 9.2PCh. 9 - Prob. 9.3PCh. 9 - Prob. 9.4PCh. 9 - The cost of debt Gronseth Drywall Systems Inc. is...Ch. 9 - After-tax cost of debt Bella Wans is interested in...Ch. 9 - Prob. 9.7PCh. 9 - Cost of preferred stock Determine the cost for...Ch. 9 - Prob. 9.9PCh. 9 - Prob. 9.10PCh. 9 - Retained earnings versus new common stock Using...Ch. 9 - The effect of tax rate on WACC K. Bell Jewelers...Ch. 9 - WACC: Market value weights The market values and...Ch. 9 - WACC: Book weights and market weights Webster...Ch. 9 - Prob. 9.15PCh. 9 - Cost of capital Edna Recording Studios Inc....Ch. 9 - Prob. 9.17PCh. 9 - Prob. 9.18PCh. 9 - Calculation of individual costs and WACC Lang...Ch. 9 - Weighted average cost of capital (WACC) American...Ch. 9 - Prob. 9.21PCh. 9 - Eco Plastics Company Since its inception, Eco...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- a. What information does a comparison of the current ratio and acid test ratio provide? b. Is the company using leverage to its advantage? Explain. c. What other observations can be made comparing Global Technologys ratios to the following industry norms:arrow_forwardProvide an Market Performance Ratio analysis based on P/E, ROE and D/E.arrow_forwardWhat is SWOT analysis for Smith field Foods Incarrow_forward

- Select which one is the method for ‘material issue pricing’. a. Weighted average method b. ABC analysis c. Reorder level d. Economic order quantityarrow_forwardWhy do U.S. companies keep using LIFO while IFRS prohibits it? a. LIFO provides a more realistic income statement since the most recent items purchased are what is measured on the income statement. b. LIFO assigns less weight to the balance sheet. c. The taxing authority in the U.S. has conformity provisions.arrow_forwardWhich of the following does NOT accurately describe the requirements to apply relative valuation? a. The market value of the comps should be available. b. The valuation object should be compared with similar firms, preferably in industry, size, market and other measures. c. The market value of the valuation object should be available. d. The prices of the comps should be standardized, meaning a price ratio instead of the absolute price value should be compared.arrow_forward

- In vertical analysis, the relevant base for cost of goods sold is which of the following? Multiple Choice Sales revenue Total credit sales Total assets Total stockholders’ equityarrow_forwardUse the following information to answer the questions that follow. A. Calculate the operating income percentage for each of the stores. Comment on how your analysis has changed for each store. B. Perform a vertical analysis for each store. Based on your analysis, what accounts would you want to investigate further? How might management utilize this information? C. Which method of analysis (using a dollar value or percentage) is most relevant and/or useful? Explain.arrow_forwardIn the percentage of sales approach of financial forecasting, the balancing of assets and liabilities sides in a pro forma statement of financial position is achieved by the use of a _______ variable. Multiple Choice Slug. Chug. Balancing. Glug. Plugarrow_forward

- How should you compute the number that appears as "cost of good sold" in a common-size income statement?arrow_forwarda) Based on the information provided, calculate the operating income in good format. Show all calculations. b) Calculate the individual and net Growth Component. c) Calculate the individual and net Price Recovery. d) Calculate the Productivity Component e) Show the reconciliation of the Operating Incomearrow_forwardUsing the average multiples for P/E, P/B and P/S, which company will you buy? Show computations to support your decision.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning - Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

What is WACC-Weighted average cost of capital; Author: Learn to invest;https://www.youtube.com/watch?v=0inqw9cCJnM;License: Standard YouTube License, CC-BY