INTEGRATION EXERCISE I Different Costs for Different Purposes, Cost-Volume-Profit-Relationships

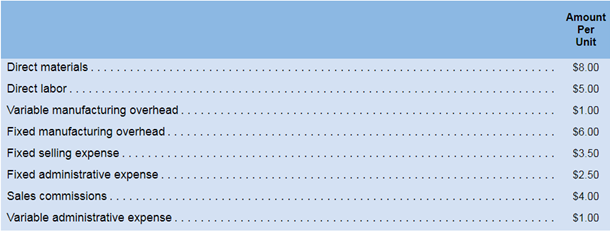

Hixson Company manufactures and sells one product for $34 per unit. The company maintains no beginning or ending inventories and its relevant range of production is 20,000 units to 30,000 units. When Hixson produces and sells 25,000 units, its unit costs are as follows:

Required:

- For financial accounting purposes. what is the total amount of product costs incurred to make 25.000 units? What is the total amount of period costs incurred to sell 25.000 units?

1

Product cost Product cost include all the costs or expenses that are directly related to product. These costs are incurred only during the production process. For example- cost incurred for direct material, direct labor, etc.

Period cost Period costs are the expenses that are incurred even when there is no production. These costs are not related to products but to passage of time. For example, depreciation expense, advertising expense, etc.

To calculate: Total amount of product cost and period cost incurred to produce 25,000 units.

Answer to Problem 1IE

Total product cost for manufacturing 25,000 units is $500,000 and total period cost is $275,000.

Explanation of Solution

Calculation of product cost for 25,000 units will be as follows:

| Particulars | Amount (in $) | |

| Direct materials | (25,000 * $8) | 200,000 |

| Direct labors | (25,000 * $5) | 125,000 |

| Manufacturing overheads (variable) | (25,000 * $1) | 25,000 |

| Manufacturing overheads (fixed) | (25,000 * $6) | 150,000 |

| Total product cost | 500,000 |

Calculation of period cost for 25,000 units will be as follows:

| Particulars | Amount (in $) | |

| Selling expense (fixed) | (25,000 * $3.5) | 87,500 |

| Administration expense (fixed) | (25,000 * $2.5) | 62,500 |

| Sales commission | (25,000 * $4) | 100,000 |

| Administrative expense | (25,000 * $1) | 25,000 |

| Total product cost | 275,000 |

For 25,000 units, total product cost is $500,000 and total period cost is $275,000.

2

Variable cost per unit This is the total variable cost that a company incurs to produce one unit. This is calculated by the division of total variable cost and the number of manufactured units. Variable cost per unit remains the same.

Average fixed manufacturing cost per unit This shows fixed manufacturing cost incurred for one unit. This is calculated by the division of total fixed manufacturing expenses and total units.

To calculate: Per unit variable manufacturing cost and average fixed manufacturing cost for 24,000 units.

Answer to Problem 1IE

Variable manufacturing cost is calculated as $14 per unit and fixed manufacturing overhead is $6.25 per unit.

Explanation of Solution

For 24,000 units, Variable manufacturing cost per unit will be calculated as:

| Particulars | Amount (in S) |

| Direct material (per unit) | 8 |

| Direct labor (per unit) | 5 |

| Manufacturing overhead (variable) (per unit) | 1 |

| Variable manufacturing cost (per unit) | 14 |

Fixed manufacturing cost per unit will be calculated as:

| Particulars | Amount (in $) |

| Total fixed manufacturing overheads (shown in sub part 1) | 150,000 |

| Total units | 24,000 units |

| Per unit fixed manufacturing cost (total cost / units) | 6.25 |

Variable manufacturing cost per unit is $14.00 and per unit fixed manufacturing overhead is $6.25.

3

Variable manufacturing cost per unit This is the total variable cost that a company incurs to manufacture one unit. This is calculated by the division of total variable cost and the number of manufactured units. Variable cost per unit remains the same.

Fixed manufacturing cost per unit This shows fixed manufacturing cost incurred for one unit. This is calculated by the division of total fixed manufacturing expenses and total units.

To calculate: For 26,000 units per unit variable and fixed manufacturing costs.

Answer to Problem 1IE

Variable manufacturing cost is calculated as $14 per unit and fixed manufacturing overhead is $5.77 per unit.

Explanation of Solution

For 26,000 units, Variable manufacturing cost per unit will be calculated as:

| Particulars | Amount (in S) |

| Direct material (per unit) | 8.00 |

| Direct labor (per unit) | 5.00 |

| Manufacturing overhead (variable) (per unit) | 1.00 |

| Total variable manufacturing cost (per unit) | 14.00 |

Note: Variable cost per unit remains the same, irrespective of the number of units produced.

Fixed manufacturing cost per unit for 26,000 units will be calculated as:

| Particulars | Amount (in $) |

| Total fixed manufacturing overheads (shown in sub part 1) | 150,000 |

| Total units | 26,000 units |

| Per unit fixed manufacturing cost (total cost / units) | 5.77 |

Note: Total fixed cost incurred by the company does not change.

Variable manufacturing cost per unit is $14.00 and fixed manufacturing overhead per unit is $5.77.

4

Direct manufacturing cost Direct cost covers all the costs that are directly associated with a product. For example, costs related to direct material, labor, etc.

Indirect manufacturing cost Indirect cost covers all the costs that are not directly associated with a product but help in operating in a more efficient way. For example, supervision cost, advertising cost, etc.

To calculate: Total direct and indirect manufacturing costs for 27,000 units.

Answer to Problem 1IE

Total direct manufacturing cost for 27,000 units is $351,000 and total indirect manufacturing cost is $177,000.

Explanation of Solution

For 27,000 units, total direct manufacturing cost will be calculated as:

| Particulars | Amount (in $) |

| Direct material (27,000 * $8) | 216,000 |

| Direct labor (27,000 * $5) | 135,000 |

| Total direct manufacturing cost | 351,000 |

For 27,000 units, total indirect manufacturing cost will be calculated as:

| Particulars | Amount (in $) |

| Manufacturing overhead (variable) (27,000 * $1) | 27,000 |

| Manufacturing overhead (fixed) | 150,000 |

| Total indirect manufacturing cost | 177,000 |

For 27,000 units, total direct manufacturing expense is $351,000 and total indirect manufacturing expense is $177,000.

5

Incremental manufacturing cost Incremental cost refers to the additional cost that a company incurs by producing one addiyional unit.

To calculate: Total incremental manufacturing cost that the company would incur if number of units change from 25,000 to 25,001.

Answer to Problem 1IE

Incremental cost that the company will incur by increasing one unit is $14.

Explanation of Solution

Calculation for incremental cost will be done as follows:

| Particulars | For 25,000 units | For 25,001 units |

| Direct material ($8) | 200,000 | 200,008 |

| Direct labor ($5) | 125,000 | 125,005 |

| Manufacturing overhead (variable) (1) | 25,000 | 25,001 |

| Manufacturing overhead (fixed) (fixed cost does not change in total) | 150,000 | 150,000 |

| Total | 500,000 | 500,014 |

So, incremental cost when company changes the number of units from 25,000 to 25,001 is $14 (500,014 − 500,000).

6

Contribution margin Contribution margin represents the portion of sales, which does not include any amount of variable costs. This portion of sale includes only fixed costs and profit. It is calculated by deducting total variable cost from sale price or by adding amount of fixed costs and profit.

To calculate: Per unit contribution margin and contribution margin ratio of the company.

Answer to Problem 1IE

Contribution margin is $15 per unit and Contribution margin ratio is 44.1%.

Explanation of Solution

Contribution margin per unit is calculated by the following formula:

Selling price is given as $34 per unit and total variable cost per unit will be calculated as:

| Particulars | Amount (in S) |

| Direct material (per unit) | 8.00 |

| Direct labor (per unit) | 5.00 |

| Manufacturing overhead (variable) (per unit) | 1.00 |

| Sales commission | 4.00 |

| Variable administration expense | 1.00 |

| Total variable manufacturing cost (per unit) | 19.00 |

So, contribution margin per unit will be:

Formula to calculate contribution margin ratio is:

Contribution margin ratio will be:

So, contribution is $15 per unit and contribution margin ratio is 44.1%.

7

Break even point It is that level of sales at which, cost incurred by a company is exactly equal to the revenue earned. It is known as the level of no profit or no loss as, at this level company does not earn any profit and covers all of its costs.

To calculate:Break-even point in units and in sales.

Answer to Problem 1IE

Break-even point in units is calculated as 20,000 units and in sales, it is calculated as $680,000.

Explanation of Solution

Calculation for total fixed cost:

| Particulars | Amount (in S) |

| Fixed manufacturing cost | 150,000 |

| Fixed selling expense | 87,500 |

| Fixed administrative expense | 62,500 |

| Total fixed costs | 300,000 |

Now, break even point (in units) will be calculated as:

Break even point (in sales) will be:

Break even point in units is 20,000 units and break even point in sales $680,000.

8

Net operating income It is the net income generated by a company and it is obtained after deducting both types of costs, variable and fixed, from the sale value.

To calculate:Increase in net operating income when units increase from 25,000 units to 26,500 units.

Answer to Problem 1IE

Net operating income will increase by $22,500.

Explanation of Solution

Net operating income is calculated by deducting amount of total fixed cost from contribution (in rupees).

Calculation for increase in net operating income will be done as follows:

| Particulars | For 25,000 units | For 26,500 units |

| Contribution margin per unit | $15 | $15 |

| Total units | 25,000 | 26,500 |

| Total contribution in rupees | $375,000 | $397,500 |

| Total fixed cost (computed in sub part 7) | $300,000 | $300,000 |

| Net operating income | $75,000 | $97,500 |

So, increase in net operating income of the company number of units increase from 25,000 to 26,500 is $22,500 ($97,500 − 75,000).

9

Margin of safety Margin of safety represents the sales made by a company in addition to its break-even level. It is calculated by deducting break even sales from the actual sales made.

To calculate:Margin of safety at 25,000 units.

Answer to Problem 1IE

Margin of safety at 25,000 unit is $170,000.

Explanation of Solution

Margin of safety is calculated by deducting break even sales from the total actual sales. So, it will be calculated as:

| Particulars | Amount (in $) |

| Total sales (25,000 * 34) | 850,000 |

| Less: Break-even point (in sales) (computed in sub part 7) | 680,000 |

| Margin of safety | 170,000 |

So, margin of safety is $170,000.

10

Operating leverage Operating leverage measures the degree by which operating income for a company will increase with an increase in its revenue.

To calculate:Degree of operating leverage at 25,000 units.

Answer to Problem 1IE

Operating leverage at 25,000 units is 5.0.

Explanation of Solution

Degree of operating leverage is obtained by dividing contribution margin and net operating income. So, Calculation for degree of operating leverage will be done as follows:

So, degree of operating leverage, at 25,000 units, is 5.0.

Note: contribution margin and net operating income both are calculated in sub part 8.

Want to see more full solutions like this?

Chapter IE Solutions

INTRO.TO MANAG...(LL)-W/ACCESS >CUSTOM<

- Sell or Process Further, Basic Analysis Shenista Inc. produces four products (Alpha, Beta, Gamma, and Delta) from a common input. The joint costs for a typical quarter follow: The revenues from each product are as follows: Alpha, 100,000; Beta, 93,000; Gamma, 30,000; and Delta, 40,000. Management is considering processing Delta beyond the split-off point, which would increase the sales value of Delta to 75,000. However, to process Delta further means that the company must rent some special equipment that costs 15,400 per quarter. Additional materials and labor also needed will cost 8,500 per quarter. Required: 1. What is the operating profit earned by the four products for one quarter? 2. CONCEPTUAL CONNECTION Should the division process Delta further or sell it at split-off? What is the effect of the decision on quarterly operating profit?arrow_forwardAssume you are the department B manager for Marleys Manufacturing. Marleys operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only o department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation. (Hint: It may be helpful to perform a vertical analysis.)arrow_forwardVariable-Costing and Absorption-Costing Income Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for the past year were as follows: During the year, Borques produced 200,000 wooden pallets and sold 204,300 at 9 each. Borques had 8,200 pallets in beginning finished goods inventory; costs have not changed from last year to this year. An actual costing system is used for product costing. Required: 1. What is the per-unit inventory cost that is acceptable for reporting on Borquess balance sheet at the end of the year ? How many units are in ending inventory? What is the total cost of ending inventory? 2. Calculate absorption-costing operating income. 3. CONCEPTUAL CONNECTION What would the per-unit inventory cost be under variable costing? Does this differ from the unit cost computed in Requirement 1? Why? 4. Calculate variable-costing operating income. 5. Suppose that Borques Company had sold 196,700 pallets during the year. What would absorption-costing operating income have been? Variable-costing operating income?arrow_forward

- Product Mix Decision, Single Constraint Norton Company produces two products (Juno and Hera) that use the same material input. Juno uses two pounds of the material for every unit produced, and Hera uses five pounds. Currently, Norton has 16,000 pounds of the material in inventory. All of the material is imported. For the coming year, Norton plans to import an additional 8,000 pounds to produce 2,000 units of Juno and 4,000 units of Hera. The unit contribution margin is 30 for Juno and 60 for Hera. Also, assume that Nortons marketing department estimates that the company can sell a maximum of 2,000 units of Juno and 4,000 units of Hera. Norton has received word that the source of the material has been shut down by embargo. Consequently, the company will not be able to import the 8,000 pounds it planned to use in the coming years production. There is no other source of the material. Required: 1. Compute the total contribution margin that the company would earn if it could manufacture 2,000 units of Juno and 4,000 units of Hera. 2. Determine the optimal usage of the companys inventory of 16,000 pounds of the material. Compute the total contribution margin for the product mix that you recommend.arrow_forwardProblem: Sell or Process Further, Basic Analysis Shenista Inc. produces four products (Alpha, Beta, Gamma, and Delta) from a common input. The joint costs for a typical quarter follow: Direct Materials $500,000 Direct Labor 36,000 Overhead 72,000 The revenues from each product are as follows: Alpha, $100,000; Beta, $93,000; Gamma, $30,000; and Delta, $40,000. Management is considering processing Delta beyond the split-off point, which would increase the sales value of Delta to $75,000. However, to process Delta further means that the company must rent some special equipment that costs $15,400 per quarter. Additional materials and labor also needed will cost $8,500 per quarter. Required: What is the effect of the process-further decision on the quarterly operating profit?arrow_forwardItem 3 Assume a company has two divisions, Division A and Division B. Division A has provided the following information regarding the one product that it manufactures and sells on the outside market: Selling price per unit (on the outside market) $ 75 Variable cost per unit $ 59 Fixed costs per unit (based on capacity) $ 4 Capacity in units 20,000 Division B could use Division A’s product as a component part in the manufacture of 4,000 units of its own newly-designed product. Division B has received a quote of $58 from an outside supplier for a component part that is comparable to the one that Division A makes. If that the company’s divisional managers are evaluated based their division’s profits and Division A is currently selling 20,000 units on the outside market, what is lowest acceptable transfer price for Division A if it were to sell 4,000 units to Division B? Multiple Choice $79 $75 $73 $71arrow_forward

- Subject: Cost management & accounting Question No. 3: Absorption and Marginal Costing (remaining part)The Dorset Corporation produces and sells a single product. The following data refer to the year just completed:Beginning inventory 0Units produced 10,000Units sold 8,000Selling price per unit $50Selling and administrative expenses:Variable per unit $5Fixed per year $60,000Manufacturing costs:Direct materials cost per unit $10Direct labor cost per unit $6Variable manufacturing overhead cost per unit $5Fixed manufacturing overhead per year $80,000Assume that direct labor is a variable cost.Required: (remaining part) b. Reconcile the absorption costing and variable costing net operating income figuresa. Prepare an income statement for the year using absorption costing and variable costingarrow_forwardSubject: Cost management & accounting Question No. 3: Absorption and Marginal Costing (remaining part)The Dorset Corporation produces and sells a single product. The following data refer to the year just completed:Beginning inventory 0Units produced 10,000Units sold 8,000Selling price per unit $50Selling and administrative expenses:Variable per unit $5Fixed per year $60,000Manufacturing costs:Direct materials cost per unit $10Direct labor cost per unit $6Variable manufacturing overhead cost per unit $5Fixed manufacturing overhead per year $80,000Assume that direct labor is a variable cost.Required: (remaining part) b. Reconcile the absorption costing and variable costing net operating income figuresarrow_forwardResponse containing written narrative, figures, and charts. Milano Co. manufactures and sells three products: product 1, product 2, and product 3. Their unit selling prices are product 1, $40; product 2, $30; and product 3, $20. The per unit variable costs to manufacture and sell these products are product 1, $30; product 2, $15; and product 3, $8. Their sales mix is reflected in a ratio of 6:4:2. Annual fixed costs shared by all three products are $270,000. One type of raw material has been used to manufacture products 1 and 2. The company has developed a new material of equal quality for less cost. The new material would reduce variable costs per unit as follows: product 1 by $10 and product 2 by $5. However, the new material requires new equipment, which will increase annual fixed costs by $50,000. If the company continues to use the old material, determine its break-even point in both sales units and sales dollars of each individual product. If the company uses the new…arrow_forward

- Question Content Area Sales Mix and Break-Even Analysis Olmstead Company has fixed costs of $2,170,920. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow: Product Selling Price Variable Cost per Unit Contribution Margin per Unit QQ $700 $380 $320 ZZ 940 760 180 The sales mix for Products QQ and ZZ is 35% and 65%, respectively. Determine the break-even point in units of QQ and ZZ. If required, round your answers to the nearest whole number. a. Product QQ fill in the blank 1 unitsb. Product ZZ fill in the blank 2 unitsarrow_forwardVariable and Absorption Costing Unit Product Costs and Income Statements Haas Company manufactures and sells one product. The following information pertains to each of the company’s first three years of operations: During its first year of operations, Haas produced 60,000 units and sold 60,000 units. During its second year of operations, it produced 75,000 units and sold 50,000 units. In its third year, Haas produced 40,000 units and sold 65,000 units. The selling price of the company’s product is $58 per unit. Required: 1. Compute the company’s break-even point in unit sales. 2. Assume the company uses variable costing: a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. 3. Assume the company uses absorption costing: a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. 4. Compare the net operating incomes that you computed in…arrow_forwardVariable and Absorption Costing Unit Product Costs and Income Statements Lynch Company manufactures and sells a single product. The following costs were incurred during the company’s first year of operations: During the year, the company produced 25,000 units and sold 20,000 units. The selling price of the company’s product is $50 per unit. Required: 1. Assume that the company uses absorption costing: a. Compute the unit product cost. b. Prepare an income statement for the year. 2. Assume that the company uses variable costing: a. Compute the unit product cost. b. Prepare an income statement for the year.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College