Concept explainers

Cash budgets under two alternatives (Learning Objectives 2 & 3)

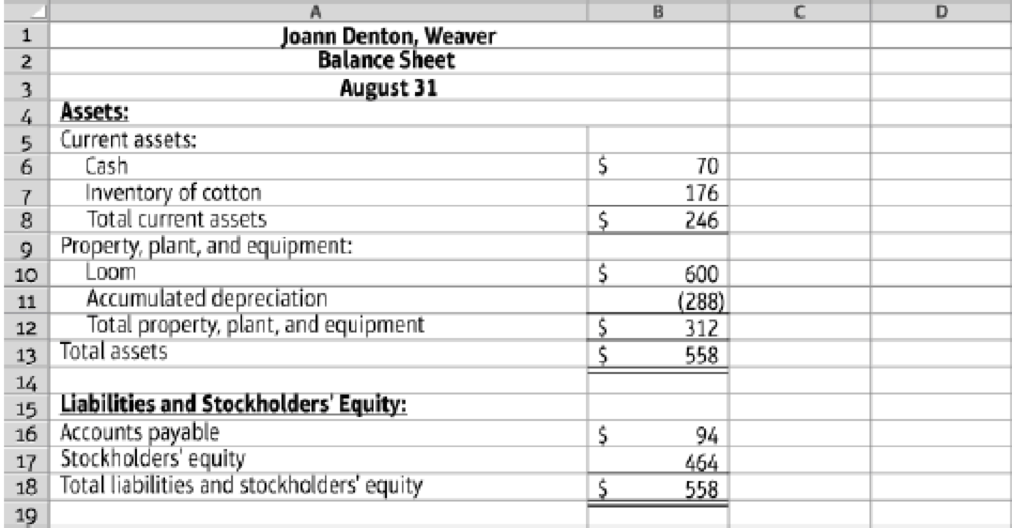

Each autumn, as a hobby, Joann Denton weaves cotton placemats to sell at a local craft shop. The mats sell for $20 per set of four mats. The shop charges a 15% commission and remits the net proceeds to Denton at the end of December. Denton has woven and sold 22 sets in each of the last two years. She has enough cotton in inventory to make another 22 sets. She paid $8 per set for the cotton. Denton uses a four-harness loom that she purchased for cash exactly two years ago. It is

Denton is considering buying an eight-harness loom so that she can weave more intricate patterns in linen. The new loom costs $1,000; it would be depreciated at $20 per month. Her bank has agreed to lend her $1,000 at 9% interest, with $200 principal plus accrued interest payable each December 31. Denton believes she can weave 10 linen place mat sets in time for the Christmas rush if she does not weave any cotton mats. She predicts that each linen set will sell for $40. Linen costs $5 per set. Denton’s supplier will sell her linen on credit, payable December 31.

Denton plans to keep her old loom whether or not she buys the new loom. The

9.5-70 Full Alternative Text

Requirements

- 1. Prepare a combined

cash budget for the four months ending December 31, for two alternatives: weaving the placemats in cotton using the existing loom and weaving the placemats in linen using the new loom. For each alternative, prepare abudgeted income statement for the four months ending December 31 and a budgeted balance sheet at December 31. - 2. On the basis of financial considerations only, what should Denton do? Give your reason.

9.6 What nonfinancial factors might Denton consider in her decision?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Managerial Accounting Plus Mylab Accounting With Pearson Etext -- Access Card Package (5th Edition)

- Direct Labor Budget for Service The School of Accounting (SOA) at State University is planning its annual fundraising campaign for accounting alumni. This year, the SOA is planning a call-a-thon and will ask Beta Alpha Psi members to volunteer to make phone calls to a list of 7,000 alumni. The Dean's office has agreed to let Beta Alpha Psi use their offices from 6 p.m. to 9 p.m. each weekday so that they will have access to phones. Each volunteer will be provided with a phone and a script with an introduction and suggested responses to various questions that had been asked in the past. Carol Johnson, Beta Alpha Psi faculty advisor, estimates the following: Of the 7,000 phone numbers, roughly 10 percent will be wrong numbers (because alumni change addresses and phone numbers without updating State University). In that case, the student is instructed to apologize to the answering party, hang up, and move on to the next phone number. Each of these calls takes about three minutes. Another…arrow_forwardAt the beginning of the school year, Katherine Malloy decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same as the fall tuition. The following information relates to the budget: Cash balance, September 1 (from a summer job) $7,180 Purchase season football tickets in September 100 Additional entertainment for each month 250 Pay fall semester tuition in September 3,900 Pay rent at the beginning of each month 350 Pay for food each month 200 Pay apartment deposit on September 2 (to be returned December 15) 500 Part-time job earnings each month (net of taxes) 890 a. Prepare a cash budget for September, October, November, and December. Enter all amounts as positive values except an overall cash decrease which should be indicated with a minus sign. b. Are the four monthly budgets that are presented prepared as static…arrow_forwardAt the beginning of the school year, Katherine Malloy decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same as the fall tuition. The following information relates to the budget: Cash balance, September 1 (from a summer job) $5,750 Purchase season football tickets in September 210 Additional entertainment for each month 275 Pay fall semester tuition in September 3,700 Pay rent at the beginning of each month 600 Pay for food each month 235 Pay apartment deposit on September 2 (to be returned December 15) 500 Part-time job earnings each month (net of taxes) 1,400 Are the four monthly budgets that are presented prepared as static budgets or flexible budgets?Static c. Malloy can see that her present plan will not provide sufficient cash. If Malloy did not budget but went ahead with the original plan, she would be $fill in…arrow_forward

- At the beginning of the school year, Katherine Malloy decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same as the fall tuition. The following information relates to the budget: Cash balance, September 1 (from a summer job) $5,750 Purchase season football tickets in September 210 Additional entertainment for each month 275 Pay fall semester tuition in September 3,700 Pay rent at the beginning of each month 600 Pay for food each month 235 Pay apartment deposit on September 2 (to be returned December 15) 500 Part-time job earnings each month (net of taxes) 1,400 a. Prepare a cash budget for September, October, November, and December. Enter all amounts as positive values except an overall cash decrease which should be indicated with a minus sign. Katherine MalloyCash BudgetFor the Four Months Ending December 31…arrow_forwardAt the beginning of the school year, Katherine Malloy decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same as the fall tuition. The following information relates to the budget: Cash balance, September 1 (from a summer job) $7,650 Purchase season football tickets in September 100 Additional entertainment for each month 270 Pay fall semester tuition in September 4,100 Pay rent at the beginning of each month 370 Pay for food each month 210 Pay apartment deposit on September 2 (to be returned December 15) 500 Part-time job earnings each month (net of taxes) 950 Question Content Area a. Prepare a cash budget for September, October, November, and December. Enter all amounts as positive values except an overall cash decrease which should be indicated with a minus sign. KATHERINE MALLOYCash BudgetFor the Four Months…arrow_forwardShawnTech is a for-profit vocational school. The school bases its budgets on two measures of activity (i.e., cost drivers), namely student and course. The school uses the following data in its budgeting: Fixed element per month variable element per student variable element per course revenue $0 $354 $0 faculty wages $0 $0 $2,300 course supplies $0 $48 $40 administrative expenses $41,700 $13 $21 In October, the school budgeted for 1,400 students and 127 courses. The actual activity for the month was 1,500 students and 129 courses. Prepare a report showing the school's activity variances for October. Label each variance as favorable (F) or unfavorable (U).arrow_forward

- At the beginning of the school year, Katherine Malloy decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same as the fall tuition. The following information relates to the budget: Cash balance, September 1 (from a summer job) $9,060 Purchase season football tickets in September 120 Additional entertainment for each month 310 Pay fall semester tuition in September 4,900 Pay rent at the beginning of each month 440 Pay for food each month 250 Pay apartment deposit on September 2 (to be returned December 15) 600 Part-time job earnings each month (net of taxes) 1,120 a. Prepare a cash budget for September, October, November, and December. Enter all amounts as positive values except an overall cash decrease which should be indicated with a minus sign. KATHERINE MALLOYCash BudgetFor the Four Months Ending December 31…arrow_forwardRoberds Tech is a for-profit vocational school. The school bases its budgets on two measures of activity (i.e., cost drivers), namely student and course. The school uses the following data in its budgeting: Fixed element per month Variable element per student Variable element per course Revenue $ 0 $ 298 $ 0 Faculty wages $ 0 $ 0 $ 3,100 Course supplies $ 0 $ 52 $ 40 Administrative expenses $ 26,500 $ 27 $ 52 In March, the school budgeted for 1,910 students and 88 courses. The school's income statement showing the actual results for the month appears below: Roberds Tech Income Statement For the Month Ended March 31 Actual students 1,810 Actual courses 91 Revenue $ 411,340 Expenses: Faculty wages 214,950 Course supplies 62,590 Administrative expenses 84,562 Total expense 362,102 Net operating income $ 49,238 Required: Prepare a flexible budget performance report showing both the school's activity variances and revenue and spending…arrow_forwardAt the beginning of the school year, Katherine Malloy decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same as the fall tuition. The following information relates to the budget: Cash balance, September 1 (from a summer job) $6,540 Purchase season football tickets in September 90 Additional entertainment for each month 230 Pay fall semester tuition in September 3,500 Pay rent at the beginning of each month 320 Pay for food each month 180 Pay apartment deposit on September 2 (to be returned December 15) 500 Part-time job earnings each month (net of taxes) 810 a. Prepare a cash budget for September, October, November, and December. Enter all amounts as positive values except an overall cash decrease which should be indicated with a minus sign. KATHERINE MALLOY Cash Budget For the Four Months Ending December…arrow_forward

- Personal Budget At the beginning of the school year, Katherine Malloy decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same as the fall tuition. The following information relates to the budget: Cash balance, September 1 (from a summer job) $8,680 Purchase season football tickets in September 120 Additional entertainment for each month 300 Pay fall semester tuition in September 4,700 Pay rent at the beginning of each month 420 Pay for food each month 240 Pay apartment deposit on September 2 (to be returned December 15) 600 Part-time job earnings each month (net of taxes) 1,080 a. Prepare a cash budget for September, October, November, and December. Enter all amounts as positive values except an overall cash decrease which should be indicated with a minus sign. KATHERINE MALLOY Cash Budget For the Four Months Ending…arrow_forwardPersonal Budget At the beginning of the school year, Katherine Malloy decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same as the fall tuition. The following information relates to the budget: Cash balance, September 1 (from a summer job) $8,860 Purchase season football tickets in September 120 Additional entertainment for each month 310 Pay fall semester tuition in September 4,800 Pay rent at the beginning of each month 430 Pay for food each month 240 Pay apartment deposit on September 2 (to be returned December 15) 600 Part-time job earnings each month (net of taxes) 1,100 a. Prepare a cash budget for September, October, November, and December. Enter all amounts as positive values except an overall cash decrease which should be indicated with a minus sign. KATHERINE MALLOY Cash Budget For the Four…arrow_forwardPersonal Budget At the beginning of the school year, Katherine Malloy decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same as the fall tuition. The following information relates to the budget: Cash balance, September 1 (from a summer job) $5,750 Purchase season football tickets in September 210 Additional entertainment for each month 275 Pay fall semester tuition in September 3,700 Pay rent at the beginning of each month 600 Pay for food each month 235 Pay apartment deposit on September 2 (to be returned December 15) 500 Part-time job earnings each month (net of taxes) 1,400 a. Prepare a cash budget for September, October, November, and December. Enter all amounts as positive values except an overall cash decrease which should be indicated with a minus sign. Katherine Malloy Cash Budget For the Four…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education