Concept explainers

Compute

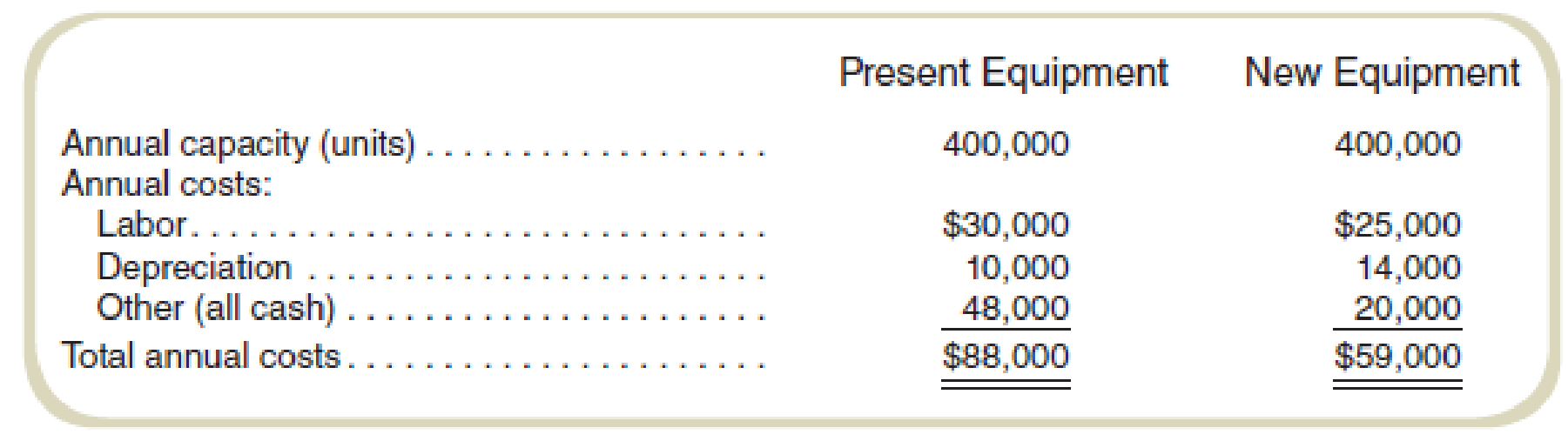

Dungan Corporation is evaluating a proposal to purchase a new drill press to replace a less efficient machine presently in use. The cost of the new equipment at time 0, including delivery and installation, is $200,000. If it is purchased, Dungan will incur costs of $5,000 to remove the present equipment and revamp its facilities. This $5,000 is tax deductible at time 0.

Depreciation for tax purposes will be allowed as follows: year 1, $40,000; year 2, $70,000; and in each of years 3 through 5, $30,000 per year. The existing equipment has a book and tax value of $100,000 and a remaining useful life of 10 years. However, the existing equipment can be sold for only $40,000 and is being

Management has provided you with the following comparative

The existing equipment is expected to have a salvage value equal to its removal costs at the end of 10 years. The new equipment is expected to have a salvage value of $60,000 at the end of 10 years, which will be taxable, and no removal costs. No changes in

Required

- a. Calculate the removal costs of the existing equipment net of tax effects.

- b. Compute the depreciation tax shield.

- c. Compute the forgone tax benefits of the old equipment.

- d. Calculate the

cash inflow , net of taxes, from the sale of the new equipment in year 10. - e. Calculate the tax benefit arising from the loss on the old equipment.

- f. Compute the annual differential cash flows arising from the investment in years 1 through 10.

- g. Compute the net present value of the project.

a.

Compute the removal costs of the existing equipment net of tax effects.

Explanation of Solution

Net of tax:

Net of tax is the resultant amount that determines the final amount of the accounting period for the tax savings. The net of tax is determined by taking gross figures in the account.

Compute the equipment removal net of tax effects:

Thus, the value of equipment removal net of tax effects is $3,000.

b.

Compute the depreciation tax shield.

Explanation of Solution

Depreciation:

Depreciation is the method of calculating the value of the assets for the current accounting period. The value of any capital asset cannot be accounted for the total cost it has incurred in the period that it has been bought in. The value of the asset is distributed over different accounting periods according to the utility of the asset.

Compute the depreciation tax shield:

| Year | Depreciation | Tax shield | PV factor | Present value |

| 1 | $40,000 | $16,000 | 0.862 | $13,792 |

| 2 | $70,000 | $28,000 | 0.743 | $20,804 |

| 3 | $30,000 | $12,000 | 0.641 | $7,692 |

| 4 | $30,000 | $12,000 | 0.552 | $6,624 |

| 5 | $30,000 | $12,000 | 0.476 | $5,712 |

| Total | $200,000 | $80,000 | $54,624 |

Table: (1)

Thus, the PV of the depreciation schedule is $54,624.

c.

Compute the foregone tax benefits of the old equipment.

Explanation of Solution

Tax shield:

Tax shield refers to a reduction in taxable income. The reduction in taxable income is achieved by claiming the allowable deductions.

Compute the foregone tax benefits of the old equipment:

Thus, the value of foregone tax benefits is $4,000.

d.

Compute the cash inflow, net of taxes, from the sale of the new equipment in year 10.

Explanation of Solution

Gain:

Gain is the resultant value of the difference between revenue earned on sale and the cost of the same.

Compute gain from salvage of new equipment:

Thus, the value of gain from salvage of new equipment is $36,000.

e.

Compute the tax benefit arising from the loss on the old equipment.

Explanation of Solution

Tax shield:

Tax shield refers to a reduction in taxable income. The reduction in taxable income is achieved by claiming the allowable deductions.

Compute the tax benefit arising from a loss on old equipment:

Thus, the value of the tax benefit is $24,000.

f.

Compute the annual differential cash flows arising from the investment in years 1 through 10.

Explanation of Solution

Differential cash flow:

Differential cash flow is the difference between several options of businesses’ cash flows.

Compute the differential cash flows:

Thus, the value of differential cash flows is $19,800.

g.

Compute the net present value of the project.

Explanation of Solution

Net present value (NPV):

Net present value (NPV) is a type of intrinsic valuation analysis. NPV is the sum total of all the future cash flows (inflows/outflows) that will occur over the lifetime of a project discounted to the present.

| Year | |||||||||||

| Particulars | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Investment flows: | |||||||||||

| Equipment cost | ($200,000) | ||||||||||

| Removal | ($3,000) | ||||||||||

| Salvage of old equipment | $40,000 | ||||||||||

| Tax benefit-sale of old equipment | $24,000 | ||||||||||

| Periodic operating flows | $19,800 | $19,800 | $19,800 | $19,800 | $19,800 | $19,800 | $19,800 | $19,800 | $19,800 | $19,800 | |

| Tax shield from depreciation: | |||||||||||

| Year 1 | $16,000 | ||||||||||

| Year 2 | $28,000 | ||||||||||

| Year 3-5 | $12,000 | $12,000 | $12,000 | ||||||||

| Old equipment (forgone) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | ($4,000) | |

| Disinvestment: | |||||||||||

| Proceeds of disposal | $60,000 | ||||||||||

| Tax on gain | ($24,000) | ||||||||||

| Total cash flows | ($139,000) | $31,800 | $43,800 | $27,800 | $27,800 | $27,800 | $15,800 | $15,800 | $15,800 | $15,800 | $51,800 |

| PV factor | $1.000 | $0.862 | $0.743 | $0.641 | $0.552 | $0.476 | $0.410 | $0.354 | $0.305 | $0.263 | $0.227 |

|

Present value | ($139,000) | $27,412 | $32,543 | $17,820 | $15,346 | $13,233 | $6,478 | $5,593 | $4,819 | $4,155 | $11,759 |

| Net present value | $157 | ||||||||||

Table: (1)

Thus, the NPV of the project is $157.

Want to see more full solutions like this?

Chapter A Solutions

Gen Combo Fundamentals Of Cost Accounting; Connect Access Card

- The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it is expected to generate net after-tax operating cash flows, including depreciation, of $6,250 per year. The truck has a 5-year expected life. The expected salvage values after tax adjustments for the truck are given here. The company’s cost of capital is 10%. Should the firm operate the truck until the end of its 5-year physical life? If not, then what is its optimal economic life? Would the introduction of salvage values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project?arrow_forwardREPLACEMENT ANALYSIS St. Johns River Shipyards is considering the replacement of an 8-year-old riveting machine with a new one that will increase earnings from 24,000 to 46,000 per year. The new machine will cost 80,000, and it will have an estimated life of 8 years and no salvage value. The new riveting machine is eligible for 100% bonus depreciation at the time of purchase. The applicable corporate tax rate is 25%, and the firms WACC is 10%. The old machine has been fully depreciated and has no salvage value. Should the old riveting machine be replaced by the new one? Explain your answer.arrow_forwardMontello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one the company expects the truck to be driven for 26,000 miles; in year two, 30,000 miles; and in year three, 40,000 miles. Consider how the purchase of the truck will impact Montellos depreciation expense each year and what the trucks book value will be each year after depreciation expense is recorded.arrow_forward

- Utica Corporation paid 360,000 to purchase land and a building. An appraisal showed that the land is worth 100,000 and the building is worth 300,000. What cost should Utica assign to the land and to the building, respectively?arrow_forwardDauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?arrow_forwardDepreciation Jensen Inc., a graphic arts studio, is considering the purchase of computer equipment and software for a total cost of $18,000. Jensen can pay for the equipment and software over three years at the rate of $6,000 per year. The equipment is expected to last 10 to 20 years, but because of changing technology, Jensen believes it may need to replace the system in as soon as three to five years. A three-year lease of similar equipment and software is available for $6,000 per year. Jensens accountant has asked you to recommend whether the company should purchase or lease the equipment and software and to suggest the length of time over which to depreciate the software and equipment if the company makes the purchase. Required Ignoring the effect of taxes, would you recommend the purchase or the lease? Why or why not? Referring to the definition of depreciation, what appropriate useful life should be used for the equipment and software?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning