As a result of the 20% rent increase, the number of vacant units demanded units. Adjust the previous graph to show the effect of the increase in earnings. The increase in earnings results in a new equilibrium rent of s | per month and a new equilibrium number of vacancies of |units. Now suppose that the state of California introduces rent control by setting the maximum rent at $2,400 per month. On the previous graph, use the grev point (star symbol) to indicate the number of vacancies demanded. Then use the tan point (dash svmbol) to

As a result of the 20% rent increase, the number of vacant units demanded units. Adjust the previous graph to show the effect of the increase in earnings. The increase in earnings results in a new equilibrium rent of s | per month and a new equilibrium number of vacancies of |units. Now suppose that the state of California introduces rent control by setting the maximum rent at $2,400 per month. On the previous graph, use the grev point (star symbol) to indicate the number of vacancies demanded. Then use the tan point (dash svmbol) to

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter4: Demand And Supply: Applications And Extensions

Section: Chapter Questions

Problem 2CQ

Related questions

Question

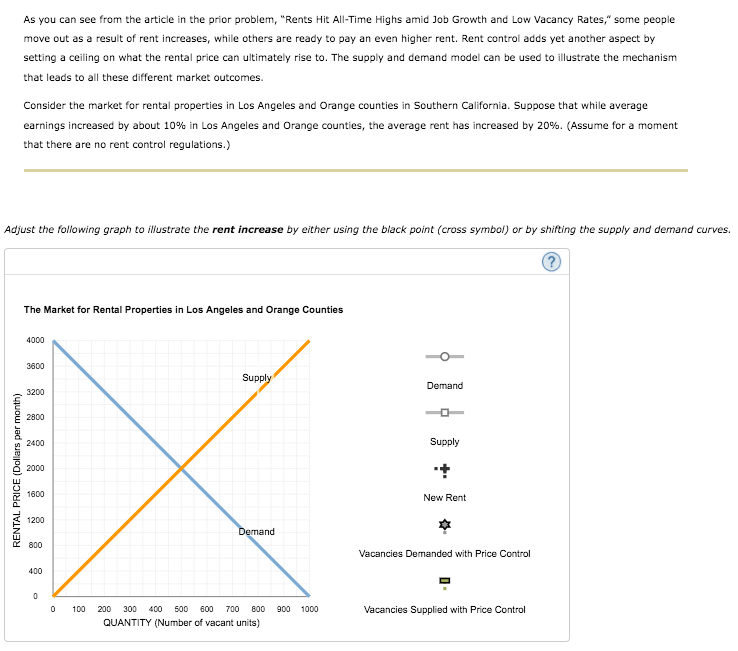

Transcribed Image Text:As you can see from the article in the prior problem, "Rents Hit All-Time Highs amid Job Growth and Low Vacancy Rates," some people

move out as a result of rent increases, while others are ready to pay an even higher rent. Rent control adds yet another aspect by

setting a ceiling on what the rental price can ultimately rise to. The supply and demand model can be used to illustrate the mechanism

that leads to all these different market outcomes.

Consider the market for rental properties in Los Angeles and Orange counties in Southern California. Suppose that while average

earnings increased by about 10% in Los Angeles and Orange counties, the average rent has increased by 20%. (Assume for a moment

that there are no rent control regulations.)

Adjust the following graph to illustrate the rent increase by either using the black point (cross symbol) or by shifting the supply and demand curves.

The Market for Rental Properties in Los Angeles and Orange Counties

4000

3600

Supply

Demand

3200

2800

2400

Supply

2000

1600

New Rent

1200

Demand

800

Vacancies Demanded with Price Control

400

100

200

300 400

500

600

700

800

900 1000

Vacancies Supplied with Price Control

QUANTITY (Number of vacant units)

RENTAL PRICE (Dollars per month)

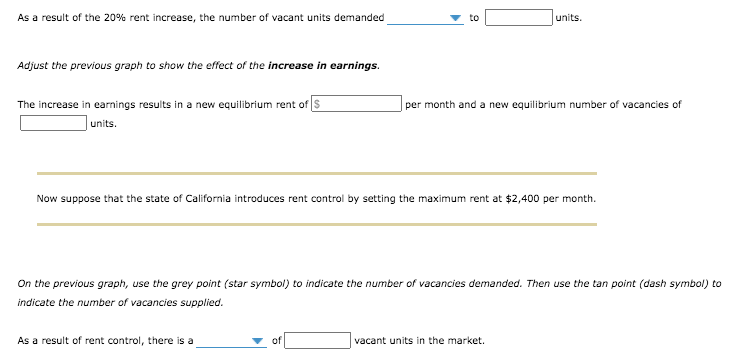

Transcribed Image Text:As a result of the 20% rent increase, the number of vacant units demanded

to

units.

Adjust the previous graph to show the effect of the increase in earnings.

The increase in earnings results in a new equilibrium rent of S

per month and a new equilibrium number of vacancies of

units.

Now suppose that the state of California introduces rent control by setting the maximum rent at $2,400 per month.

On the previous graph, use the grey point (star symbol) to indicate the number of vacancies demanded. Then use the tan point (dash symbol) to

indicate the number of vacancies supplied.

As a result of rent control, there is a

vacant units in the market.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning