1) Total Fixed Liabilities / LTD. 2) Current Liabilities / STD. 3) Total Liabilities.

1) Total Fixed Liabilities / LTD. 2) Current Liabilities / STD. 3) Total Liabilities.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter8: Investing Activities

Section: Chapter Questions

Problem 1.3AIC: Estimate the average total estimated useful life of depreciable property, plant, and equipment....

Related questions

Question

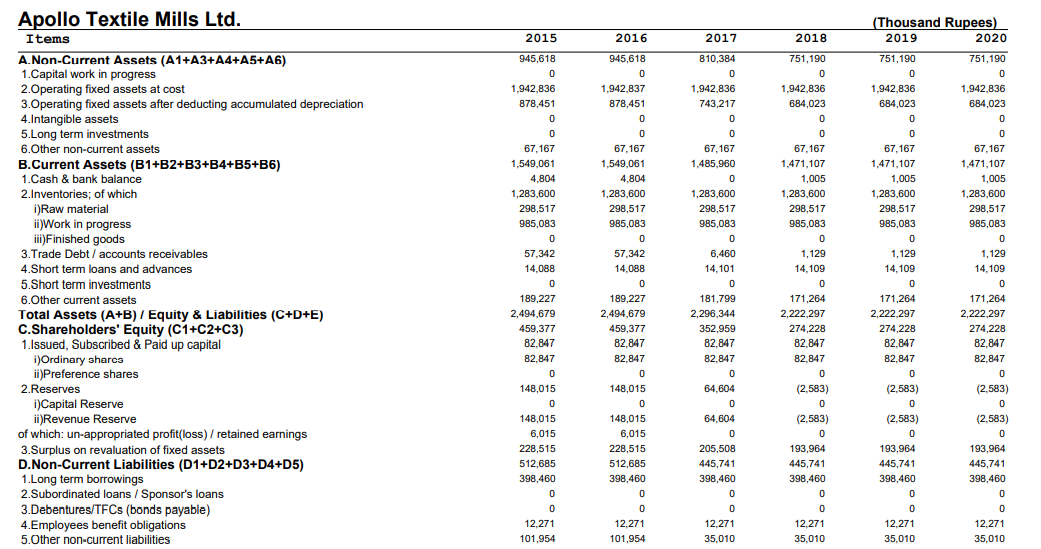

Select 2019 Year From The Given Data In Image And Find The Following thing:

1) Total Fixed Liabilities / LTD.

2) Current Liabilities / STD.

3) Total Liabilities.

4) Contractual Liabilities or Total Bank Debt.

5) Shareholders Equity (SHE) / Net worth.

6) Financial Exp as a % of Sales.

7) Balance Sheet Growth - (TOTAL ASSETS CURRENT YEAR- TOTAL ASSETS CURRENT YEAR) / TOTAL ASSETS PREVIOUS YEAR.

8) Sales.

9) PAT / NI.

10) Annual

11) Fixed Assets at Book Value.

12) Total Assets.

13) EBIT.

14) Financial Cost / Interest Expense.

Transcribed Image Text:Apollo Textile Mills Ltd.

(Thousand Rupees)

2020

Items

2015

2016

2017

2018

2019

A.Non-Current Assets (A1+A3+A4+A5+A6)

1.Capital work in progress

2.0perating fixed assets at cost

3.0perating fixed assets after deducting accumulated depreciation

4.Intangible assets

5.Long term investments

945,618

945,618

810,384

751,190

751,190

751,190

1,942,836

1,942,837

1,942,836

1,942,836

1,942,836

1,942,836

878,451

878,451

743,217

684,023

684,023

684,023

6.Other non-current assets

67,167

67,167

67, 167

67,167

67,167

67,167

B.Current Assets (B1+B2+B3+B4+B5+B6)

1.Cash & bank balance

1,549,061

1,549,061

1,485,960

1,471,107

1,471,107

1,471,107

4,804

4,804

1,005

1,005

1,005

2.Inventories; of which

i)Raw material

1,283,600

1,283,600

1,283,600

1,283,600

1,283,600

1,283,600

298,517

298,517

298,517

298,517

298,517

298,517

ii)Work in progress

iii)Finished goods

985,083

985,083

985,083

985,083

985,083

985,083

3.Trade Debt / accounts receivables

57,342

57,342

6,460

1,129

1,129

1,129

4.Short term loans and advances

5.Short term investments

6.Other current assets

Total Assets (A+B) / Equity & Liabilities (C+D+E)

C.Shareholders' Equity (C1+C2+C3)

1.lssued, Subscribed & Paid up capital

i)Ordinary sharc3

ii)Preference shares

2.Reserves

i)Capital Reserve

ii)Revenue Reserve

of which: un-appropriated profit(loss) / retained earnings

14,088

14,088

14,101

14,109

14,109

14,109

189,227

189,227

181,799

171,264

171,264

171,264

2,222,297

274,228

82,847

2,494,679

2,494,679

2,296,344

2,222,297

2,222,297

459,377

459,377

352,959

274,228

274,228

82,847

82,847

82,847

82,847

82,847

82,847

82,847

82,847

82,847

82,847

82,847

148,015

148,015

64,604

(2,583)

(2,583)

(2,583)

148,015

148,015

64,604

(2,583)

(2,583)

(2,583)

6,015

6,015

193,964

3.Surplus on revaluation of fixed assets

D.Non-Current Liabilities (D1+D2+D3+D4+D5)

1.Long term borrowings

2.Subordinated loans / Sponsor's loans

B.Debentures/TFCS (bonds payable)

4.Employees benefit obligations

228,515

228,515

205,508

193,964

193,964

512,685

512,685

445,741

445,741

445,741

445,741

398,460

398,460

398,460

398,460

398,460

398,460

12,271

12,271

12,271

12,271

12,271

12,271

5.0ther non-current liabilities

101,954

101,954

35,010

35,010

35,010

35,010

![1,502,328

E.Current Liabilities (E1+E2+E3+E4)

1.Trade credit & other accounts payables

of which: i) Trade credits

2.Short term borrowings

1,522,617

1,522,617

1,497,644

1,502,328

1,502,328

51,357

51,357

26,388

31,072

31,072

31,072

24,992

24,992

13,540

13,501

13,501

13,501

1,153,889

1,153,889

1,167,608

1,167,608

1,167,608

1,167,608

77,655

77,655

63,936

63,936

63,936

63,936

3.Current portion of non-current liabilities

4.Other current liabilities

239,716

239,716

239,712

239,712

239,712

239,712

F.Operations:

1.Sales

373

373

i)Local sales (Net)

ii)Export sales (Net)

373

373

2.Cost of sales

93,182

93,182

69,854

66,129

66,129

66, 129

i)Cost of material

3.Gross profit / (loss) (F1-F2)

4.General, administrative and other expenses

i)Selling & distribution expenses

ii)Administrative and other expenses

5.Other income / (loss)

(92,809)

11,078

(92,809)

(69,854)

(66,129)

(66, 129)

(66,129)

11,078

9,196

12,544

12,544

12,544

2

11.076

11,076

9,196

12,544

12,544

12,544

(103,887]

(79,050)

(78,673)

(78,673)

(78,673)

6.EBIT (F3-F4+F5)

7.Financial expenses

of which: (i) Interest expenses

8.Profit / (loss) before taxation (F6-F7)

9.Тах еxpenses

10.Profit / (loss) after tax (F8-F9)

11.Cash dividends

12.Bonus shares / stock dividends

(103,887)

19

19

31

59

59

59

(103,906)

(103,906)

(79,081)

(78,732)

(78,732)

(78,732)

(6,208)

(6,208)

(97,698)

(97,698)

(79,081)

(78,732)

(78,732)

(78,732)

G.Statement of Cash Flows

(3,104)

1.Net cash flows from operating activities

2.Net cash flows from investing activities

3.Net cash flows from financing activities

H.Miscellaneous

1.Total capital employed (C+D)

2.Retention in business (F10-F11-F12)

3.Depreciation for the year

4.Salaries, wages and employee benefits

I.Key Performance Indicators

P1. Net Profit margin / Net profit to sales (F10 as % of F1)

P2. Asset turnover (F1 to Avg (Current year(A+B).previous year (A+B)})

P3. Return on Assets (F10 as a % of Avg {Current year(A+B).previous year (A+B)}

P4. Financial leverage (Avg. (Current year(A+B),previous year (A+B) to Avg. Current

year(C).previous year (C)})

P5. Return on equity (F10 as % of Avg (Current year(C),previous year (C)}

V3. Basic earnings per share (Rs./share) (F10 to No. of shares)

(3,104)

1,005

1,005

1,005

1,153,889

972,062

972,062

798,700

719,969

719,969

719,969

(97,698)

(97,698)

(79,081)

(78,732)

59,194

(78,732)

59,194

(78,732)

64,640

59,194

6,290

7,371

7,371

7,371

-26,192.49

-26,192.49

0.00

0.00

0.00

0.00

0.00

0.00

-3.82

-3.92

-3.30

-3.48

-3.54

-3.54

5.03

5.43

5.90

7.20

8.10

8.10

-19.22

-21.27

-19.47

-25.11

-28.71

-28.71

-11.79

-11.79

-9.55

-9.50

-9.50

-9.50](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fb4c5181b-7421-4f0c-a496-5abae2d13788%2F98b85659-fe98-4277-86dc-4eaf69fe04c4%2Fhgw5rm_processed.png&w=3840&q=75)

Transcribed Image Text:1,502,328

E.Current Liabilities (E1+E2+E3+E4)

1.Trade credit & other accounts payables

of which: i) Trade credits

2.Short term borrowings

1,522,617

1,522,617

1,497,644

1,502,328

1,502,328

51,357

51,357

26,388

31,072

31,072

31,072

24,992

24,992

13,540

13,501

13,501

13,501

1,153,889

1,153,889

1,167,608

1,167,608

1,167,608

1,167,608

77,655

77,655

63,936

63,936

63,936

63,936

3.Current portion of non-current liabilities

4.Other current liabilities

239,716

239,716

239,712

239,712

239,712

239,712

F.Operations:

1.Sales

373

373

i)Local sales (Net)

ii)Export sales (Net)

373

373

2.Cost of sales

93,182

93,182

69,854

66,129

66,129

66, 129

i)Cost of material

3.Gross profit / (loss) (F1-F2)

4.General, administrative and other expenses

i)Selling & distribution expenses

ii)Administrative and other expenses

5.Other income / (loss)

(92,809)

11,078

(92,809)

(69,854)

(66,129)

(66, 129)

(66,129)

11,078

9,196

12,544

12,544

12,544

2

11.076

11,076

9,196

12,544

12,544

12,544

(103,887]

(79,050)

(78,673)

(78,673)

(78,673)

6.EBIT (F3-F4+F5)

7.Financial expenses

of which: (i) Interest expenses

8.Profit / (loss) before taxation (F6-F7)

9.Тах еxpenses

10.Profit / (loss) after tax (F8-F9)

11.Cash dividends

12.Bonus shares / stock dividends

(103,887)

19

19

31

59

59

59

(103,906)

(103,906)

(79,081)

(78,732)

(78,732)

(78,732)

(6,208)

(6,208)

(97,698)

(97,698)

(79,081)

(78,732)

(78,732)

(78,732)

G.Statement of Cash Flows

(3,104)

1.Net cash flows from operating activities

2.Net cash flows from investing activities

3.Net cash flows from financing activities

H.Miscellaneous

1.Total capital employed (C+D)

2.Retention in business (F10-F11-F12)

3.Depreciation for the year

4.Salaries, wages and employee benefits

I.Key Performance Indicators

P1. Net Profit margin / Net profit to sales (F10 as % of F1)

P2. Asset turnover (F1 to Avg (Current year(A+B).previous year (A+B)})

P3. Return on Assets (F10 as a % of Avg {Current year(A+B).previous year (A+B)}

P4. Financial leverage (Avg. (Current year(A+B),previous year (A+B) to Avg. Current

year(C).previous year (C)})

P5. Return on equity (F10 as % of Avg (Current year(C),previous year (C)}

V3. Basic earnings per share (Rs./share) (F10 to No. of shares)

(3,104)

1,005

1,005

1,005

1,153,889

972,062

972,062

798,700

719,969

719,969

719,969

(97,698)

(97,698)

(79,081)

(78,732)

59,194

(78,732)

59,194

(78,732)

64,640

59,194

6,290

7,371

7,371

7,371

-26,192.49

-26,192.49

0.00

0.00

0.00

0.00

0.00

0.00

-3.82

-3.92

-3.30

-3.48

-3.54

-3.54

5.03

5.43

5.90

7.20

8.10

8.10

-19.22

-21.27

-19.47

-25.11

-28.71

-28.71

-11.79

-11.79

-9.55

-9.50

-9.50

-9.50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College