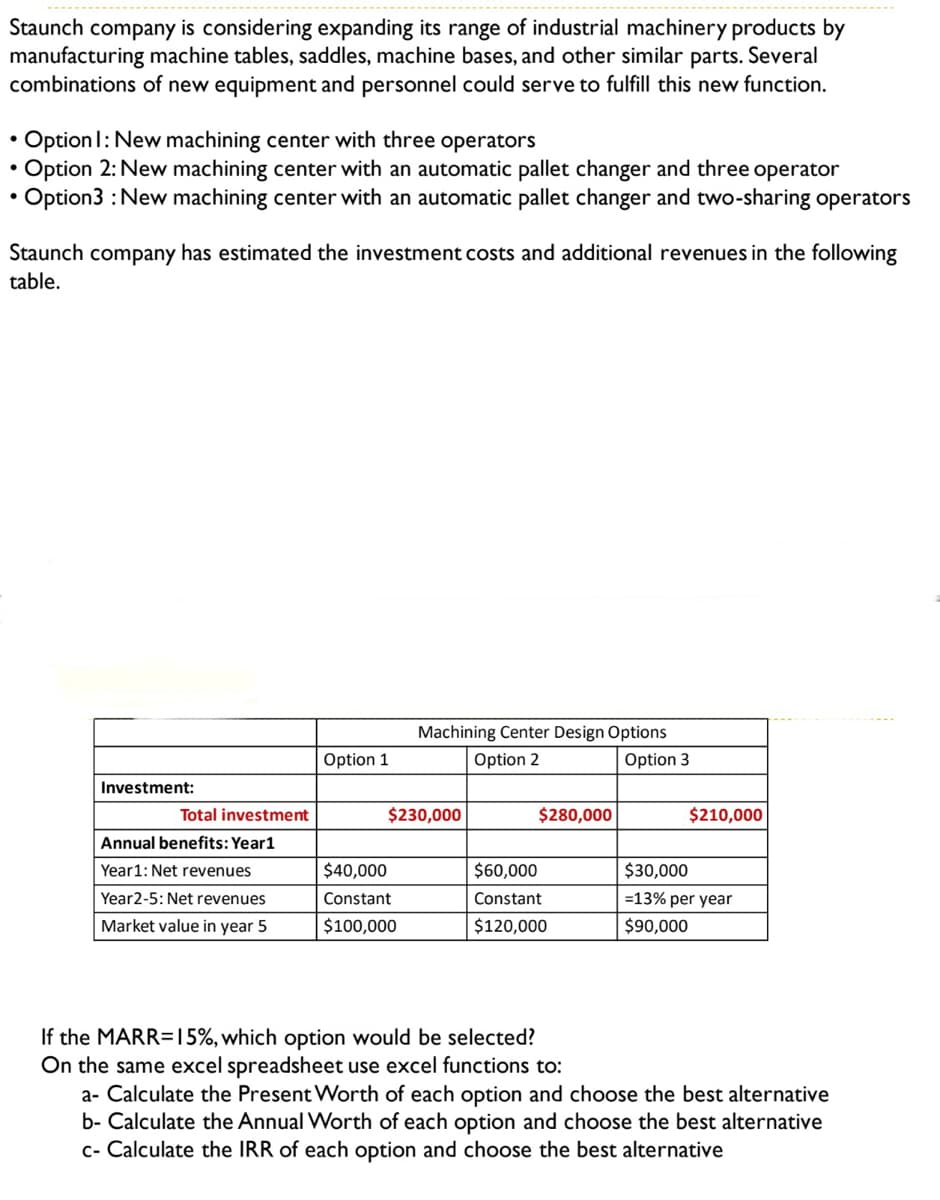

Machining Center Design Options Option 1 Option 2 Option 3 Investment: Total investment $230,000 $280,000 $210,000 Annual benefits: Year1 Year1: Net revenues $40,000 $60,000 $30,000 Year2-5: Net revenues Constant Constant =13% per year Market value in year 5 $100,000 $120,000 $90,000 If the MARR=15%, which option would be selected? On the same excel spreadsheet use excel functions to: a- Calculate the Present Worth of each option and choose the best alternative b- Calculate the Annual Worth of each option and choose the best alternative c- Calculate the IRR of each option and choose the best alternative

Q: 8.(new question) An engineer proposes to spend $95,000 on a capital project to upgrade a package…

A: present worth = -initial cashflow +present value of future cashflow worst scenario given, initial…

Q: Initial cost: $240,000 Cash flow year one: $25,000 Cash flow year two: $75,000 Cash flow year…

A: A method of capital budgeting that helps to evaluate the present worth of cash flow and a series of…

Q: NPV Total and Differential Analysis of Replacement Decision Assume Mitsubishi Chemical is evaluating…

A: Evaluation of the alternatives of keeping the old compressor and purchasing the new compressor.…

Q: Fixed capital investment 320 000 € working capital 35 000 € scrap value 30 000 € for the project…

A: "Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Year 1 180,000 200,000 300,000 240,000 230,000 210,000 330,000 260,000 195,000 155,000 The company…

A: “Since you have asked to solve part D, E and F only, we will solve the same parts for you.” Capital…

Q: NPV

A: Formula for NPV: NPV = Cash flows/(1+i)^n - Initial investment

Q: MCQ'S: 36) n) __ is a cash outlay that is expected to generate a flow of future cash benefits…

A: Cash flows are the cash generated from the operation of the business organisation. In other words,…

Q: А C Capital investment $ 2,000 7,000 4,200 Annual revenues 3,200 8,000 6,000 Annual costs 2,100…

A: Incremental analysis determine the true cost differences between the two alternatives.

Q: ETM Co is considering investing in machinery costing K150,000 payable at the start of first year.…

A: NPV It is a capital budgeting tool. As per NPV rule, the project should be accepted by the company…

Q: Internal rate of return: Casa Del Sol Property Development Company is refurbishing a 200-unit…

A: The question is based on the concept of calculation of Internal rate of return (IRR). IRR is ideal…

Q: Porter Company is analyzing two potential investments Project X $ 75,900 Initial investment Net cash…

A: Payback period = Initial investment/Annual cash inflows

Q: Product A Product B Initial cost $750,000 $650,000 Expected life 5 years 5 years Scrap value…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Question 1 Data for two alternatives are as follows: A B INVESTMENT 35,000 50,000 ANNUAL BENEFITS…

A: IRR: In capital budgeting, the internal rate of return, or IRR, is a metric that is used to assess…

Q: a) Identify which project should the company accept based on NPV method. (Note: Please round up the…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: PROBLEM TWO: Capital Budgeting The plant manager of IHK is considering the purchase of a new robotic…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: please see attachemnet. There is a part a & oart b in the attached file.

A: Formulas Used:Payback period = Initial Investment ÷ Annual Cash InflowAverage Investment = (Initial…

Q: Basic Present Value Concepts Fraser Company will need a new warehouse in five years. The warehouse…

A: Future value (FV) is the value of any assets/investment in the future Present Value (PV) is the…

Q: A firm must choose between two investment alternatives, each costing $90,000. The first alternative…

A: Here, Discount rate = 9% To Find: Net present value (NPV) =?

Q: Problem 2. Tipan’s Company is planning to invest Php 40,000 in a 3-year project. Tipan’s expected…

A: Initial Investment = PV of Annual Cash Flows Cash Flow = Present Value of Cash Flow / Present Value…

Q: Elite Apparel Inc. is considering two investment projects. The estimated net cas follows: Year Plant…

A: Solution 1b: Period PV Factor Plant expansion Retail Store expansion Amount…

Q: Week 4 Giant Equipment Ltd. is considering two projects to invest next year. Both projects have the…

A: Time value It tells that money received today by an individual has more worth than that of receiving…

Q: formation, for the plan. First cost in year 0: $816,000,000 Annual operating cost: $7,000,000 in…

A: In this we have to calculate the present value of all cost.

Q: the present value of the cash inflows/savings

A: Present Value: It represents the present worth of the future sum of money and is estimated by…

Q: 6. David is opening an Aerial Adventure Park. He has three mutually exclusive design alternatives:…

A: Future worth is a compounding technique of the time value of money. It is used to calculate the…

Q: 19. Economic data pertaining to three mutually exclusive layout design of a small facility are given…

A: The alternatives given above have been evaluated using the following capital budgeting techniques:…

Q: Payback Analysis System 1 12,000 3,000 System 2 8,000 1,000 (year 1-5) 3,000 (year 6-14) 14 First…

A: No Return payback period is the period (Number of years) it takes the cash flows to cover the…

Q: Required Investment = $80,000. Project life = 2 years. Salvage value =$30,000. CCA rate = 20%…

A: Computation of NPW Particulars Year 1 Year 2 Annual revenue with inflation @ 6% 90,000…

Q: Should WLW lease or construct their own production facility Option 1: Construct Costs to incur:…

A: Net Present Value=(Present Value of Cash Inflows-Present Value of Cash Outflows)

Q: Piping Hot Food Services (PHFS) is evaluating a capital budgeting project that costs $75,000. The…

A: Given: The cash flow after tax is $26,000 per year Rate of return is 14% Lifetime is 4 yrs Cost of…

Q: Two mutually exclusive alternatives are being considered. The MARR is 15% per year. General…

A: In case of analysis of alternatives for economic analysis, the alternative bearing the least cost or…

Q: Project Evaluation. Revenues generated by a new fad product are forecast as follows: Year Revenues…

A: Net Present Value(NPV) is excess of PV of inflows over PV of outlays of an investment at given…

Q: COST-BENEFIT ANALYSIS Cost of Capital = .14 Design A Design B Project-Completion time 24 months 24…

A: Net Present Value=(Present Value of Cash Inflows-Present Value of Cash Outflows) Payback…

Q: We assume that the company you selected is considering a new project. The project has 8 years’ life.…

A: The difference between the current value of cash inflows and outflow of cash over a period of time…

Q: 2. Data for two alternatives are as follows: Alternative A Investment P 35,000 Annual Benefits…

A: The IRR help in evaluating the profitability of the potential investment. It provides insight into…

Q: Two roadway designs are under consideration for access to a permanent suspension bridge. Design 1A…

A: Annual worth can be computed by dividing the project’s Net Present Value by the present value…

Q: Question 2: SABIRCO wants to investigate the following project. Initial investment $1,000,000 Annual…

A: Pay back period is period required to recover the initial amount.

Step by step

Solved in 3 steps with 4 images

- Kingsley Products, Ltd., is using a model 400 shaping machine to make one of its products. The companyis expecting to have a large increase in demand for the product and is anxious to expand its productivecapacity. Two possibilities are under consideration:Alternative 1. Purchase another model 400 shaping machine to operate along with the currentlyowned model 400 machine.Alternative 2. Purchase a model 800 shaping machine and use the currently owned model 400machine as standby equipment. The model 800 machine is a high-speed unit with double thecapacity of the model 400 machine.The following additional information is available on the two alternatives:a. Both the model 400 machine and the model 800 machine have a 10-year life from the time they arefirst used in production. The scrap value of both machines is negligible and can be ignored. Straightline depreciation is used.b. The cost of a new model 800 machine is $300,000.c. The model 400 machine now in use cost $160,000 three years…Borges Machine Shop, Inc., has a 1-year contractfor the production of 200,000 gear housings for a new off-roadvehicle. Owner Luis Borges hopes the contract will be extendedand the volume increased next year. Borges has developed costsfor three alternatives. They are general-purpose equipment(GPE), flexible manufacturing system (FMS), and expensive, butefficient, dedicated machine (DM). The cost data follow: GENERAL-PURPOSE EQUIPMENT(GPE) FLEXIBLEMANUFACTURINGSYSTEM (FMS) DEDICATEDMACHINE(DM) Annual contractedunits 200,000 200,000 200,000Annual fi xed cost $100,000 $200,000 $500,000Per unit variable cost $ 15.00 $ 14.00 $ 13.00Which process is best for this contract?Monroe Manufacturing owns a warehouse that has been used for storing finished goods for electro-pump products. As the company is phasing out the electro-pump product line, the company is considering modifying the existing structure to use for manufacturing a new product line. Monroe's production engineer feels that the warehouse could be modified to handle one of two new product lines. The cost and revenue data for the two product alternatives arc as follows: Product A Product BInitial cash expenditure:• Warehouse modification $115,000 $189,000• Equipment $250,000 $315,000Annual revenues $215,000 $289,000Annual O&M costs $126,000 $168,000Product life 8 years 8 yearsSalvage value…

- The operations manager at Sebago Manufacturing is considering three proposals for supplying a critical component for its new line of electric watercraft. Proposal one is to purchase the component, proposal two is make the component in-house using rebuilt equipment, and proposal three is to purchase new, highly automated equipment. The costs associated with each proposal are provided in the table below. Proposal Annual cost ofcapital required Variable cost ofeach component One: purchase $0.00 $22.00 Two: make with rebuiltequipment $150,000.00 $14.00 Three: make with newequipment $450,000.00 $12.50 At what quantity range will each option be preferred?Kagle design engineers are in the process of developing a new green product, one that will significantly reduce impact on the environment and yet still provide the desired customer functionality. Currently, two designs are being considered. The manager of Kagle has told the engineers that the cost for the new product cannot exceed 550 per unit (target cost). In the past, the Cost Accounting Department has given estimated costs using a unit-based system. At the request of the Engineering Department, Cost Accounting is providing both unit-and activity-based accounting information (made possible by a recent pilot study producing the activity-based data). Unit-based system: Variable conversion activity rate: 100 per direct labor hour Material usage rate: 20 per part ABC system: Labor usage: 15 per direct labor hour Material usage (direct materials): 20 per part Machining: 75 per machine hour Purchasing activity: 150 per purchase order Setup activity: 3,000 per setup hour Warranty activity: 500 per returned unit (usually requires extensive rework) Customer repair cost: 25 per repair hour (average) Required: 1. Select the lower-cost design using unit-based costing. Are logistical and post-purchase activities considered in this analysis? 2. Select the lower-cost design using ABC analysis. Explain why the analysis differs from the unit-based analysis. 3. What if the post-purchase cost was an environmental contaminant and amounted to 10 per unit for Design A and 40 per unit for Design B? Assume that the environmental cost is borne by society. Now which is the better design?Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.

- Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)A process control manager is considering two robots to improve materials handling capacity in the production of rigid shaft couplings that mate dissimilar drive components. Robot X has a first cost of $84,000, an annual M&O cost of $31,000, a $40,000 salvage value, and will improve revenues by $96,000 per year. Robot Y has a first cost of $146,000, an annual M&O cost of $28,000, a $47,000 salvage value, and will increase revenues by $119,000 per year. The company’s MARR is 15% per year and it uses a 3-year study period for economic evaluations. Which one should the manager select (a) on the basis of ROR values, and (b) on the basis of the incremental ROR value? (c) Which is the correct selection basis? Perform the analysis by hand or spreadsheet, as instructed.Exploiting Internal Linkages Woodruff Company is currently producing a snowmobile that uses five specialized parts. Engineering has proposed replacing these specialized parts with commodity parts, which will cost less and can be purchased in larger order quantities. Current activity capacity and demand (with specialized parts required) and expected activity demand (with only commodity parts required) are provided. Activities Activity Driver ActivityCapacity Current ActivityDemand Expected ActivityDemand Material usage Number of parts 200,000 200,000 200,000 Installing parts Direct labor hours 20,000 20,000 16,000 Purchasing parts Number of orders 7,600 6,498 3,990 Additionally, the following activity cost data are provided: Material usage: $11 per specialized part used; $27 per commodity part; no fixed activity cost. Installing parts: $21 per direct labor hour; no fixed activity cost. Purchasing parts: Four salaried clerks, each earning a $47,000 annual salary; each clerk…

- Vamoose plc is a company based in the Teeside which manufactures components for the motorised scooter and bicycle industry. Vamoose’s Research and Development unit has recently developed an innovative new product for which there is considerable market demand. The production of this new product represents a major shift in Vamoose’s strategic direction as a company. Subsequently, the company is now planning to acquire a piece of equipment to manufacture the new product. The equipment will cost £6,600,000 and is expected to last for 5 years with an estimated scrap value of £2,300,000. Management expects to produce 160,000 units per annum (p.a.) of the new product, which will be sold for £68 per unit in the first year. Production costs per unit (at current prices) are as follows: Materials: £28.50 Labour: £24.40 Materials are expected to inflate at 8.5% p.a. and labour is expected to inflate at 6.5% p.a. Fixed overheads of the company currently amount to £1,370,000. These are not expected…Vamoose plc is a company based in the Teeside which manufactures components for the motorised scooter and bicycle industry. Vamoose’s Research and Development unit has recently developed an innovative new product for which there is considerable market demand. The production of this new product represents a major shift in Vamoose’s strategic direction as a company. Subsequently, the company is now planning to acquire a piece of equipment to manufacture the new product. The equipment will cost £6,600,000 and is expected to last for 5 years with an estimated scrap value of £2,300,000. Management expects to produce 160,000 units per annum (p.a.) of the new product, which will be sold for £68 per unit in the first year. Production costs per unit (at current prices) are as follows: Materials: £28.50 Labour: £24.40 Materials are expected to inflate at 8.5% p.a. and labour is expected to inflate at 6.5% p.a. Fixed overheads of the company currently amount to £1,370,000. These are not expected…Vamoose plc is a company based in the Teeside which manufactures components for the motorised scooter and bicycle industry. Vamoose’s Research and Development unit has recently developed an innovative new product for which there is considerable market demand. The production of this new product represents a major shift in Vamoose’s strategic direction as a company. Subsequently, the company is now planning to acquire a piece of equipment to manufacture the new product. The equipment will cost £6,600,000 and is expected to last for 5 years with an estimated scrap value of £2,300,000. Management expects to produce 160,000 units per annum (p.a.) of the new product, which will be sold for £68 per unit in the first year. Production costs per unit (at current prices) are as follows: Materials: £28.50 Labour: £24.40 Materials are expected to inflate at 8.5% p.a. and labour is expected to inflate at 6.5% p.a. Fixed overheads of the company currently amount to £1,370,000. These are not expected…