Suppose that the US. government decides to charge beer consumers a tax. Before the tax, 10,000 cases of beer were sold every week at a price of 14 per case After the tax, 3,000 cases of beer are sold every week; consumers pay $5 per case (induding the tax), and producers receive $2 per case The amount of the tax on a case of beer is burden that fallis on producers is s Joer cane. of this amount, the burden that fals on consumers is per cane. per case, and the True or False: The effect of the tax on the quantity sold would have been larger if the tax had been levied on producers O true O Fae

Suppose that the US. government decides to charge beer consumers a tax. Before the tax, 10,000 cases of beer were sold every week at a price of 14 per case After the tax, 3,000 cases of beer are sold every week; consumers pay $5 per case (induding the tax), and producers receive $2 per case The amount of the tax on a case of beer is burden that fallis on producers is s Joer cane. of this amount, the burden that fals on consumers is per cane. per case, and the True or False: The effect of the tax on the quantity sold would have been larger if the tax had been levied on producers O true O Fae

Principles of Microeconomics

7th Edition

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter6: Supply, Demand And Government Policies

Section: Chapter Questions

Problem 5QR

Related questions

Question

100%

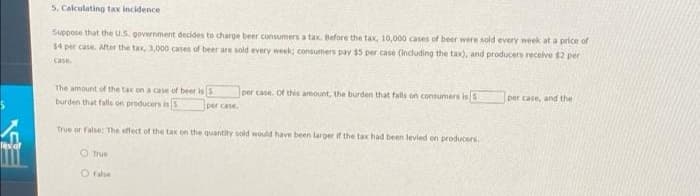

Transcribed Image Text:5. Calculating tax incidence

Suppose that the US. government decides to charge beer consumers a tax. Before the tax, 10,000 cases of beer were sold every week at a price of

$4 per case. After the tax, 3,000 cases of beer are sold every week; consumers pay $5 per case (including the tax), and producers recelve $2 per

Case

The amount of the tax on a case of beer is s

per case. of this amount, the burden that falls on consumers is s

per case, and the

burden that falls on producers is

per case.

True or False: The effect of the tax on the quantity sold would have been larger if the tax had been levied on producers

les or

O True

O False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning