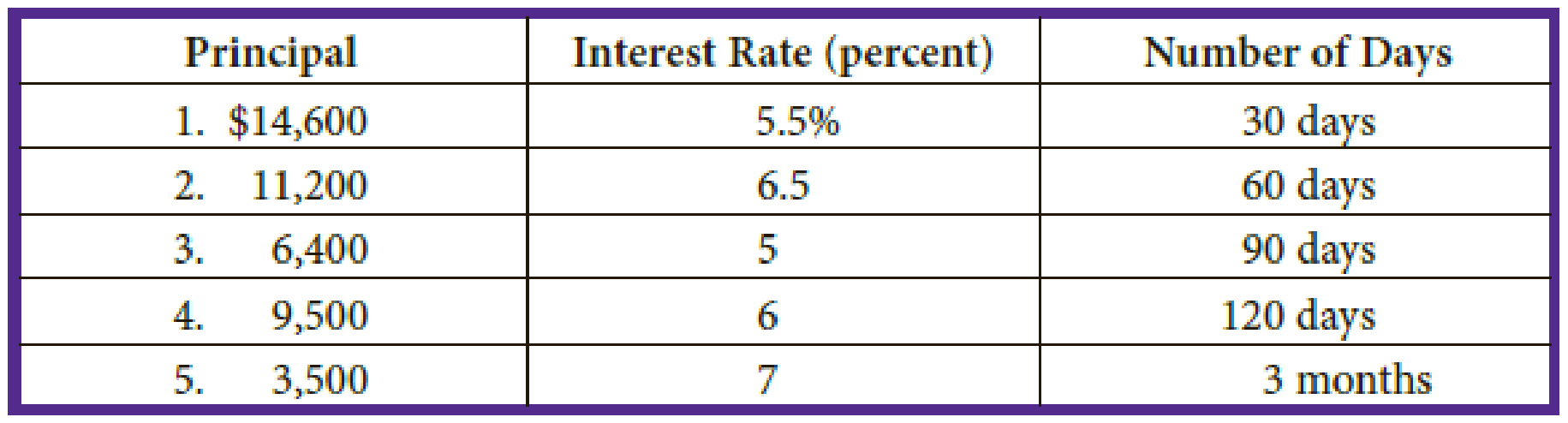

Part A: Calculate the interest on the following notes:

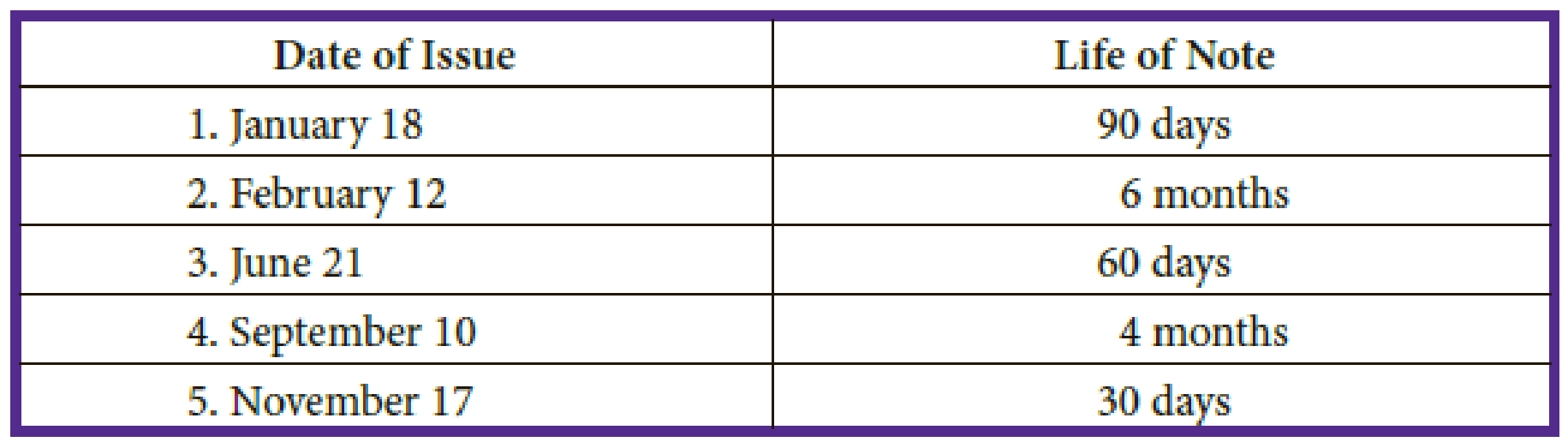

Part B: Determine the maturity dates on the following notes:

Check Figure

1. Interest, $66.92

A.

Compute the interest for the given notes.

Explanation of Solution

Interest: The money charged by the lender for using lender’s funds is referred to as interest. So, interest is an expense for the borrower and revenue for the lender. The interest is generally, computed as a percentage of the money borrowed.

Compute the interest for the given notes.

| Principal | × | Rate of Interest | × | Time of Note | = | Interest | |

| 1. | $14,600 | × | 5.5% | × | = | $66.92 | |

| 2. | 11,200 | × | 6.5% | × | = | 121.33 | |

| 3. | 6,400 | × | 5.0% | × | = | 80.00 | |

| 4. | 9,500 | × | 6.0% | × | = | 190.00 | |

| 5. | 3,500 | × | 7.0% | × | = | 61.25 | |

Table (1)

B.

Compute the maturity dates.

Explanation of Solution

Maturity date: The date on which the borrower should pay the principal amount of loan, or bond, is referred to as maturity date.

Compute the maturity date for the note issued on January 18 with the life of note for 90 days.

| Description | Count |

| Number of days left in January (From 18th to 31st) | 13 days |

| Number of days in February | 28 days |

| Number of days in March | 31 days |

| 72 days | |

| Number of days required in April to total 90 days (90 days–72 days) | 18 days |

| Total days of the term | 90 days |

Table (2)

Hence, the maturity date is 18th April.

Compute the maturity date for the note issued on February 12 with the life of note for 6 months.

| Description | Count |

| Number of months from February 12 to March 12 | 1 month |

| Number of months from March 12 to April 12 | 1 month |

| Number of months from April 12 to May 12 | 1 month |

| Number of months from May 12 to June 12 | 1 month |

| Number of months from June 12 to July 12 | 1 month |

| Number of months from July 12 to August 12 | 1 month |

| Total months of the term | 6 months |

Table (3)

Hence, the maturity date is 12th August.

Compute the maturity date for the note issued on June 21 with the life of note for 60 days.

| Description | Count |

| Number of days left in June (From 21st to 30th) | 9 days |

| Number of days in July | 31 days |

| 40 days | |

| Number of days required in August to total 60 days (60 days–40 days) | 20 days |

| Total days of the term | 60 days |

Table (4)

Hence, the maturity date is 20th August.

Compute the maturity date for the note issued on September 10 with the life of note for 4 months.

| Description | Count |

| Number of months from September 10 to October 10 | 1 month |

| Number of months from October 10to November 10 | 1 month |

| Number of months from November 10 to December 10 | 1 month |

| Number of months from December 10 to January 10 | 1 month |

| Total months of the term | 4 months |

Table (5)

Hence, the maturity date is 10th January.

Compute the maturity date for the note issued on November 17 with the life of note for 30 days.

| Description | Count |

| Number of days left in November (From 17th to 30th) | 13 days |

| Number of days required in December to total 30 days (30 days–13 days) | 17 days |

| Total days of the term | 30 days |

Table (6)

Hence, the maturity date is 17th December.

Want to see more full solutions like this?

Chapter D Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

FINANCIAL ACCT.FUND.(LOOSELEAF)

Construction Accounting And Financial Management (4th Edition)

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Intermediate Accounting

Financial Accounting (11th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

- A company collects an honored note with a maturity date of 24 months from establishment, a 10% interest rate, and an initial loan amount of $30,000. Which accounts are used to record collection of the honored note at maturity date? A. Interest Revenue, Interest Expense, Cash B. Interest Receivable, Cash, Notes Receivable C. Interest Revenue, Interest Receivable, Cash, Notes Receivable D. Notes Receivable, Interest Revenue, Cash, Interest Expensearrow_forwardWhich of the following accounts are used when a short-term note payable with 5% interest is honored (paid)? A. short-term notes payable, cash B. short-term notes payable, cash, interest expense C. interest expense, cash D. short-term notes payable, interest expense, interest payablearrow_forwardCalculate maturity value for the interest-bearing note using ordinary interest: Face Value Interest Rate Time in Days $42,000 13% 79arrow_forward

- Compute the maturity date and interest for the following notes.( use 360 days for calculation) Dates of notes Terms Principal Interest Rate a. April 17 45 days 48,000 3% b. August 11 2 months 72,000. 7% Maturity date. Interest a. ? $? b. ? $?arrow_forwardCalculate the due date, interest due, and maturity value of the following notes: Date of Note Face Amount Interest Rate Term of Note Due Date Interest Due Maturity Value a. 24-Apr $70,000 3% 60 days b. 13-Jul 30,000 5% 120 days c. 9-Aug 40,000 4% 45 days d. 12-Sep 60,000 8% 90 days e. 5-Nov 50,000 6% 30 daysarrow_forwardDetermine the due date and the amount of interest due at maturity on the following notes: Date of Note Face Amount Interest Rate Term of Note Due Date Interest (1) Jun 1 $20,000 3% 40 days (2) June 30 9,000 3% 180 days (3) March 30 12,000 5% 45 days (4) March 1 10,000 5% 60 days (5) January 15 8,000 4% 60 daysarrow_forward

- 1. Assuming that the notes were discounted ten months prior to maturity, the total proceeds from both notes discounted is? Please include solutions. Thank you.arrow_forwardQUESTION 1 The interest deducted in advance from the face valueof a non-interest bearing notes payable is/are called: a bankdiscount. proceeds. interest payable. interest receivable. QUESTION 2 The normal balance of the Notes Receivable accountis: credit. debit. nominal. income. QUESTION 3 When the due date of a note extends beyond one year, it becomes a:long-term liability. current liability. short-term liability.current asset. QUESTION 4 Mr. Robert signed a120 day, 10% note with First Federal State Bank for $12,000 onAugust 5th. What will be the maturity date of the note? December3rd December 4th November 30th December 2nd QUESTION 5 What will the maturity value of a note payable be if theprincipal is $15,000, the interest rate is 8%, and the term is 60days? $15,197.26 $14,802.74 $15,000 $197.26 QUESTION 6 Jacob borrowed $20,000 for 30 days at 5% from SkyBank.What will be the interest amount? $20,000 $82.19 $19,917.80$20,082.19 QUESTION 7 Match the terms incolumn I with the…arrow_forwardThe formula for computing interest on a note is: Principal of the notex Annual interest rate x Time expressed in fraction of year. True or False True Falsearrow_forward

- From the information given below, determine the due date for the following notes: Date Issued Term of the Note Due Date 1. January 1 30 days __________ 2. January 15 30 days __________ 3. March 20 60 days __________ 4. March 20 3 months __________ 5. June 18 90 days __________ Compute the amount of accrued interest on the following notes: Principal InterestRate Time AccruedInterest 6. $7,800 9.0% 75 days __________ 7. 3,600 12.5% 45 days __________ 8. 2,700 9.9% 90 days __________ 9. 4,300 6.2% 6 months __________ 10. 5,500 11.0% 120 days __________ Compute the number of days from the issue date to the maturity date for the following notes: Issue Date Maturity Date Term of the Note 11. March 14, 2020 June 12, 2020 __________ 12. September 27, 2020 December 11, 2020 __________ 13. November 11, 2020 March 14, 2021 __________ 14.…arrow_forwardInterest on a note payable can be calculated by multiplying the amount owed by the interest rate by the fraction of year that represents the time elapsed since borrowing. a. True b. Falsearrow_forwardCompute the principal (in $) for the loan. Use ordinary interest when time is stated in days. Principal Rate (%) Time Interest $ 9 6 months $1,575arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning