Concept explainers

Integrating Case 9–3

FIFO and lower of cost or net realizable value

• LO9–1

York Co. sells one product, which it purchases from various suppliers. York’s

| Sales (33,000 units @ $16) | $528,000 |

| Sales discounts | 7,500 |

| Purchases | 368,900 |

| Purchase discounts | 18,000 |

| Freight-in | 5,000 |

| Freight-out | 11,000 |

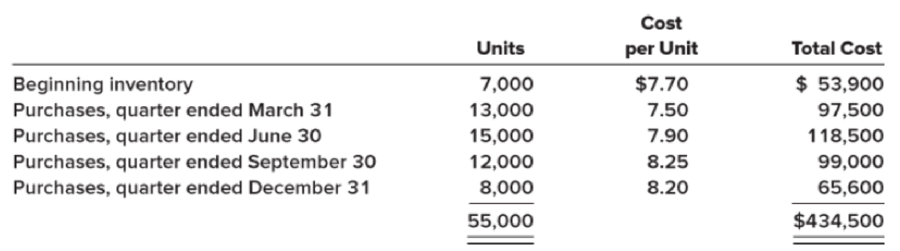

York Co.’s inventory purchases during 2018 were as follows:

Additional Information:

a. York’s accounting policy is to report inventory in its financial statements at the lower of cost or net realizable value, applied to total inventory. Cost is determined under the first-in, first-out (FIFO) method.

b. York has determined that, at December 31, 2018, the net realizable value was $8.00 per unit.

Required:

1. Prepare York’s schedule of cost of goods sold, with a supporting schedule of ending inventory. York includes inventory write-down losses in cost of goods sold.

2. Explain the rule of lower of cost or net realizable value and its application in this situation.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Intermediate Accounting

- EA5. LO 12.3During the current year, Sokowski Manufacturing earned income of $350,000 from total sales of $5,500,000 and average capital assets of $12,000,000. What is the sales margin?arrow_forwardQ.10 During the last accounting period, Carla vista corporation sold 96000 units at $45 each…arrow_forwardCH7-Q50: Hi I have asked this question before, but i haven't received explanation on requirement # 3. Also, last question was not answered. Please answer #6 (last question) and fully explain # 3. thanks! Jellico Inc.'s projected operating income (based on sales of 450,000 units) for the coming year is as follows: Total Sales $ 12,150,000 Total variable cost 7,533,000 Contribution margin $ 4,617,000 Total fixed cost 2,875,878 Operating income $ 1,741,122 Required: 1(a). Compute variable cost per unit. Enter your answer to the nearest cent.$per unit 1(b). Compute contribution margin per unit. Enter your answer to the nearest cent.$per unit 1(c). Compute contribution margin ratio. % 1(d). Compute break-even point in units. units 1(e). Compute break-even point in sales dollars.$ 2. How many units must be sold to earn operating income of $376,542? units 3. Compute the additional operating income that Jellico would earn if sales were $50,000 more than expected.$ 4. For…arrow_forward

- Q.15 Crane company sells its product for $7100 per unit…arrow_forward41. LO.2 (Identification of inventory costs) Tyler Tubing’s management has been evalu- ating company policies with respect to control of costs of corrugated metal, one of the firm’s major component materials. The firm’s controller has gathered the following financial data, which may be pertinent to controlling costs associated with the metal tubing: Ordering Costs Annual salary of purchasing department manager $61,500.00 Depreciation of equipment in purchasing…arrow_forwardHw.19. KitchenArt Co. usually purchases its mixer inventory from Johnson Company every quarter and each quarter KitchenArt purchases 500 mixers. Johnson's whole sale price for each mixer is $35. On November 15, 2014, KitchenArt received an offer from Allison Company who offered $25 for each mixer if KitchenArt purchases 2,000 mixers or more from Allison. KitchenArt still had 1,000 mixer in its inventory on November 15, 2014. Which of the following statement is NOT true? Johnson is KitchenArt's usual supplier. KitchenArt does not need to write down its ending inventory. The $25 price cannot be regarded as the market price for the mixer. KitchenArt should write down its ending inventory according to LOCMarrow_forward

- EXERCISE 5–11 Missing Data; Basic CVP Concepts [LO5–1, LO5–9] Fill in the missing amounts in each of the eight case situations below. Each case is independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format income statement for each case, enter the known data, and then compute the missing items.) a. Assume that only one product is being sold in each of the four following case situations: {picture11} b. Assume that more than one product is being sold in each of the four following case situations: {picture12}arrow_forwardhw5 q7 Lightening Bulk Company is a moving company specializing in transporting large items worldwide. The firm has an 85% on-time delivery rate. Thirteen percent of the items are misplaced and the remaining 2% are lost in shipping. On average, the firm incurs an additional $67 per item to track down and deliver misplaced items. Lost items cost the firm about $340 per item. Last year, the firm shipped 6,720 items with an average freight bill of $224 per item shipped. The firm’s manager is considering investing in a new scheduling and tracking system costing $152,000 per year. The new system is expected to reduce misplaced items to 1% and lost items to 0.50%. Furthermore, the firm expects total sales to increase by 10% with the improved service. The average contribution margin ratio on any increased sales volume, after cost savings associated with a reduction in misplaced and lost items, is expected to be 37.5%. Required: 1b. What is the estimated change in pretax cash flow…arrow_forwardCh. 8 Quesiton 6 (a) Please solve and explain the following problem: Shadee Corp. expects to sell 600 sun visors in May and 800 in June. Each visor sells for $18. Shadee’s beginning and ending finished goods inventories for May are 75 and 50 units, respectively. Ending finished goods inventory for June will be 60 units. Each visor requires a total of $4.00 in direct materials that includes an adjustable closure that the company purchases from a supplier at a cost of $1.50 each. Shadee wants to have 30 closures on hand on May 1, 20 closures on May 31 and 25 closures on June 30 and variable manufacturing overhead is $1.25 per unit produced. Suppose that each visor takes 0.30 direct labor hours to produce and Shadee pays its workers $9 per hour. Required: 1. Determine Shadee’s budgeted manufacturing cost per visor. (Note: Assume that fixed overhead per unit is $2.) (Round your answer to 2 decimal places.) 2. Determine Shadee's budgeted cost of goods sold for May and June. (Do not round…arrow_forward

- Question 10: • Problem • Amazon Co, Inc (AMZN) has an Enterprise Value of $18.7 billion. • AMZN’s Enterprise Value to Sales ratio is 0.40 versus 1.65 for peers, while their Enterprise Value to EBITDA ratio is 6.5 versus 15.7 for peers. • Is Amazon underpriced or overpriced compared to its peers?arrow_forwardExercise 6-14 (Algo) Calculate inventory using lower of cost and net realizable value (LO6-6) [The following information applies to the questions displayed below.] A company like Golf USA that sells golf-related inventory typically will have inventory items such as golf clothing and golf equipment. As technology advances the design and performance of the next generation of drivers, the older models become less marketable and therefore decline in value. Suppose that in the current year, Ping (a manufacturer of golf clubs) introduces the MegaDriver II, the new and improved version of the MegaDriver. Below are year-end amounts related to Golf USA’s inventory. Inventory Quantity Unit Cost Unit NRV Shirts 38 $55 $73 MegaDriver 18 390 330 MegaDriver II 33 410 450 Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardEC 3 Q 2 Use this income statement to answer the following questions. Sales ($50 per unit) $5,000 Less: Cost of goods sold ($33 per unit) 3,300 Gross margin 1,700 Less operating expenses: Salaries $800 Advertising 400 Shipping ($2 per unit) 200 1,400 Operating Income $300 How many units would the company need to sell to earn $1,560 in net income if the tax rate is 20%? (Round answer to the nearest whole units.) Units required to meet targetarrow_forward

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning