a.

To determine: The betas for the stocks

Introduction: Systematic risk is also known as volatility or non- diversifiable risk. It is the risk that is assumed by everyone before investing in a market. This kind of risk is unpredictable.

a.

Answer to Problem 9PS

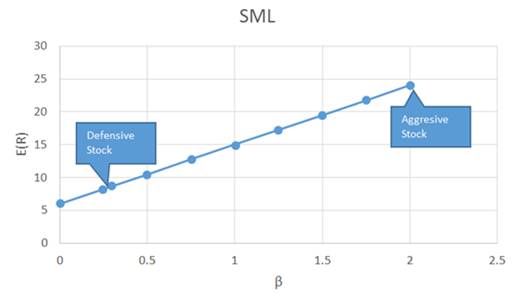

The beta value for aggressive and defensive stock is 2.00 and 0.30 respectively

Explanation of Solution

Given Information: Market return, aggressive stock and the defensive stock is given

Beta measures an investment’s volatility as it correlates to market volatility. When beta value more than 1, it means the investment has more systematic risk than the market. If beta less than 1, it means less systematic risk. When beta equals to 0, the investment has same systematic risk as the market.

So, the beta value is 2.00 and 0.30 for aggressive and defensive stock respectively.

b.

To determine: The expected

Introduction: Systematic risk is also known as volatility or non- diversifiable risk. It is the risk that is assumed by everyone before investing in a market. This kind of risk is unpredictable.

b.

Answer to Problem 9PS

The expected rate of return for aggressive stock and for the defensive stock is 18% and 9% respectively.

Explanation of Solution

Given Information: Market return, aggressive stock and the defensive stock is given

The

Calculation of expected rate of return (Aggressive Stock),

By substituting the value of 2% and 38%,

The expected rate of return (aggressive stock) is 18%

Calculation of expected rate of return (Defensive Stock),

The expected rate of return (Defensive stock) is 9%

c.

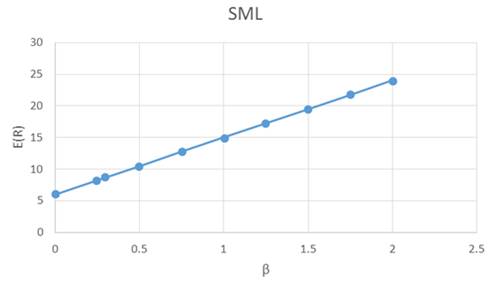

To determine: The SML for the economy

Introduction: Systematic risk is also known as volatility or non- diversifiable risk. It is the risk that is assumed by everyone before investing in a market. This kind of risk is unpredictable.

c.

Answer to Problem 9PS

The SML for the economy is shown in the graph

Explanation of Solution

Given Information: Market return, aggressive stock and the defensive stock is given

The capital asset pricing model describes the expected return on beta based security. This model is used for determine the expected return on asset, which is based on systematic risk.

The expected rate of return of each stock,

Now substituting the value of Expected rate of return on market,

So, SML is,

The SML with the market return in the graph is,

d.

To determine: The alphas of each stock

Introduction: Systematic risk is also known as volatility or non- diversifiable risk. It is the risk that is assumed by everyone before investing in a market. This kind of risk is unpredictable.

d.

Answer to Problem 9PS

The alpha of defensive stock is 8.7% and for the aggressive stock is (-6%)

Explanation of Solution

Given Information: Market return, aggressive stock and the defensive stock is given

The capital asset pricing model describes the expected return on beta based security. This model is used for determine the expected return on asset, which is based on systematic risk.

The stocks on SML graph,

Calculation of alpha value for defensive stock,

Calculation of alpha value for aggressive stock,

So, the value of alpha is (-6%) for aggressive stock

e.

To determine: The hurdle rate used by the management for a project

Introduction: Systematic risk is also known as volatility or non- diversifiable risk. It is the risk that is assumed by everyone before investing in a market. This kind of risk is unpredictable.

e.

Answer to Problem 9PS

8.7% is the hurdle rate for the project

Explanation of Solution

Given Information: Market return, aggressive stock and the defensive stock is given

The capital asset pricing model describes the expected return on beta based security. This model is used for determine the expected return on asset, which is based on systematic risk.The hurdle rate can be calculated by the beta value of the project. The hurdle rate is the expected rate of return for the defensive stock.

Calculate the discount rate for the project,

By substituting the value of expected rate of market and beta value,

So, the hurdle rate is 8.7%

Want to see more full solutions like this?

Chapter 9 Solutions

UPENN LOOSE-LEAF INVESTMENTS

- You have observed the following returns over time: Assume that the risk-free rate is 6% and the market risk premium is 5%. What are the betas of Stocks X and Y? What are the required rates of return on Stocks X and Y? What is the required rate of return on a portfolio consisting of 80% of Stock X and 20% of Stock Y?arrow_forwardAn analyst has modeled the stock of a company using the Fama-French three-factor model. The market return is 10%, the return on the SMB portfolio (rSMB) is 3.2%, and the return on the HML portfolio (rHML) is 4.8%. If ai = 0, bi = 1.2, ci = 20.4, and di = 1.3, what is the stock’s predicted return?arrow_forwardSecurity A has an expected rate of return of 6%, a standard deviation of returns of 30%, a correlation coefficient with the market of −0.25, and a beta coefficient of −0.5. Security B has an expected return of 11%, a standard deviation of returns of 10%, a correlation with the market of 0.75, and a beta coefficient of 0.5. Which security is more risky? Why?arrow_forward

- Calculate the correlation coefficient between Blandy and the market. Use this and the previously calculated (or given) standard deviations of Blandy and the market to estimate Blandy’s beta. Does Blandy contribute more or less risk to a well-diversified portfolio than does the average stock? Use the SML to estimate Blandy’s required return.arrow_forwardSuppose that the risk-free rate is 5% and that the market risk premium is 7%. What is the required return on (1) the market, (2) a stock with a beta of 1.0, and (3) a stock with a beta of 1.7?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning