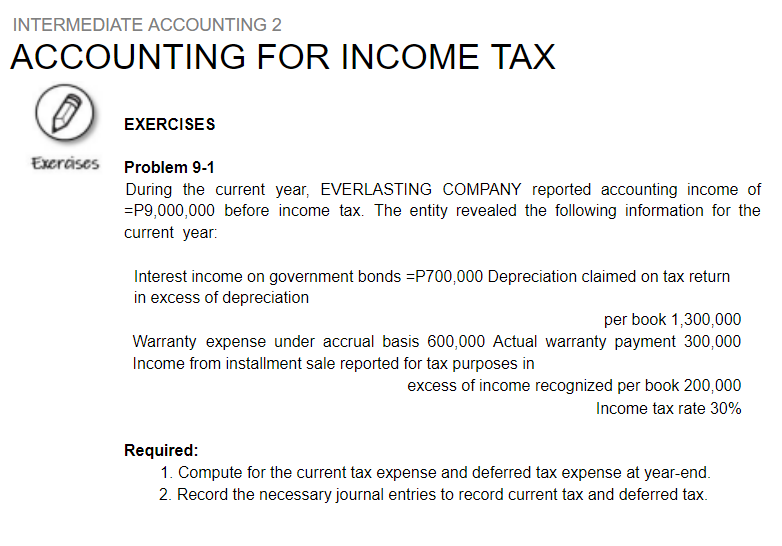

INTERMEDIATE ACCOUNTING 2 ACCOUNTING FOR INCOME TAX EXERCISES Exercises Problem 9-1 During the current year, EVERLASTING COMPANY reported accounting income of =P9,000,000 before income tax. The entity revealed the following information for the current year: Interest income on government bonds =P700,000 Depreciation claimed on tax return in excess of depreciation per book 1,300,000 Warranty expense under accrual basis 600,000 Actual warranty payment 300,000 Income from installment sale reported for tax purposes in excess of income recognized per book 200,000 Income tax rate 30% Required: 1. Compute for the current tax expense and deferred tax expense at year-end. 2. Record the necessary journal entries to record current tax and deferred tax.

INTERMEDIATE ACCOUNTING 2 ACCOUNTING FOR INCOME TAX EXERCISES Exercises Problem 9-1 During the current year, EVERLASTING COMPANY reported accounting income of =P9,000,000 before income tax. The entity revealed the following information for the current year: Interest income on government bonds =P700,000 Depreciation claimed on tax return in excess of depreciation per book 1,300,000 Warranty expense under accrual basis 600,000 Actual warranty payment 300,000 Income from installment sale reported for tax purposes in excess of income recognized per book 200,000 Income tax rate 30% Required: 1. Compute for the current tax expense and deferred tax expense at year-end. 2. Record the necessary journal entries to record current tax and deferred tax.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 1SEA: CORPORATE INCOME TAX Stanton Company estimates that its 20-1 income tax will be 80,000. Based on...

Related questions

Question

HELLO KINDLY HELP ME TO ANSWER THE QUESTIONS. THANK YOU :)

Transcribed Image Text:INTERMEDIATE ACCOUNTING 2

ACCOUNTING FOR INCOME TAX

EXERCISES

Exeráses Problem 9-1

During the current year, EVERLASTING COMPANY reported accounting income of

=P9,000,000 before income tax. The entity revealed the following information for the

current year:

Interest income on government bonds =P700,000 Depreciation claimed on tax return

in excess of depreciation

per book 1,300,000

Warranty expense under accrual basis 600,000 Actual warranty payment 300,000

Income from installment sale reported for tax purposes in

excess of income recognized per book 200,000

Income tax rate 30%

Required:

1. Compute for the current tax expense and deferred tax expense at year-end.

2. Record the necessary journal entries to record current tax and deferred tax.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning