Financial Accounting - Access

4th Edition

ISBN: 9781259958533

Author: SPICELAND

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 9.5AP

Understand a bond amortization schedule (LO9–6)

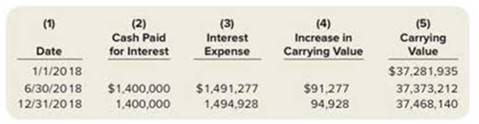

On January 1, 2018, Vacation Destinations issues $40 million of bonds that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below:

Required:

1. Were the bunds issued at face amount, a discount, or a premium?

2. What is the original issue price of the bonds?

3. What is the face amount of the bonds?

4. What is the stated annual interest rate?

5. What is the market annual interest rate?

6. What is the total cash paid for interest assuming the bonds mature in 10 years?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

At December 31, 2018, Newman Engineering’s liabilities include the following:1. $10 million of 9% bonds were issued for $10 million on May 31, 1999. The bonds mature on May 31, 2029,but bondholders have the option of calling (demanding payment on) the bonds on May 31, 2019. However,the option to call is not expected to be exercised, given prevailing market conditions.2. $14 million of 8% notes are due on May 31, 2022. A debt covenant requires Newman to maintain currentassets at least equal to 175% of its current liabilities. On December 31, 2018, Newman is in violation of thiscovenant. Newman obtained a waiver from National City Bank until June 2019, having convinced the bankthat the company’s normal 2 to 1 ratio of current assets to current liabilities will be reestablished during thefirst half of 2019.3. $7 million of 11% bonds were issued for $7 million on August 1, 1989. The bonds mature on July 31, 2019.Sufficient cash is expected to be available to retire the bonds at…

On January 1, 2021, Nell issued 600,000 in non-interest-bearing bonds that mature on January 1, 2041. The bonds pay no interest during the period of time they are outstanding interest rate for borrowing with a similar risk and maturity is 12% and the bonds are priced to yield accordingly. What is interest expense in 2022?

a. $0

b. 62,202

c. 7,464

d. 8,360

Hi, I'm stuck on these questions. I need explanations, thanks.

On January 1, 2021, Vacation Destinations issues $37 million of bonds that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below:

(1)

(2)

(3)

(4)

(5)

Cash Paid

Interest

Increase in

Carrying

Date

for Interest

Expense

Carrying Value

Value

1/1/2021

$

34,485,790

6/30/2021

$

1,295,000

$

1,379,432

$

84,432

34,570,222

12/31/2021

1,295,000

1,382,809

87,809

34,658,031

What is the original issue price of the bonds?

What is the stated annual interest rate?

What is the market annual interest rate?

What is the total cash paid for interest assuming the bonds mature in 10 years?

Chapter 9 Solutions

Financial Accounting - Access

Ch. 9 - What is capital structure? How do the capital...Ch. 9 - Prob. 2RQCh. 9 - How do interest expense and the carrying value of...Ch. 9 - Prob. 4RQCh. 9 - What are bond issue costs? What is an underwriter?Ch. 9 - Why do some companies issue bonds rather than...Ch. 9 - Prob. 7RQCh. 9 - What are convertible bonds? How do they benefit...Ch. 9 - How do we calculate the issue price of bonds? Is...Ch. 9 - Prob. 10RQ

Ch. 9 - If bonds issue at a discount, is the stated...Ch. 9 - Prob. 12RQCh. 9 - Prob. 13RQCh. 9 - Prob. 14RQCh. 9 - 15.If bonds issue at a discount, what happens to...Ch. 9 - Prob. 16RQCh. 9 - Prob. 17RQCh. 9 - Prob. 18RQCh. 9 - 19.If bonds with a face value of 250,000 and a...Ch. 9 - Prob. 20RQCh. 9 - Prob. 9.1BECh. 9 - Prob. 9.2BECh. 9 - Calculate the issue price of bonds (LO95) Ultimate...Ch. 9 - Calculate the issue price of bonds (LO95) Ultimate...Ch. 9 - Calculate the issue price of bonds (LO95) Ultimate...Ch. 9 - Prob. 9.6BECh. 9 - Prob. 9.7BECh. 9 - Prob. 9.8BECh. 9 - Prob. 9.9BECh. 9 - Record bond issue and related annual interest...Ch. 9 - Record bond issue and related annual interest...Ch. 9 - Prob. 9.12BECh. 9 - Prob. 9.13BECh. 9 - Prob. 9.14BECh. 9 - Prob. 9.15BECh. 9 - Prob. 9.16BECh. 9 - Prob. 9.17BECh. 9 - Calculate ratios (LO98) Surfs Up, a manufacturer...Ch. 9 - Prob. 9.1ECh. 9 - Prob. 9.2ECh. 9 - Compare operating and capital teasel (LO93, LO98)...Ch. 9 - listed below are terms and definitions associated...Ch. 9 - Prob. 9.5ECh. 9 - Prob. 9.6ECh. 9 - Prob. 9.7ECh. 9 - Prob. 9.8ECh. 9 - Prob. 9.9ECh. 9 - Prob. 9.10ECh. 9 - Prob. 9.11ECh. 9 - Prob. 9.12ECh. 9 - Prob. 9.13ECh. 9 - Prob. 9.14ECh. 9 - Prob. 9.15ECh. 9 - Prob. 9.16ECh. 9 - Prob. 9.17ECh. 9 - Prob. 9.18ECh. 9 - (LO92, LO98) On January 1, 2018, the general...Ch. 9 - Record and analyze installment notes (LO92) On...Ch. 9 - Explore the impact of leases on the debt to equity...Ch. 9 - Prob. 9.3APCh. 9 - Prob. 9.4APCh. 9 - Understand a bond amortization schedule (LO96) On...Ch. 9 - Prob. 9.6APCh. 9 - Calculate and analyze ratios (LO98) Selected...Ch. 9 - Prob. 9.1BPCh. 9 - Explore the impact of leases on the debt to equity...Ch. 9 - Prob. 9.3BPCh. 9 - Prob. 9.4BPCh. 9 - Prob. 9.5BPCh. 9 - Prob. 9.6BPCh. 9 - Calculate and analyze ratios (LO98) Selected...Ch. 9 - Prob. 9.1APCPCh. 9 - Prob. 9.2APFACh. 9 - The Buckle, Inc. Financial information for Buckle...Ch. 9 - American Eagle Outfitters, Inc., vs. The Buckle,...Ch. 9 - Ethics The Tony Hawk Skate Park was built in early...Ch. 9 - Prob. 9.7APWCCh. 9 - Prob. 9.8APEM

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Stone Energy Corporation’s 7.5% bonds due in 2022 were reported as selling for 82.95. Were the bonds selling at a premium or at a discount? Why is Stone Energy Corporation able to sell its bonds at this price?arrow_forwardOn January 1, 2021, Jackie Company issued P8,000,000 8% eight-year bonds. Similar bonds had an effective rate of 8.8%. On yearend, the bonds had a market value quotation of 88. Jackie opted to measure the bonds at fair value. How much is the net effect of bonds on the 2021 Statement of Comprehensive Income? [Indicate whether it is a gain or loss] How much is the discount/premium amortization during 2022? [Indicate whether it is a discount or premium]arrow_forwardGordon Corporation issued $700,000 par value 2% 5 year bonds on Jan 1 2019. The bonds mature on 12/31/23 and pay semi annual interest. The market rate on the date of issue is 4%. Gordon has elected to use the straight line method for discount amortization. What is the bond issue price for the Gordon bonds? A. $586,447 B. $637,122 C. $766,299 D. $700,000 The answer is B, how do you get that using Excel formulas rather than the tables?arrow_forward

- On January 1, 2024, an investor paid $299,000 for bonds with a face amount of $360,000. The contract rate of interest is 8% while the current market rate of interest is 10%. Using the effective interest method, how much interest income is recognized by the investor in 2025 (assume annual interest payments and amortization)? rev: 02_26_2021_QC_CS-252921• $30,010.• $30,160.• $29,900.• $28,204.arrow_forward7. On January 1, 2016, Giant Company issued an 8% callable bond which has a par value of $200,000 for $180,000. The bond is callable at 106 any time after January 1, 2020. One-half of the bond was called back on January 1, 2021 when the unamortized discount had a balance of $4,000. Compute the amount of the gain or loss when the bond was retired on January 1, 2021.arrow_forward4. On the first day of 2021, Applebaum issues $850 million of its 8% bonds for $786 million. The bonds were priced with an effective interest rate of 10%. Interest is payable semiannually on June 30 and December 31. Applebaum records interest at the effective rate and elected the fair value option. One million dollars of the increase in fair value was due to a change in the general rate of interest. The rest of the change in fair value is due to a change in credit risk. On December 31, 2021, the fair value of the bonds was $802 million as determined by their market value. Required:1. Prepare the journal entry to record interest on June 30, 2021 (the first interest payment).2. Prepare the journal entry to record interest on December 31, 2021 (the second interest payment).3. Prepare the journal entry to adjust the bonds to their fair value for presentation in the December 31, 2021, balance sheet.arrow_forward

- Temptation Vacations issues $60 million in bonds on January 1, 2021, that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below:Required:1. Were the bonds issued at face amount, a discount, or a premium?2. What is the original issue price of the bonds?3. What is the face amount of the bonds?4. What is the stated annual interest rate?5. What is the market annual interest rate?6. What is the total cash paid for interest assuming the bonds mature in 20 years?arrow_forwardHello, I just need help with requirements 5-7 please! On January 1, 2021, Labtech Circuits borrowed $136,500 from First Bank by issuing a three-year, 6% note, payable on December 31, 2023. Labtech wanted to hedge the risk that general interest rates will decline, causing the fair value of its debt to increase. Therefore, Labtech entered into a three-year interest rate swap agreement on January 1, 2021, and designated the swap as a fair value hedge. The agreement called for the company to receive payment based on an 6% fixed interest rate on a notional amount of $136,500 and to pay interest based on a floating interest rate tied to LIBOR. The contract called for cash settlement of the net interest amount on December 31 of each year. Floating (LIBOR) settlement rates were 6% at inception and 7%, 5%, and 5% at the end of 2021, 2022, and 2023, respectively. The fair values of the swap are quotes obtained from a derivatives dealer. Those quotes and the fair values of the note are as…arrow_forwardOn 2/1/2012, the Union Company issued an amount of 1,500,000 dinars in the form of bonds with a value of 10% due on December 31, 2021. Note that the interest rate in the market is 11%. Interest on the bonds is accrued annually at the end of each year 12/31. The bond carries a callable bound, and the company decided to use the real interest method to amortize the difference between the bond interest rate and the market price, and on 1/2/2015, Al-Ittihad decided to call the bond (pay the bond value) at 1,010,000 dinars of the face value for bonds.Required:(A) Determining the price of Union Company bonds when they are issued on 2/1/2012.(B) Determining the book value of the bond in 2016. (Through the amortization schedule for the period 2012-2016 or using the formula)(C) Preparing the journal entries for the bond payment on 2/1/2015.arrow_forward

- 3) On August 6, 2023, the Bank of Mexico (BANXICO) placed bonds with a nominal value of 10 pesos for 120 days and at a simple discount rate of 3.57% annually. What was the rate of return obtained by bonds buyers? options: 5.32 8.74 1.05 3.61arrow_forward62. On January 1, 2021, M&M company purchased P1,000,000, 12% bonds for P1,065,000, a price that yields 10%. The bonds pay interest semi-annually every January 1and July 1. On December 31, 2021, each bond is selling at P1,055. If the debt investments are classified as at amortized cost, what is the carrying value of the debt investment reported at December 31, 2021? A.P1,051,163B.P1,000,000C.P1,065,000D.P1,055,000arrow_forward2. On December 31,2020, what amount should be recorded as discount or premium on bonds payable? A. 170,000 discount B. 450,000 premium C. 450,000 discount D. 800,000 discount E. None of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License