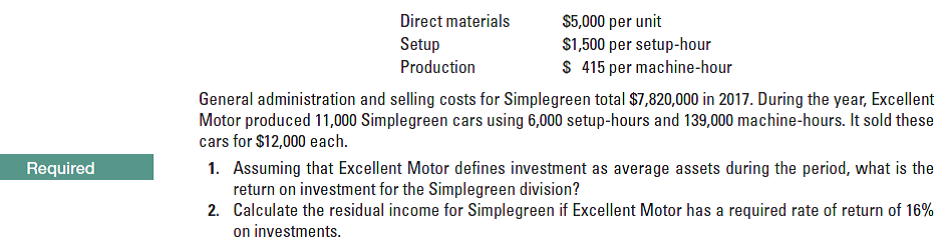

Direct materials Setup Production $5,000 per unit $1,500 per setup-hour $ 415 per machine-hour General administration and selling costs for Simplegreen total $7,820,000 in 2017. During the year, Excellent Motor produced 11,000 Simplegreen cars using 6,000 setup-hours and 139,000 machine-hours. It sold these cars for $12,000 each. 1. Assuming that Excellent Motor defines investment as average assets during the period, what is the return on investment for the Simplegreen division? 2. Calculate the residual income for Simplegreen if Excellent Motor has a required rate of return of 16% on investments. Required

Direct materials Setup Production $5,000 per unit $1,500 per setup-hour $ 415 per machine-hour General administration and selling costs for Simplegreen total $7,820,000 in 2017. During the year, Excellent Motor produced 11,000 Simplegreen cars using 6,000 setup-hours and 139,000 machine-hours. It sold these cars for $12,000 each. 1. Assuming that Excellent Motor defines investment as average assets during the period, what is the return on investment for the Simplegreen division? 2. Calculate the residual income for Simplegreen if Excellent Motor has a required rate of return of 16% on investments. Required

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 8P: The production of a new product required Zion Manufacturing Co. to lease additional plant...

Related questions

Question

Transcribed Image Text:Direct materials

Setup

Production

$5,000 per unit

$1,500 per setup-hour

$ 415 per machine-hour

General administration and selling costs for Simplegreen total $7,820,000 in 2017. During the year, Excellent

Motor produced 11,000 Simplegreen cars using 6,000 setup-hours and 139,000 machine-hours. It sold these

cars for $12,000 each.

1. Assuming that Excellent Motor defines investment as average assets during the period, what is the

return on investment for the Simplegreen division?

2. Calculate the residual income for Simplegreen if Excellent Motor has a required rate of return of 16%

on investments.

Required

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning