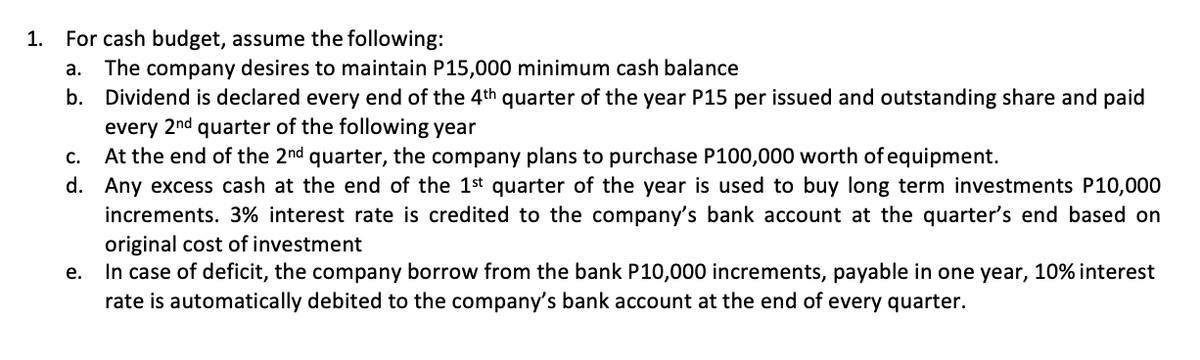

For cash budget, assume the following: The company desires to maintain P15,000 minimum cash balance b. Dividend is declared every end of the 4th quarter of the year P15 per issued and outstanding share and paid every 2nd quarter of the following year At the end of the 2nd quarter, the company plans to purchase P100,000 worth of equipment. d. Any excess cash at the end of the 1st quarter of the year is used to buy long term investments P10,000 increments. 3% interest rate is credited to the company's bank account at the quarter's end based on original cost of investment In case of deficit, the company borrow from the bank P10,000 increments, payable in one year, 10% interest rate is automatically debited to the company's bank account at the end of every quarter. 1. а. С. е.

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

PREPARE

Trending now

This is a popular solution!

Step by step

Solved in 2 steps