In estimating the regression in problem #2, you are also concerned that the t-statistics may be inflated because of the presence of conditional heteroscedasticity. There are 214 observations and 3 independent variables.

In estimating the regression in problem #2, you are also concerned that the t-statistics may be inflated because of the presence of conditional heteroscedasticity. There are 214 observations and 3 independent variables.

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter4: Eigenvalues And Eigenvectors

Section4.6: Applications And The Perron-frobenius Theorem

Problem 25EQ

Related questions

Question

- ) In estimating the regression in problem #2, you are also concerned that the t-statistics may be inflated because of the presence of conditional heteroscedasticity. There are 214 observations and 3 independent variables.

You conduct a regression of the squared residuals against the dummy variables X1, X2, and X3 and find that for the squared residuals regression:

|

|

Multiple R |

0.4145 |

|

|

R Square |

0.1718 |

|

|

Adjusted R Square |

0.1600 |

|

|

SEE |

92.3760 |

- Conduct a Breusch–Pagan test at the 0.05 level to see if conditional heteroskedasticity is present and from your results, what needs to be done?

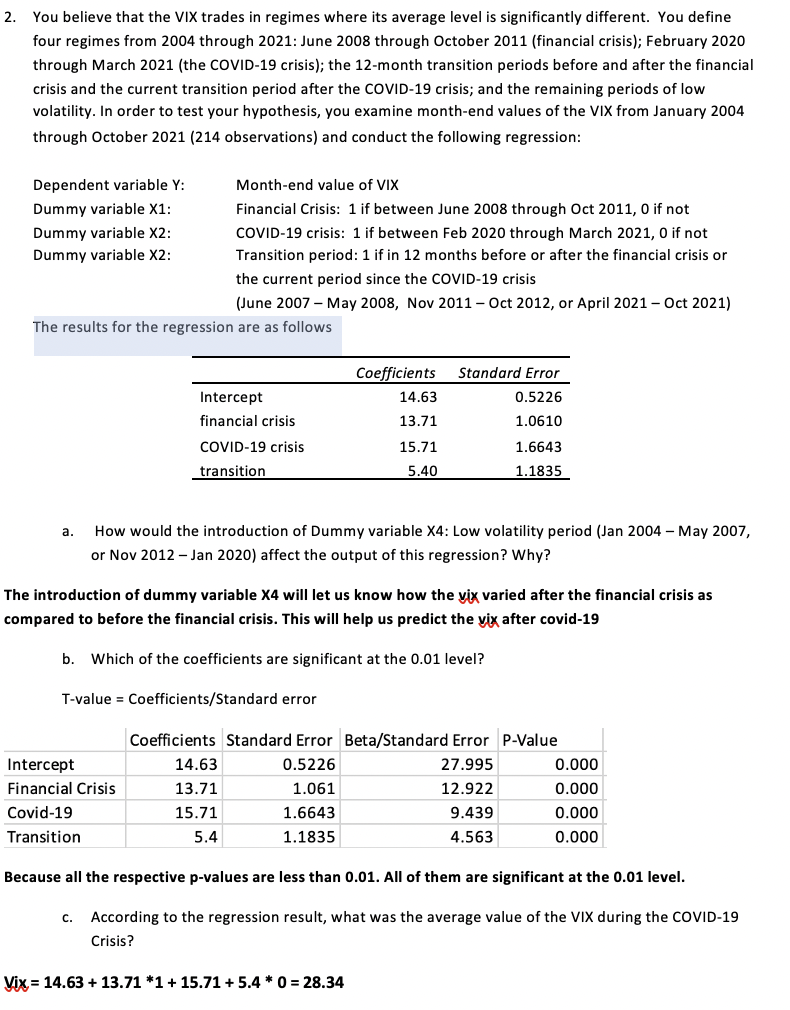

Transcribed Image Text:2. You believe that the VIX trades in regimes where its average level is significantly different. You define

four regimes from 2004 through 2021: June 2008 through October 2011 (financial crisis); February 2020

through March 2021 (the COVID-19 crisis); the 12-month transition periods before and after the financial

crisis and the current transition period after the COVID-19 crisis; and the remaining periods of low

volatility. In order to test your hypothesis, you examine month-end values of the VIX from January 2004

through October 2021 (214 observations) and conduct the following regression:

Dependent variable Y:

Month-end value of VIX

Dummy variable X1:

Financial Crisis: 1 if between June 2008 through Oct 2011, 0 if not

COVID-19 crisis: 1 if between Feb 2020 through March 2021, 0 if not

Transition period: 1 if in 12 months before or after the financial crisis or

Dummy variable X2:

Dummy variable X2:

the current period since the COVID-19 crisis

(June 2007 – May 2008, Nov 2011 – Oct 2012, or April 2021- Oct 2021)

The results for the regression are as follows

Coefficients

Standard Error

Intercept

14.63

0.5226

financial crisis

13.71

1.0610

COVID-19 crisis

15.71

1.6643

transition

5.40

1.1835

а.

How would the introduction of Dummy variable X4: Low volatility period (Jan 2004 – May 2007,

or Nov 2012 - Jan 2020) affect the output of this regression? Why?

The introduction of dummy variable X4 will let us know how the vix varied after the financial crisis as

compared to before the financial crisis. This will help us predict the yix after covid-19

b.

Which of the coefficients are significant at the 0.01 level?

T-value = Coefficients/Standard error

Coefficients Standard Error Beta/Standard Error P-Value

Intercept

14.63

0.5226

27.995

0.000

Financial Crisis

13.71

1.061

12.922

0.000

Covid-19

15.71

1.6643

9.439

0.000

Transition

5.4

1.1835

4.563

0.000

Because all the respective p-values are less than 0.01. All of them are significant at the 0.01 level.

C.

According to the regression result, what was the average value of the VIX during the COVID-19

Crisis?

Vix = 14.63 + 13.71 *1+ 15.71 + 5.4 * 0 = 28.34

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning