? Graph Input Tool Market for Research Assistants 20 18 Wage (Dollars per hour) 4 16 Labor Supplied (Number of workers) Labor Demanded (Number of workers) Supply 250 14 12 10 Demand Shifter Supply Shifter 8 Demand Tax Levied on Employers (Dollars per hour) Tax Levied on Workers (Dollars per hour) 4 2 0 0 20 40 0 80 100 120 140 180 180 200 LABOR (Number of workers) WAGE (Dollars per hour)

? Graph Input Tool Market for Research Assistants 20 18 Wage (Dollars per hour) 4 16 Labor Supplied (Number of workers) Labor Demanded (Number of workers) Supply 250 14 12 10 Demand Shifter Supply Shifter 8 Demand Tax Levied on Employers (Dollars per hour) Tax Levied on Workers (Dollars per hour) 4 2 0 0 20 40 0 80 100 120 140 180 180 200 LABOR (Number of workers) WAGE (Dollars per hour)

Chapter11: Labor Markets

Section: Chapter Questions

Problem 1SQ

Related questions

Question

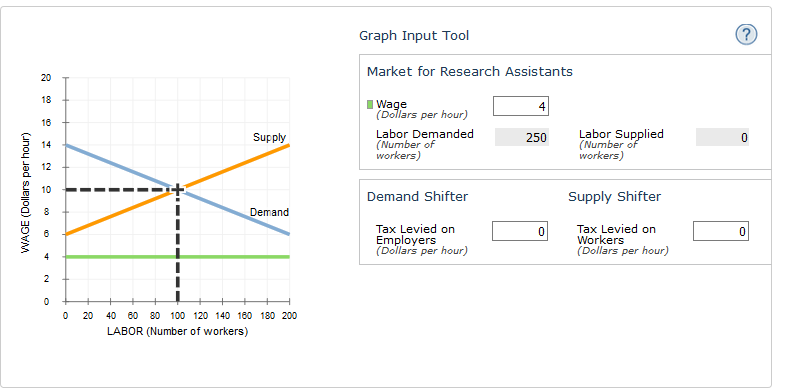

The following graph shows the labor market for research assistants in the fictional country of Universalia. The equilibrium wage is $10 per hour, and the equilibrium number of research assistants is 100.

Suppose the government has decided to institute a $4-per-hour payroll tax on research assistants and is trying to determine whether the tax should be levied on the employer, the workers, or both (such that half the tax is collected from each side).

Use the graph input tool to evaluate these three proposals. Entering a number into the Tax Levied on Employers field (initially set at zero dollars per hour) shifts the demand curve down by the amount you enter, and entering a number into the Tax Levied on Workers field (initially set at zero dollars per hour) shifts the supply curve up by the amount you enter. To determine the before-tax wage for each tax proposal, adjust the amount in the Wage field until the quantity of labor supplied equals the quantity of labor demanded. You will not be graded on any changes you make to this graph.

Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly.

(Dollars per hour)LABOR (Number of workers)Demand Supply

Graph Input Tool

|

Market for Research Assistants

|

|||||

|---|---|---|---|---|---|

|

Wage

(Dollars per hour)

|

|

||||

|

Labor Demanded

(Number of workers)

|

|

Labor Supplied

(Number of workers)

|

|

|

Demand Shifter

|

Supply Shifter

|

||||

|---|---|---|---|---|---|

|

Tax Levied on Employers

(Dollars per hour)

|

|

Tax Levied on Workers

(Dollars per hour)

|

|

For each of the proposals, use the previous graph to determine the new number of research assistants hired. Then compute the after-tax amount paid by employers (that is, the wage paid to workers plus any taxes collected from the employers) and the after-tax amount earned by research assistants (that is, the wage received by workers minus any taxes collected from the workers).

|

Tax Proposal

|

Quantity Hired

|

After-Tax Wage Paid by Employers

|

After-Tax Wage Received by Workers

|

|

|---|---|---|---|---|

|

Levied on Employers

|

Levied on Workers

|

(Number of workers)

|

(Dollars per hour)

|

(Dollars per hour)

|

|

(Dollars per hour)

|

(Dollars per hour)

|

|||

| 4 | 0 |

|

|

|

| 0 | 4 |

|

|

|

| 2 | 2 |

|

|

|

Suppose the government doesn't want to discourage employers from hiring research assistants and, therefore, wants to minimize the share of the tax paid by the employers. Of the three tax proposals, which is best for accomplishing this goal?

The proposal in which the entire tax is collected from workers

The proposal in which the tax is collected from each side evenly

The proposal in which the tax is collected from employers

None of the proposals is better than the ot

Transcribed Image Text:?

Graph Input Tool

Market for Research Assistants

20

18

Wage

(Dollars per hour)

4

16

Labor Supplied

(Number of

workers)

Labor Demanded

(Number of

workers)

Supply

250

14

12

10

Demand Shifter

Supply Shifter

8

Demand

Tax Levied on

Employers

(Dollars per hour)

Tax Levied on

Workers

(Dollars per hour)

4

2

0

0

20

40 0

80 100 120 140 180 180 200

LABOR (Number of workers)

WAGE (Dollars per hour)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning