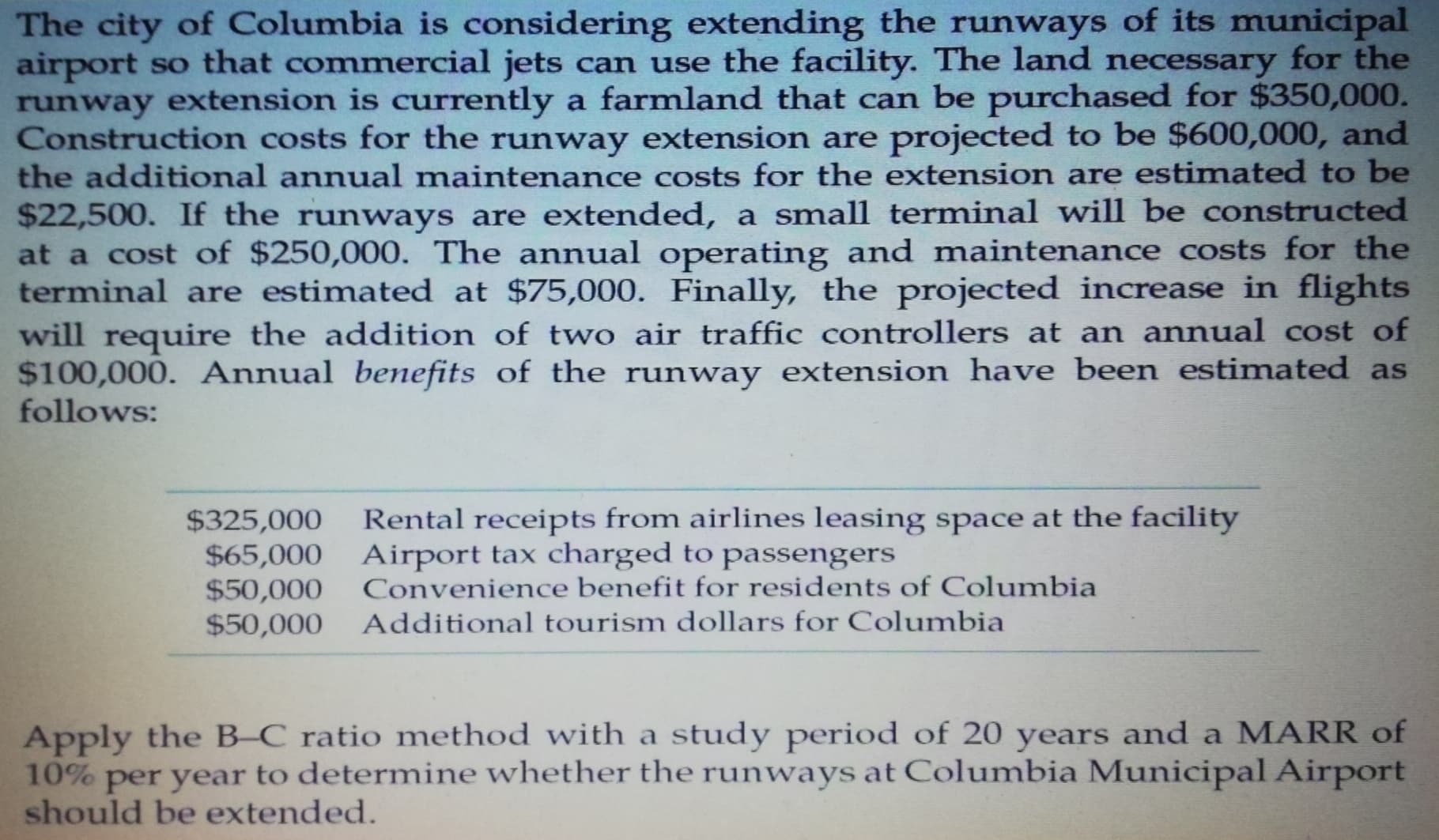

The city of Columbia is considering extending the runways of its municipal airport so that commercial jets can use the facility. The land necessary for the runway extension is currently a farmland that can be purchased for $350,000. Construction costs for the runway extension are projected to be $600,000, and the additional annual maintenance costs for the extension are estimated to be $22,500. If the runways are extended, a small terminal will be constructed at a cost of $250,000. The annual operating and maintenance costs for the terminal are estimated at $75,000. Finally, the projected increase in flights will require the addition of two air traffic controllers at an annual cost of $100,000. Annual bemefits of the runway extension have been estimated as follows: Rental receipts from airlines leasing space at the facility $325,000 $65,000 Airport tax charged to passengers $50,000 $50,000 Convenience benefit for residents of Columbia Additional tourism dollars for Columbia Apply the B-C ratio method with a study period of 20 years and a MARR of 10% per year to determine whether the runways at Columbia Municipal Airport should be extended.

The city of Columbia is considering extending the runways of its municipal airport so that commercial jets can use the facility. The land necessary for the runway extension is currently a farmland that can be purchased for $350,000. Construction costs for the runway extension are projected to be $600,000, and the additional annual maintenance costs for the extension are estimated to be $22,500. If the runways are extended, a small terminal will be constructed at a cost of $250,000. The annual operating and maintenance costs for the terminal are estimated at $75,000. Finally, the projected increase in flights will require the addition of two air traffic controllers at an annual cost of $100,000. Annual bemefits of the runway extension have been estimated as follows: Rental receipts from airlines leasing space at the facility $325,000 $65,000 Airport tax charged to passengers $50,000 $50,000 Convenience benefit for residents of Columbia Additional tourism dollars for Columbia Apply the B-C ratio method with a study period of 20 years and a MARR of 10% per year to determine whether the runways at Columbia Municipal Airport should be extended.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 5MAD: Home Garden Inc. is considering the construction of a distribution warehouse in West Virginia to...

Related questions

Question

Transcribed Image Text:The city of Columbia is considering extending the runways of its municipal

airport so that commercial jets can use the facility. The land necessary for the

runway extension is currently a farmland that can be purchased for $350,000.

Construction costs for the runway extension are projected to be $600,000, and

the additional annual maintenance costs for the extension are estimated to be

$22,500. If the runways are extended, a small terminal will be constructed

at a cost of $250,000. The annual operating and maintenance costs for the

terminal are estimated at $75,000. Finally, the projected increase in flights

will require the addition of two air traffic controllers at an annual cost of

$100,000. Annual bemefits of the runway extension have been estimated as

follows:

Rental receipts from airlines leasing space at the facility

$325,000

$65,000 Airport tax charged to passengers

$50,000

$50,000

Convenience benefit for residents of Columbia

Additional tourism dollars for Columbia

Apply the B-C ratio method with a study period of 20 years and a MARR of

10% per year to determine whether the runways at Columbia Municipal Airport

should be extended.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning