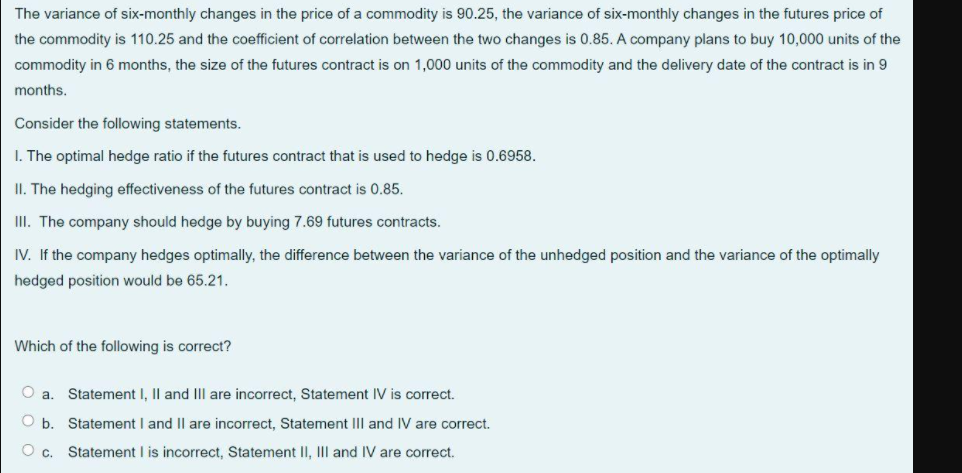

The variance of six-monthly changes in the price of a commodity is 90.25, the variance of six-monthly changes in the futures price of the commodity is 110.25 and the coefficient of correlation between the two changes is 0.85. A company plans to buy 10,000 units of th commodity in 6 months, the size of the futures contract is on 1,000 units of the commodity and the delivery date of the contract is in 9 months. Consider the following statements. I. The optimal hedge ratio if the futures contract that is used to hedge is 0.6958. II. The hedging effectiveness of the futures contract is 0.85. II. The company should hedge by buying 7.69 futures contracts. IV. If the company hedges optimally, the difference between the variance of the unhedged position and the variance of the optimally hedged position would be 65.21.

The variance of six-monthly changes in the price of a commodity is 90.25, the variance of six-monthly changes in the futures price of the commodity is 110.25 and the coefficient of correlation between the two changes is 0.85. A company plans to buy 10,000 units of th commodity in 6 months, the size of the futures contract is on 1,000 units of the commodity and the delivery date of the contract is in 9 months. Consider the following statements. I. The optimal hedge ratio if the futures contract that is used to hedge is 0.6958. II. The hedging effectiveness of the futures contract is 0.85. II. The company should hedge by buying 7.69 futures contracts. IV. If the company hedges optimally, the difference between the variance of the unhedged position and the variance of the optimally hedged position would be 65.21.

Chapter16: Labor Markets

Section: Chapter Questions

Problem 16.9P

Related questions

Question

Transcribed Image Text:The variance of six-monthly changes in the price of a commodity is 90.25, the variance of six-monthly changes in the futures price of

the commodity is 110.25 and the coefficient of correlation between the two changes is 0.85. A company plans to buy 10,000 units of the

commodity in 6 months, the size of the futures contract is on 1,000 units of the commodity and the delivery date of the contract is in 9

months.

Consider the following statements.

I. The optimal hedge ratio if the futures contract that is used to hedge is 0.6958.

II. The hedging effectiveness of the futures contract is 0.85.

II. The company should hedge by buying 7.69 futures contracts.

IV. If the company hedges optimally, the difference between the variance of the unhedged position and the variance of the optimally

hedged position would be 65.21.

Which of the following is correct?

a.

Statement I, |l and IIl are incorrect, Statement IV is correct.

O b. Statement I and Il are incorrect, Statement IIlI and IV are correct.

Statement I is incorrect, Statement II, III and IV are correct.

Oc.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning