Concept explainers

Problems Group B

P9-65B Comprehensive budgeting problem (Learning Objectives 2 & 3)

Conrad Manufacturing is preparing its

| Current assets as of December 31 (prior year): | |

| Cash | $ 4.460 |

| $ 49,000 | |

| Inventory | $ 15,600 |

| Property, plant, and equipment, net | $121,500 |

| Accounts payable | $ 43,000 |

| Capital stock | $127,000 |

| $ 22,800 |

- a. Actual sales in December were $76,000. Selling price per unit is projected to remain stable at $9 per unit throughout the budget period. Sales for the first five months of the upcoming year are budgeted to be as follows:

| January | $80,100 |

| February | $89,100 |

| March | $82,800 |

| April | $85,500 |

| May | $77,400 |

- b. Sales are 30% cash and 70% credit. All credit sales are collected in the month following the sale.

- c. Conrad Manufacturing has a policy stating that each month’s ending inventory of finished goods should be 10% of the following month’s sales (in units).

- d. Of each month’s direct materials purchases, 20% are paid for in the month of purchase, while the remainder is paid for in the month following purchase. Two pounds of direct material is needed per unit at $1.50 per pound. Ending inventory of direct materials should be 20% of next month’s production needs.

- e. Most of the labor at the manufacturing facility is indirect, but there is some direct labor incurred. The direct labor hours per unit is 0.03. The direct labor rate per hour is $13 per hour. All direct labor is paid for in the month in which the work is performed. The direct labor total cost for each of the upcoming three months is as follows:

| January | $3,510 |

| February | $3,834 |

| March | $3,600 |

- f. Monthly manufacturing overhead costs are $6,500 for factory rent, $2,900 for other fixed manufacturing expenses, and $1.40 per unit for variable manufacturing overhead. No

depreciation is included in these figures. All expenses are paid in the month in which they are incurred. - g. Computer equipment for the administrative offices will be purchased in the upcoming quarter. In January, the company will purchase equipment for $5,800 (cash), while February’s cash expenditure will be $11,600 and March’s cash expenditure will be $15,800.

- h. Operating expenses are budgeted to be $1.20 per unit sold plus fixed operating expenses of $1,400 per month. All operating expenses are paid in the month in which they are incurred. No depreciation is included in these figures.

- i. Depreciation on the building and equipment for the general and administrative offices is budgeted to be $4,900 for the entire quarter, which includes depreciation on new acquisitions.

- j. Conrad Manufacturing has a policy that the ending cash balance in each month must be at least $4,400. The company has a line of credit with a local bank. It can borrow in increments of $1,000 at the beginning of each month, up to a total outstanding loan balance of $160,000. The interest rate on these loans is 1% per month simple interest (not compounded). The company would pay down on the line of credit balance in increments of $1,000 if it has excess funds at the end of the quarter. The company would also pay the accumulated interest at the end of the quarter on the funds borrowed during the quarter.

- k. The company’s income tax rate is projected to be 30% of operating income less interest expense. The company pays $10,800 cash at the end of February in estimated taxes.

Requirements

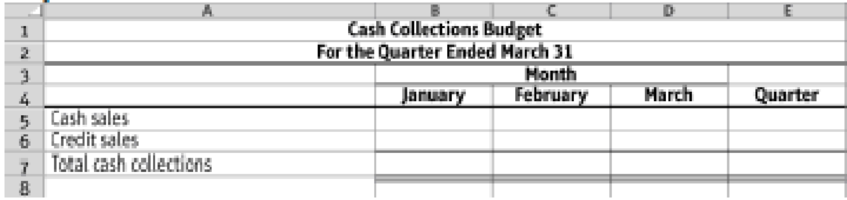

- 1. Prepare a schedule of cash collections for January, February, and March, and for the quarter in total.

9.5-60 Full Alternative Text

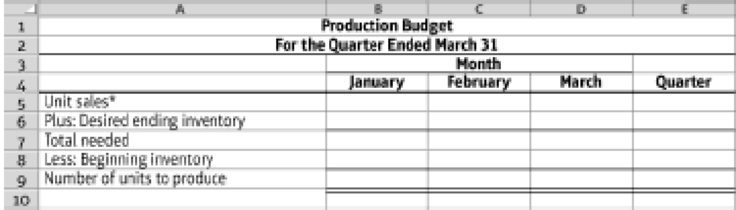

- 2. Prepare a production budget.

9.5-61 Full Alternative Text

*Hint: Unit sales = Sales in dollars/Selling price per unit

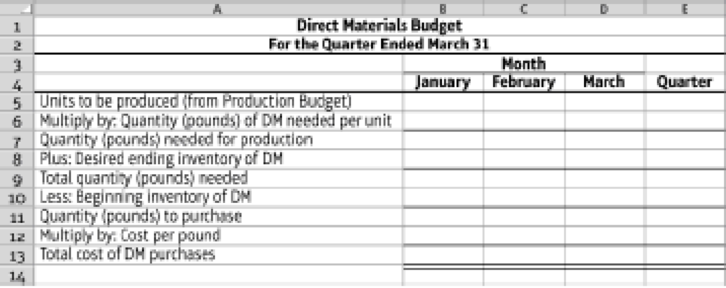

- 3. Prepare a direct materials budget.

9.5-62 Full Alternative Text

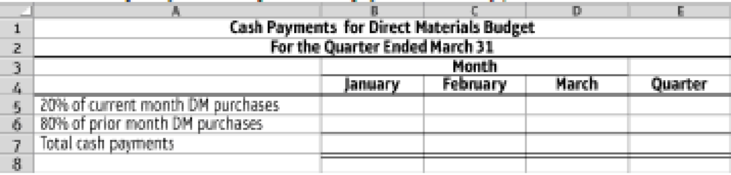

- 4. Prepare a cash payments budget for the direct material purchases from Requirement 3, using the following format. (Use the accounts payable balance at December 31 of prior year for the prior month payment in January.)

9.5-63 Full Alternative Text

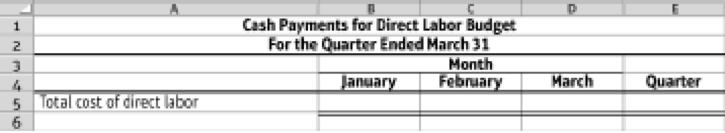

- 5. Prepare a cash payments budget for direct labor, using the following format:

9.5-64 Full Alternative Text

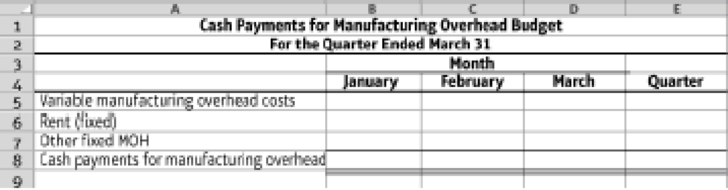

- 6. Prepare a cash payments budget for manufacturing overhead costs.

9.5-65 Full Alternative Text

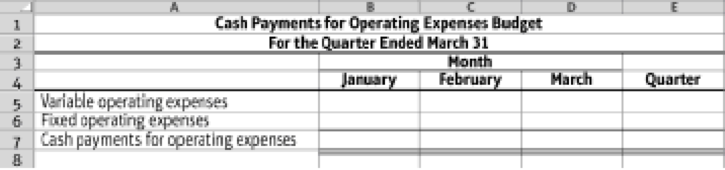

- 7. Prepare a cash payments budget for operating expenses.

9.5-66 Full Alternative Text

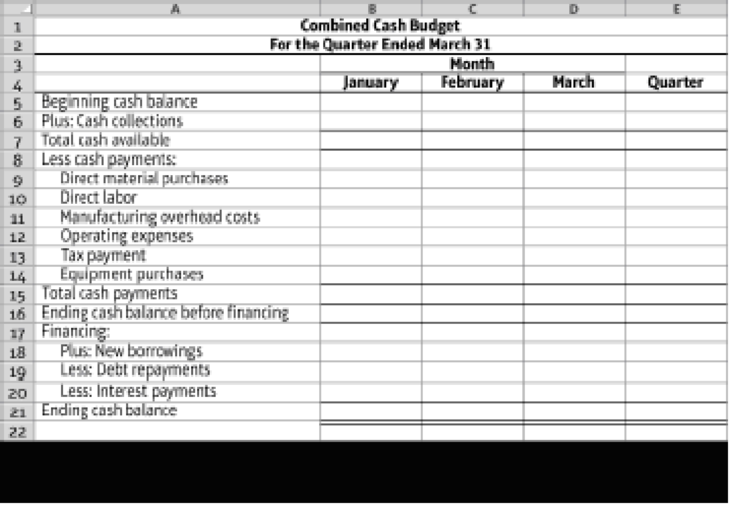

- 8. Prepare a combined

cash budget .

9.5-67 Full Alternative Text

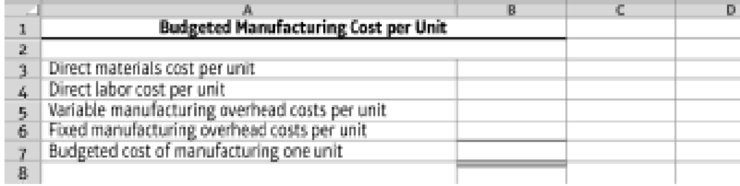

- 9. Calculate the budgeted

manufacturing cost per unit (assume that fixed manufacturing overhead is budgeted to be $0.70 per unit for the year).

9.5-68 Full Alternative Text

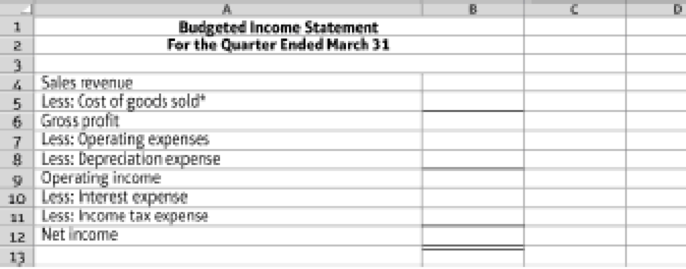

- 10. Prepare a

budgeted income statement for the quarter ending March 31.

9.5-69 Full Alternative Text

*Hint: Cost of goods sold = Budgeted cost of manufacturing one unit x Number of units sold

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Managerial Accounting Plus Mylab Accounting With Pearson Etext -- Access Card Package (5th Edition)

- ICE TASK 4 – Budgeting Techniques The University of Africa requires all second-year engineering students to have their own laptop computers to do practical work and tasks. During the last quarter of 2022, a private company, Laptops for Students Proprietary Limited (“LFS”) was established to supply laptops according to the specifications set by the university, at affordable prices. At that time, a loan of R800 000 was granted to LFS and the funds were deposited into the bank account. Prior to the receipt of the loan amount no cash transactions occurred. The following additional information is available for LFS: According to estimates, 200 of the 400 second year engineering students will buy their laptops from LFS. There are two types of laptops which will be supplied, namely Exceptional at a selling price of R10 000 and Superior at a selling price of R8 000. Since the Exceptional laptop has a more powerful hard drive, it is expected that 60% of the 200 students will prefer to…arrow_forwardApplying Excel: Master Budgeting Beech Corporation is a master budget for the 3rd quarter of the calendar year. The company’s balance sheet is shown below: June Corporation Balance Sheet June 30 Assets Cash $ 90,000 Accounts receivable 136,000 Inventory 62,000 Building + equipment, net of depreciation 210,000 Total assets $498,000 Liability and Stockholder’s Equity Accounts payable $ 71,100 Common stock 327,000 Retained earnings 99,900 Total liability and stockholder’s equity $498,000 Beech’s managers have made the following assumptions and estimates: Estimated sales for July, August, September, and October will be $210,000, $230,000, $220,000, and $240,000 respectively. All sales are credit and all credit sales are collected. (Note: there are no cash sales). Thirty-five percent (35%) the month’s credit sales are collected in the month the sales are made, and the remaining 65% is collected the…arrow_forwarda. Prepare a revenue budget for the upcoming academic year.b. Determine the number of staff needed to cover classes.c. Assume there is a shortage of full-time academic staff. List at least five actions thatSouth Hampton might take to accommodate the growing student numbers.arrow_forward

- Problem 07-4A Manufacturing: Preparation of a complete master budget LO P1, P2, P3 The management of Zigby Manufacturing prepared the following estimated balance sheet for March 2019. ZIGBY MANUFACTURINGEstimated Balance SheetMarch 31, 2019 Assets Cash $ 54,000 Accounts receivable 354,375 Raw materials inventory 100,495 Finished goods inventory 333,000 Total current assets 841,870 Equipment 628,000 Accumulated depreciation (164,000 ) Equipment, net 464,000 Total assets $ 1,305,870 Liabilities and Equity Accounts payable $ 212,195 Short-term notes payable 26,000 Total current liabilities 238,195 Long-term note payable 514,000 Total liabilities 752,195 Common stock 349,000 Retained earnings 204,675 Total stockholders’ equity 553,675 Total liabilities and equity $ 1,305,870 To prepare a master budget for April, May, and June…arrow_forward7-23A Compute breakeven and project income (Learning Objectives 1 & 2)Grover’s Steel Parts produces parts for the automobile industry. The company hasmonthly fixed expenses of $630,000 and a contribution margin of 70% of revenues.Requirements1. Compute Grover’s Steel Parts’ monthly breakeven sales in dollars.2. Use the contribution margin ratio to project operating income (or loss) if revenues are$520,000 and if they are $1,010,000.3. Do the results in Requirement 2 make sense given the breakeven sales you computedin Requirement 1? Explain.arrow_forwardRelevant data from the Poster Company’s operating budgets are: Quarter 1 Quarter 2 Sales $208,470 $211,539 Direct material purchases 115,290 120,832 Direct labor 75,205 73,299 Manufacturing overhead 25,400 25,400 Selling and administrative expenses 33,400 33,400 Depreciation included in selling and administrative 1,400 1,100 Collections from customers 215,391 240,154 Cash payments for purchases 114,300 119,253 Additional data:Capital assets were sold in January for $9,000 and $4,600 in May.Dividends of $4,400 were paid in February. The beginning cash balance was $60,359 and a required minimum cash balance is $58,000. Use this information to prepare a cash budget for the first two quarters of the year: If an amount box does not require an entry, leave it blank. The Poster Company Cash Budget For the First Two Quarters Quarter 1 Quarter 2 Beginning Cash Balance $fill in the blank 2 $fill in the blank 3 Add: Cash Receipts Collections from…arrow_forward

- Please prepare a consolidated budget pivot table in Excel by budget class and year. Please upload your excel document. Budget Class – Staff Costs • Salary of the Project Manager @ USD 5,000 per month. • Salary of the Admin Finance Officer @ USD 3,500 per month. • Salary of Admin. & Finance Assistant @USD 1,000 per month • Salary of Driver @USD 500 per month Budget Class – Equipment & Furniture Cost of the office equipment and furniture required for the project is USD 30,000 for three years to be procured during the 1st year of the project. Budget Class – Operating Costs (training) Two trainers are required for each training. Each training lasts for 5 days. The total number of participants for each training is 30. • DSA/ ticket cost of each participant @ USD1, 000 per training. • Total number of 5-day trainings planned for each year is 4. • Fee for Trainer @ USD 2,000 per training. • Cost of logistic arrangements for each training @ USD 10,000. In addition to the main direct…arrow_forward2. Direct Labor Budget for Service The School of Accounting (SOA) at State University is planning its annual fundraising campaign for accounting alumni. This year, the SOA is planning a call-a-thon and will ask Beta Alpha Psi members to volunteer to make phone calls to a list of 7,000 alumni. The Dean's office has agreed to let Beta Alpha Psi use their offices from 6 p.m. to 9 p.m. each weekday so that they will have access to phones. Each volunteer will be provided with a phone and a script with an introduction and suggested responses to various questions that had been asked in the past. Carol Johnson, Beta Alpha Psi faculty advisor, estimates the following: Of the 7,000 phone numbers, roughly 10 percent will be wrong numbers (because alumni change addresses and phone numbers without updating State University). In that case, the student is instructed to apologize to the answering party, hang up, and move on to the next phone number. Each of these calls takes about three minutes.…arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year. The company’s balance sheet as of June 30th is shown below: Beech Corporation Balance Sheet June 30 Assets Cash $ 76,000 Accounts receivable 137,000 Inventory 86,100 Plant and equipment, net of depreciation 230,000 Total assets $ 529,100 Liabilities and Stockholders’ Equity Accounts payable $91,000 Common stock 312,000 Retained earnings 126,100 Total liabilities and stockholders’ equity $ 529,100 Beech’s managers have made the following additional assumptions and estimates: Estimated sales for July, August, September, and October will be $410,000, $430,000, $420,000, and $440,000, respectively. All sales are on credit and all credit sales are collected. Each month’s credit sales are collected 35% in the…arrow_forward

- Relevant data from the Poster Company’s operating budgets are: Quarter 1 Quarter 2 Sales $208,480 $211,540 Direct material purchases 115,295 120,832 Direct labor 75,210 73,298 Manufacturing overhead 25,400 25,400 Selling and administrative expenses 33,600 33,400 Depreciation included in selling and administrative 1,600 900 Collections from customers 215,393 240,156 Cash payments for purchases 114,295 119,254 Additional data:Capital assets were sold in January for $9,000 and $4,500 in May.Dividends of $4,600 were paid in February. The beginning cash balance was $60,359 and a required minimum cash balance is $59,000. Use this information to prepare a cash budget for the first two quarters of the year: If an amount box does not require an entry, leave it blank. The Poster CompanyCash BudgetFor the First Two Quartersarrow_forwardPlease answer the first 3 parts Problem 8-19 (Algo) Cash Budget; Income Statement; Balance Sheet [LO8-2, LO8-4, LO8-8, LO8-9, LO8-10] Minden Company is a wholesale distributor of premium European chocolates. The company’s balance sheet as of April 30 is given below: Minden CompanyBalance SheetApril 30 Assets Cash $ 9,200 Accounts receivable 76,250 Inventory 49,750 Buildings and equipment, net of depreciation 228,000 Total assets $ 363,200 Liabilities and Stockholders’ Equity Accounts payable $ 63,750 Note payable 23,900 Common stock 180,000 Retained earnings 95,550 Total liabilities and stockholders’ equity $ 363,200 The company is in the process of preparing a budget for May and has assembled the following data: Sales are budgeted at $227,000 for May. Of these sales, $68,100 will be for cash; the remainder will be credit sales. One-half of a month’s credit sales are collected in the month the sales are made, and the remainder is collected…arrow_forwardRelevant data from the Poster Company’s operating budgets are: Quarter 1 Quarter 2 Sales $208,480 $211,540 Direct material purchases 115,300 120,832 Direct labor 75,205 73,298 Manufacturing overhead 25,300 25,400 Selling and administrative expenses 33,400 33,500 Depreciation included in selling and administrative 1,500 900 Collections from customers 215,392 240,154 Cash payments for purchases 114,290 119,254 Additional data:Capital assets were sold in January for $10,000 and $4,400 in May.Dividends of $4,600 were paid in February. The beginning cash balance was $60,360 and a required minimum cash balance is $59,000. Use this information to prepare a cash budget for the first two quarters of the year: If an amount box does not require an entry, leave it blank. The Poster CompanyCash BudgetFor the First Two Quarters Quarter 1 Quarter 2 $Beginning Cash Balance $Beginning Cash Balance Add: Cash Receipts Collections from Customers…arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College