Target is a customer centric retail store in what way Target follows marketing orientation to ensure customer experience? Identify Target competitive edge and market offering in the tough competition with Walmart clarifying its competitive strategy? Target is about "Customer delight" identify Target market mix integration to achieve this objective

Target is a customer centric retail store in what way Target follows marketing orientation to ensure customer experience? Identify Target competitive edge and market offering in the tough competition with Walmart clarifying its competitive strategy? Target is about "Customer delight" identify Target market mix integration to achieve this objective

Principles Of Marketing

17th Edition

ISBN:9780134492513

Author:Kotler, Philip, Armstrong, Gary (gary M.)

Publisher:Kotler, Philip, Armstrong, Gary (gary M.)

Chapter1: Marketing: Creating Customer Value And Engagement

Section: Chapter Questions

Problem 1.1DQ

Related questions

Question

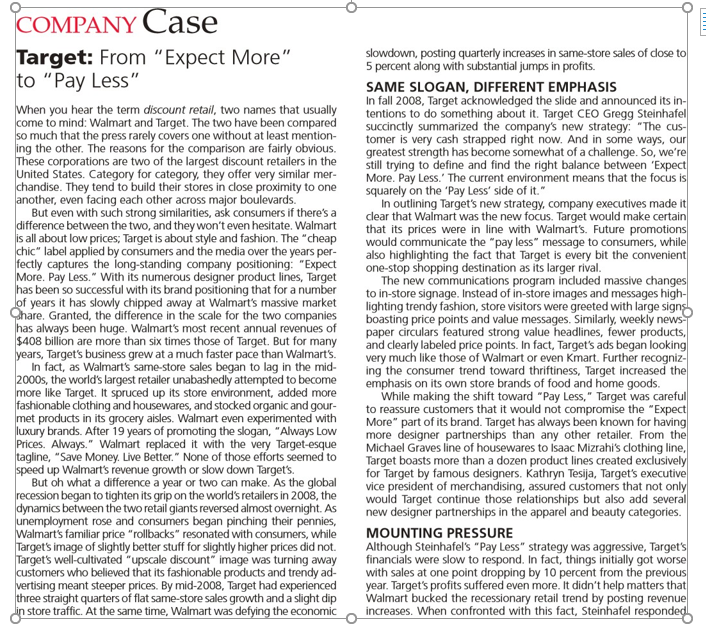

Transcribed Image Text:COMPANY Case

Target: From "Expect More"

to "Pay Less"

slowdown, posting quarterly increases in same-store sales of dose to

5 percent along with substantial jumps in profits.

When you hear the term discount retail, two names that usually

come to mind: Walmart and Target. The two have been compared

so much that the press rarely covers one without at least mention-

ing the other. The reasons for the comparison are fairly obvious.

These corporations are two of the largest discount retailers in the

United States. Category for category, they offer very similar mer-

chandise. They tend to build their stores in close proximity to one

another, even facing each other across major boulevards.

But even with such strong similarities, ask consumers if there's a

difference between the two, and they won't even hesitate. Walmart

is all about low prices; Target is about style and fashion. The "cheap

chic" label applied by consumers and the media over the years per-

fectly captures the Íong-standing company positioning: "Expect

More. Pay Less." With its numerous designer product lines, Target

has been so successful with its brand positioning that for a number

lof years it has slowly chipped away at Walmart's massive market

Chare. Granted, the difference in the scale for the two companies

has always been huge. Walmart's most recent annual revenues of

$408 billion are more than six times those of Target. But for many

years, Target's business grew at a much faster pace than Walmart's.

In fact, as Walmart's same-store sales began to lag in the mid-

2000s, the world's largest retailer unabashedly attempted to become

more like Target. It spruced up its store environment, added more

fashionable clothing and housewares, and stocked organic and gour-

met products in its grocery aisles. Walmart even experimented with

luxury brands. After 19 years of promoting the slogan, "Always Low

Prices. Always." Walmart replaced it with the very Target-esque

tagline, "Save Money. Live Better." None of those efforts seemed to

speed up Walmart's revenue growth or slow down Target's.

But oh what a difference a year or two can make. As the global

recession began to tighten its grip on the world's retailers in 2008, the

dynamics between the two retail giants reversed almost overnight. As

unemployment rose and consumers began pinching their pennies,

Walmart's familiar price "rollbacks" resonated with consumers, while

Target's image of slightly better stuff for slightly higher prices did not.

Target's well-cultivated "upscale discount" image was turning away

customers who believed that its fashionable products and trendy ad-

vertising meant steeper prices. By mid-2008, Target had experienced

three straight quarters of flat same-store sales growth and a slight dip

din store traffic. At the same time, Walmart was defying the economic

SAME SLOGAN, DIFFERENT EMPHASIS

In fall 2008, Target acknowledged the slide and announced its in-

tentions to do something about it. Target CEO Gregg Steinhafel

succinctly summarized the company's new strategy: "The cus-

tomer is very cash strapped right now. And in some ways, our

greatest strength has become somewhat of a challenge. So, we're

still trying to define and find the right balance between 'Expect

More. Pay Less.' The current environment means that the focus is

squarely on the 'Pay Less' side of it."

In outlining Target's new strategy, company executives made it

clear that Walmart was the new focus. Target would make certain

that its prices were in line with Walmart's. Future promotions

would communicate the "pay less" message to consumers, while

also highlighting the fact that Target is every bit the convenient

one-stop shopping destination as its larger rival.

The new communications program included massive changes

to in-store signage. Instead of in-store images and messages high-

lighting trendy fashion, store visitors were greeted with large signs

boasting price points and value messages. Similarly, weekly news

paper circulars featured strong value headlines, fewer products,

and clearly labeled price points. In fact, Target's ads began looking

very much like those of Walmart or even Kmart. Further recogniz-

ing the consumer trend toward thriftiness, Target increased the

emphasis on its own store brands of food and home goods.

While making the shift toward "Pay Less," Target was careful

to reassure customers that it would not compromise the "Expect

More" part of its brand. Target has always been known for having

more designer partnerships than any other retailer. From the

Michael Graves line of housewares to Isaac Mizrahi's clothing line,

Target boasts more than a dozen product lines created exclusively

for Target by famous designers. Kathryn Tesija, Target's executive

vice president of merchandising, assured customers that not only

would Target continue those relationships but also add several

new designer partnerships in the apparel and beauty categories.

MOUNTING PRESSURE

Although Steinhafel's "Pay Less" strategy was aggressive, Target's

financials were slow to respond. In fact, things initially got worse

with sales at one point dropping by 10 percent from the previous

year. Target's profits suffered even more. It didn't help matters that

Walmart bucked the recessionary retail trend by posting revenue

increases. When confronted with this fact, Steinhafel responded

Transcribed Image Text:From Target practices, identify the following questions:

1. Target is a customer centric retail store in what way Target follows marketing orientation to ensure

customer experience?

2. Identify Target competitive edge and market offering in the tough competition with Walmart clarifying its

competitive strategy?

3. Target is about "Customer delight" identify Target market mix integration to achieve this objective

In what way does Target handle its communication strategy?

5. What is target pricing strategy?

4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles Of Marketing

Marketing

ISBN:

9780134492513

Author:

Kotler, Philip, Armstrong, Gary (gary M.)

Publisher:

Pearson Higher Education,

Marketing

Marketing

ISBN:

9781259924040

Author:

Roger A. Kerin, Steven W. Hartley

Publisher:

McGraw-Hill Education

Foundations of Business (MindTap Course List)

Marketing

ISBN:

9781337386920

Author:

William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:

Cengage Learning

Principles Of Marketing

Marketing

ISBN:

9780134492513

Author:

Kotler, Philip, Armstrong, Gary (gary M.)

Publisher:

Pearson Higher Education,

Marketing

Marketing

ISBN:

9781259924040

Author:

Roger A. Kerin, Steven W. Hartley

Publisher:

McGraw-Hill Education

Foundations of Business (MindTap Course List)

Marketing

ISBN:

9781337386920

Author:

William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:

Cengage Learning

Marketing: An Introduction (13th Edition)

Marketing

ISBN:

9780134149530

Author:

Gary Armstrong, Philip Kotler

Publisher:

PEARSON

Contemporary Marketing

Marketing

ISBN:

9780357033777

Author:

Louis E. Boone, David L. Kurtz

Publisher:

Cengage Learning