Derivatives; interest rate swap; fixed rate investment

(This is a variation of E A–2, modified to consider an investment in debt securities.)

On January 1, 2018, S&S Corporation invested in LLB Industries’ negotiable two-year, 10% notes, with interest receivable quarterly. The company classified the investment as available-for-sale. S&S entered into a two-year interest rate swap agreement on January 1, 2018, and designated the swap as a fair value hedge. Its intent was to hedge the risk that general interest rates will decline, causing the fair value of its investment to increase. The agreement called for the company to make payment based on a 10% fixed interest rate on a notional amount of $200,000 and to receive interest based on a floating interest rate. The contract called for cash settlement of the net interest amount quarterly.

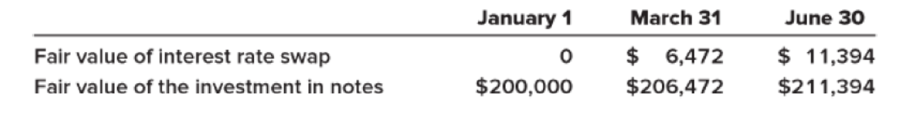

Floating (LIBOR) settlement rates were 10% at January 1, 8% at March 31, and 6% June 30, 2018. The fair values of the swap are quotes obtained from a derivatives dealer. Those quotes and the fair values of the investment in notes are as follows:

Required:

- 1. Calculate the net cash settlement at March 31 and June 30, 2018.

- 2. Prepare the

journal entries through June 30, 2018, to record the investment in notes, interest, and necessary adjustments for changes in fair value.

Want to see the full answer?

Check out a sample textbook solution

Chapter A Solutions

Intermediate Accounting

- Held-to-Maturity Securities and Amortization of a Discount On January 1, 2019, Kelly Corporation acquired bonds with a face value of 500,000 for 483,841.79, a price that yields a 10% effective annual interest rate. The bonds carry a 9% stated rate of interest, pay interest semiannually on June 30 and December 31, are due December 31, 2022, and are being held to maturity Required: Prepare journal entries to record the purchase of the bonds and the first two interest receipts using the: 1. straight-line method of amortization 2. effective interest method of amortizationarrow_forwardTransfer between Categories On December 31, 2018, Leslie Company held an investment in bonds of Kaufmann Company which it categorized as being held to maturity. At that time, the 8%, 100,000 face value bonds had a carrying value of 107,023.56 and were being amortized using the effective interest method based on a market rate of 7%. Interest on these bonds is paid annually each December 31. On December 31, 2019, after recording the interest earned, Leslie decided to reclassify the Kaufmann bonds to its available-for-sale category in anticipation of a major restructuring. At that time, the ending quoted market price for the bonds was 105,000. Required: Prepare the journal entries on December 31, 2019, to record the interest earned and the reclassification.arrow_forwardThis problem is a variation of P12–1, modified to categorize the investment as trading securities.]Fuzzy Monkey Technologies, Inc., purchased as a short-term investment $80 million of 8% bonds, datedJanuary 1, on January 1, 2018. Management intends to include the investment in a short-term, active tradingportfolio. For bonds of similar risk and maturity the market yield was 10%. The price paid for the bonds was $66million. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, thefair value of the bonds at December 31, 2018, was $70 million.Required:1. Prepare the journal entry to record Fuzzy Monkey’s investment on January 1, 2018.2. Prepare the journal entry by Fuzzy Monkey to record interest on June 30, 2018 (at the effective rate).3. Prepare the journal entries by Fuzzy Monkey to record interest on December 31, 2018 (at the effective rate).4. At what amount will Fuzzy Monkey report its investment in the December 31, 2018, balance sheet?…arrow_forward

- Tanner-UNF Corporation acquired as a long-term investment $240 million of 6% bonds, dated July 1, on July1, 2018. Company management has the positive intent and ability to hold the bonds until maturity. The marketinterest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $200 million for the bonds.The company will receive interest semiannually on June 30 and December 31. As a result of changing marketconditions, the fair value of the bonds at December 31, 2018, was $210 million.Required:1. Prepare the journal entry to record Tanner-UNF’s investment in the bonds on July 1, 2018.2. Prepare the journal entries by Tanner-UNF to record interest on December 31, 2018, at the effective (market)rate.3. At what amount will Tanner-UNF report its investment in the December 31, 2018, balance sheet? Why?4. Suppose Moody’s bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sellthe investment on January 2, 2019, for $190 million. Prepare the…arrow_forwardOn January 1, 2021, LLB Industries borrowed $360,000 from Trust Bank by issuing a two-year, 10% note, with interest payable quarterly. LLB entered into a two-year interest rate swap agreement on January 1, 2021, and designated the swap as a fair value hedge. Its intent was to hedge the risk that general interest rates will decline, causing the fair value of its debt to increase. The agreement called for the company to receive payment based on a 10% fixed interest rate on a notional amount of $360,000 and to pay interest based on a floating interest rate. The contract called for cash settlement of the net interest amount quarterly. Floating (LIBOR) settlement rates were 10% at January 1, 8% at March 31, and 6% June 30, 2021. The fair values of the swap are quotes obtained from a derivatives dealer. Those quotes and the fair values of the note are as indicated below. January 1…arrow_forwardTanner-unf corporation acquired as a long-term investment 245 million of 8% bonds, dated July 1, on July1, 2018. The market interest rate (yield) was 10% for bonds of similiar risk and maturity. Tanner-UNF paid 200 million for the bonds. the company will receive interest semiannually on June 30 and December 31. Company management is holding the bonds in its trading profolio. as a result of changing market conditions the fair value of the bonds at december 31, 2018 was 205 million. 1 and 2 prepare journal entry to record Tannner-UNF'S investment in bonds on July 1,2018 and interest on December 31,2018 at the effective (market rate). 3 Prepare any additional journal entry neccessary for Tannner-UNF to report its investment in the December 31,2018 balance sheet 4 Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell investments on January 2,2019 for 180 Million. Prepare the journal entries to record the sale.arrow_forward

- On February 18, 2021, Union Corporation purchased 600 IBM bonds as a long-term investment at their face value for a total of $600,000. Union will hold the bonds indefinitely, and may sell them if their price increases sufficiently. On December 31, 2021, and December 31, 2022, the market value of the bonds was $580,000 and $610,000, respectively.Required:1. What is the appropriate reporting category for this investment? Why?2. Prepare the adjusting entry for December 31, 2021.3. Prepare the adjusting entry for December 31, 2022.arrow_forwardABC Co. is contemplating on investing on 12%, 3-year p1,000,000 bonds. Pricipal is due at maturity date but interest is due annually at each year-end. Market rate on January 1, 20x1 is 10%. Information regarding the fair values follows: December 31, 20x2….104 December 31, 20x3….105 Please provide entries on reclassification date under the ff scenarios:( changes in business model in 20x2) a. Amortised cost to FVPL b. PVPL to Amortised cost c. Amortised cost to FVOCI-mandatory Required : Prepare journal entriesarrow_forwardRell Corporation reports under IFRS No. 9. Rell has an investment in Tirish, Inc. bonds that Rell accounts for atamortized cost, given that the bonds pay only interest and principal and Rell’s business purpose is to hold the bondsto maturity. Rell purchased the bonds for €10,000,000. As of December 31, 2018, Rell calculates €750,000 ofcredit losses expected for default events occurring during 2019 and €450,000 of credit losses expected for defaultevents occurring after 2019. Required:1. Assume the Tirish bonds have not had a significant increase in credit risk. Prepare the journal entry to recordany impairment loss as of December 31, 2018.2. Assume the Tirish bonds have had a significant increase in credit risk. Prepare the journal entry to record anyimpairment loss as of December 31, 2018.3. Assume the Tirish bonds have not had a significant increase in credit risk, and that as of December 31, 2019,Rell calculates €650,000 of credit losses expected for default events occurring during…arrow_forward

- On February 18, 2021, Union Corporation purchased 1,311 IBM bonds as a long-term investment at their face value for a total of $1,311,000. Union will hold the bonds indefinitely, and may sell them if their price increases sufficiently. On December 31, 2021, and December 31, 2022, the market value of the bonds was $1,273,000 and $1,330,000, respectively. Required: 2. & 3. Prepare the adjusting entry for December 31, 2021 and 2022. (If no entry is required for aarrow_forwardE26-4 (Fair Value Hedge) Company issues a four-year, 7.5% fixed-rate interest only, nonpre-payable $1,000,000 note payable on December 31, 2000. It decides to change the interest rate from a fixed rate to variable rate and enters into a swap agreement with M&S Corp. The swap agreement specifies that Sarazan will receive a fixed rate at 7.5% and pay variable with settlement dates that match the interest payments on the debt. Assume that interest rates have declined during 2001 and that Sarazan received $13,000 as an adjustment to Interest expense for the settlement at December 31, 2001. The loss related to the debt (due to interest rate changes) was $48,000. The value of the swap contract increased $48,000. a. Prepare the journal entry to record the payment of interest expense on December 31, 2001. b. Prepare the journal entry to record the receipt of the swap settlement on December 31, 2001. c. Prepare the journal entry to record the change in the fair value of the swap contract…arrow_forward(Fair Value Hedge) Sarazan Company issues a 4-year, 7.5% fixed-rate interest only, nonrepayable $1,000,000 note payable on December 31, 2016. It decides to change the interest rate from a fixed rate to variable rate and enters into a swap agreement with M&S Corp. The swap agreement specifies that Sarazan will receive a fixed rate at 7.5% and pay variable with settlement dates that match the interest payments on the debt. Assume that interest rates have declined during 2017 and thatSarazan received $13,000 as an adjustment to interest expense for the settlement at December 31, 2017. The loss related to the debt (due to interest rate changes) was $48,000. The value of the swap contract increased $48,000.Instructions(a) Prepare the journal entry to record the payment of interest expense on December 31, 2017.(b) Prepare the journal entry to record the receipt of the swap settlement on December 31, 2017.(c) Prepare the journal entry to record the change in the fair value of the swap…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT