Bruce Honiball's Invention It was another disappointing year for Bruce Honiball, the manager of retail services at the Gibb River Bank. Sure, the retail side of Gibb River was making money, but it didn't grow at all in 2009. Gibb River had plenty of loyal depositors, but few new ones. Bruce had to figure out some new product or financial service-something that would generate some excitement and attention. Bruce had been musing on one idea for some time. How about making it easy and safe for Gibb River's customers to put money in the stock market? How about giving them the upside of investing in equities-at least some of the upside-but none of the downside?

Bruce Honiball's Invention It was another disappointing year for Bruce Honiball, the manager of retail services at the Gibb River Bank. Sure, the retail side of Gibb River was making money, but it didn't grow at all in 2009. Gibb River had plenty of loyal depositors, but few new ones. Bruce had to figure out some new product or financial service-something that would generate some excitement and attention. Bruce had been musing on one idea for some time. How about making it easy and safe for Gibb River's customers to put money in the stock market? How about giving them the upside of investing in equities-at least some of the upside-but none of the downside?

Chapter3: Analysis Of Financial Statements

Section: Chapter Questions

Problem 1aM

Related questions

Concept explainers

Question

Transcribed Image Text:Bruce Honiball's Invention

It was another disappointing year for Bruce Honiball, the manager of retail services at the Gibb

River Bank. Sure, the retail side of Gibb River was making money, but it didn't grow at all in 2009.

Gibb River had plenty of loyal depositors, but few new ones. Bruce had to figure out some new

product or financial service-something that would generate some excitement and attention.

Bruce had been musing on one idea for some time. How about making it easy and safe for

Gibb River's customers to put money in the stock market? How about giving them the upside of

investing in equities-at least some of the upside-but none of the downside?

Transcribed Image Text:Bruce could see the advertisements now:

How would you like to invest in Australian stocks completely risk-free? You can with the new

Gibb River Bank Equity-Linked Deposit. You share in the good years; we take care of the bad ones.

Here's how it works. Deposit A$100 with us for one year. At the end of that period you get

back your A$100 plus AS5 for every 10% rise in the value of the Australian All Ordinaries stock

index. But, if the market index falls during this period, the Bank will still refund your AS100

deposit in full.

There's no risk of loss. Gibb River Bank is your safety net.

Bruce had floated the idea before and encountered immediate skepticism, even derision: "Heads

they win, tails we lose-is that what you're proposing, Mr. Honiball?" Bruce had no ready answer.

Could the bank really afford to make such an attractive offer? How should it invest the money

that would come in from customers? The bank had no appetite for major new risks.

Bruce has puzzled over these questions for the past two weeks but has been unable to come up

with a satisfactory answer. He believes that the Australian equity market is currently fully valued,

but he realizes that some of his colleagues are more bullish than he is about equity prices.

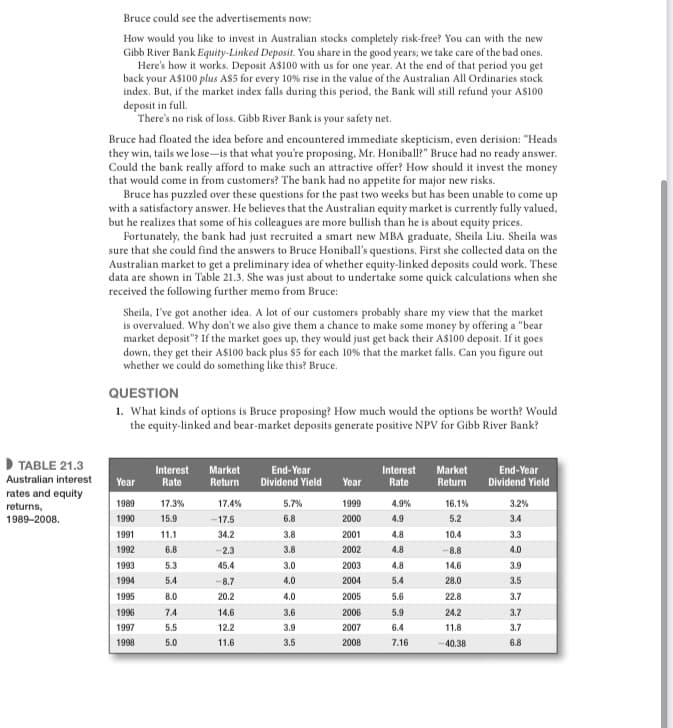

Fortunately, the bank had just recruited a smart new MBA graduate, Sheila Liu. Sheila was

sure that she could find the answers to Bruce Honiball's questions. First she collected data on the

Australian market to get a preliminary idea of whether equity-linked deposits could work. These

data are shown in Table 21.3. She was just about to undertake some quick calculations when she

received the following further memo from Bruce:

Sheila, I've got another idea. A lot of our customers probably share my view that the market

is overvalued. Why don't we also give them a chance to make some money by offering a "bear

market deposit"? If the market goes up, they would just get back their A$100 deposit. If it goes

down, they get their A$i00 back plus $5 for each 10% that the market falls. Can you figure out

whether we could do something like this? Bruce.

QUESTION

1. What kinds of options is Bruce proposing? How much would the options be worth? Would

the equity-linked and bear-market deposits generate positive NPV for Gibb River Bank?

D TABLE 21.3

Interest

Rate

Market

Return

End-Year

Dividend Yield

Interest

Rate

Market

Return

End-Year

Dividend Yield

Australian interest

Year

Year

rates and equity

1989

17.3%

17.4%

5.7%

1999

4.9%

16.1%

3.2%

returns,

1989-2008.

1990

15.9

-17.5

6.8

2000

4.9

5.2

3.4

1991

11.1

34.2

3.8

2001

4.8

10.4

3.3

1992

6.8

-2.3

3.8

2002

4.8

-8.8

4.0

1993

5.3

45.4

3.0

2003

4.8

14.6

3.9

5.4

8.0

1994

-8.7

4.0

2004

5.4

28.0

3.5

1995

20.2

4.0

2005

5.6

22.8

3.7

1996

7.4

14.6

3.6

2006

5.9

24.2

3.7

1997

5.5

12.2

3.9

2007

6.4

11.8

3.7

1998

5.0

11.6

3.5

2008

7.16

-40.38

6.8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 10 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning