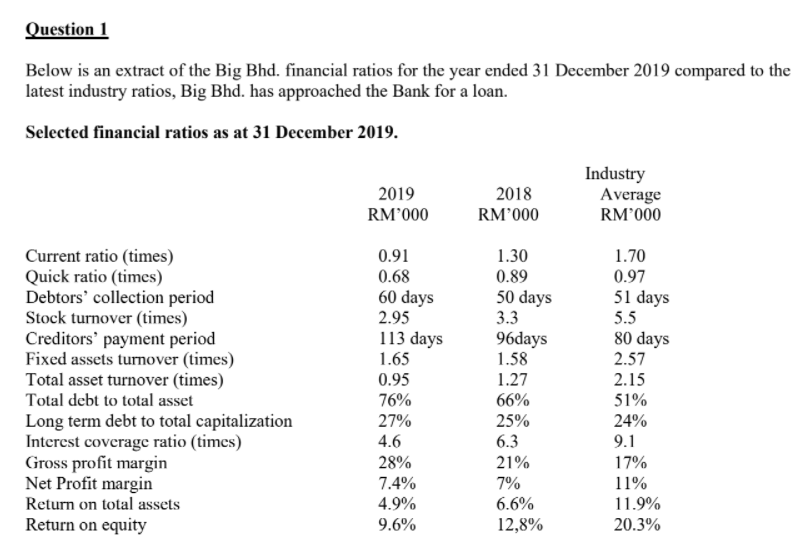

Question 1 Below is an extract of the Big Bhd. financial ratios for the year ended 31 December 2019 compared to the latest industry ratios, Big Bhd. has approached the Bank for a loan. Selected financial ratios as at 31 December 2019. Industry Average RM'000 2019 2018 RM'000 RM'000 Current ratio (times) Quick ratio (times) Debtors' collection period Stock turnover (times) Creditors' payment period Fixed assets turmover (times) Total asset turnover (times) Total debt to total asset 1.30 0.89 50 days 3.3 96days 1.58 1.27 66% 25% 6.3 0.91 1.70 0.68 0.97 60 days 2.95 113 days 1.65 51 days 5.5 80 days 2.57 2.15 51% 24% 0.95 76% 27% Long term debt to total capitalization Interest coverage ratio (times) Gross profit margin Net Profit margin Return on total assets Return on equity 4.6 9.1 28% 21% 17% 7.4% 7% 11% 4.9% 6.6% 11.9% 9.6% 12,8% 20.3%

Question 1 Below is an extract of the Big Bhd. financial ratios for the year ended 31 December 2019 compared to the latest industry ratios, Big Bhd. has approached the Bank for a loan. Selected financial ratios as at 31 December 2019. Industry Average RM'000 2019 2018 RM'000 RM'000 Current ratio (times) Quick ratio (times) Debtors' collection period Stock turnover (times) Creditors' payment period Fixed assets turmover (times) Total asset turnover (times) Total debt to total asset 1.30 0.89 50 days 3.3 96days 1.58 1.27 66% 25% 6.3 0.91 1.70 0.68 0.97 60 days 2.95 113 days 1.65 51 days 5.5 80 days 2.57 2.15 51% 24% 0.95 76% 27% Long term debt to total capitalization Interest coverage ratio (times) Gross profit margin Net Profit margin Return on total assets Return on equity 4.6 9.1 28% 21% 17% 7.4% 7% 11% 4.9% 6.6% 11.9% 9.6% 12,8% 20.3%

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 2TIF: Real-world annual report The financial statements for Nike, Inc. (NKE), are presented in Appendix E...

Related questions

Question

Assume that you are a bank officer. Perform a comparative analysis based on the above ratios.

Advise the bank whether to grant Big Bhd. a loan.

Transcribed Image Text:Question 1

Below is an extract of the Big Bhd. financial ratios for the year ended 31 December 2019 compared to the

latest industry ratios, Big Bhd. has approached the Bank for a loan.

Selected financial ratios as at 31 December 2019.

Industry

Average

RM°000

2019

2018

RM°000

RM'000

Current ratio (times)

Quick ratio (times)

Debtors' collection period

Stock turnover (times)

Creditors' payment period

Fixed assets turmover (times)

Total asset turnover (times)

Total debt to total asset

0.91

1.30

1.70

0.68

0.97

51 days

5.5

80 days

2.57

0.89

60 days

2.95

50 days

3.3

113 days

1.65

96days

1.58

0.95

76%

1.27

2.15

66%

51%

Long term debt to total capitalization

Interest coverage ratio (times)

Gross profit margin

Net Profit margin

Return on total assets

27%

25%

24%

4.6

6.3

9.1

28%

21%

17%

7.4%

7%

11%

4.9%

6.6%

11.9%

Return on equity

9.6%

12,8%

20.3%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College