Executive management at Cup of Joe coffee shops is very pessimistic about the chain's ability to maintain current sales volume and estimates decreases in sales in each of the next six years. Decrease in the company's profit will be :minimum if management creates a(n) low leverage cost structure. O operating leverage does not affect decrease in profit. O cost structure does not affect decrease in profit. O medium leverage cost structure. O high leverage cost structure. O

Executive management at Cup of Joe coffee shops is very pessimistic about the chain's ability to maintain current sales volume and estimates decreases in sales in each of the next six years. Decrease in the company's profit will be :minimum if management creates a(n) low leverage cost structure. O operating leverage does not affect decrease in profit. O cost structure does not affect decrease in profit. O medium leverage cost structure. O high leverage cost structure. O

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter10: Forecasting Financial Statement

Section: Chapter Questions

Problem 4QE: Suppose you are analyzing a firm that is successfully executing a strategy that differentiates its...

Related questions

Question

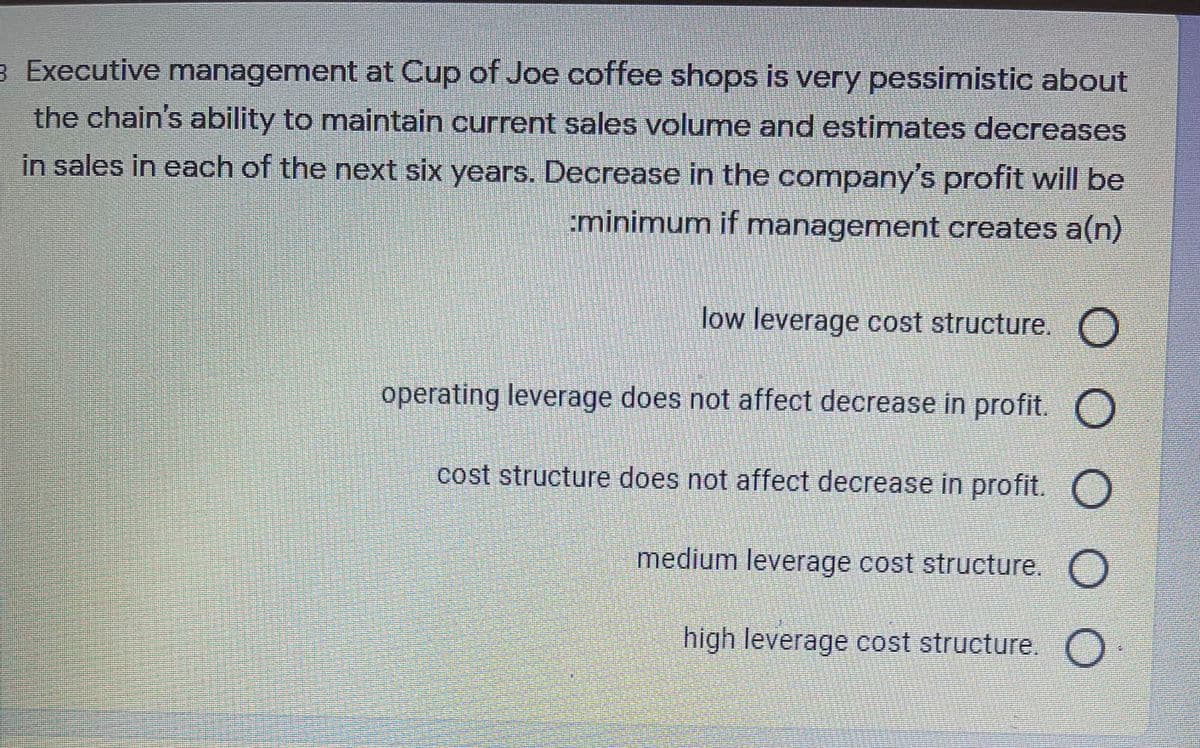

Transcribed Image Text:3 Executive management at Cup of Joe coffee shops is very pessimistic about

the chain's ability to maintain current sales volume and estimates decreases

in sales in each of the next six years. Decrease in the company's profit will be

:minimum if management creates a(n)

low leverage cost structure.

operating leverage does not affect decrease in profit. O

cost structure does not affect decrease in profit. O

medium leverage cost structure. O

high leverage cost structure. O

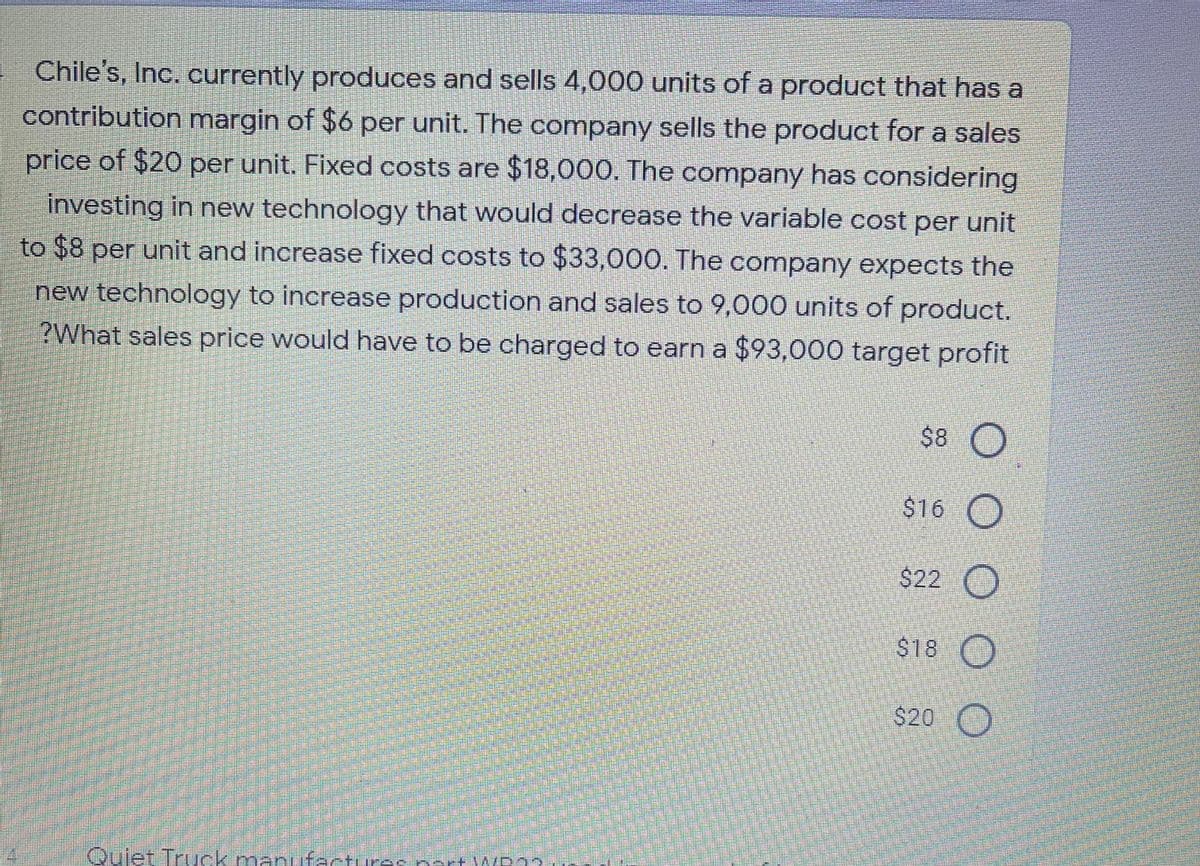

Transcribed Image Text:Chile's, Inc. currently produces and sells 4,000 units of a product that has a

contribution margin of $6 per unit. The company sells the product for a sales

price of $20 per unit. Fixed costs are $18,000. The company has considering

investing in new technology that would decrease the variable cost per unit

to $8 per unit and increase fixed costs to $33,000. The company expects the

new technology to increase production and sales to 9,000 units of product.

?What sales price would have to be charged to earn a $93,000 target profit

$8 O

$16 O

$22 O

$18 O

$20 O

Quiet Truuck.manufactures nart WP22M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning