Financial Accounting-w/cd-package

3rd Edition

ISBN: 9780131060876

Author: REIMERS

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter B, Problem 25EA

Record journal entries, record

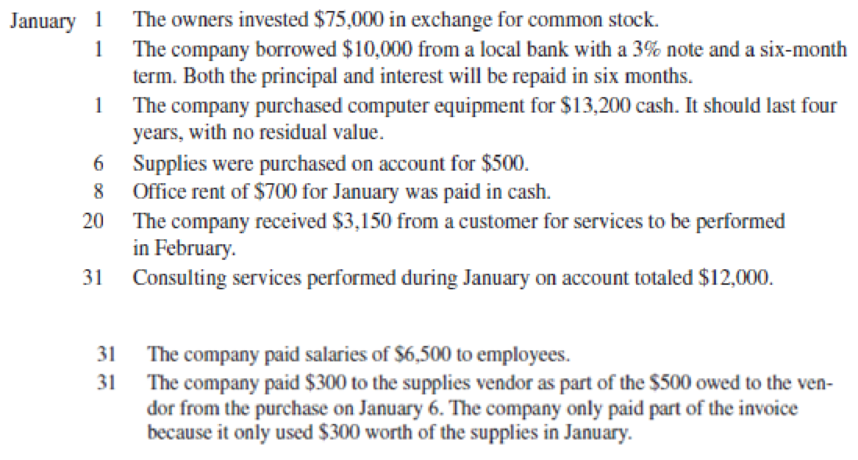

(LO 1, 2, 3, 4). The Problem Solvers Consulting Corporation began business in 2010. The following transactions took place during January:

Give the

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

As a bookkeeper of a new start-up company, you are responsible for keeping the chart of accounts up to date. At the end of each year, you analyze the accounts to verify that each account should be active for accumulation of costs, revenues and expenses. In July, the accounts payable clerk has asked you to open an account named “New Expenses”. You know that an account name should be specific and well defined. You feel that the A/P clerk might want to charge some expenses to that account that would not be appropriate. Why do you think the A/P clerk need this “New Expenses” account? Who needs to know this information and what action should you consider?

The fiscal year-end for Mason's Landscaping and Snow Removal is December 31.

Record the adjusting entries for December 31, 2014.

Hint: It is helpful to record the original transactions (or account balances) in your own rough

notes as part of your analysis and calculations of year-end adjusting entries. T-accounts can be

very useful for doing this. However, the only entries that should be recorded in the journal for

this assignment are the December 31 adjusting entries.

The accounts in Mason's ledger are:

Bank

Accounts Receivable

Supplies

Prepaid Insurance

Prepaid Rent

Truck

Assignment 1 - Adjusting Entries

Accounts Payable

Unearned Service Fees

Bank Loan

B. Mason, Capital

B. Mason, Drawings

Service Fees Earned

Rent Expense

Insurance Expense

Supplies Expense

Office Expense

Maintenance Expense

Truck Expense

Interest Expense

1. On July 1, 2014, a customer signed a contract and agreed to pay $840 for 12 months of

landscaping and snow removal services.

2. The balance in the Supplies account…

As the bookkeeper of a new start-up company, you are responsible for keeping the chart of accounts up to date. At the end of each year, you analyze the accounts to verify that each account should be active for accumulation of costs, revenues, and expenses. In July, the accounts payable clerk has asked you to open an account named New Expenses. You know that an account name should be specific and well defined. You feel that the A/P clerk might want to charge some expenses to that account that would not be appropriate. Why do you think the A/P clerk needs this New Expenses account? Who needs to know this information and what action should you consider?

Chapter B Solutions

Financial Accounting-w/cd-package

Ch. B - Indicate whether each of the following accounts...Ch. B - Prob. 2YTCh. B - Prob. 1QCh. B - Prob. 2QCh. B - Prob. 3QCh. B - Prob. 4QCh. B - Prob. 5QCh. B - Prob. 6QCh. B - Prob. 7QCh. B - Prob. 8Q

Ch. B - Prob. 9QCh. B - Prob. 1MCQCh. B - Prob. 2MCQCh. B - Prob. 3MCQCh. B - Prob. 4MCQCh. B - Prob. 5MCQCh. B - Prob. 6MCQCh. B - Prob. 7MCQCh. B - Prob. 8MCQCh. B - Prob. 9MCQCh. B - Prob. 10MCQCh. B - Prob. 1SEACh. B - Prob. 2SEACh. B - Prob. 3SEACh. B - Prob. 4SEACh. B - Prob. 5SEACh. B - Prob. 6SEACh. B - Prob. 7SEACh. B - Prob. 8SEACh. B - Prob. 9SEACh. B - Prob. 10SEBCh. B - Prob. 11SEBCh. B - Prob. 12SEBCh. B - Prob. 13SEBCh. B - Prob. 14SEBCh. B - Prob. 15SEBCh. B - Prob. 16SEBCh. B - Prob. 17SEBCh. B - Prob. 18SEBCh. B - Prob. 19EACh. B - Prob. 20EACh. B - Record transactions to T-accounts and prepare an...Ch. B - Prob. 22EACh. B - Prob. 23EACh. B - Record closing entries and compute net income. (LO...Ch. B - Record journal entries, record adjusting entries,...Ch. B - Record journal entries, post to T-accounts, and...Ch. B - Prob. 27EBCh. B - Prob. 28EBCh. B - Prob. 29EBCh. B - Prob. 30EBCh. B - Prob. 31EBCh. B - Prob. 32EBCh. B - Prob. 33EBCh. B - Prob. 34EBCh. B - Prepare a trial balance and financial statements....Ch. B - Record journal entries, post to T-accounts, and...Ch. B - Prepare closing entries and financial statements....Ch. B - Record adjusting journal entries, post to...Ch. B - Prob. 39PACh. B - Prob. 40PACh. B - Prob. 41PACh. B - Prob. 42PACh. B - Prob. 43PBCh. B - Prob. 44PBCh. B - Prob. 45PBCh. B - Prob. 46PBCh. B - Prob. 47PBCh. B - Prob. 48PBCh. B - Prob. 49PBCh. B - Prob. 50PBCh. B - Prob. 51FSACh. B - Prob. 52CTP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You are at the end of the month, and you have to reset the temporary accounts prior to the new period starting. You must do the closing entries in order to complete this. Please close the appropriate accounts using the journal and ledgers again. Make sure to do a post-closing trial balance to ensure you are still in balance after the closing is finished. Continue to use the Excel templates provided. Account Debit Cash Accounts Receivable Equipment Accumulated Depreciation Inventory Accounts Payable common stock COGS Sales Sales returns Sales Discounts Rent Expense Electric Expense Depreciation Shipping Expense Act. # 100640.00 3000.00 10100.00 850.00 750 500.00 60.00 2000.00 100.00 210.00 200.00 Credit 210.00 11700.00 100000.00 6500.00arrow_forwardThe following transactions occurred for Luminary Engineering: View the transactions. View the journal entries. Read the requirements. Requirements 1 and 2. Post the journal entries (including dates) to the T-accounts. Compute the July 31 balance for each account. Use a "Bal." posting reference on the proper side of each account to show the ending balances of the accounts. (For accounts with a $0 balance, make sure to enter "0" in the appropriate input field on the normal side of the account.) Accounts Payable Cash Accounts Receivable Supplies Equipment Notes Payable Common Stock Dividends Service Revenue Utilities Expense Transactions Jul. 2 Jul. 4 Jul. 5 Jul. 10 Jul. 12 Jul. 19 Jul. 21 Jul. 27 Requirements Received $9,000 contribution from Bob Luminary in exchange for common stock. Paid utilities expense of $420. Purchased equipment on account, $2,400. Performed services for a client on account, $2,900. Borrowed $7,600 cash, signing a notes payable. Paid cash dividends of $500 to…arrow_forwardAs the bookkeeper of a new start-up company, you are responsible for keeping the chart of accounts up to date. At the end of each year, you analyze the accounts to verify that each account should be active for acumulation of costs, revenues, and expenses. In July, the accounts payable (A/P) clerk asked you to open an account named New Expenses. You know that an account name should be specific and well defined, and you're afraid the A/P clerk might charge some expenses to the account that are inappropriate. Respond to the following in a minimum of 175 words: *Why do you think the A/P clerk needs the New Expenses account? * Who needs to know this information and what action should you consider?arrow_forward

- The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts. Note: You must complete parts 1, 2 and 3 before completing parts 4 and 6. Please note that part 5 is optional. Part 4: At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is $275.b. Supplies on hand on May 31 are $715.c. Depreciation of office equipment for May is $330.d. Accrued receptionist salary on May 31 is $325.e. Rent expired during May is $1,600.f. Unearned fees on May 31 are $3,210. Part 6: Journalize the adjusting entries. Then, post the entries to the attached spreadsheet from part 2.arrow_forward1. When should you select settings and customizations for your company file? A. At the time you create the company file B. As work related to the settings comes up C. Before the end of the business's first fiscal year D. In the second quarter 2. What is the Chart of Accounts? A. The list of accounts for each transaction in the accounting system or general ledger B. The menu of products and services that the company offers its customers C. The full list of account numbers associated with the company's customers and vendors D. The balance of each account as of the start date of the business 3. Which of these would be an appropriate start date for a business? A. December 31 of the current year B. The first day of a period, month, quarter, or year C. The day of your first expense D. The day of your first sale 4. What is an historical transaction? A. A transaction that occurred before the start date of the company B. A transaction that appears in the company file by default in QuickBooks…arrow_forwardAs the bookkeeper of a new start-up company, you are responsible for keeping the chart of accounts up to date. At the end of each year, you analyze the accounts to verify that each account should be active for accumulation of costs, revenues, and expenses. In July, the accounts payable (A/P) clerk asked you to open an account named New Expenses. You know that an account name should be specific and well defined, and you're afraid the A/P clerk might charge some expenses to the account that are inappropriate. Why do you think the A/P clerk needs the New Expenses account? Who needs to know this information and what action should you consider?arrow_forward

- Make first a proper Chart of Accounts. Then make a proper Trial Balance from the following accounts and balances listed in alphabetical order for MN Company for August 31 of the current year. Put them in the correct order along with their debit and credit balances on your Trial Balance. Total the DR and CR column and make sure they balance. Make sure you have a heading. We will work on this in class. Upload here on D2L if you are not yet finished in class. Accounts Payable $2300, Accounts Receivable $1200, Accumulated Depreciation-Equipment $800, Advertising Expense $200, Cash $3400, Equipment $12,500, Furniture and Fixtures $6700, MN, Capital, $6500, MN, Drawing $500, Notes Payable $8000, Prepaid Insurance $1200, Professional Fees $10,000, Rent Expense $500, Supplies $100, Utilities Expense $300, Wages Expense $1000.arrow_forwardI need to create a journal entry for my accounting class. Here is the question: May 8: Sign a letter of intent to switch electric suppliers starting in June. I believe no journal entry is required?arrow_forwardComplex Company prepares monthly financial statements. Below are listed some selected accounts and their balances in the September 30 trial balance before any adjustments have been made for the month of September. Instruction: Using the information given, prepare the adjusting entries that should be made by Complex Company on September 30. Complex COMPANY Trial Balance (Selected Accounts) September 30, 2010 Debit Credit Office Supplies....................................................................................$ 2,700 Prepaid Insurance..............................................................................$4,200 Office Equipment............................................................................. $16,200 Accumulated Depreciation—Office…arrow_forward

- If you were starting a business next month, what are some of the accounts you would establish up front to manage the business? Knowing that the chart of accounts can change, how often would you review your chart of accounts to potentially identify changes? When reviewing the chart of accounts, what personnel should be including in the review and the decision to make changes?arrow_forwardIn the New Company File Assistant, before pressing the Next button in the 'Create your company file' window, Isabella wants to confirm some of the company settings you selected when creating the company file in MYOB. Isabella asks you to select the correct options that appear throughout the New Company File Assistant that correspond to the company settings required for Hi-Fi Way in MYOB: 12 accounting periods and 'Other' as the industry classification of the business June as the conversion month and a financial year starting in January 12 accounting periods and 'Retail Business, Other' as the industry classification of the business January as the conversion month and a financial year ending in Julyarrow_forwardYou have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY