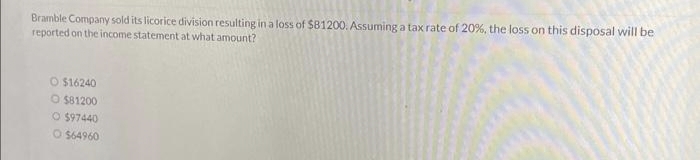

Bramble Company sold its licorice division resulting in a loss of $81200. Assuming a tax rate of 20%, the loss on this disposal will be reported on the income statement at what amount? O $16240 O $81200 O $97440 O $64960

Q: Required information Problem 3-8B Complete the full accounting cycle (LO3-3, 3-4, 3-5, 3-6, 3-7)…

A: Income Statement :— It is one of the financial statement that shows profitability, total revenue and…

Q: Annual Costs of Operating Each Product Line Sales in units Sales in dollars Unit-level costs: Cost…

A: Product-line earnings statement represents a summary of earnings and costs of each product line run…

Q: Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a…

A: SHEDULE OF COST OF GOODS MANUFACTURED Schedule of Cost of Goods Manufacturing States the total Cost…

Q: Prepare adjusting journal entries for the month of December. The insurance policy is for 1 year.…

A: Adjustment Journal Entry A general ledger entry known as a "adjustment journal entry" is made at the…

Q: Use the following data to compute total factory overhead costs for the month: Sales commissions $…

A: Formula used: Total factory overhead costs=Indirect materials+Factory utilities+Indirect…

Q: Catena's Marketing Company has the following adjusted trial balance at the end of the current year.…

A: In the above income Statement, interest Revenue is not incorporated. Therefore the correct net…

Q: What is accounting and how does it help you manage your personal finances?

A: Accounting is process which includes evaluation, summarizing, analysing, posting and reporting the…

Q: View Policies Current Attempt in Progress For the year ended June 30, 2024, Tamarisk Inc. had…

A: You have asked for two different questions. Both questions are not interlinked so as per guidelines…

Q: interest rate needed for the sinking fund

A: A sinking fund is actually an account set up with the goal of saving a desired amount of money as a…

Q: Clarks Inc., a shoe retailer, sells boots in different styles. In early November the company starts…

A: A performance obligation is a kind of promise made by the company to transfer goods and services to…

Q: Harbor Island Investments (HII) is a discount brokerage firm offering clients investment advice,…

A: INCOME STATEMENT Income Statement is one of the Important Financial Statement of the Company.…

Q: What is the present value of all these payments using an interest rate of 2%?

A: Given in the question is that 1,000 is received as annuity for the period of seven years. The first…

Q: ember 31, the ledger of Aulani Company includes the following accounts, all having normal balances:…

A: Answer : Journal entry : Date Account title Debit Credit Dec.31 Sales revenue $59,800…

Q: Required information [The following information applies to the questions displayed below.] Martinez…

A: All indirect expenses which are incurred by the business entities throughout the production process…

Q: Question 5 In 20X7, Company E sold its only product for £16 per unit. Variable costs per unit were…

A: Break Even Point (BEP) :— It is the point of production where total cost is equal to total revenue.…

Q: Use the the marginal tax information in the table below to calculate the after tax monthly income…

A: The taxpayers are required to pay taxes on the taxable income. The tax liability depends upon the…

Q: 70) On July 8, Ray Inc. sold 100 printers to Office Rental Company at $600 each and offered a 2%…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: 1. How long will it take for P4,300 to to P5,250 at 9.4% semi-annually? accumulate compounded

A: Future value is a value received in the future by the investor, The interest amount is included in…

Q: . Compute ROI for Division A. b. Compute residual income for Division B. c. Division A could…

A: Lets understand the basics. Return on investment shows how much profit is earned using the…

Q: The Rice Company made the transactions during the month of December 2022. Journalize the…

A: Journal Entries are the prime entries to record the transaction in a chronological order. Each entry…

Q: (b) The trial balance of Ahasan Ltd. at December 31, 2021, is as follows: Trial Balance As of…

A: A financial statement is a statement of a systematic format prepared by the business entity to…

Q: The trial balance of Garana's Bakery on June 30, 2024 is shown below: GARANA'S BAKERY Trial Balance…

A: Trial Balance: A trial balance is the summary of all the financial transactions of any business…

Q: Fitzgerald Limited produces and sells a single product. Budgeted results for that product, for the…

A: The BEP sales indicate the minimum sales required to cover the fixed costs. When the company makes…

Q: 5) Use the following information to calculate the company's accounting net income for the year.…

A: The accrual concept of accounting states that the revenues earned during the year must be recognized…

Q: Quick Computing installed its previous generation of computer chip manufacturing equipment 3 years…

A: DEPRECIATION EXPENSE Depreciation means gradual decrease in the value of an asset due to normal wear…

Q: Problem 4-3 Calculating EFN [LO2] The most recent financial statements for Camryn, Incorporated, are…

A: ANSWER:- External financing needed = $ 410.33

Q: Required information Use the following information for the Exercises below. (Algo) [The following…

A: Formula Used: Contribution margin per unit = Selling price per unit - Variable cost per unit Break…

Q: The following transactions occurred during 2024 for the Beehive Honey Corporation: February 1…

A: A journal entry is a process of recording the transactions in the book of the company. A journal…

Q: Pan Demic, Inc. (PDI) manufactures and sells cast iron skillets. A finished skillet sells for $40…

A: SHEDULE OF COST OF GOODS MANUFACTURED Schedule of Cost of Goods Manufacturing States the total Cost…

Q: how did you get the -68419 and -61272 in the fifo balance sheet

A: Cost of goods sold is the amount of cost which is assigned to the sold goods. Taxes are calculated…

Q: Question 7 a. O b. O C. O d. Oe. 7. The cost behavior for costs 1 and 2 are as follows: 2,000 Units…

A: A mixed cost is a cost that contains both a fixed cost component and a variable cost component.Costs…

Q: Units to be Assigned Costs Oak Ridge Steel Company has two departments, Casting and Rolling. In the…

A: Started and completed during July = Completed during the month - Opening work in process

Q: On October 1, 2024, Microchip lent $99,000 to another company. A note was signed with principal and…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: In the current tax year, a taxpayer sells a painting for $12,000. She purchased the painting two…

A: Since you have posted two questions, we will do the first one for you. To get the other question…

Q: Major League Bat Company manufactures baseball bats. In addition to its work in process inventories,…

A: Part 2: Formula used:

Q: Headland Corporation is a regional company which is an SEC registrant. The corporation's securities…

A: The incremental method is a type of method in which the apportionment of the value is done in the…

Q: Blossom Manufacturing Inc. shipped finished goods inventory with a total cost of $56,700 to…

A: a) 1.Calculation of Cash sales: Cash sales = Sales…

Q: James and Susan Morley recently converted a large turn-of-the-century house into a hotel and…

A: Temporary accounts The accounts from which the balances are transferred to permanent accounts are…

Q: ok int rences Classify each cost as being either variable or fixed with respect to the number of…

A: Product Cost :— It is the cost incurred in the manufacturing of product during the period.…

Q: Calculate cost of goods manufacturing and cost of goods sold based on the following data belo

A: SOLUTION

Q: auditing RRR Services Inc

A: An audit is actually an independent examination or scrutiny of financial information of a company,…

Q: Tuscan Incorporated had a retained earnings balance of $96,000 at December 31 of the prior year. In…

A: The statement of Retained earnings is prepared to record the changes in cumulative profits of the…

Q: Problem #8 Treasury Stock Transactions Briones, Inc. has the following stock outstanding on Dec. 31,…

A: Journal Entry A journal is a book in which all of a company's transactions are recorded for…

Q: M9-3 Deciding Whether to Capitalize an Expense For each of the following items, enter the correct…

A: The expenditures that are made for the purpose of increasing the useful life and working condition…

Q: The following information was taken from a company's bank reconciliation at the end of the year:…

A: Ideally cash balance as per cashbook and bank balance as per bank statement must reconcile with each…

Q: Assume that you are the owner of Campus Connection, which specializes in items that interest…

A: What's left over after taxes and other pay withholding have been taken out of your paycheck is known…

Q: Use the following data to compute total manufacturing costs for the month: Sales commissions $…

A: Sales commissions, depreciation office equipment, corporate office salaries are period costs, hence…

Q: 10 The actual manufacturing overhead incurred at Gutekunst Corporation during March was $53,000,…

A: Cost of goods sold after closing out to manufacturing overhead account=Cost of goods sold prior to…

Q: Find the monthly revenue 1 month and 4 months after the online store opened. Record the value in the…

A: after taking into consideration the trend of the sales, it can be interpreted that there is an…

Q: Problem 31-7 (IAA) On January 1, 2018, Epitome Company acquired the following property, plant and…

A: Revaluation is the process of recording non-current assets of the business entity with respect to…

Do not give answer in image

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- On January 1, 20x6, the Bronze Co. purchased equipment for P300,000. The equipment was being depreciated over an estimated life of 10 years on the straight-line method, with no estimated residual value. On December 31, 20x9, the equipment was sold for P200,000. The historical cost/constant peso statement of profit or loss prepared for the year ended December 31, 20x9 should include how much gain or loss from this sale? *On June 30, Flores Corporation discontinued its operations in Mexico. On September 1, Flores disposed of the Mexico facility at a pretax loss of $ 690,000. The applicable tax rate is 30%. Show the discontinued operations section of Flores’s statement of comprehensive income.Oriole Company purchased equipment that cost $2595000 on January 1, 2020. The entire cost was recorded as an expense. The equipment had a 9-year life and a $103800 residual value. Oriole uses the straight-line method to account for depreciation expense. The error was discovered on December 10, 2022. Oriole is subject to a 30% tax rate. Oriole’s net income for the year ended December 31, 2020, was understated by $2595000. $2318200. $1816500. $1622740.

- On May 31, 2015, top management of Stafford Manufacturing Co. decided to dispose of an unprofitable business component. An operating loss of $210,000 associated with the component was incurred during the year. The plant facilities associated with the business segment were sold on November 30, and a $23,000 gain was realized on the sale of the plant assets. Assuming a 30% tax rate, prepare the discontinued operations section of Stafford Manufacturing Co.’s income statement for the year ending December 31, 2015. What additional information about the discontinued segment would be provided by Stafford Manufacturing if it were reporting using the accounting standards of the United Kingdom?need help figuring out the comprehensive income On June 30, Flores Corporation discontinued its operations in Mexico. On September 1, Flores disposed of the Mexico facility at a pretax loss of $570,000. The applicable tax rate is 22%. keyword dividends,expenses,loss on disposal of discontinued operations,net income/loss, retained earningsOn June 30, Reyes Corporation discontinued its operations in Mexico. On September 1, Reyes disposed of the Mexico facility at a pretax loss of $640,000. The applicable tax rate is 25%. Show the discontinued operations section of Reyes

- 4. Enron Company decided on August 1, 2011 to dispose of a component of its business. The component was sold on November 30, 2011. Enron's income for 2011 included income of P5,000,000 from operating the discontinued segment from January 1 to the sale date. Enron incurred a loss on the November 30 sale of P4,500,000. Ignoring income tax, what amount should be reported in the 2011 income statement as income or loss under "discontinued operation"? a. 4,500,000 loss b. 5,000,000 income c. 500,000 loss d. 500,000 incomeWanda sold an asset for £10,000. The original cost was £23,000. The asset, which had an estimated residual value of £6,000, had a net book value at the time of sale of £9,000. What was the profit or loss on disposal? a) £1,000 lossb) £4,000 profitc) £1,000 profitd) £4,000 lossA corporation sold a piece of equipment during the tax year for $85,200. The accounting records show that its cost basis is $190,000 and the accumulated depreciation is $150,000. Does the company owe additional taxes due to this sale? no excel

- HunterX Company purchased pressing machinery that cost P54,000 on January 4, 2023. The entire cost was recorded as an expense. The machinery has a nine-year life and a P50,400 depreciable cost. The error was discovered on December 20, 2025. Ignoring income tax consideration, HunterX statement of comprehensive income for the year ended December 31, 2025 should show depreciation expense in the amount of A. 48.400 B. 32.700 C. 16,800 Before the correction was made, the January 1, 2025, retained earnings was understated by A 54.000 B. 48 400 C. 42.800Lagace Ltd. suffered an unusual and infrequent loss of from a tornado during 2023 that was partially insured. In addition, the company realized a loss from the disposal of a building. Include calculation and disclosure of EPS. Income from operations before tax $5,1000,000 Loss from tornado $1,250,000 Insurance portion of loss from tornado $500000 Loss from disposal of a building $85000 Income tax rate 35% Common share outstanding during 2023 2,000,000 Prepare a partial income statement for Lagace, beginning with income from operations. Include disclosure of EPS. Display all amounts as positive numbersEsquire Comic Book Company had income before tax of $1,000,000 in 2018 before considering the followingmaterial items:1. Esquire sold one of its operating divisions, which qualified as a separate component according to generallyaccepted accounting principles. The before-tax loss on disposal was $350,000. The division generated beforetax income from operations from the beginning of the year through disposal of $500,000. Neither the loss ondisposal nor the operating income is included in the $1,000,000 before-tax income the company generatedfrom its other divisions.2. The company incurred restructuring costs of $80,000 during the year.Required:Prepare a 2018 income statement for Esquire beginning with income from continuing operations. Assume anincome tax rate of 40%. Ignore EPS disclosures